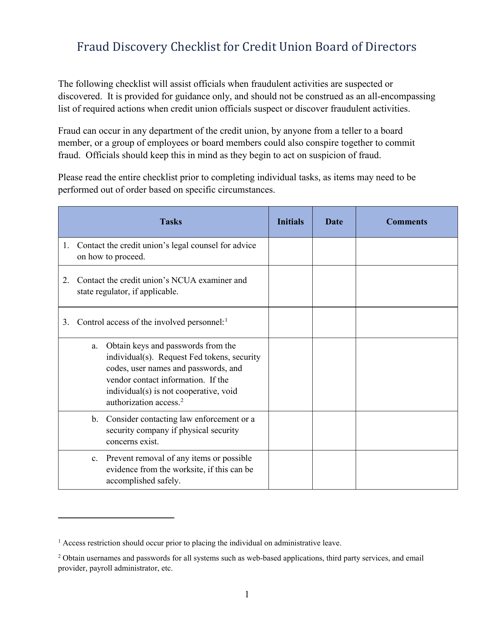

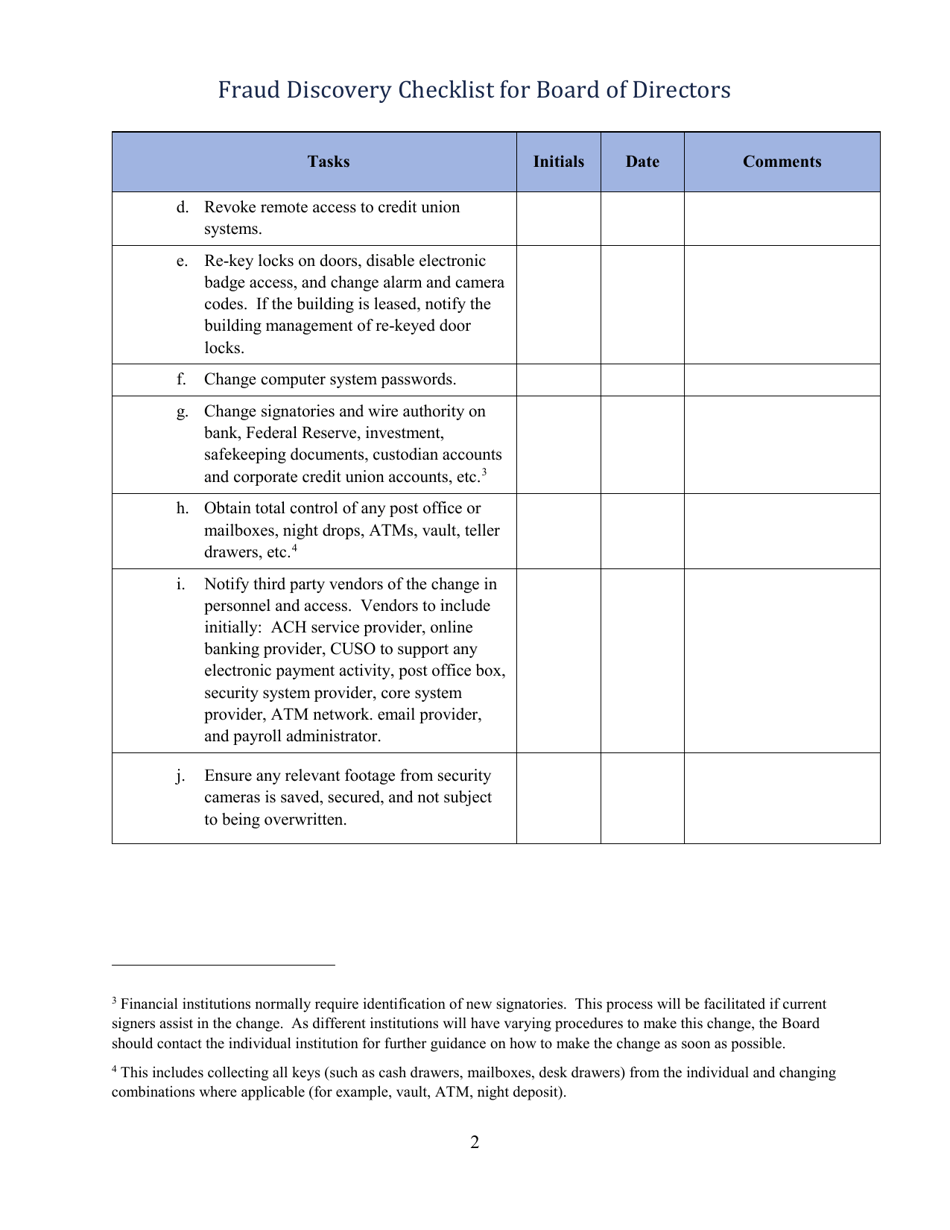

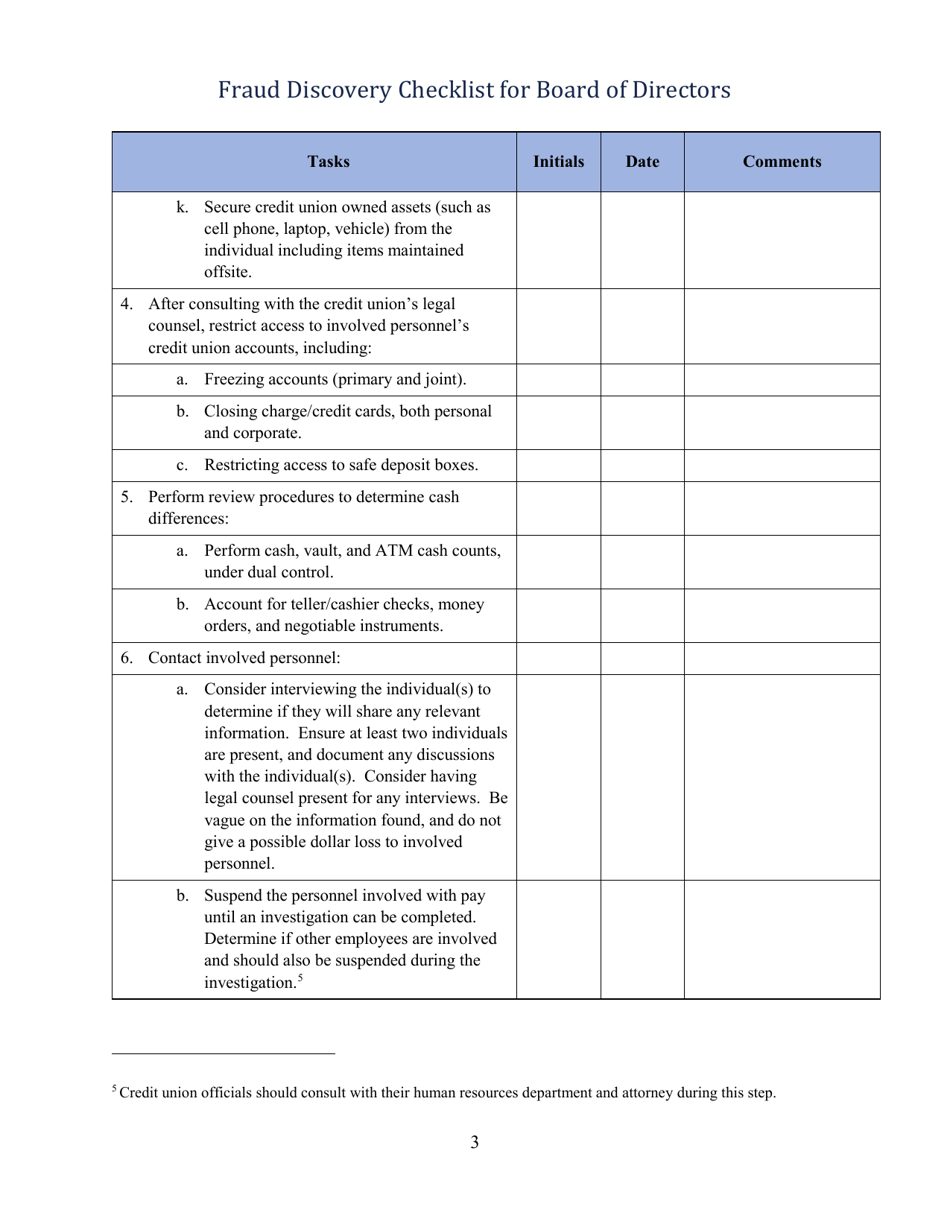

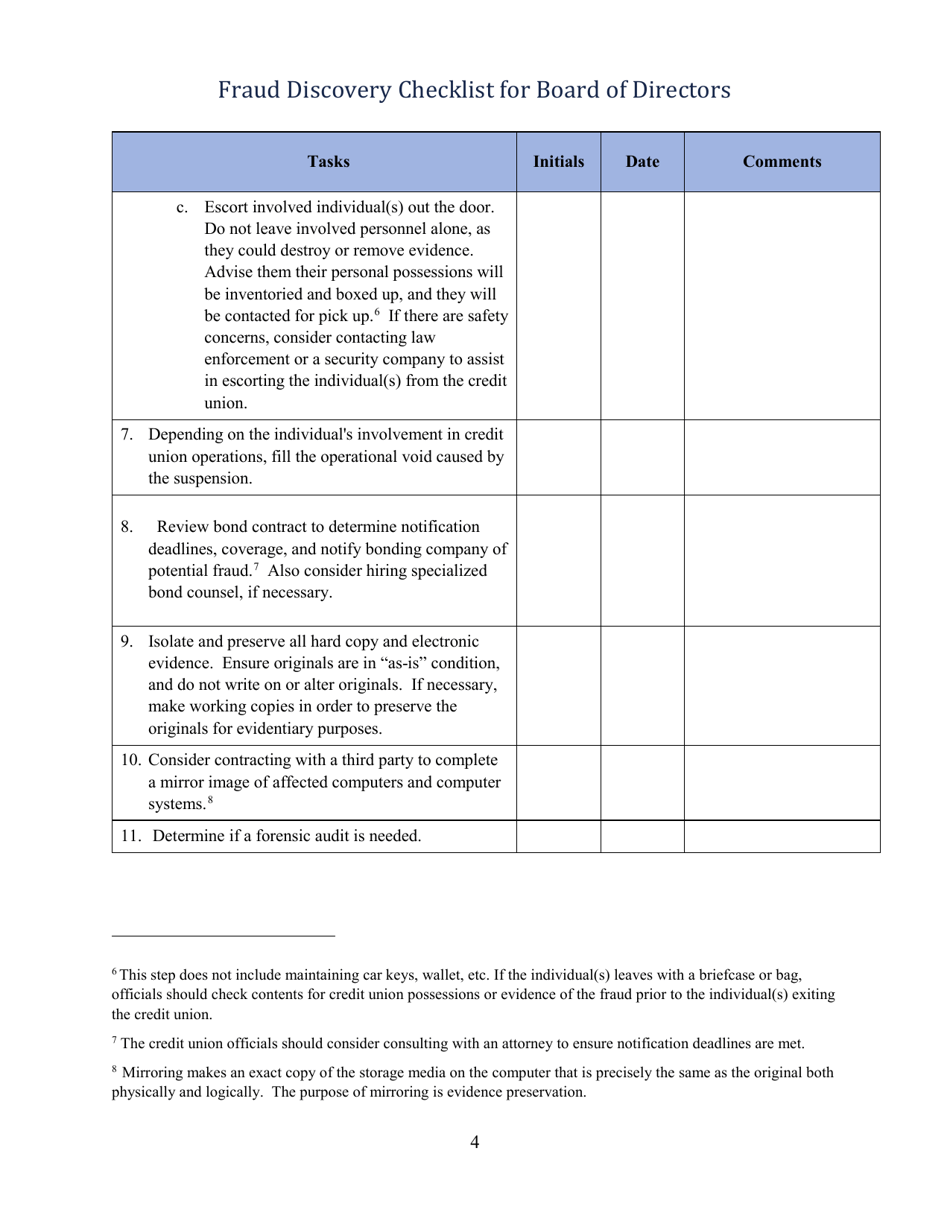

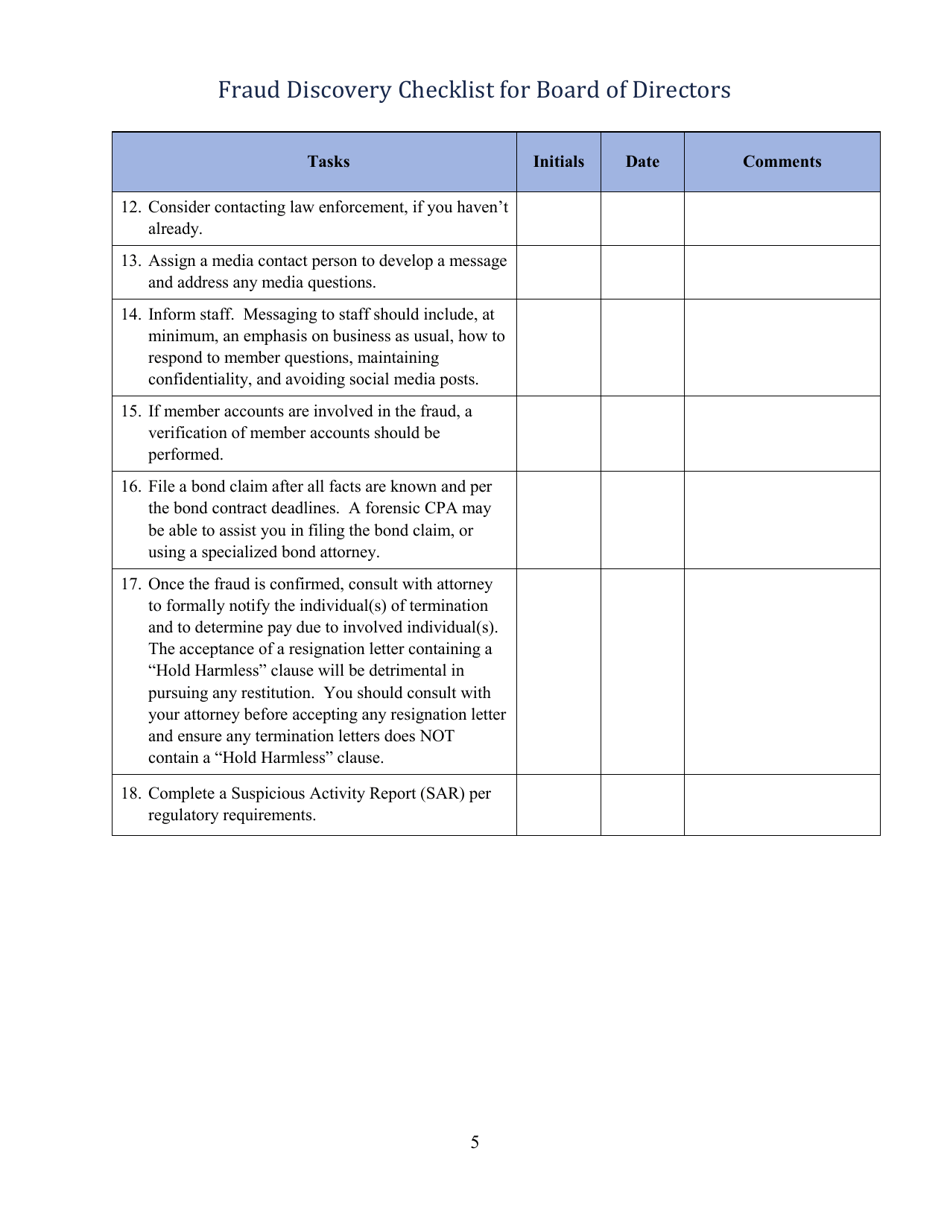

Fraud Discovery Checklist for Credit Union Board of Directors

Fraud Discovery Checklist for Credit Union Board of Directors is a 5-page legal document that was released by the National Credit Union Administration and used nation-wide.

FAQ

Q: Why is a fraud discovery checklist important for credit union board of directors?

A: A fraud discovery checklist helps credit union board of directors in identifying and preventing fraudulent activities.

Q: What is the purpose of a fraud discovery checklist?

A: The purpose of a fraud discovery checklist is to provide a systematic approach for credit union board of directors to detect and respond to potential fraud.

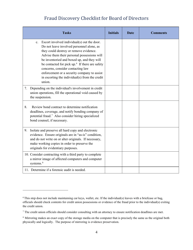

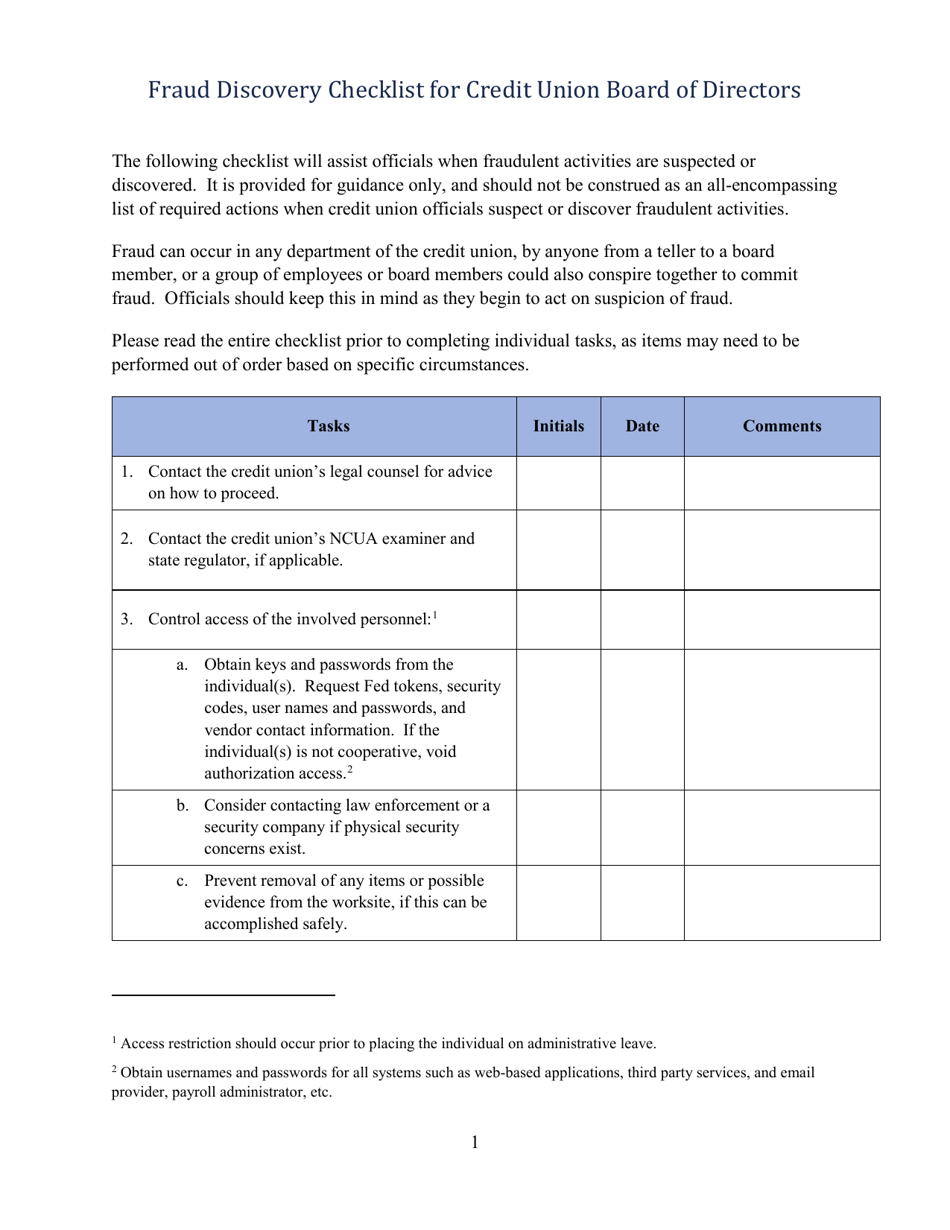

Q: What does a fraud discovery checklist include?

A: A fraud discovery checklist typically includes guidance on monitoring financial transactions, implementing internal controls, conducting audits, and educating staff and members about fraud prevention.

Q: How does a fraud discovery checklist assist credit union board of directors?

A: A fraud discovery checklist assists credit union board of directors by outlining best practices and procedures for fraud detection, helping them take necessary actions to minimize the risk of fraud.

Q: What are the benefits of using a fraud discovery checklist?

A: Using a fraud discovery checklist can enhance the board's oversight and governance, strengthen internal controls, protect the credit union's reputation, and safeguard member assets.

Form Details:

- The latest edition currently provided by the National Credit Union Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.