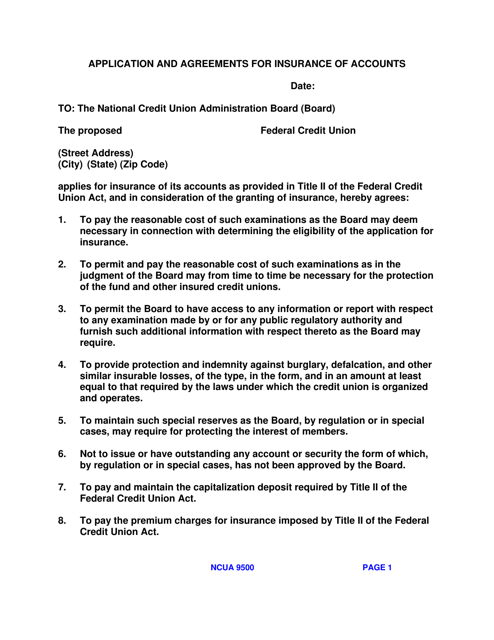

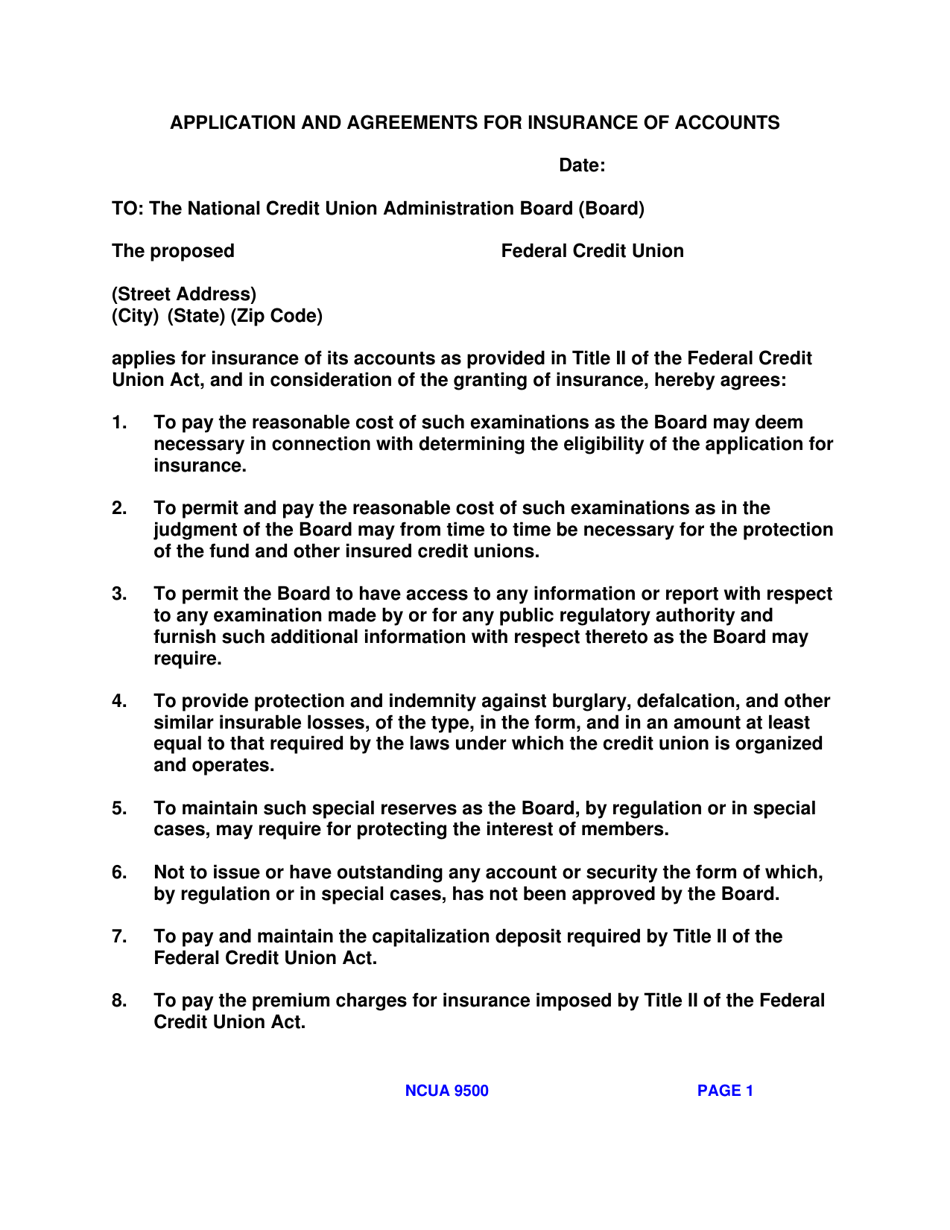

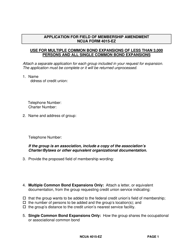

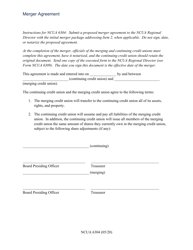

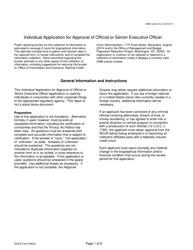

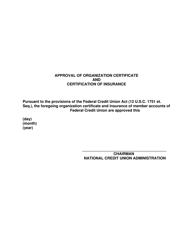

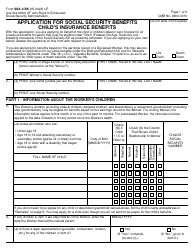

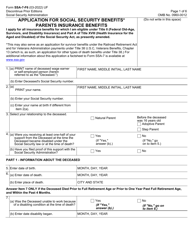

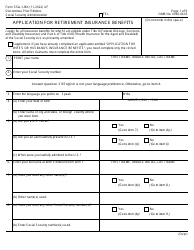

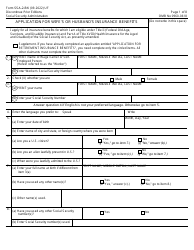

NCUA Form 9500 Application and Agreements for Insurance of Accounts

What Is NCUA Form 9500?

This is a legal form that was released by the National Credit Union Administration and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NCUA Form 9500?

A: NCUA Form 9500 is an application and agreement form for the insurance of accounts.

Q: Who uses NCUA Form 9500?

A: Credit unions use NCUA Form 9500 to apply for insurance coverage for their accounts.

Q: What is the purpose of NCUA Form 9500?

A: The purpose of NCUA Form 9500 is to apply for and establish insurance coverage for credit union accounts.

Q: What information is required on NCUA Form 9500?

A: NCUA Form 9500 requires credit unions to provide information such as the credit union's name, address, account types, and the account holders' deposit amounts.

Q: Are all credit union accounts insured?

A: Yes, all credit union accounts are insured up to the maximum amount provided by the National Credit Union Share Insurance Fund (NCUSIF).

Q: Can credit union members lose their money if the credit union fails?

A: No, credit union members are protected by the NCUSIF, and their deposits are insured up to the maximum coverage limit.

Q: Is there a fee for credit union account insurance?

A: No, there is no fee for credit union account insurance. The coverage is provided by the NCUSIF as part of being a member of a federally insured credit union.

Form Details:

- The latest available edition released by the National Credit Union Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of NCUA Form 9500 by clicking the link below or browse more documents and templates provided by the National Credit Union Administration.