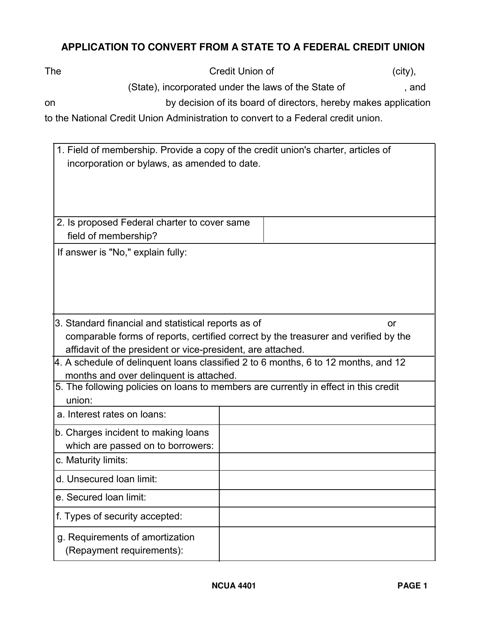

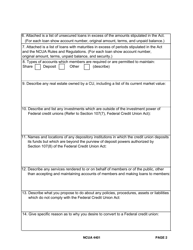

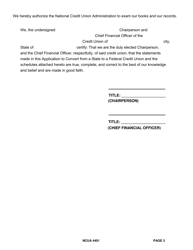

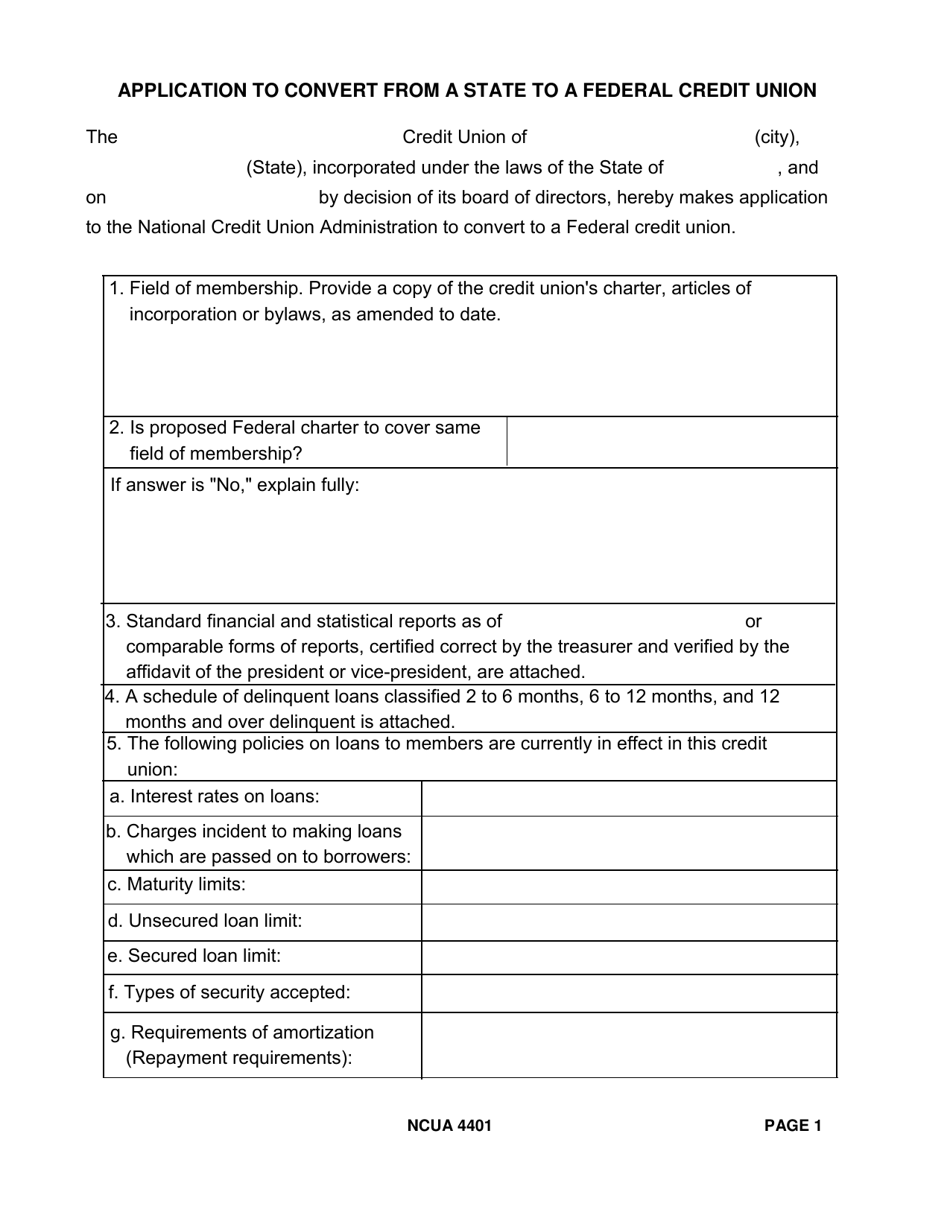

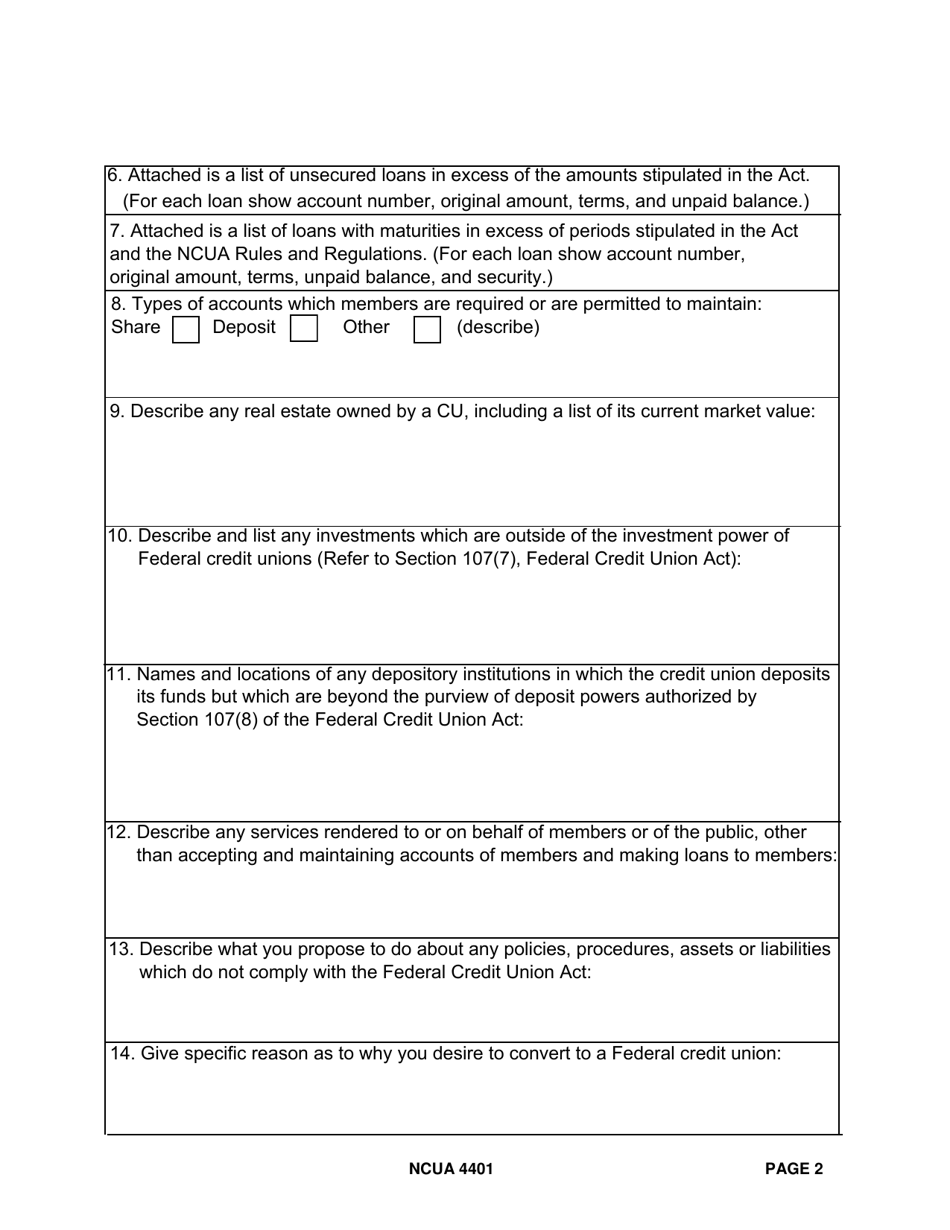

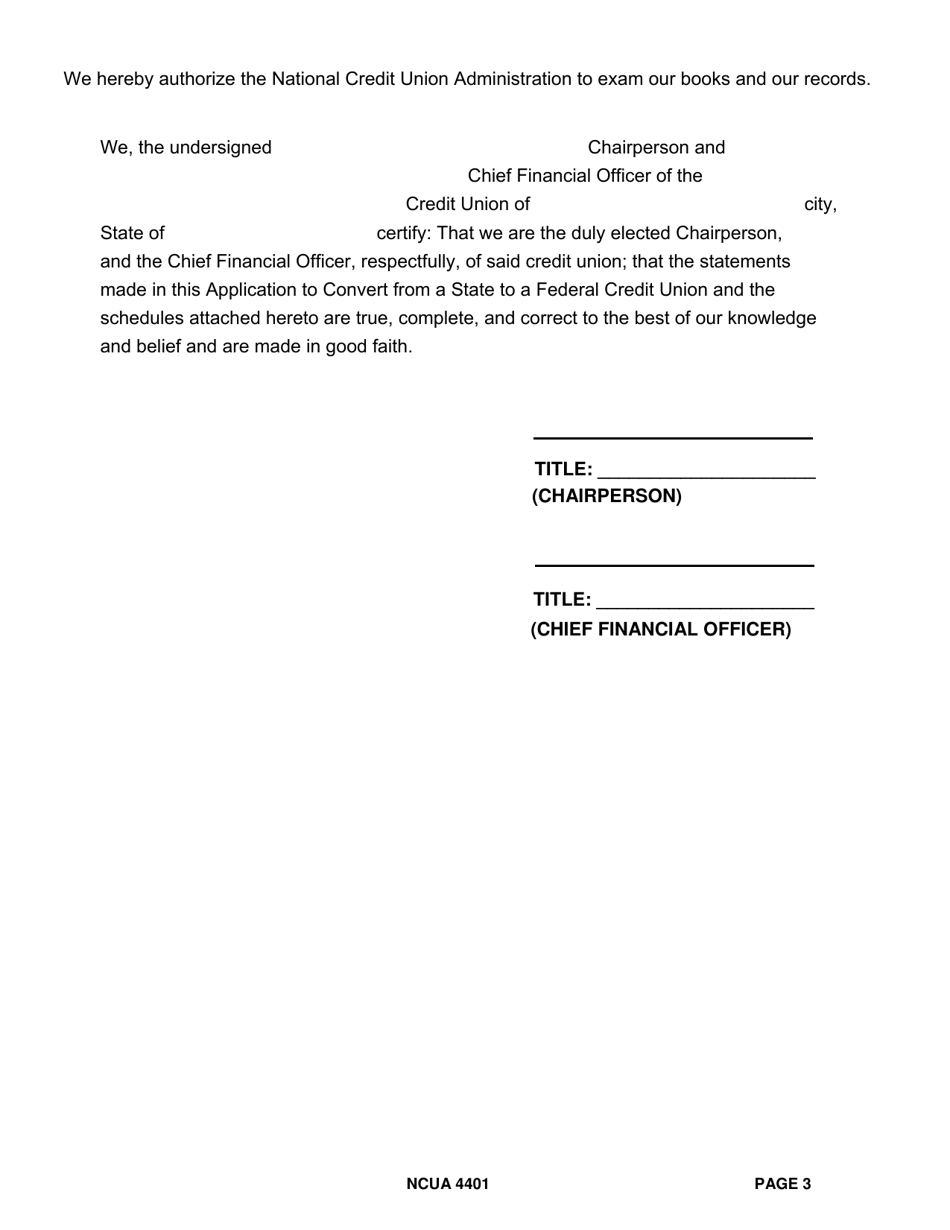

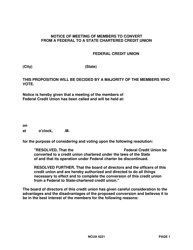

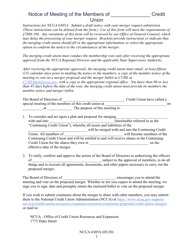

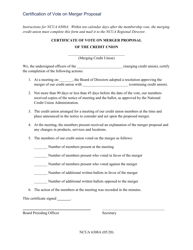

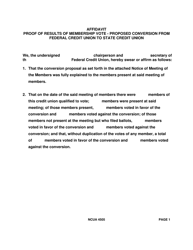

NCUA Form 4401 Application to Convert From a State to a Federal Credit Union

What Is NCUA Form 4401?

This is a legal form that was released by the National Credit Union Administration and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NCUA Form 4401?

A: NCUA Form 4401 is an application used to convert from a state credit union to a federal credit union.

Q: Why would a credit union want to convert from state to federal?

A: There are several reasons why a credit union may want to convert from state to federal, including gaining access to a larger membership base and expanding their services.

Q: What is the process for converting from state to federal?

A: The process for converting from state to federal involves completing and submitting NCUA Form 4401, providing required documentation, and meeting certain eligibility criteria.

Q: Who can apply to convert from state to federal?

A: Any state credit union can apply to convert to a federal credit union.

Q: Is there a cost involved in the conversion process?

A: Yes, there may be costs associated with the conversion process, including application fees and potential legal and consulting fees.

Q: How long does the conversion process take?

A: The length of the conversion process can vary, but it generally takes several months to complete.

Q: What are the benefits of converting to a federal credit union?

A: Benefits of converting to a federal credit union include access to federal deposit insurance, increased regulatory oversight, and potential growth opportunities.

Q: Are there any downsides to converting to a federal credit union?

A: There can be potential downsides to converting to a federal credit union, such as increased regulatory requirements and potential changes to the credit union's governance structure.

Form Details:

- The latest available edition released by the National Credit Union Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of NCUA Form 4401 by clicking the link below or browse more documents and templates provided by the National Credit Union Administration.