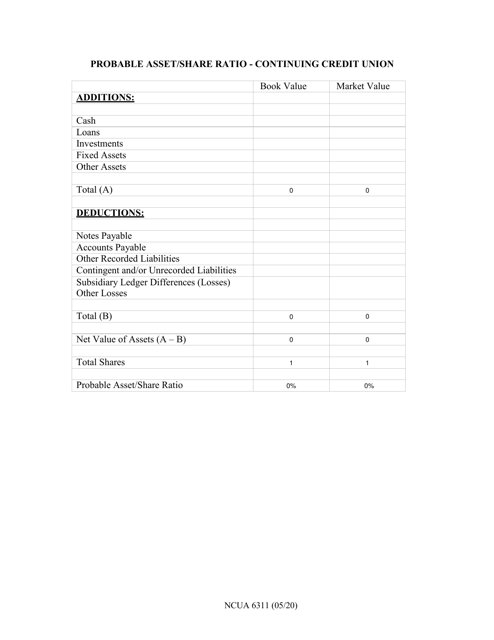

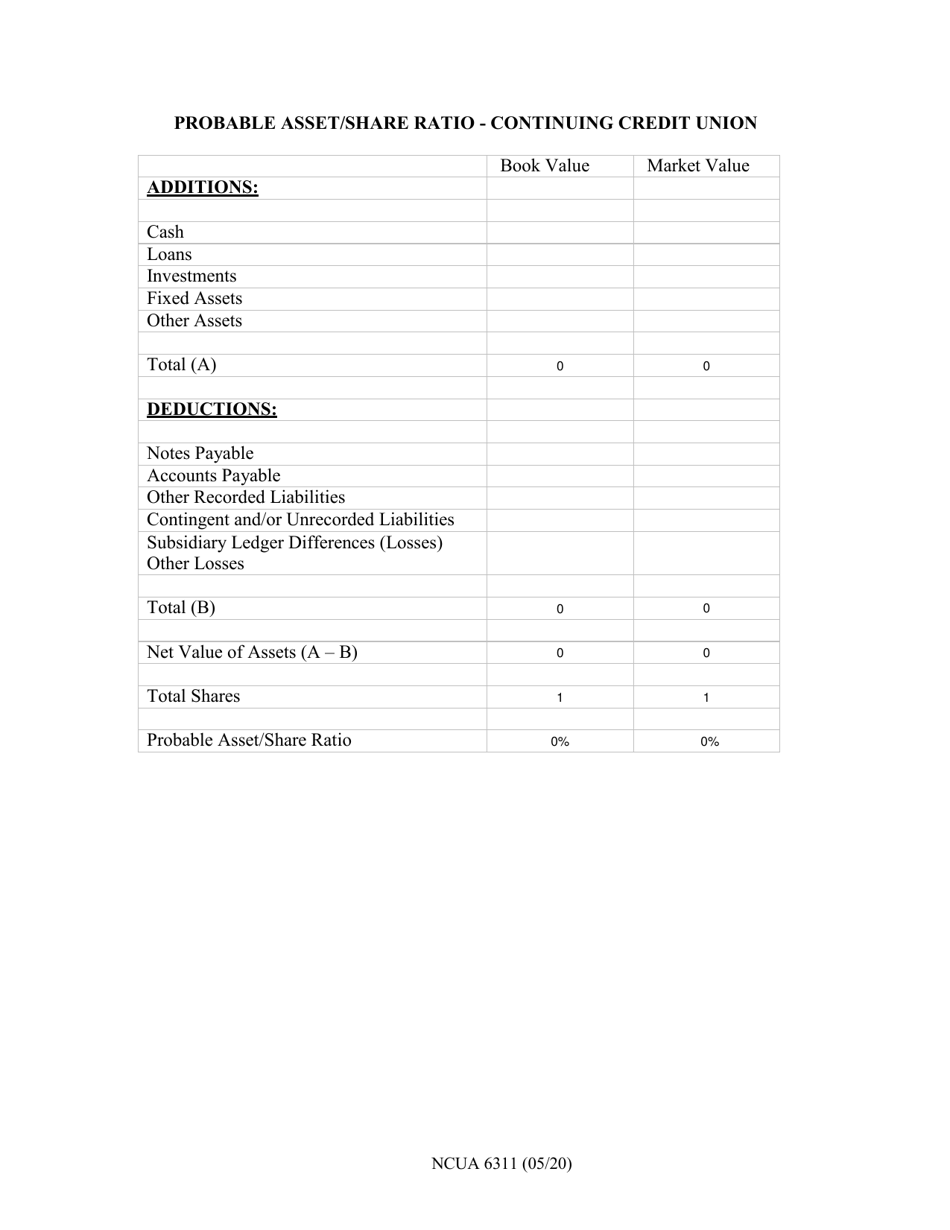

NCUA Form 6311 Probable Asset / Share Ratio - Continuing Credit Union

What Is NCUA Form 6311?

This is a legal form that was released by the National Credit Union Administration on May 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NCUA Form 6311?

A: NCUA Form 6311 is a form used by credit unions to report their probable asset/share ratio.

Q: What is the probable asset/share ratio?

A: The probable asset/share ratio is a measure of a credit union's financial strength.

Q: Why do credit unions need to report the probable asset/share ratio?

A: Credit unions are required to report the probable asset/share ratio to the National Credit Union Administration (NCUA) to assess their financial health.

Q: Who uses NCUA Form 6311?

A: Credit unions use NCUA Form 6311 to report their probable asset/share ratio to the NCUA.

Q: What information is included in NCUA Form 6311?

A: NCUA Form 6311 includes data about a credit union's assets, shares, and the calculation of the probable asset/share ratio.

Q: How often do credit unions need to submit NCUA Form 6311?

A: Credit unions need to submit NCUA Form 6311 on a quarterly basis.

Q: What does the probable asset/share ratio indicate?

A: The probable asset/share ratio indicates the financial strength and stability of a credit union.

Q: What is considered a healthy probable asset/share ratio?

A: A healthy probable asset/share ratio is generally above 1.0, indicating that a credit union has sufficient assets to cover its liabilities and maintain operational stability.

Form Details:

- Released on May 1, 2020;

- The latest available edition released by the National Credit Union Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of NCUA Form 6311 by clicking the link below or browse more documents and templates provided by the National Credit Union Administration.