Instructions for Form FFIEC002S Report of Assets and Liabilities of a Non-U.S. Branch That Is Managed or Controlled by a U.S. Branch or Agency of a Foreign (Non-U.S.) Bank

This document contains official instructions for Form FFIEC002S , Report of Assets and Liabilities of a Non-U.S. Branch That Is Managed or Controlled by a U.S. Branch or Agency of a Foreign (Non-U.S.) Bank - a form released and collected by the Federal Financial Institutions Examination Council. An up-to-date fillable Form FFIEC002S is available for download through this link.

FAQ

Q: What is Form FFIEC002S?

A: Form FFIEC002S is a report that provides information about the assets and liabilities of a non-U.S. branch that is managed or controlled by a U.S. branch or agency of a foreign bank.

Q: Who is required to file Form FFIEC002S?

A: The U.S. branch or agency of a foreign bank that manages or controls a non-U.S. branch is required to file Form FFIEC002S.

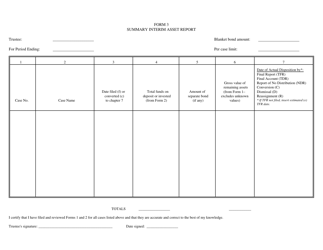

Q: What information does Form FFIEC002S include?

A: Form FFIEC002S includes information about the assets and liabilities of the non-U.S. branch, as well as other relevant details such as changes in ownership and accounting practices.

Q: Is Form FFIEC002S required to be filed regularly?

A: Yes, Form FFIEC002S is required to be filed quarterly.

Q: Are there any penalties for non-compliance with Form FFIEC002S?

A: Yes, there may be penalties for non-compliance with Form FFIEC002S, including fines and other enforcement actions.

Q: Can I use Form FFIEC002S to report on multiple non-U.S. branches?

A: No, separate Form FFIEC002S reports should be filed for each non-U.S. branch.

Q: Are there any exemptions from filing Form FFIEC002S?

A: There are certain exemptions available for small non-U.S. branches, but it is best to consult the instructions or seek professional advice to determine if you qualify for any exemptions.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Federal Financial Institutions Examination Council.