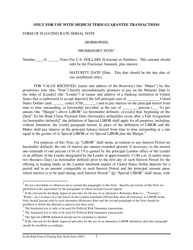

Form of Floating Rate Debt Instrument

Form of Floating Rate Debt Instrument is a 8-page legal document that was released by the Export-Import Bank of the United States on June 1, 2005 and used nation-wide.

FAQ

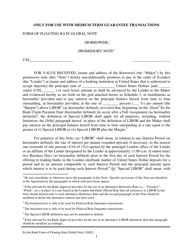

Q: What is a floating rate debt instrument?

A: A floating rate debt instrument is a type of loan or bond in which the interest rate is not fixed but instead fluctuates with changes in a reference rate, such as the prime rate or LIBOR.

Q: How does a floating rate debt instrument work?

A: With a floating rate debt instrument, the interest rate adjusts periodically based on changes in the reference rate. This means that the interest payments on the debt can either increase or decrease over time.

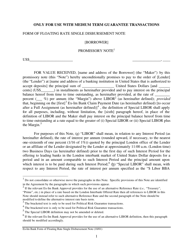

Q: What are the advantages of using a floating rate debt instrument?

A: Using a floating rate debt instrument can provide protection against rising interest rates since the interest payments will increase when rates go up. It also allows borrowers to take advantage of falling interest rates, as the payments will decrease.

Q: What are the risks associated with a floating rate debt instrument?

A: The main risk associated with a floating rate debt instrument is interest rate risk. If the reference rate increases significantly, the interest payments on the debt can become unaffordable for the borrower.

Q: Who typically uses floating rate debt instruments?

A: Floating rate debt instruments are commonly used by corporate borrowers, governments, and financial institutions to manage interest rate risk and take advantage of market conditions.

Form Details:

- The latest edition currently provided by the Export-Import Bank of the United States;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.