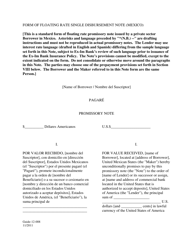

Form GUIDE-12-009 Mexican Promissory Note Fixed Rate Definitive - All Credits (Public)

What Is Form GUIDE-12-009?

This is a legal form that was released by the Export-Import Bank of the United States on November 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Mexican Promissory Note?

A: A Mexican Promissory Note is a legal document that outlines the terms and conditions of a loan agreement in Mexico.

Q: What does 'Fixed Rate' mean?

A: 'Fixed Rate' means that the interest rate on the loan remains the same throughout the term of the loan.

Q: What does 'Definitive' mean in relation to this Promissory Note?

A: 'Definitive' means that this Promissory Note is the final and binding agreement between the borrower and the lender.

Q: Who can use this Promissory Note?

A: This Promissory Note is designed for use by all individuals or entities in Mexico seeking a loan.

Q: What types of credits does this Promissory Note cover?

A: This Promissory Note covers all types of credits, including public loans.

Q: Is this Promissory Note specific to Mexico?

A: Yes, this Promissory Note is specifically designed for loans in Mexico.

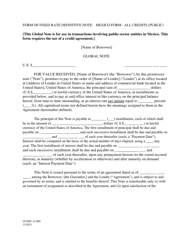

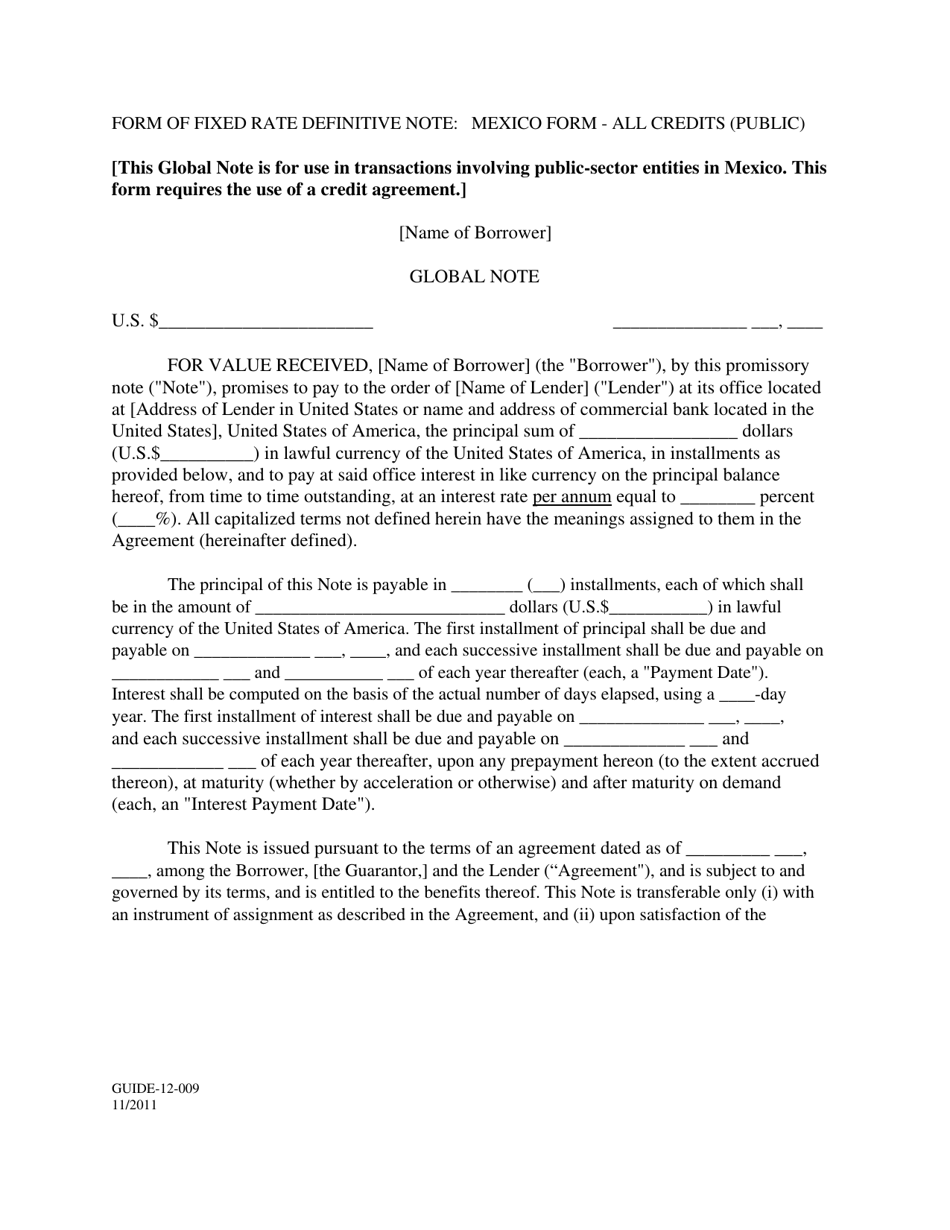

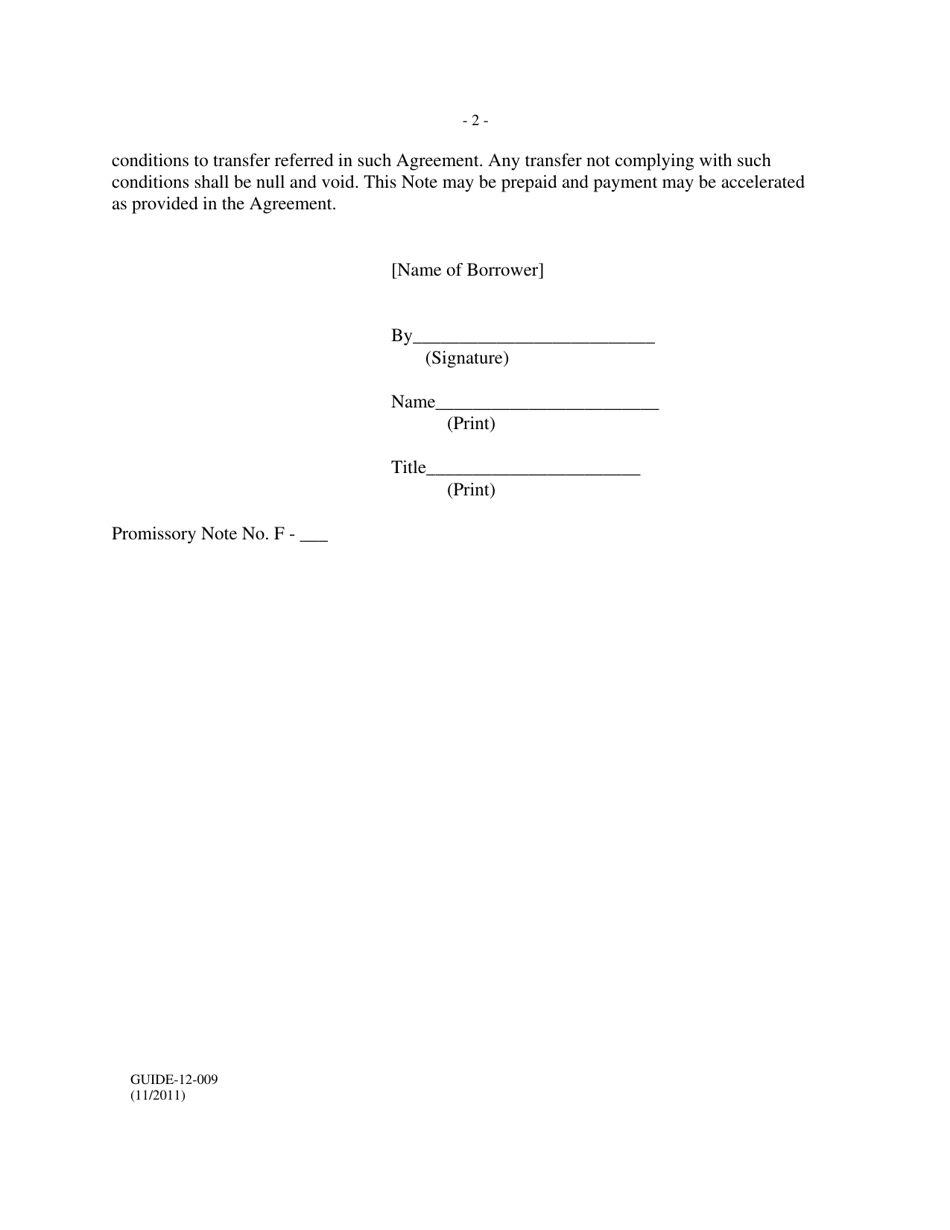

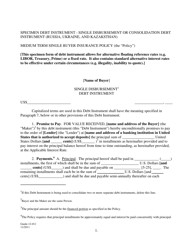

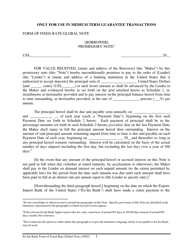

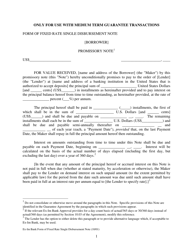

Q: What information is included in the Promissory Note?

A: The Promissory Note includes details such as the loan amount, interest rate, repayment terms, and penalties for non-payment.

Q: Is legal advice needed to use this Promissory Note?

A: It is recommended to seek legal advice when dealing with loan agreements, but it is not required to use this Promissory Note.

Q: What happens if the borrower fails to repay the loan?

A: If the borrower fails to repay the loan, the lender may pursue legal action to recover the outstanding amount.

Q: Can this Promissory Note be modified?

A: Yes, this Promissory Note can be modified to suit the specific needs of the borrower and lender, as long as both parties agree to the changes.

Form Details:

- Released on November 1, 2011;

- The latest available edition released by the Export-Import Bank of the United States;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GUIDE-12-009 by clicking the link below or browse more documents and templates provided by the Export-Import Bank of the United States.