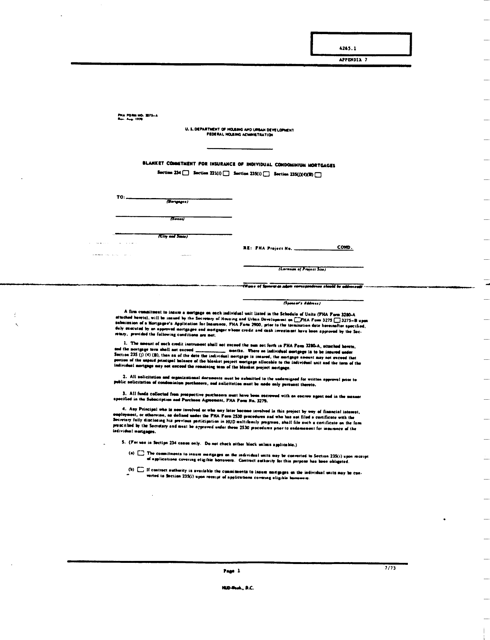

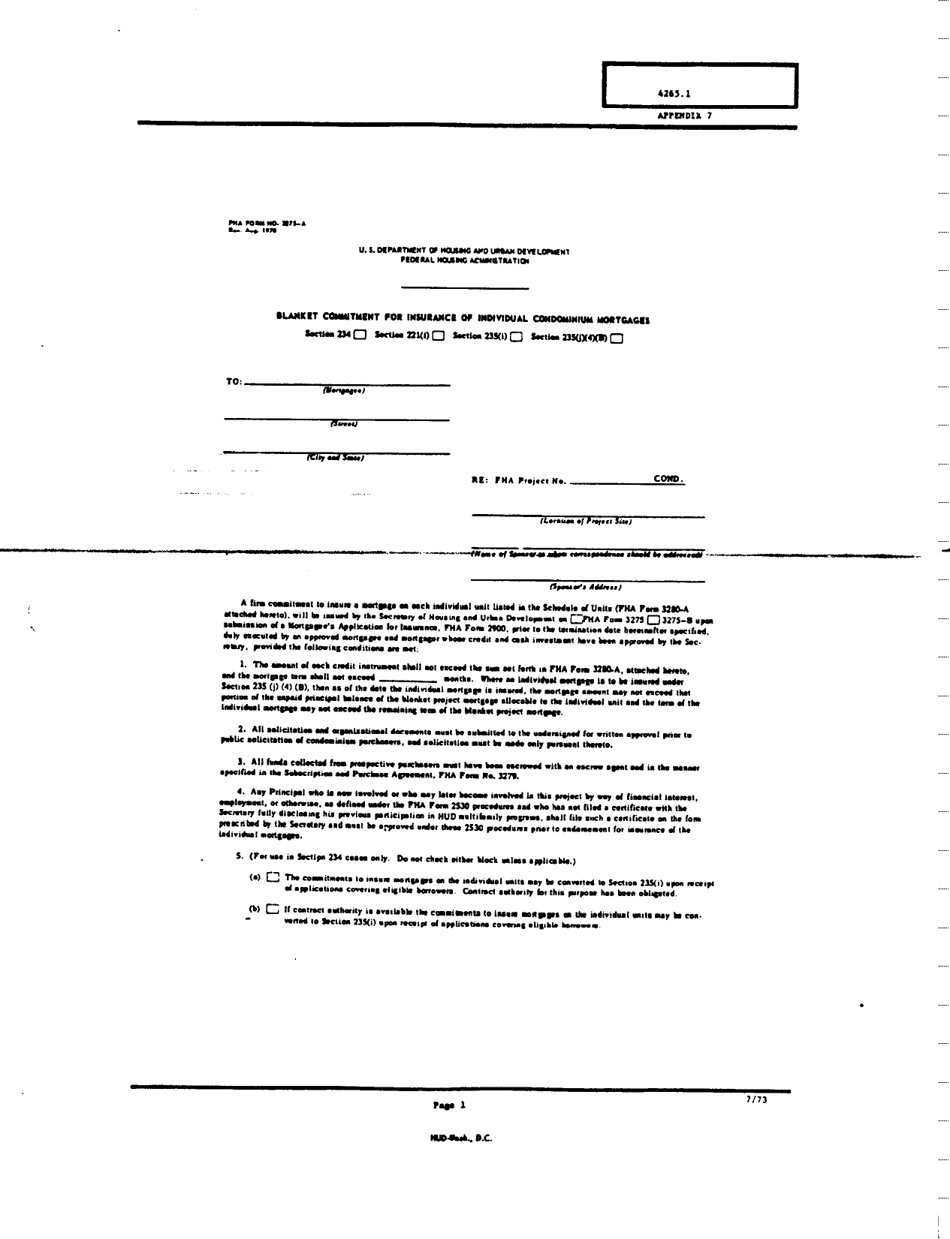

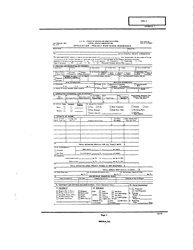

Form FHA-3275-A Appendix 7 Blanket Commitment for Insurance of Individual Condominium Mortgage

What Is Form FHA-3275-A Appendix 7?

This is a legal form that was released by the U.S. Department of Housing and Urban Development on July 1, 1973 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

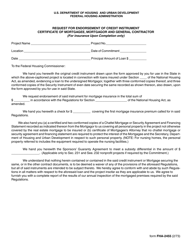

Q: What is the FHA-3275-A Appendix 7 Blanket Commitment?

A: The FHA-3275-A Appendix 7 Blanket Commitment is a document that provides insurance coverage for individual condominium mortgage loans.

Q: What does the FHA-3275-A Appendix 7 Blanket Commitment insure?

A: The FHA-3275-A Appendix 7 Blanket Commitment insures individual condominium mortgage loans.

Q: What is the purpose of the FHA-3275-A Appendix 7 Blanket Commitment?

A: The purpose of the FHA-3275-A Appendix 7 Blanket Commitment is to provide insurance coverage for individual condominium mortgage loans.

Q: Who is eligible for the FHA-3275-A Appendix 7 Blanket Commitment?

A: Lenders who are approved by the Federal Housing Administration (FHA) are eligible to request the FHA-3275-A Appendix 7 Blanket Commitment.

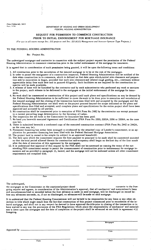

Q: What is a blanket commitment?

A: A blanket commitment is a type of insurance coverage that applies to multiple individual mortgage loans.

Q: What is a condominium mortgage loan?

A: A condominium mortgage loan is a type of loan used to finance the purchase of a condominium unit.

Q: Is the FHA-3275-A Appendix 7 Blanket Commitment specific to the United States?

A: Yes, the FHA-3275-A Appendix 7 Blanket Commitment is specific to the United States.

Q: Can individual condominium mortgage loans be insured without the FHA-3275-A Appendix 7 Blanket Commitment?

A: Yes, individual condominium mortgage loans can be insured without the FHA-3275-A Appendix 7 Blanket Commitment. However, the FHA-3275-A Appendix 7 Blanket Commitment provides additional insurance coverage for these loans.

Form Details:

- Released on July 1, 1973;

- The latest available edition released by the U.S. Department of Housing and Urban Development;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FHA-3275-A Appendix 7 by clicking the link below or browse more documents and templates provided by the U.S. Department of Housing and Urban Development.