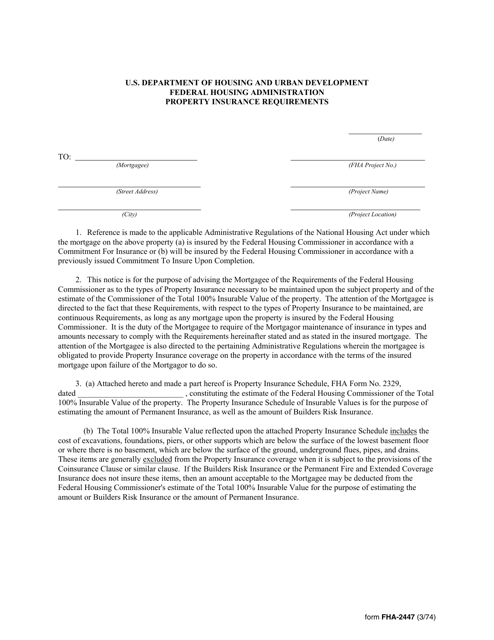

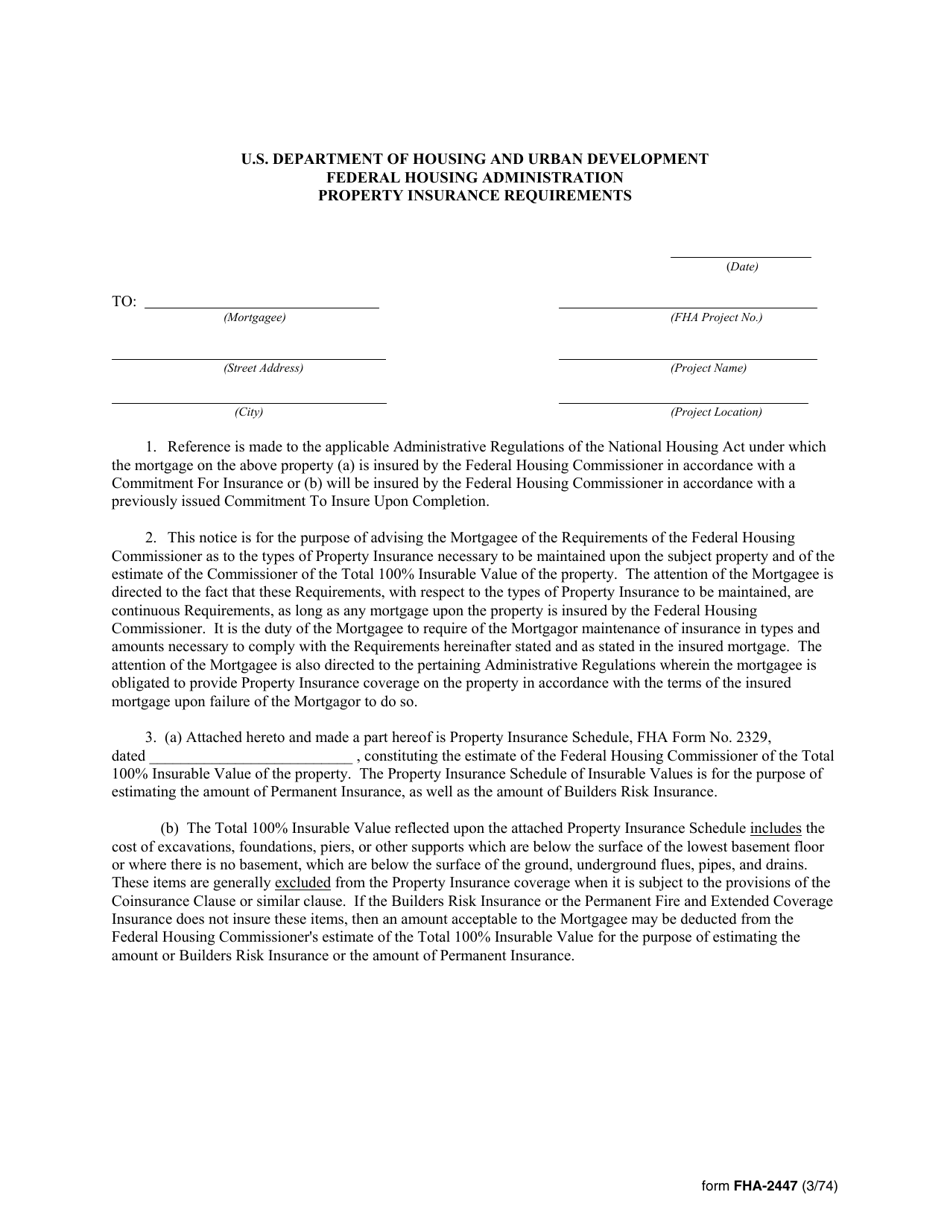

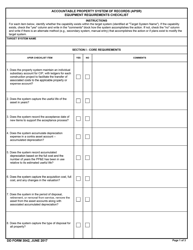

Form FHA-2447 Property Insurance Requirements

What Is Form FHA-2447?

This is a legal form that was released by the U.S. Department of Housing and Urban Development on March 1, 1974 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FHA-2447?

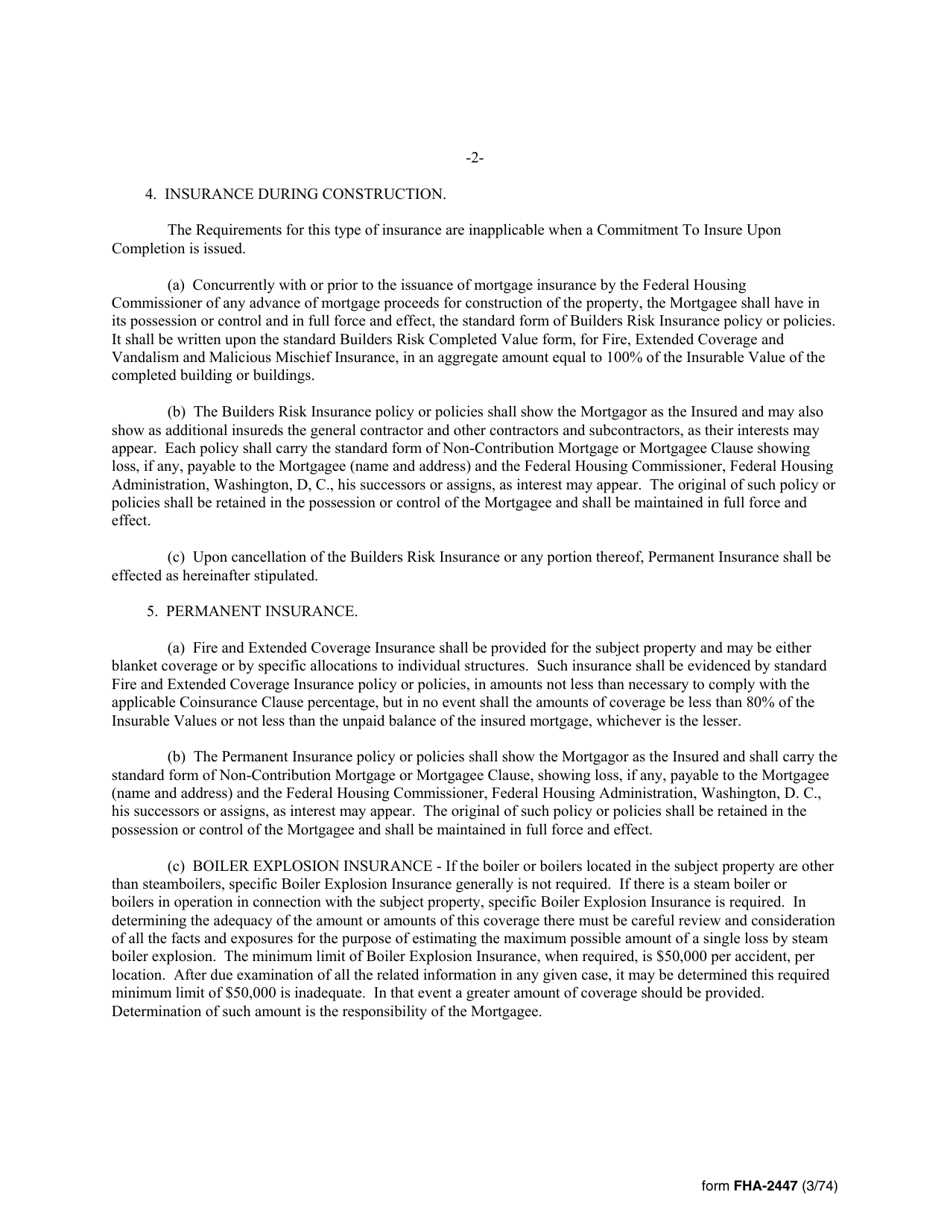

A: FHA-2447 is a form that outlines the property insurance requirements for FHA mortgages.

Q: What does FHA-2447 specify?

A: FHA-2447 specifies the minimum insurance coverage and documentation required for FHA-insured properties.

Q: What is the purpose of FHA-2447?

A: The purpose of FHA-2447 is to ensure that FHA-insured properties are adequately protected against losses.

Q: Who needs to complete FHA-2447?

A: FHA-2447 needs to be completed by lenders, borrowers, and insurance providers involved in FHA-insured property transactions.

Q: Can the property insurance requirements vary?

A: Yes, the property insurance requirements may vary depending on the specific FHA loan program and the lender's guidelines.

Form Details:

- Released on March 1, 1974;

- The latest available edition released by the U.S. Department of Housing and Urban Development;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FHA-2447 by clicking the link below or browse more documents and templates provided by the U.S. Department of Housing and Urban Development.