This version of the form is not currently in use and is provided for reference only. Download this version of

CBP Form 301

for the current year.

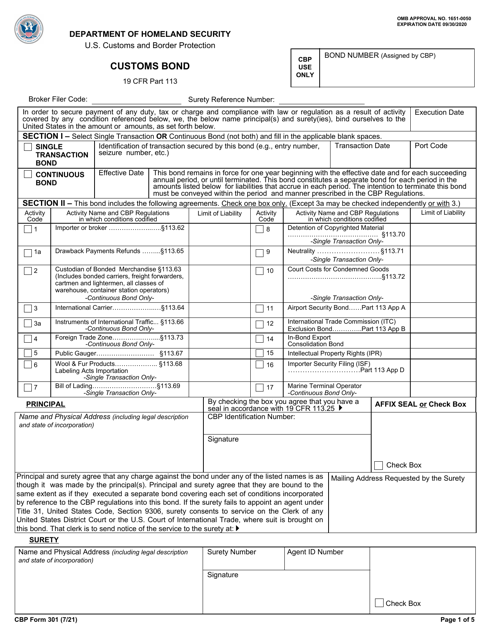

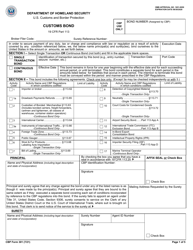

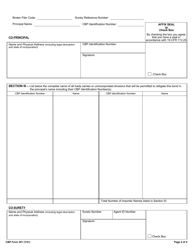

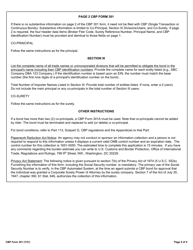

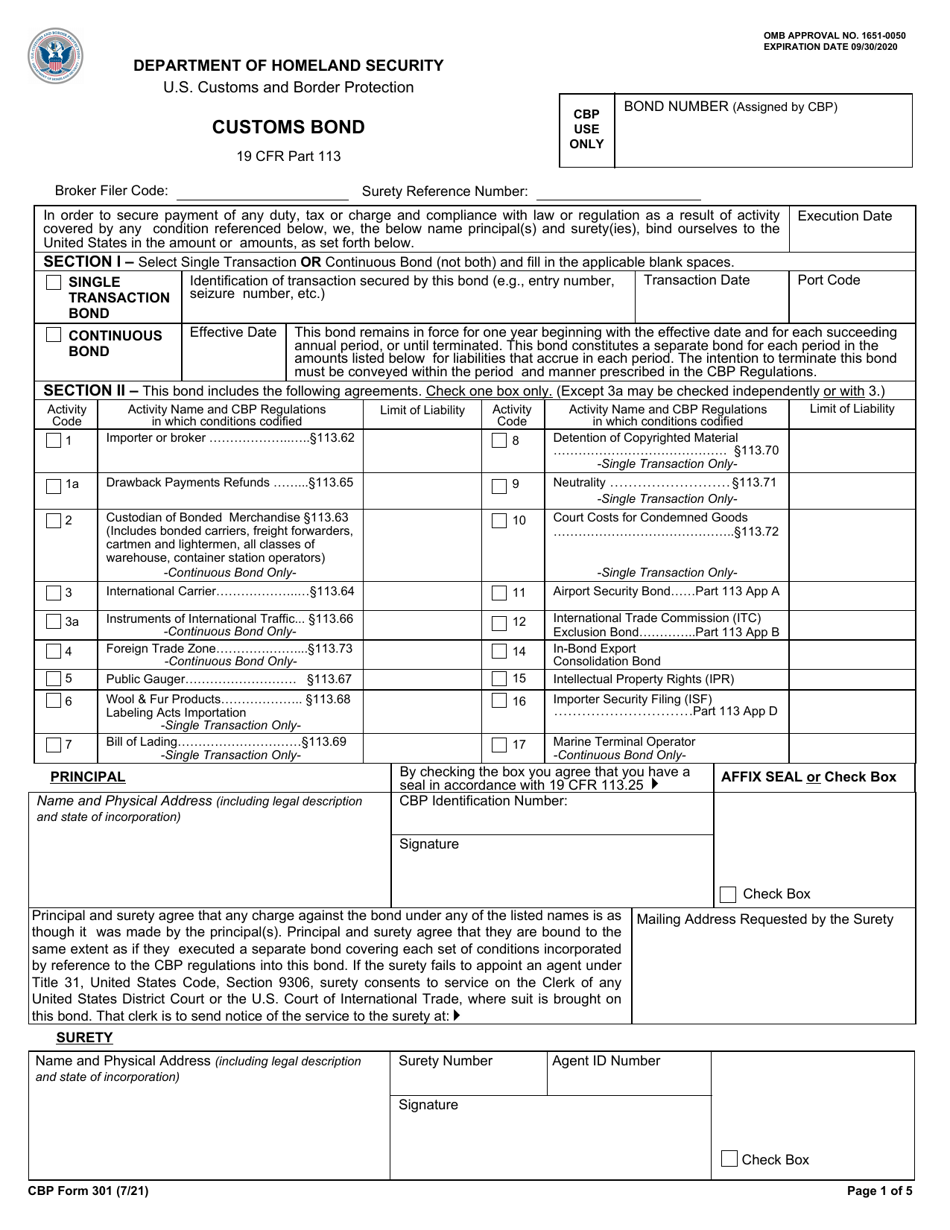

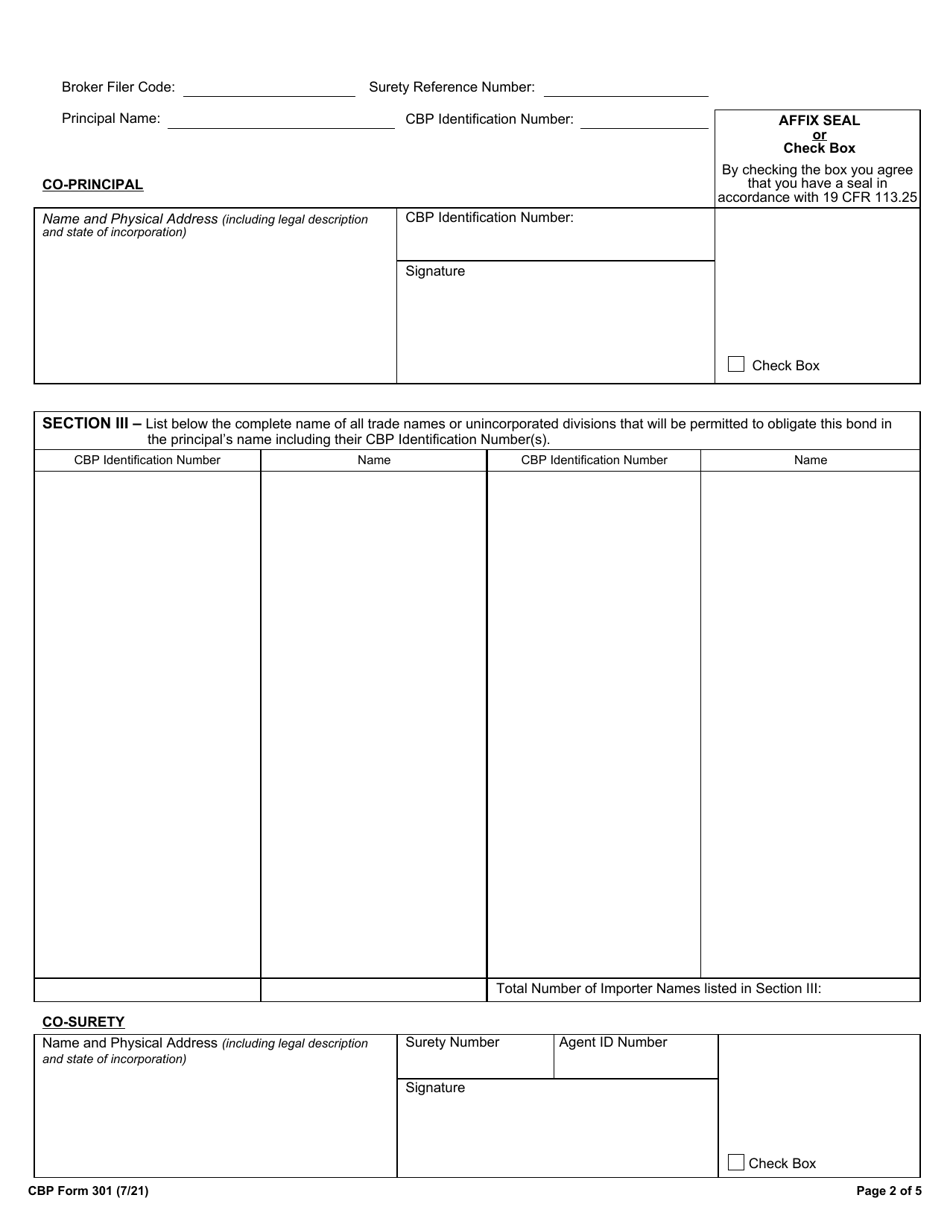

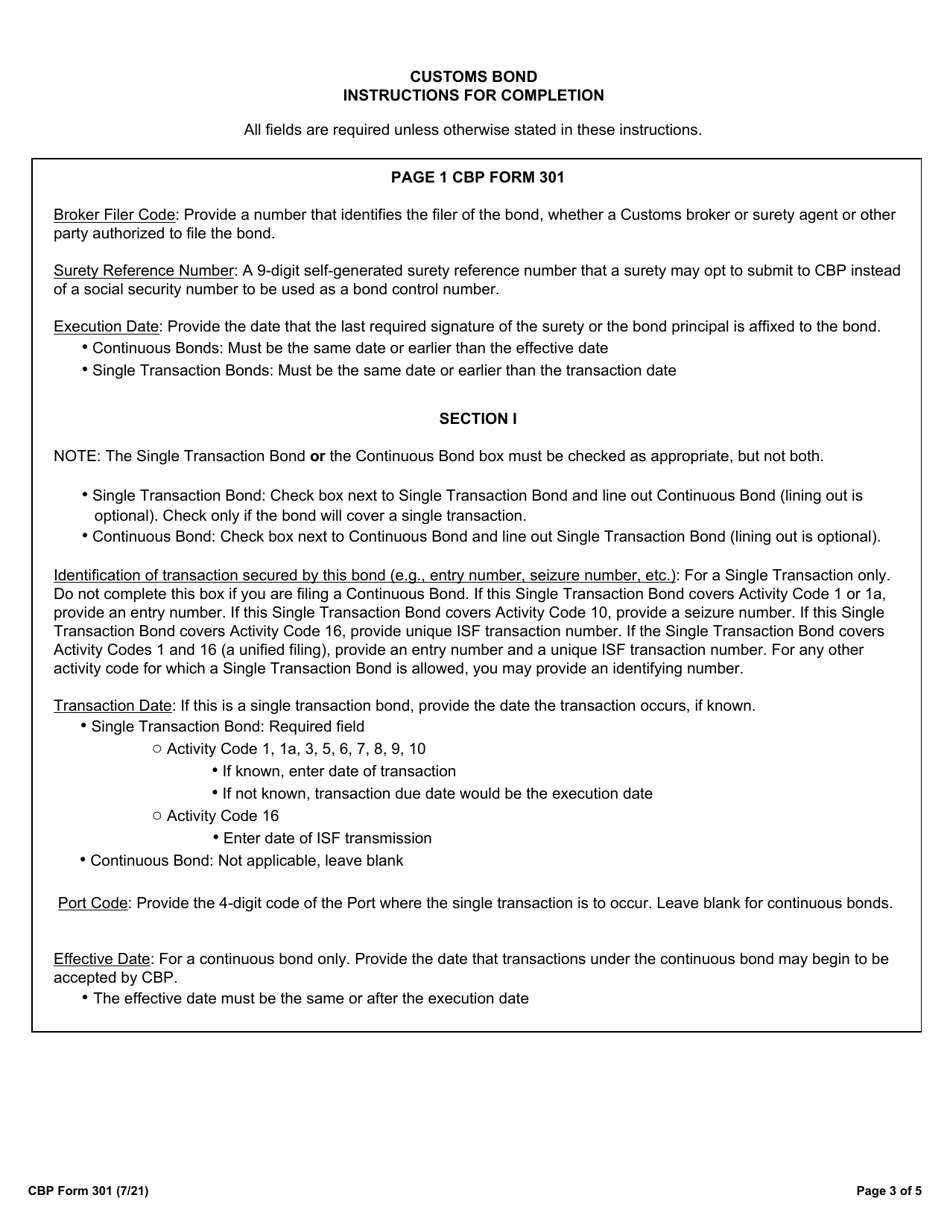

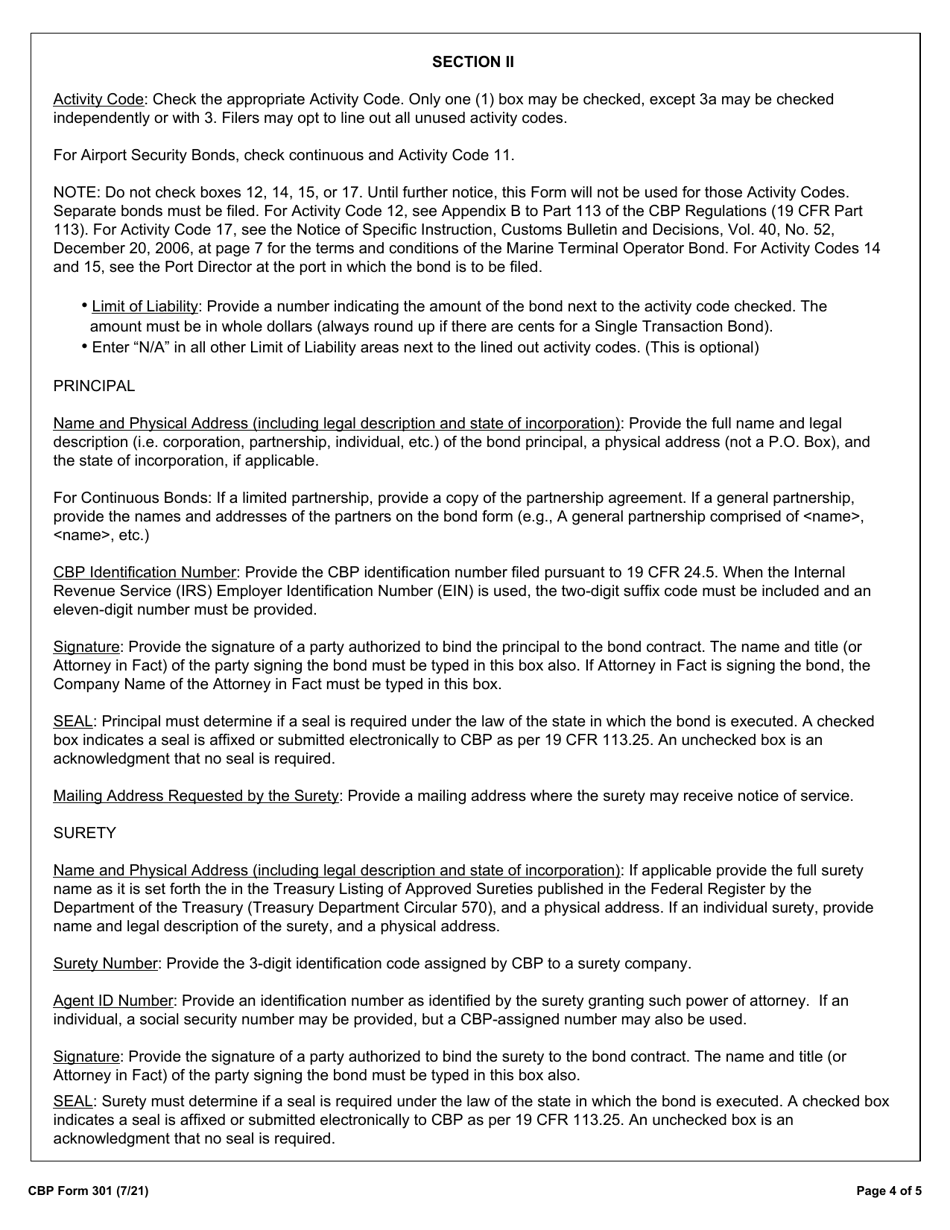

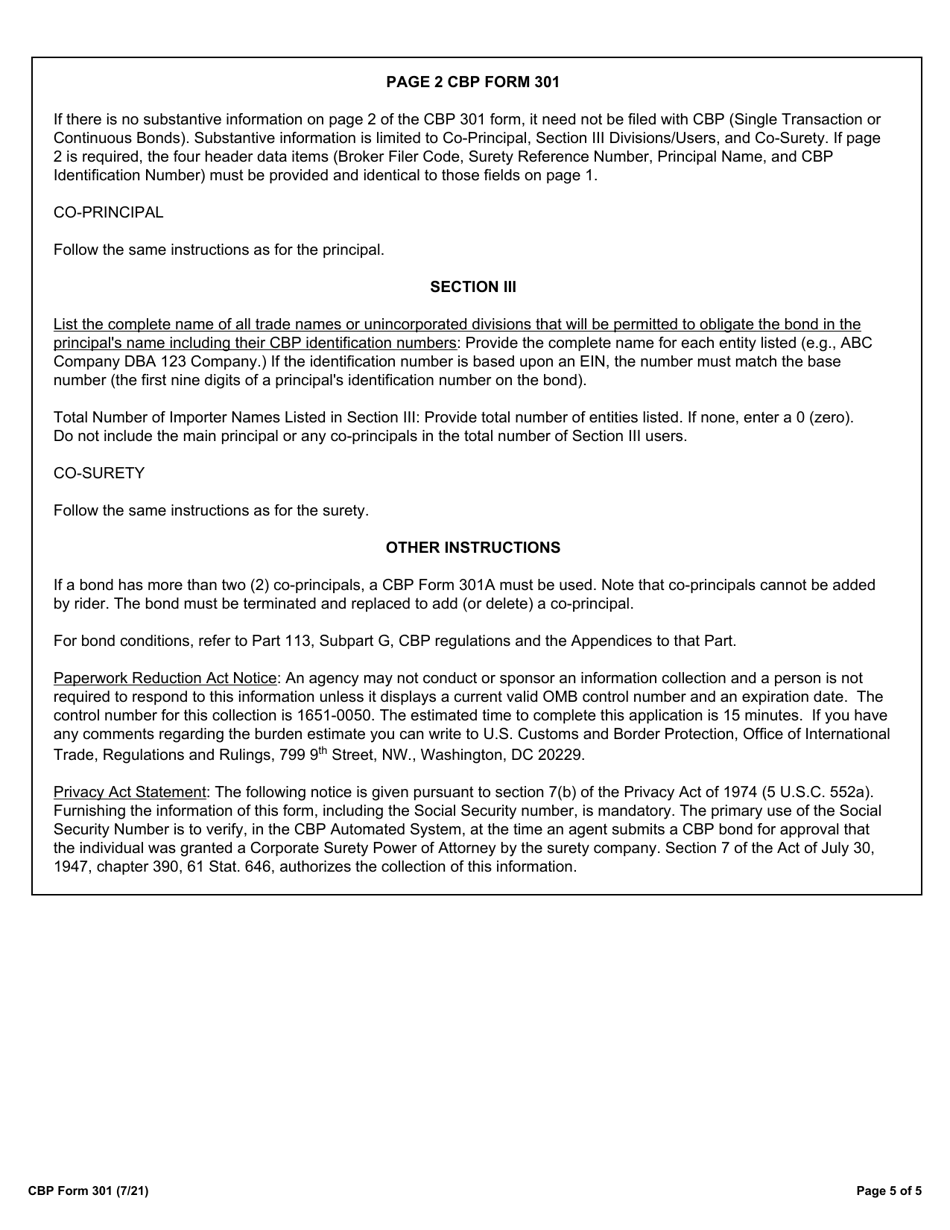

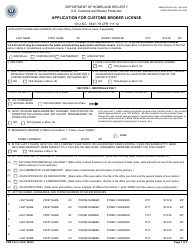

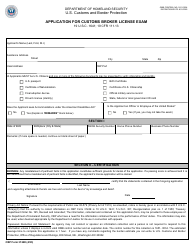

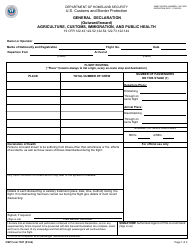

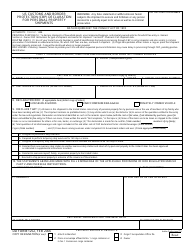

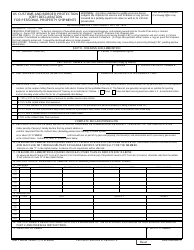

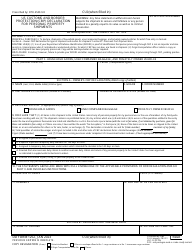

CBP Form 301 Customs Bond

What Is CBP Form 301?

This is a legal form that was released by the U.S. Department of Homeland Security - Customs and Border Protection on July 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CBP Form 301?

A: CBP Form 301 is a Customs Bond form.

Q: What is a Customs Bond?

A: A Customs Bond is a financial guarantee that ensures an importer will comply with all Customs laws and regulations.

Q: Why is a Customs Bond required?

A: A Customs Bond is required to protect the revenue of the United States and ensure compliance with Customs laws.

Q: Who needs to submit CBP Form 301?

A: Importers who wish to import goods into the United States are required to submit CBP Form 301.

Q: How do I obtain CBP Form 301?

A: CBP Form 301 can be obtained from a surety company or licensed customs broker.

Q: What information is needed on CBP Form 301?

A: CBP Form 301 requires information about the importer, the bond amount, and the bond type.

Q: What are the different types of Customs Bonds?

A: The different types of Customs Bonds include Single Entry Bonds, Continuous Bonds, and International Carrier Bonds.

Q: How long is a Customs Bond valid?

A: A Customs Bond is typically valid for a one-year period.

Q: What happens if I fail to comply with Customs laws and regulations?

A: If you fail to comply with Customs laws and regulations, your Customs Bond may be forfeited and you may be subject to penalties and fines.

Q: Can I cancel a Customs Bond?

A: Yes, a Customs Bond can be canceled but you may still be responsible for any obligations that occurred while the bond was in effect.

Form Details:

- Released on July 1, 2021;

- The latest available edition released by the U.S. Department of Homeland Security - Customs and Border Protection;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CBP Form 301 by clicking the link below or browse more documents and templates provided by the U.S. Department of Homeland Security - Customs and Border Protection.