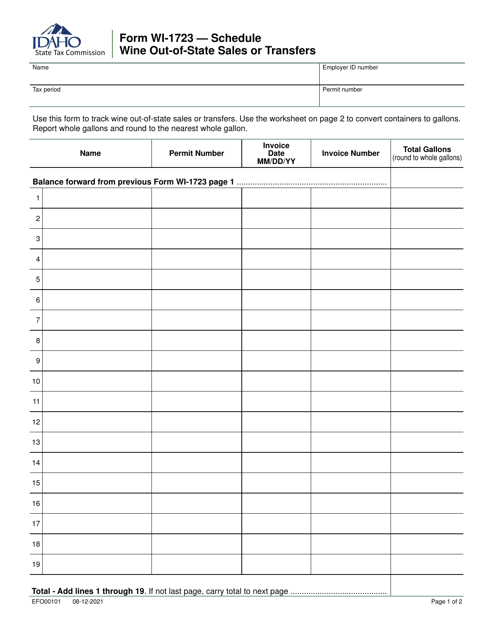

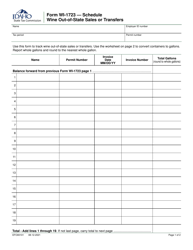

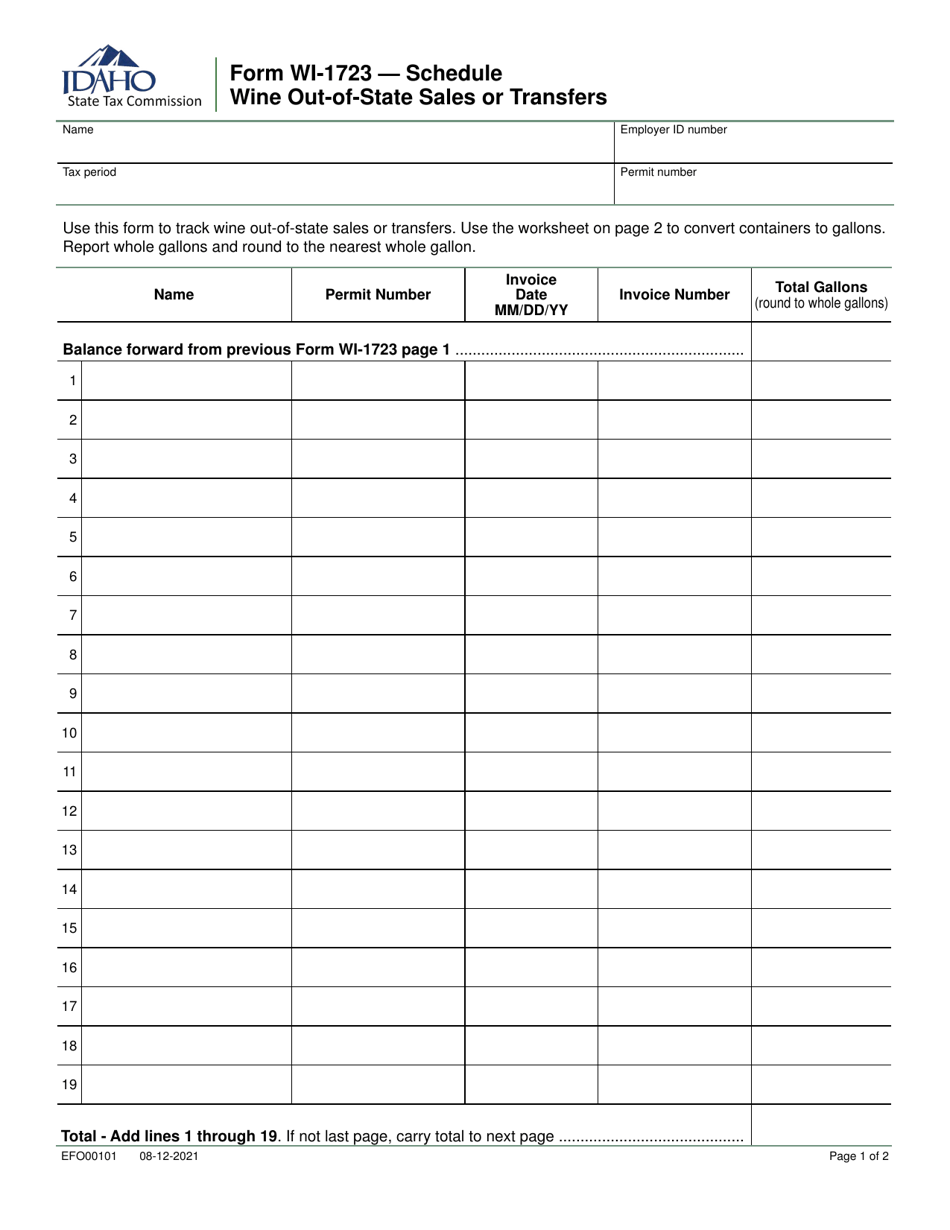

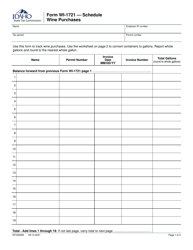

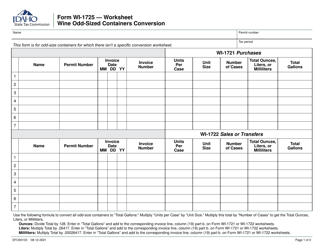

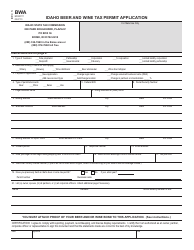

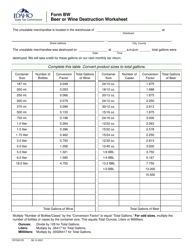

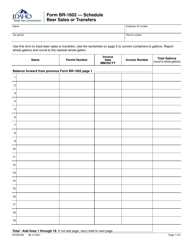

Form WI-1723 (EFO00101) Wine Out-of-State Sales or Transfers Schedule - Idaho

What Is Form WI-1723 (EFO00101)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form WI-1723?

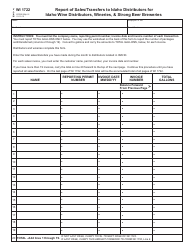

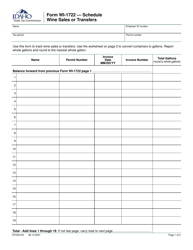

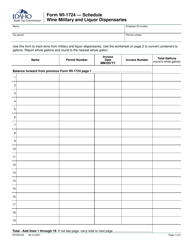

A: Form WI-1723 is used for reporting wine out-of-state sales or transfers from Idaho.

Q: Who needs to file Form WI-1723?

A: Anyone who needs to report wine out-of-state sales or transfers from Idaho.

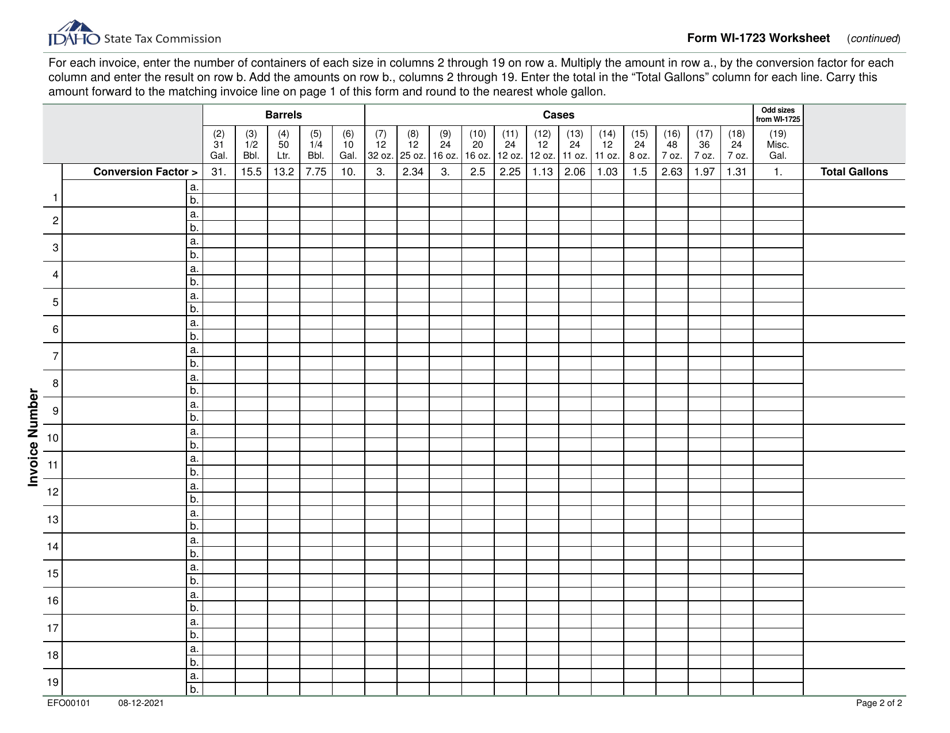

Q: What information is required on Form WI-1723?

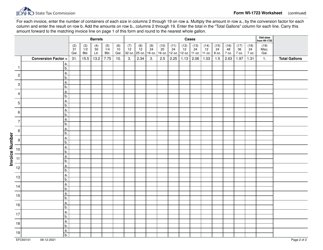

A: Form WI-1723 requires information about the amount of wine sold or transferred, the buyer's name and address, and other details.

Q: When is Form WI-1723 due?

A: Form WI-1723 is due on or before the 20th day of the month following the end of the reporting period.

Q: What are the penalties for not filing Form WI-1723?

A: Penalties may apply for failing to file Form WI-1723, including fines and interest charges.

Form Details:

- Released on August 12, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WI-1723 (EFO00101) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.