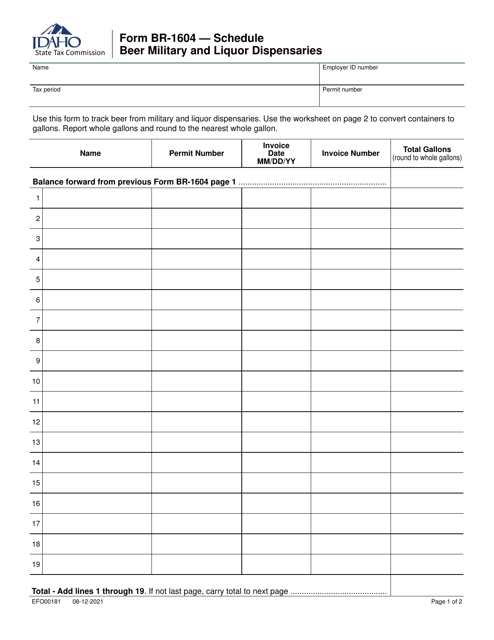

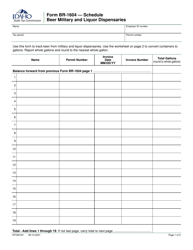

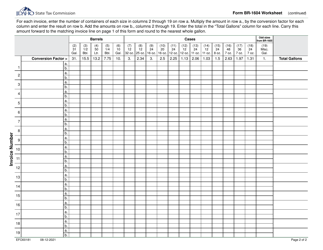

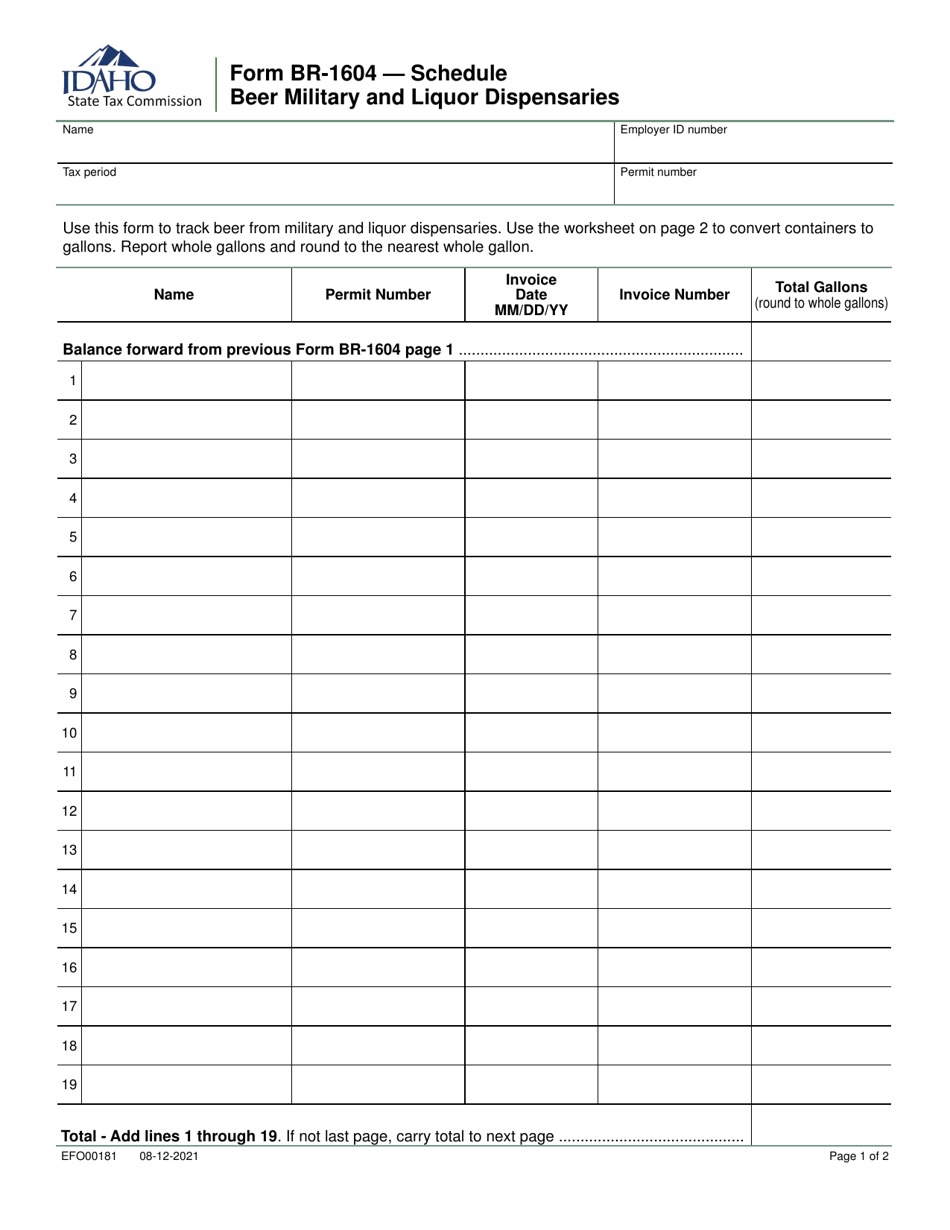

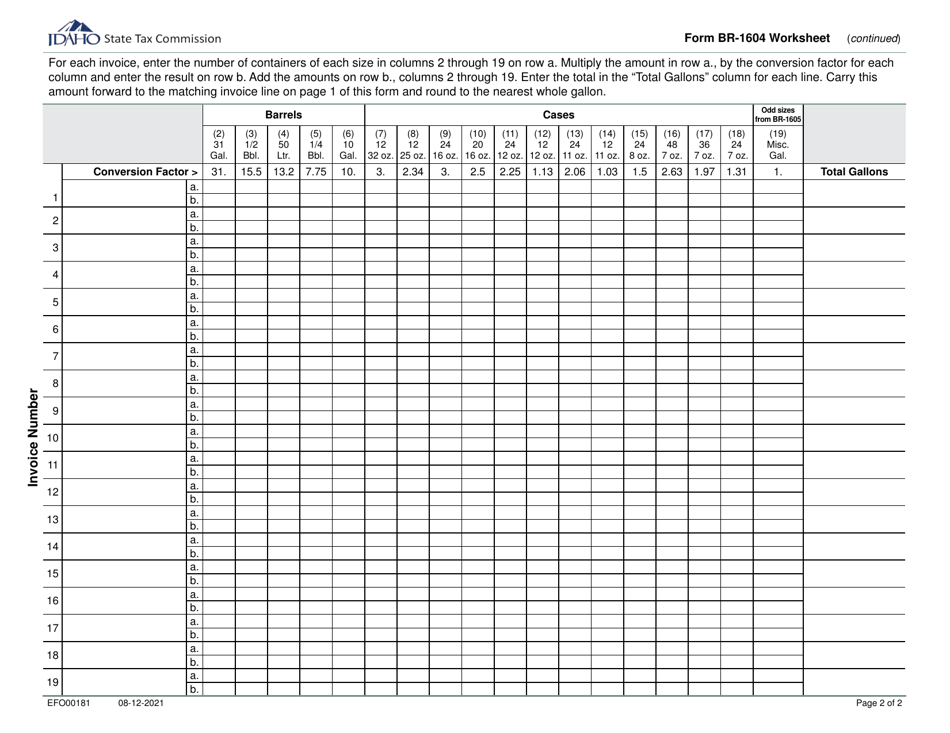

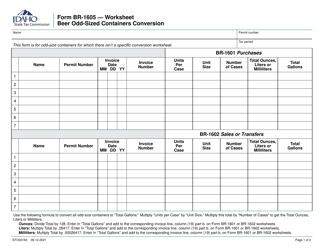

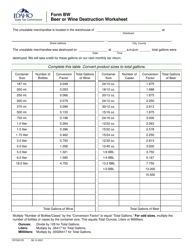

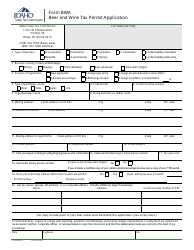

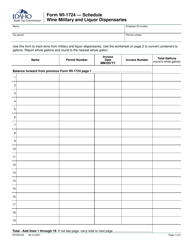

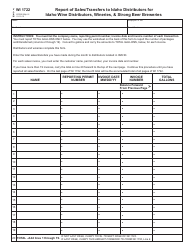

Form BR-1604 (EFO00181) Schedule Beer Military and Liquor Dispensaries - Idaho

What Is Form BR-1604 (EFO00181)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BR-1604?

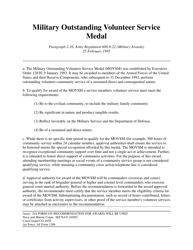

A: Form BR-1604 is a form used in Idaho for Schedule Beer Military and Liquor Dispensaries.

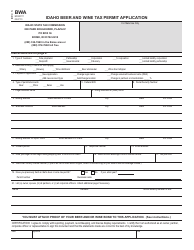

Q: What is the purpose of Form BR-1604?

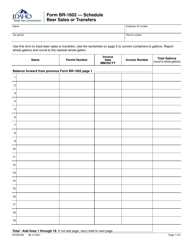

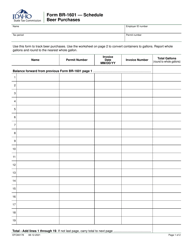

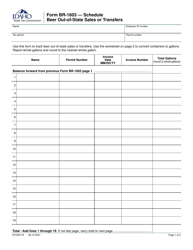

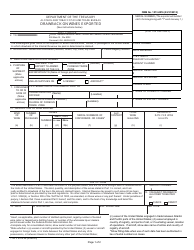

A: The purpose of Form BR-1604 is to report sales of beer and liquor in military and liquor dispensaries in Idaho.

Q: Who needs to fill out Form BR-1604?

A: Military and liquor dispensaries in Idaho need to fill out Form BR-1604.

Q: Are there any filing fees for Form BR-1604?

A: No, there are no filing fees for Form BR-1604.

Q: What is the deadline for filing Form BR-1604?

A: Form BR-1604 must be filed and paid by the 25th of each month following the reporting month.

Q: Is there a penalty for late filing of Form BR-1604?

A: Yes, there is a late filing penalty of $20 per day, up to a maximum of $500.

Q: Who can I contact for more information about Form BR-1604?

A: You can contact the Idaho State Tax Commission for more information about Form BR-1604.

Form Details:

- Released on August 12, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BR-1604 (EFO00181) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.