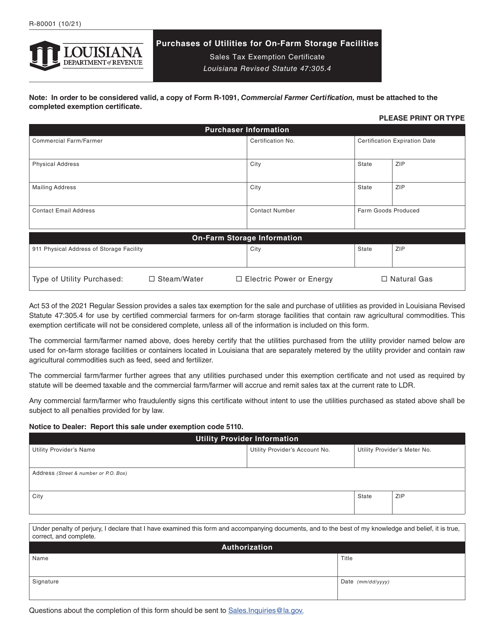

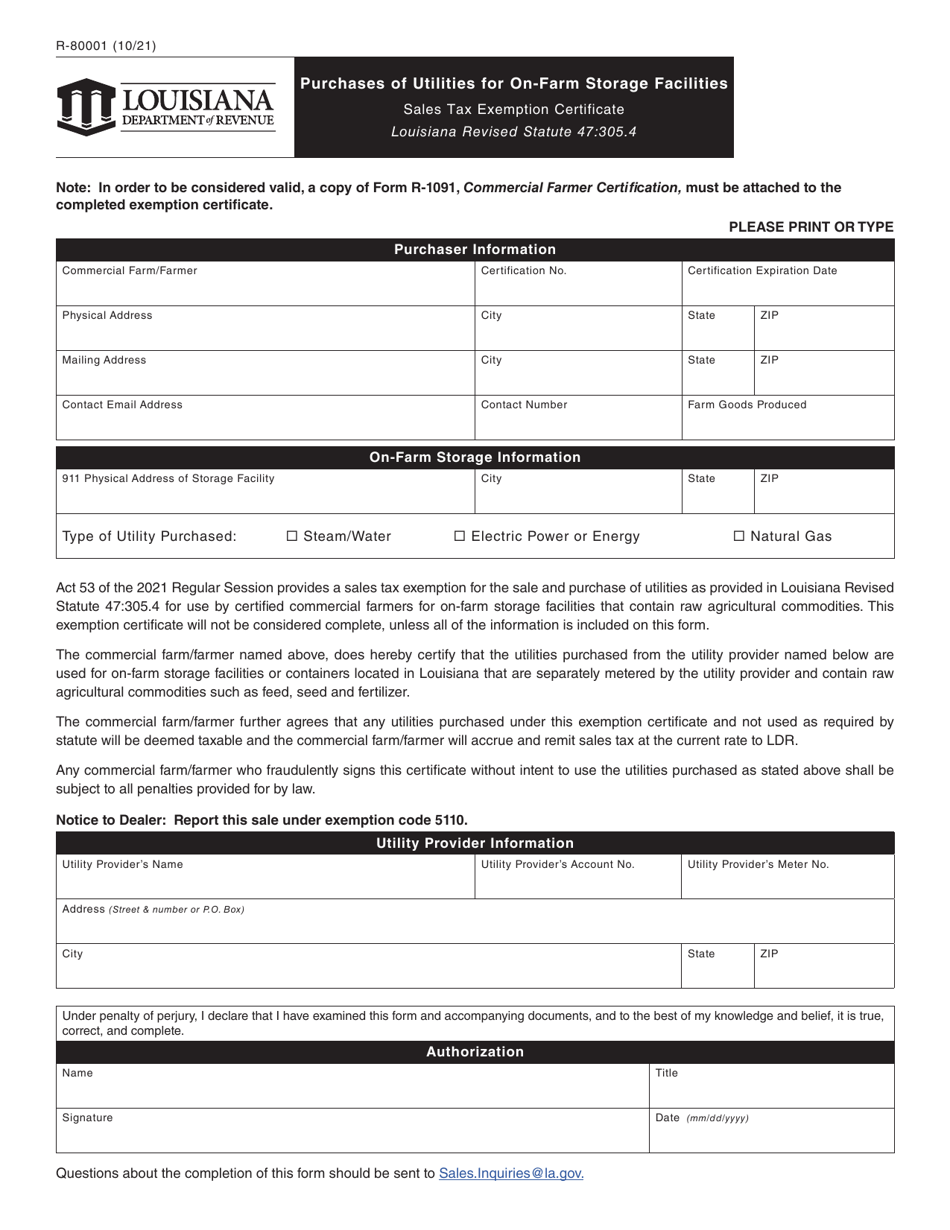

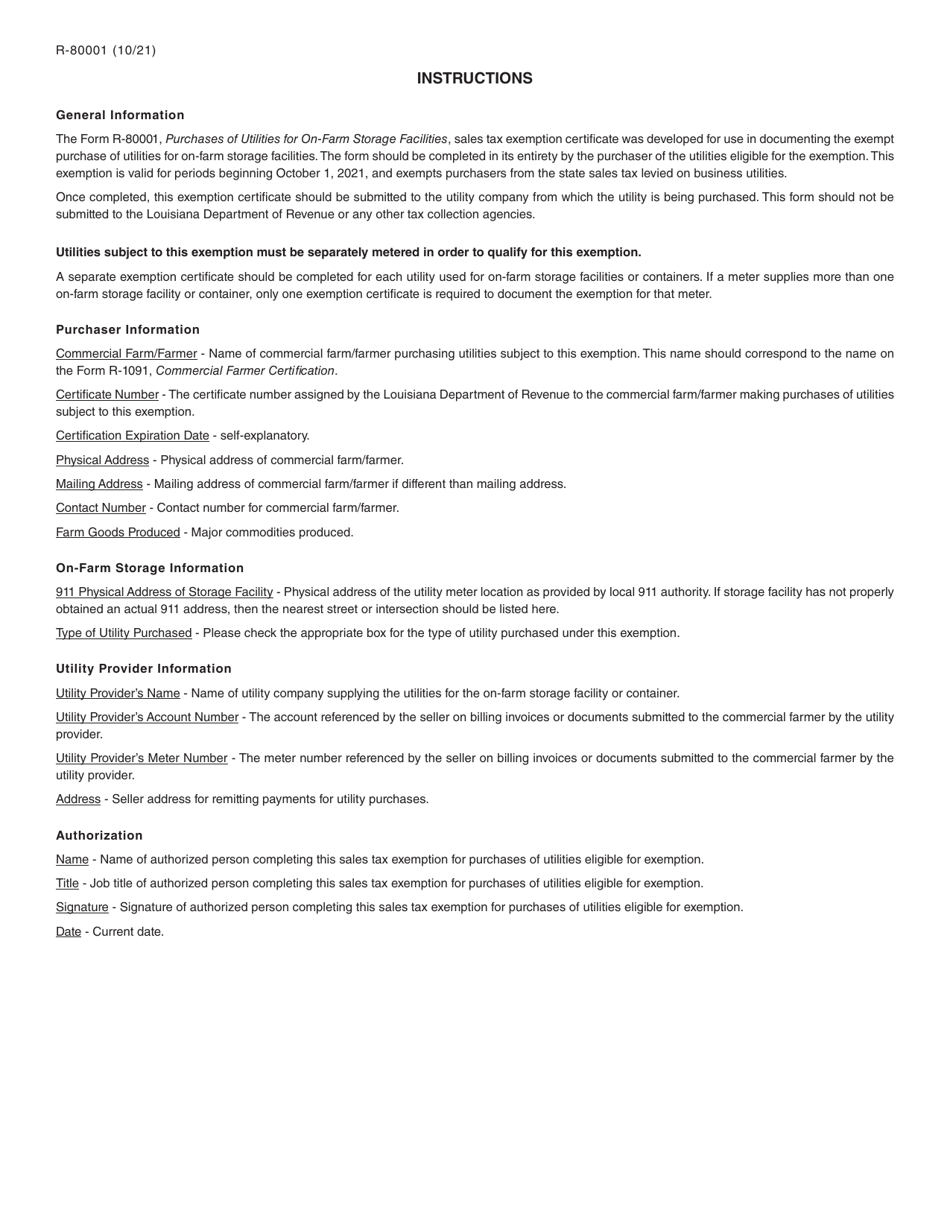

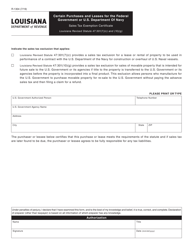

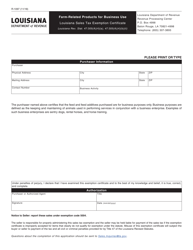

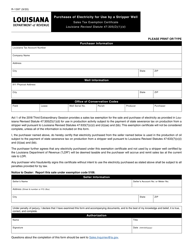

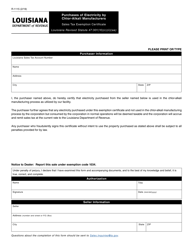

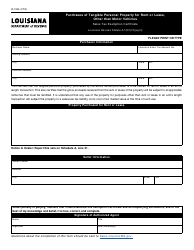

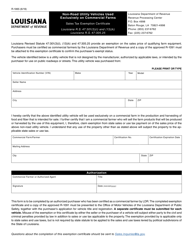

Form R-80001 Purchases of Utilities for on-Farm Storage Facilities Sales Tax Exemption Certificate - Louisiana

What Is Form R-80001?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-80001?

A: Form R-80001 is a Sales Tax Exemption Certificate for the Purchases of Utilities for on-Farm Storage Facilities in Louisiana.

Q: What is the purpose of Form R-80001?

A: The purpose of Form R-80001 is to exempt farmers from paying sales tax on purchases of utilities for on-farm storage facilities in Louisiana.

Q: Who can use Form R-80001?

A: Form R-80001 can be used by farmers who have on-farm storage facilities and wish to claim a sales tax exemption on utilities purchased for those facilities in Louisiana.

Q: What is considered an on-farm storage facility?

A: An on-farm storage facility is a structure or building used by a farmer for the storage of agricultural products, equipment, or supplies related to their farming operations.

Q: What utilities are eligible for the sales tax exemption?

A: Eligible utilities for the sales tax exemption include electricity, natural gas, propane, and water used in an on-farm storage facility.

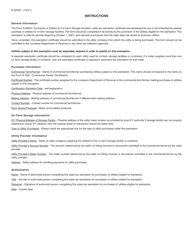

Q: How do I apply for the sales tax exemption using Form R-80001?

A: To apply for the sales tax exemption, farmers must complete Form R-80001 and provide it to their utility provider and the Louisiana Department of Revenue.

Q: Are there any restrictions on the use of this exemption?

A: Yes, the sales tax exemption only applies to utilities used exclusively for the on-farm storage facility and not for any other non-farm purposes.

Q: How long is the sales tax exemption valid?

A: The sales tax exemption is valid for one year from the date of issuance, and farmers must reapply annually to continue receiving the exemption.

Q: Can Form R-80001 be used for other types of purchases?

A: No, Form R-80001 is specifically for the sales tax exemption on purchases of utilities for on-farm storage facilities. It cannot be used for other types of purchases.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-80001 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.