This version of the form is not currently in use and is provided for reference only. Download this version of

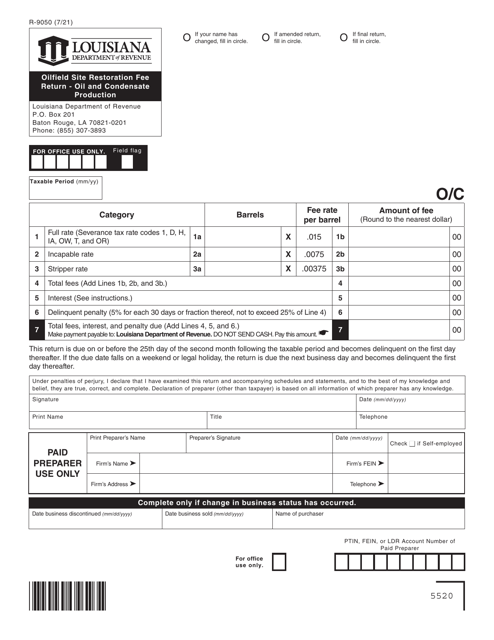

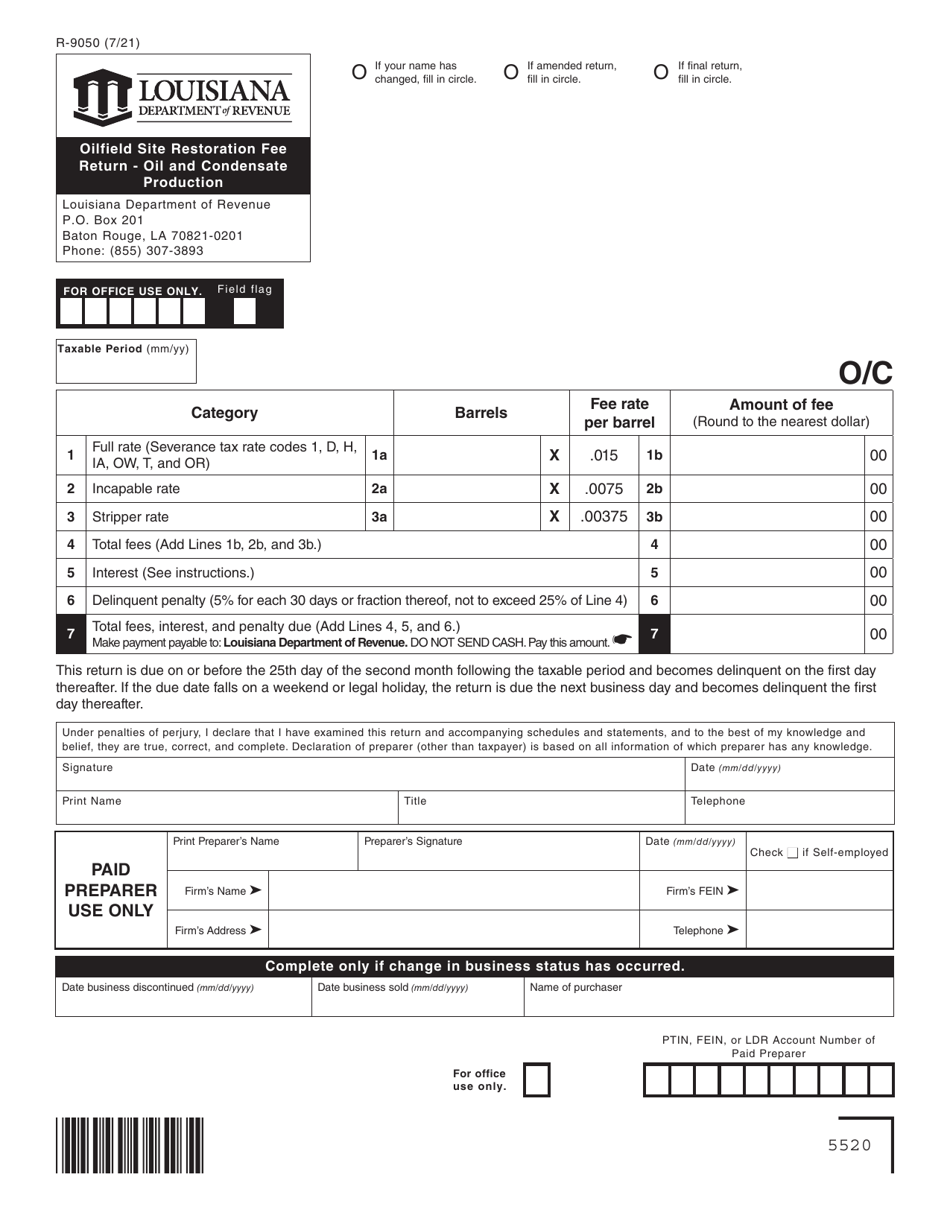

Form R-9050

for the current year.

Form R-9050 Oilfield Site Restoration Fee Return - Oil and Condensate Production - Louisiana

What Is Form R-9050?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-9050?

A: Form R-9050 is the Oilfield Site Restoration Fee Return.

Q: What is the purpose of Form R-9050?

A: The purpose of Form R-9050 is to report and pay the Oilfield Site Restoration Fee for oil and condensate production in Louisiana.

Q: Who needs to file Form R-9050?

A: Any person or entity engaged in the production of oil and condensate in Louisiana needs to file Form R-9050.

Q: What is the Oilfield Site Restoration Fee?

A: The Oilfield Site Restoration Fee is a fee imposed on the production of oil and condensate in Louisiana to fund the restoration and remediation of oilfield sites.

Q: When is Form R-9050 due?

A: Form R-9050 is due on or before the 25th day of the month following the month in which the oil and condensate was produced.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-9050 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.