This version of the form is not currently in use and is provided for reference only. Download this version of

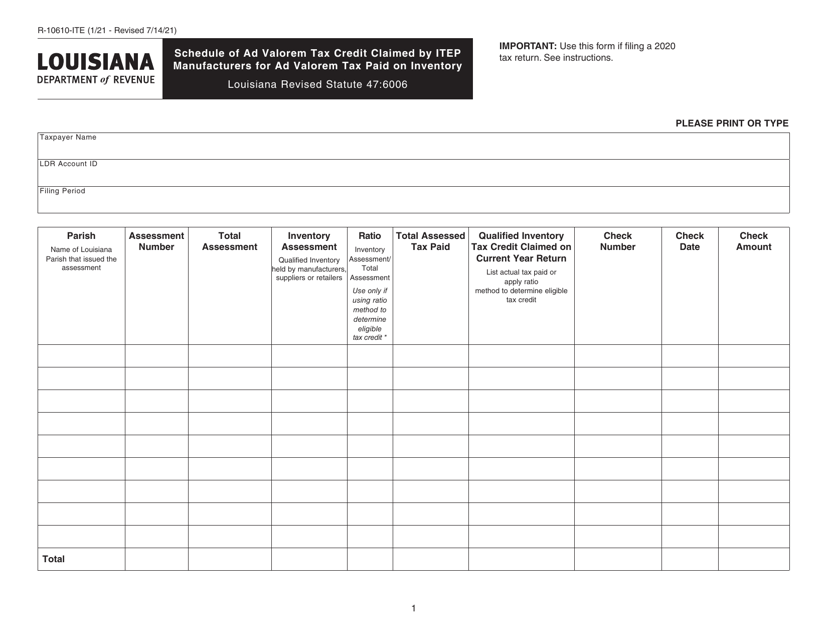

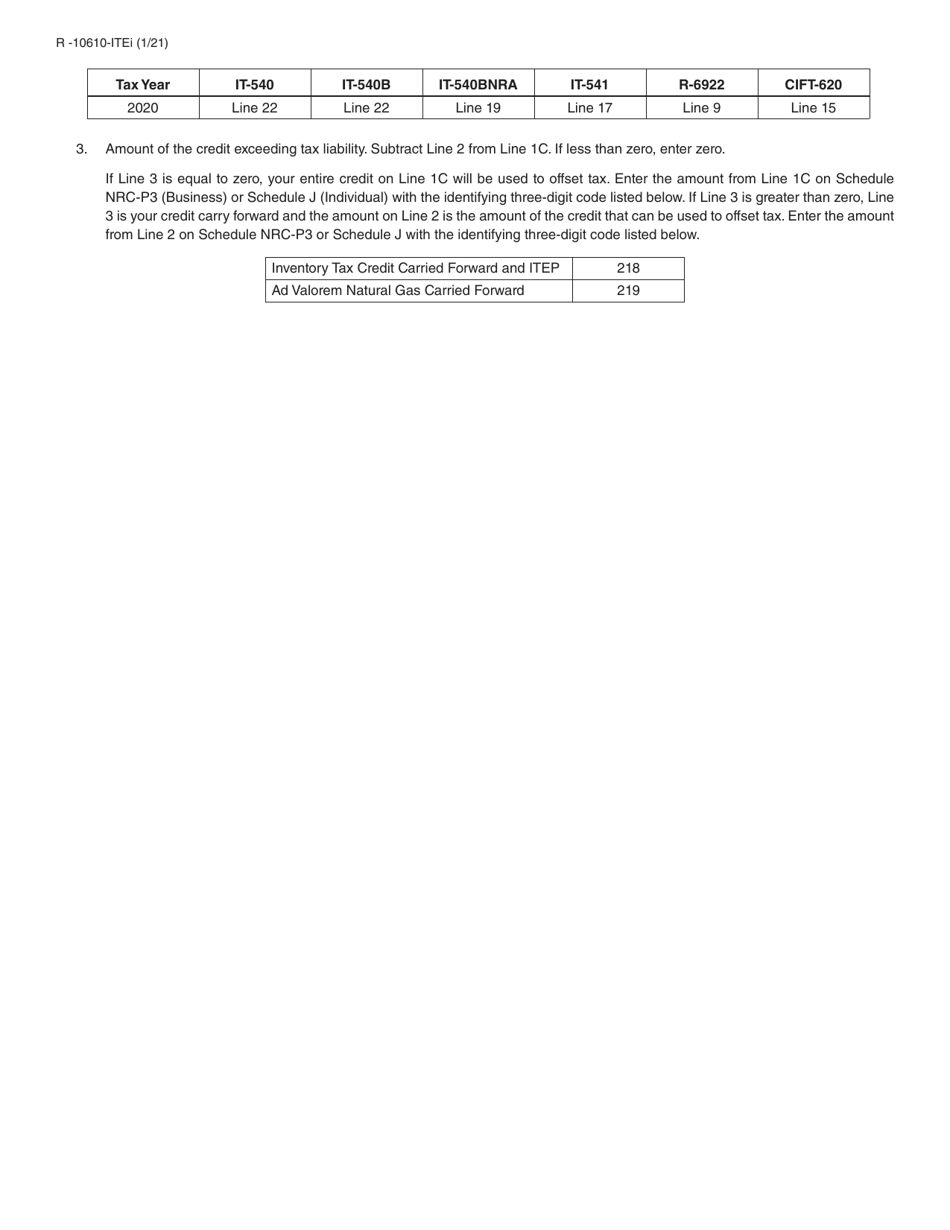

Form R-10610-ITE

for the current year.

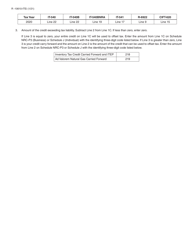

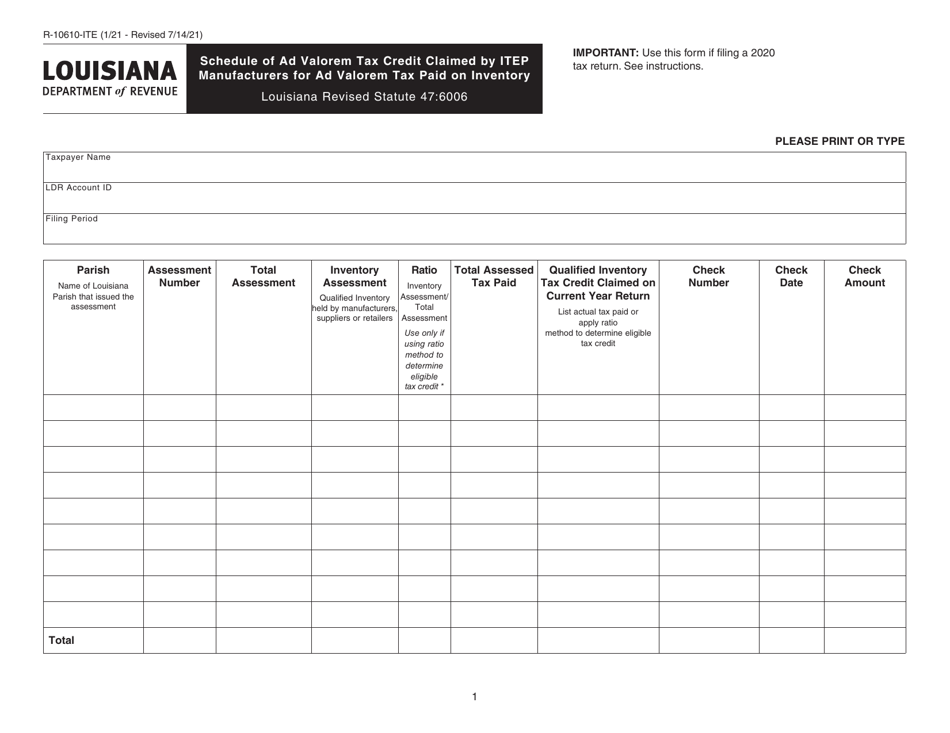

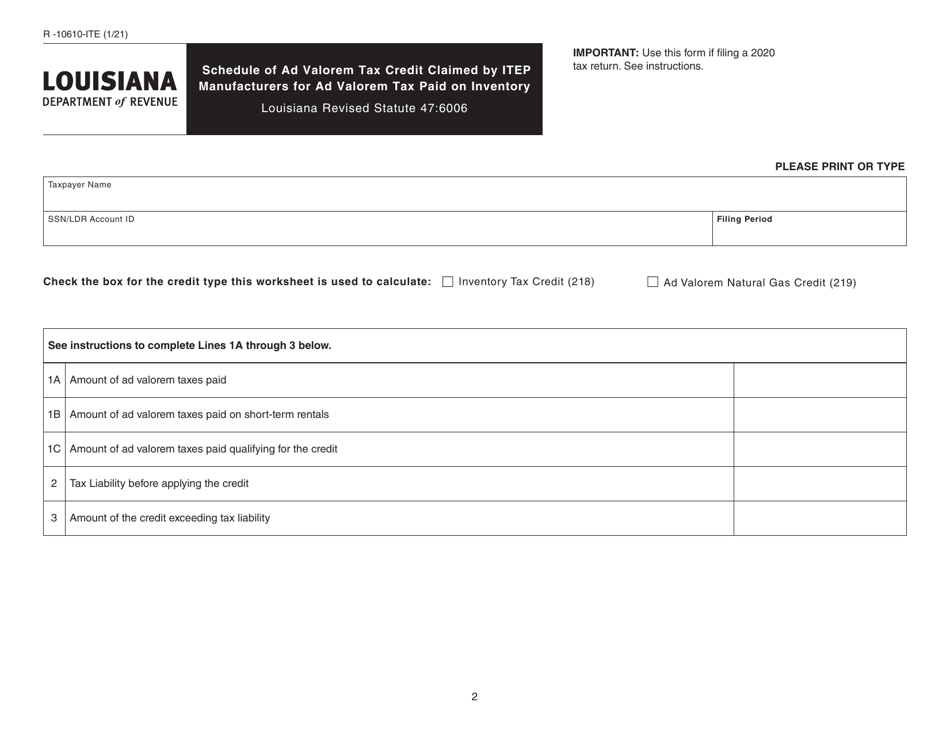

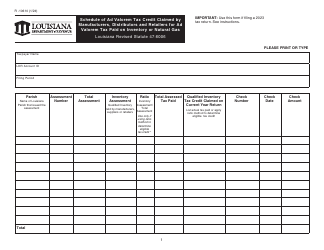

Form R-10610-ITE Schedule of Ad Valorem Tax Credit Claimed by Itep Manufacturers for Ad Valorem Tax Paid on Inventory - Louisiana

What Is Form R-10610-ITE?

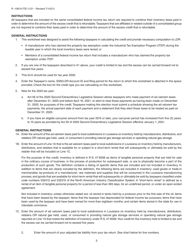

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610-ITE?

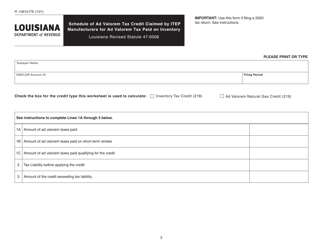

A: Form R-10610-ITE is a schedule used by Itep Manufacturers in Louisiana to claim a tax credit for ad valorem tax paid on inventory.

Q: Who can use Form R-10610-ITE?

A: Itep Manufacturers in Louisiana can use Form R-10610-ITE to claim a tax credit.

Q: What is the purpose of Form R-10610-ITE?

A: The purpose of Form R-10610-ITE is to claim a tax credit for ad valorem tax paid on inventory by Itep Manufacturers.

Q: What does the tax credit claimed on Form R-10610-ITE cover?

A: The tax credit claimed on Form R-10610-ITE covers the ad valorem tax paid on inventory.

Q: Is Form R-10610-ITE specific to Louisiana?

A: Yes, Form R-10610-ITE is specific to Louisiana and is used by Itep Manufacturers in the state.

Form Details:

- Released on July 14, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610-ITE by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.