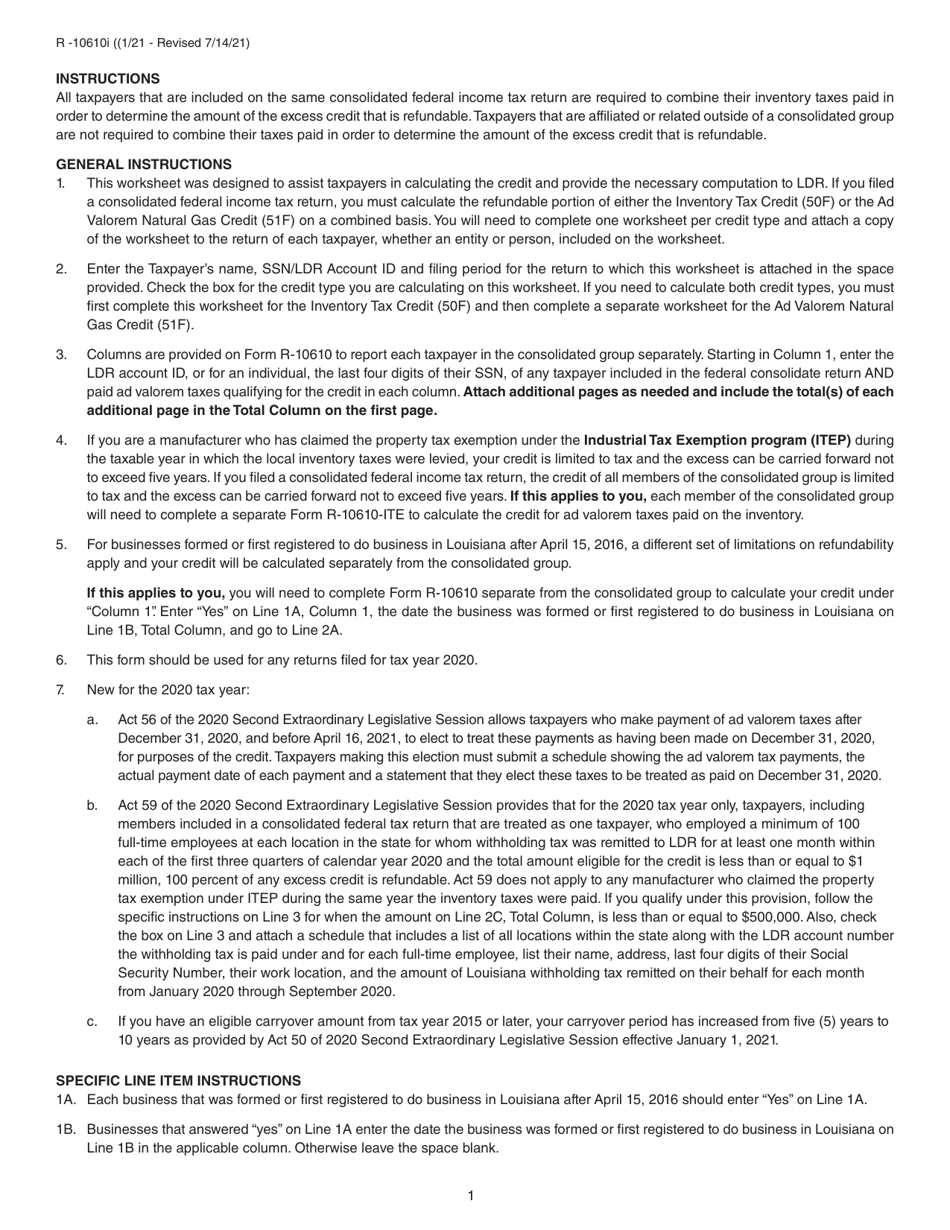

This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10610

for the current year.

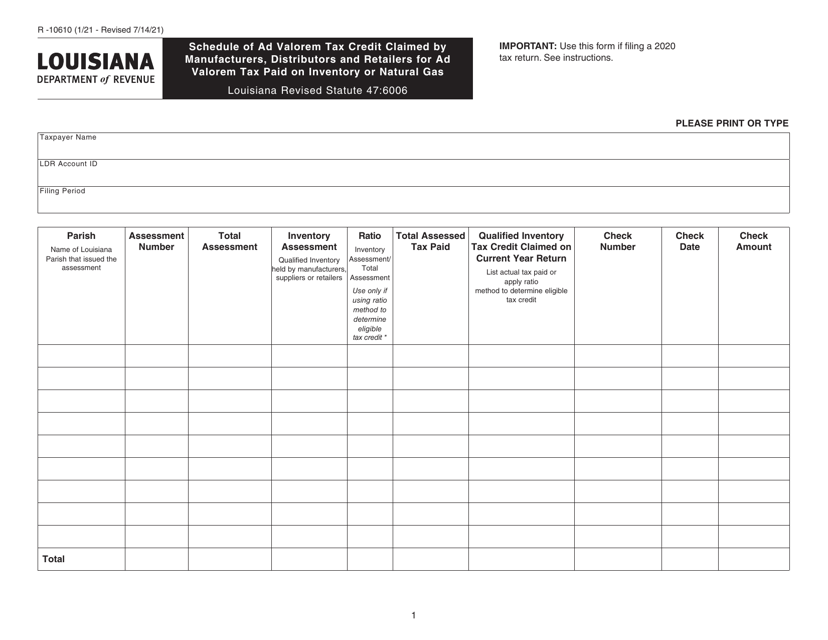

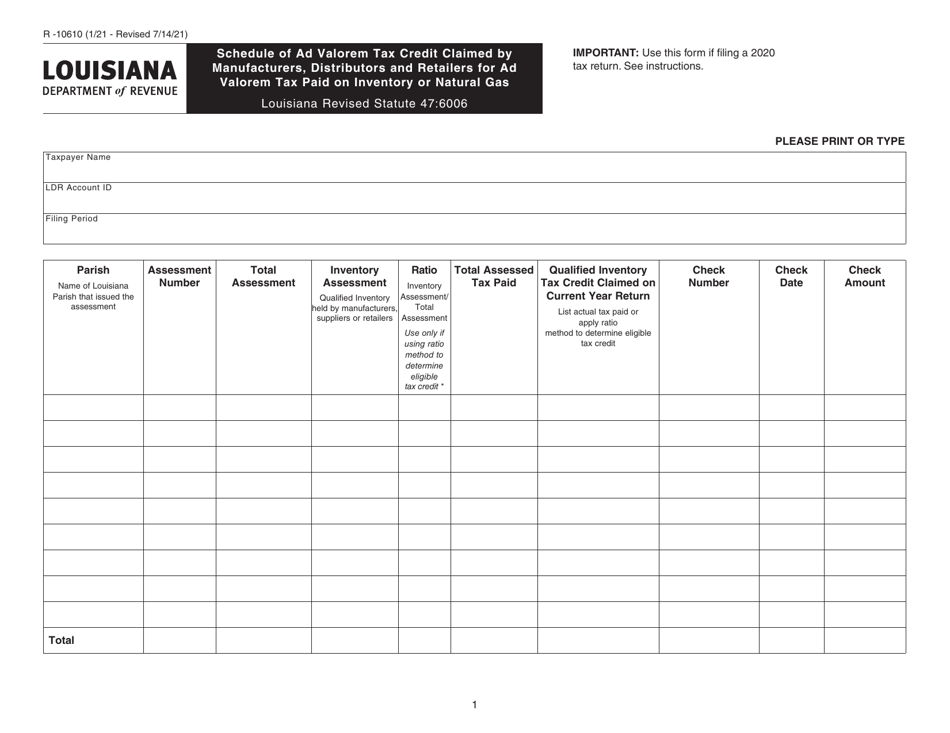

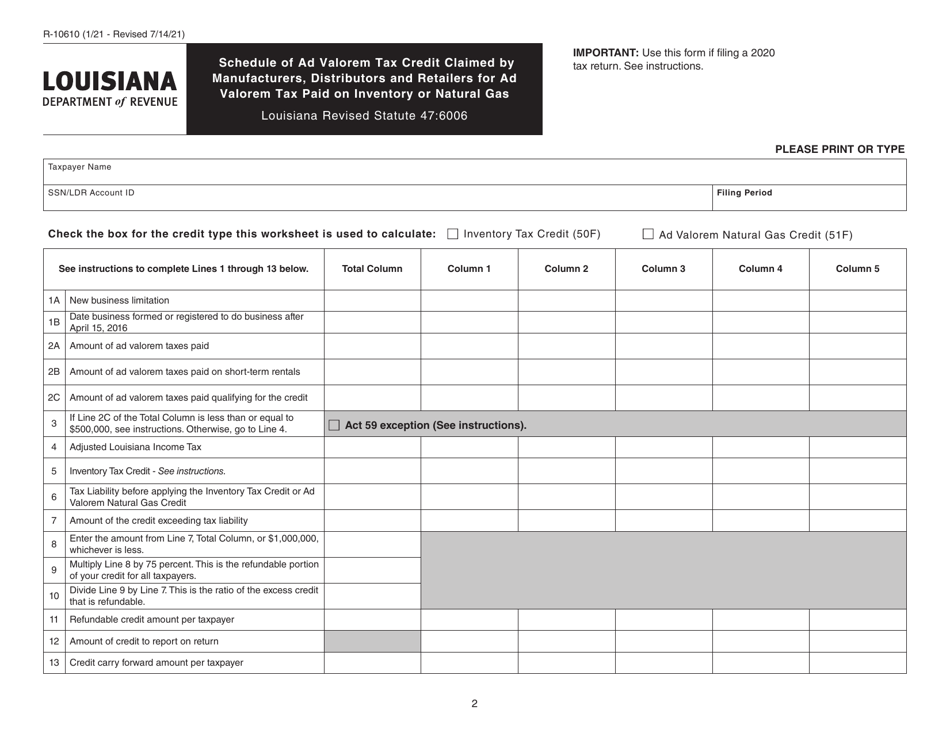

Form R-10610 Schedule of Ad Valorem Tax Credit Claimed by Manufacturers, Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas - Louisiana

What Is Form R-10610?

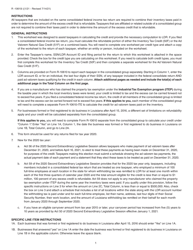

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

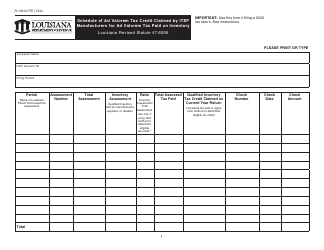

Q: What is Form R-10610?

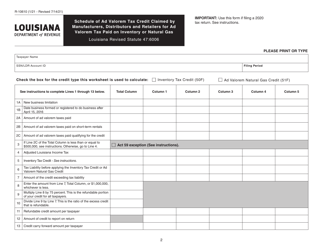

A: Form R-10610 is a schedule used by manufacturers, distributors, and retailers in Louisiana to claim a credit for Ad Valorem tax paid on inventory or natural gas.

Q: Who can use Form R-10610?

A: Manufacturers, distributors, and retailers in Louisiana can use Form R-10610 to claim a credit for Ad Valorem tax paid on inventory or natural gas.

Q: What is the purpose of Form R-10610?

A: The purpose of Form R-10610 is to allow eligible businesses to claim a credit for Ad Valorem tax paid on inventory or natural gas.

Q: What is Ad Valorem tax?

A: Ad Valorem tax is a tax assessed on the value of property, typically real estate or personal property such as inventory.

Q: What can businesses claim a credit for with Form R-10610?

A: Businesses can claim a credit for Ad Valorem tax paid on inventory or natural gas with Form R-10610.

Form Details:

- Released on July 14, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.