This version of the form is not currently in use and is provided for reference only. Download this version of

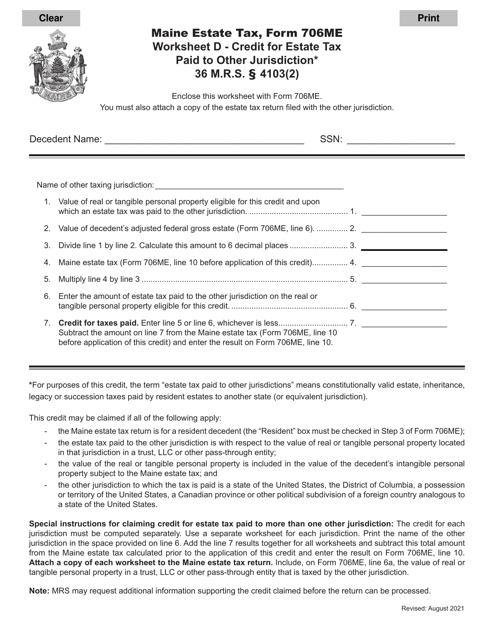

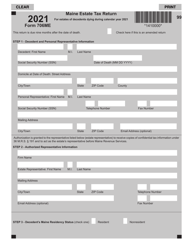

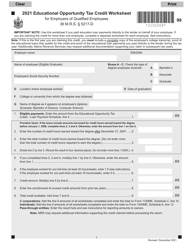

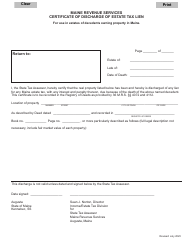

Form 706ME Worksheet D

for the current year.

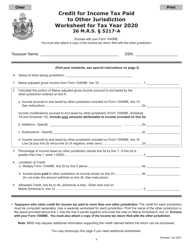

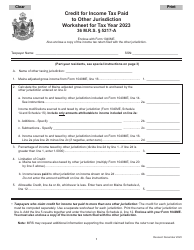

Form 706ME Worksheet D Credit for Estate Tax Paid to Other Jurisdiction - Maine

What Is Form 706ME Worksheet D?

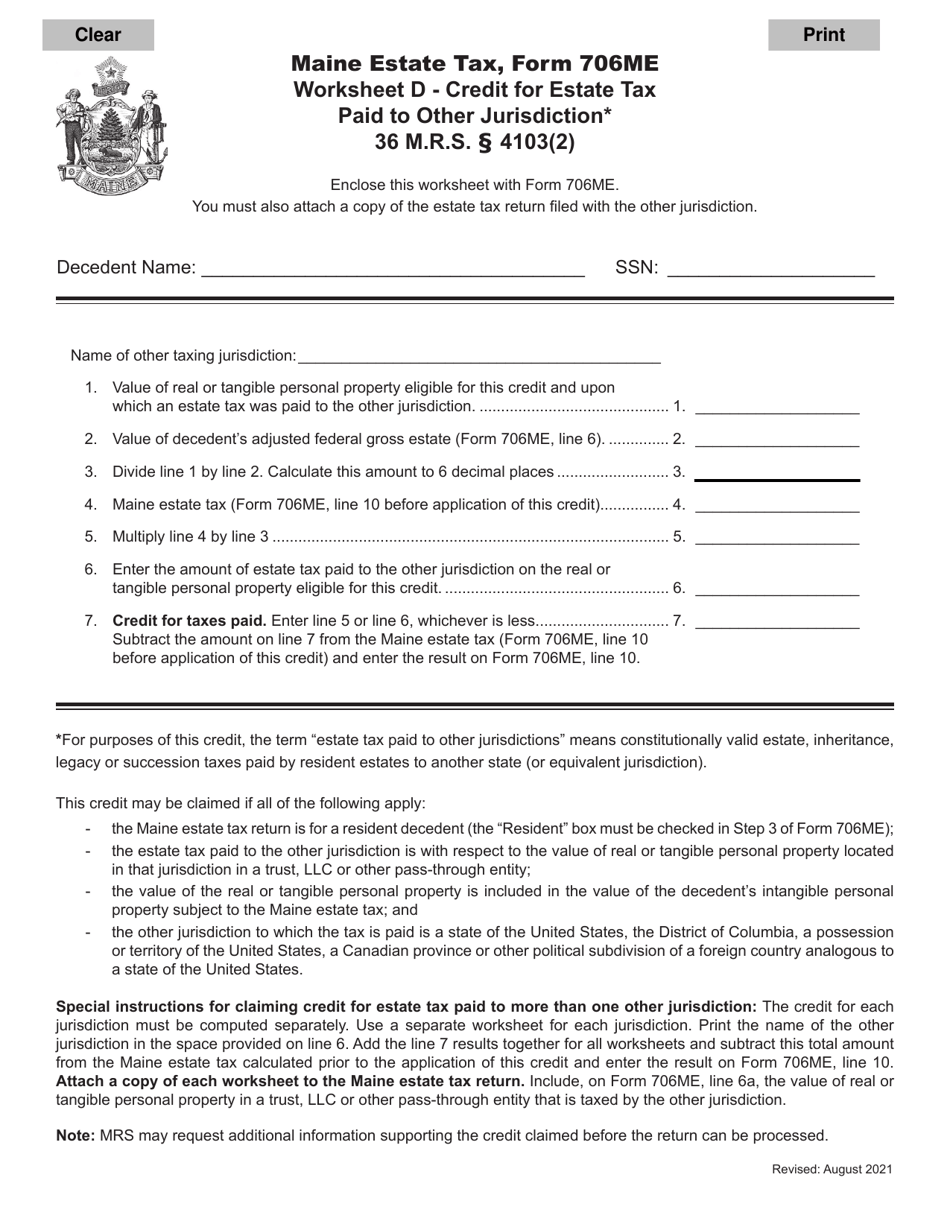

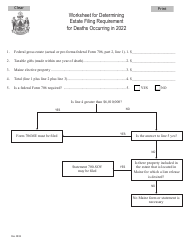

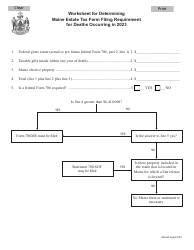

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 706ME, Worksheet D - Credit for Estate Tax Paid to Other Jurisdictions by Resident Estates. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 706ME?

A: Form 706ME is a tax form used in the state of Maine to calculate and report estate tax.

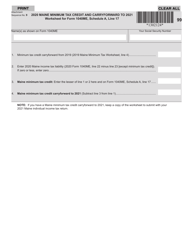

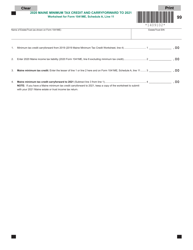

Q: What is Worksheet D on Form 706ME?

A: Worksheet D on Form 706ME is used to calculate the credit for estate tax paid to another jurisdiction, such as another state or country.

Q: Who is eligible for the credit for estate tax paid to other jurisdictions in Maine?

A: Executors or administrators of an estate that paid estate tax in another jurisdiction may be eligible for the credit in Maine.

Q: How is the credit for estate tax paid to other jurisdictions calculated in Maine?

A: The credit is calculated by multiplying the Maine estate tax liability by the ratio of the estate tax paid to the other jurisdiction to the total taxable estate.

Q: Can the credit for estate tax paid to other jurisdictions exceed the Maine estate tax liability?

A: No, the credit cannot exceed the Maine estate tax liability.

Q: What documentation is needed to claim the credit for estate tax paid to other jurisdictions in Maine?

A: Documentation proving the payment of estate tax in the other jurisdiction, such as an official tax receipt or certificate, is typically required.

Q: Is the credit for estate tax paid to other jurisdictions refundable in Maine?

A: Yes, if the credit exceeds the Maine estate tax liability, the excess may be refunded.

Q: Are there any time limits for claiming the credit for estate tax paid to other jurisdictions in Maine?

A: Yes, the credit must be claimed within 3 years from the date of payment of the estate tax to the other jurisdiction.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 706ME Worksheet D by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.