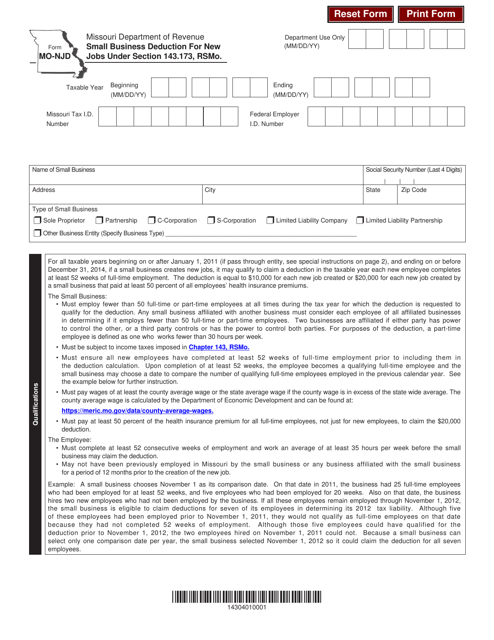

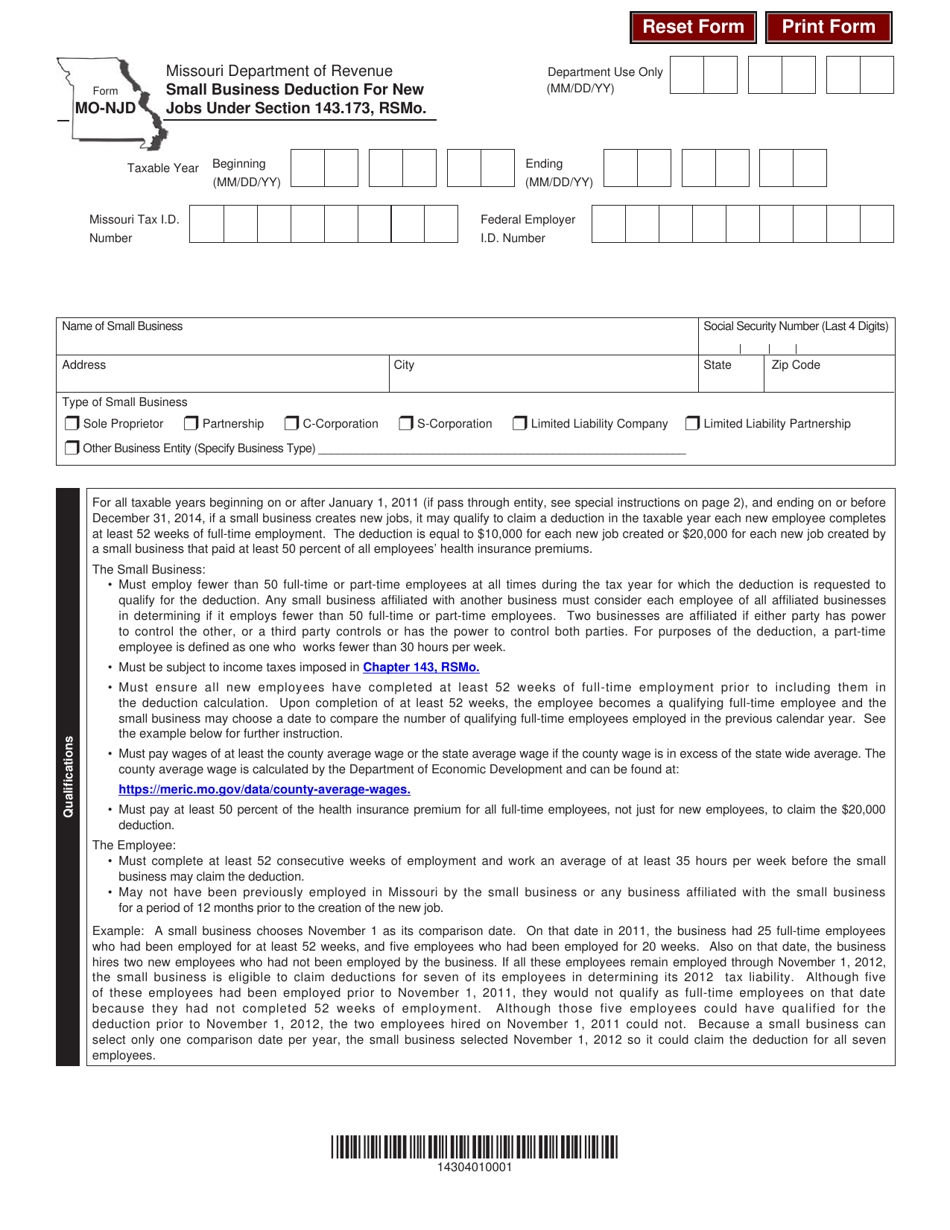

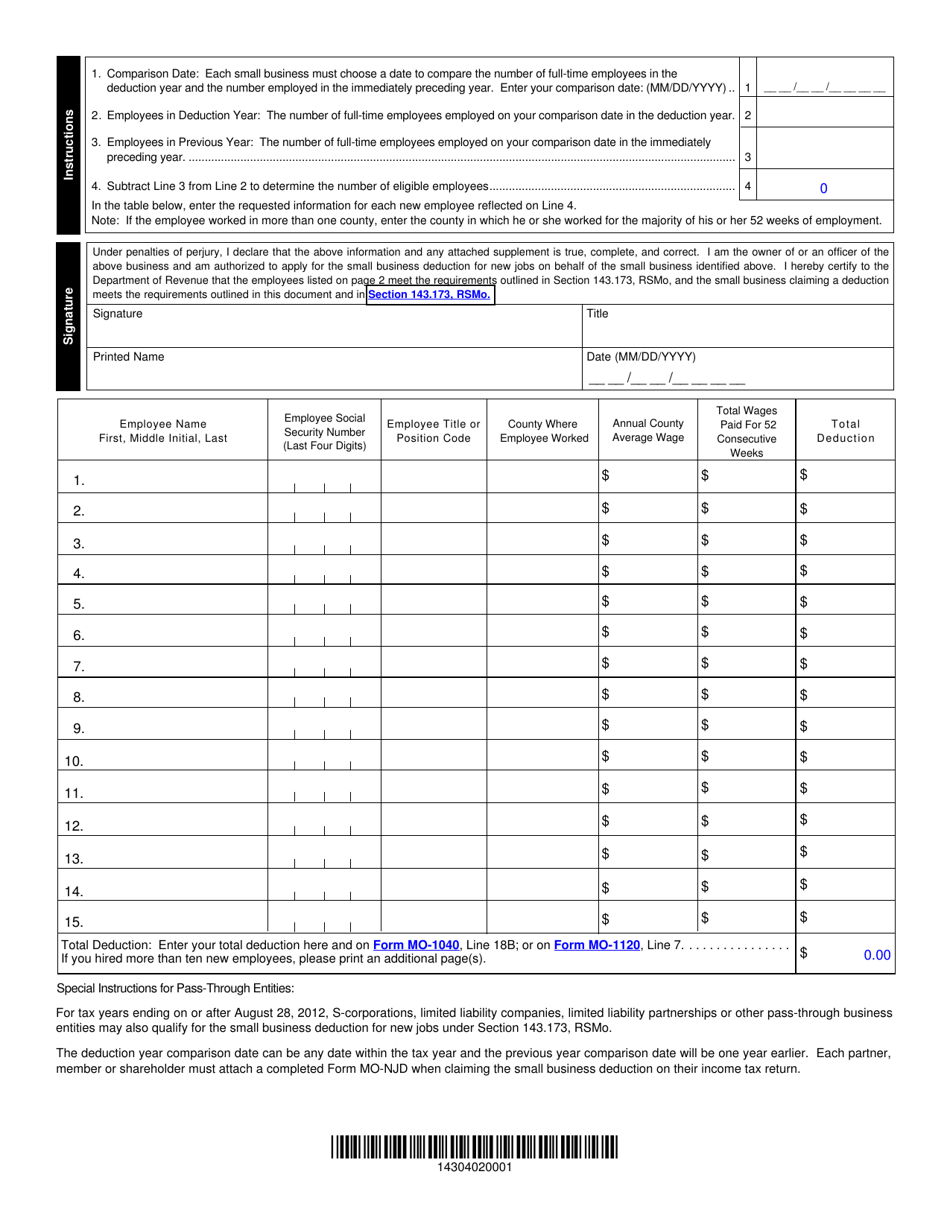

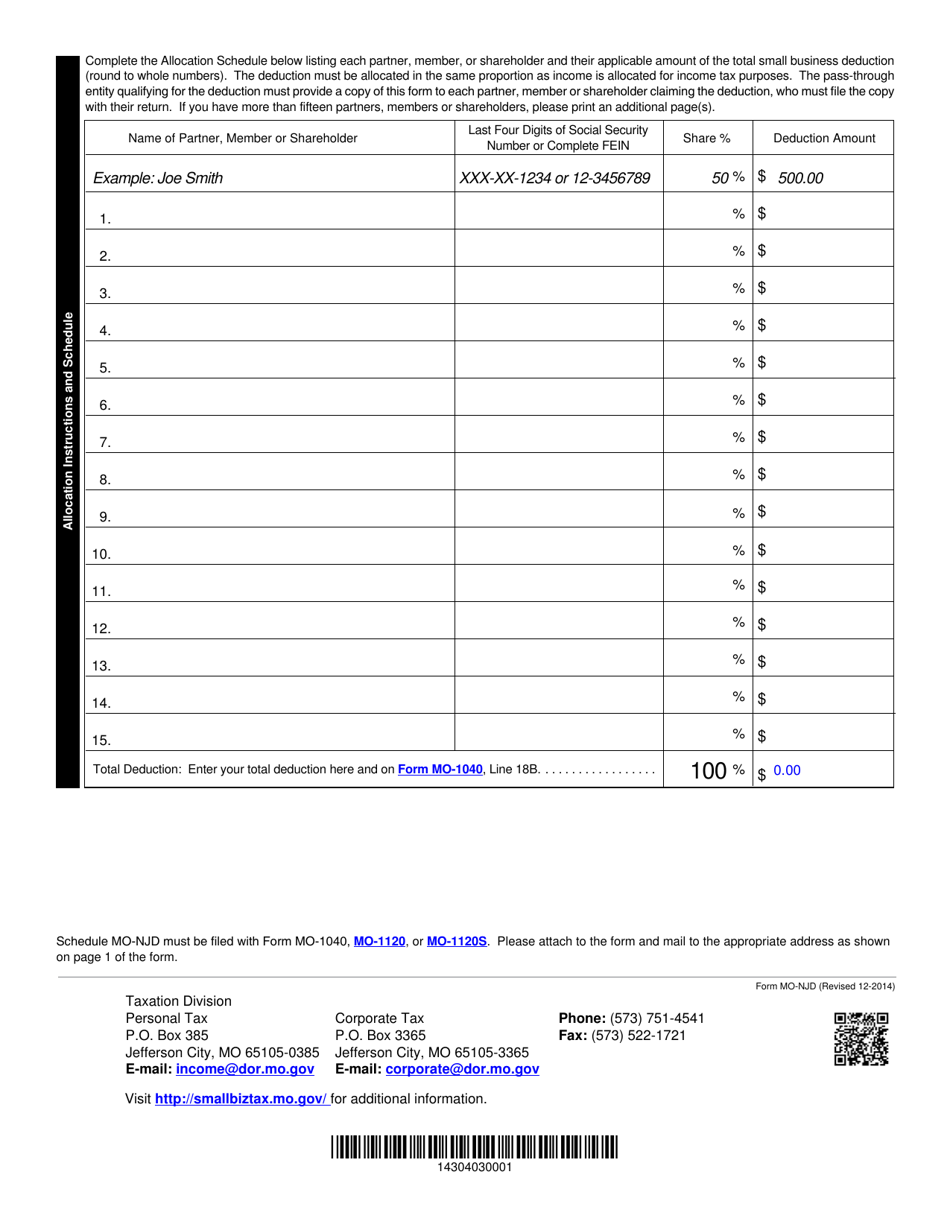

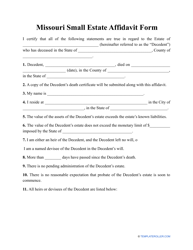

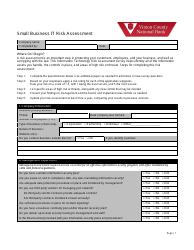

Form MO-NJD Small Business Deduction for New Jobs Under Section 143.173, Rsmo - Missouri

What Is Form MO-NJD?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-NJD Small Business Deduction for New Jobs?

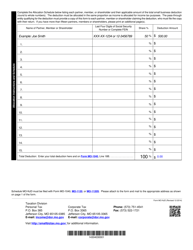

A: The MO-NJD Small Business Deduction for New Jobs is a tax deduction offered under Section 143.173, RSMo in Missouri.

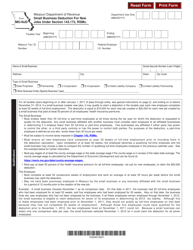

Q: Who is eligible for the MO-NJD Small Business Deduction for New Jobs?

A: Small businesses in Missouri that create new jobs may be eligible for this deduction.

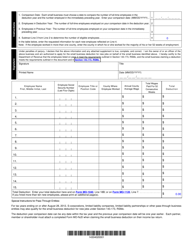

Q: What are the requirements to qualify for the MO-NJD Small Business Deduction for New Jobs?

A: To qualify for this deduction, a small business must create new jobs in Missouri and meet certain criteria set by the state.

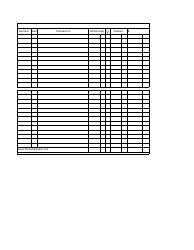

Q: How does the MO-NJD Small Business Deduction for New Jobs work?

A: This deduction allows eligible small businesses to deduct a portion of their income related to newly created jobs from their state taxes.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NJD by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.