This version of the form is not currently in use and is provided for reference only. Download this version of

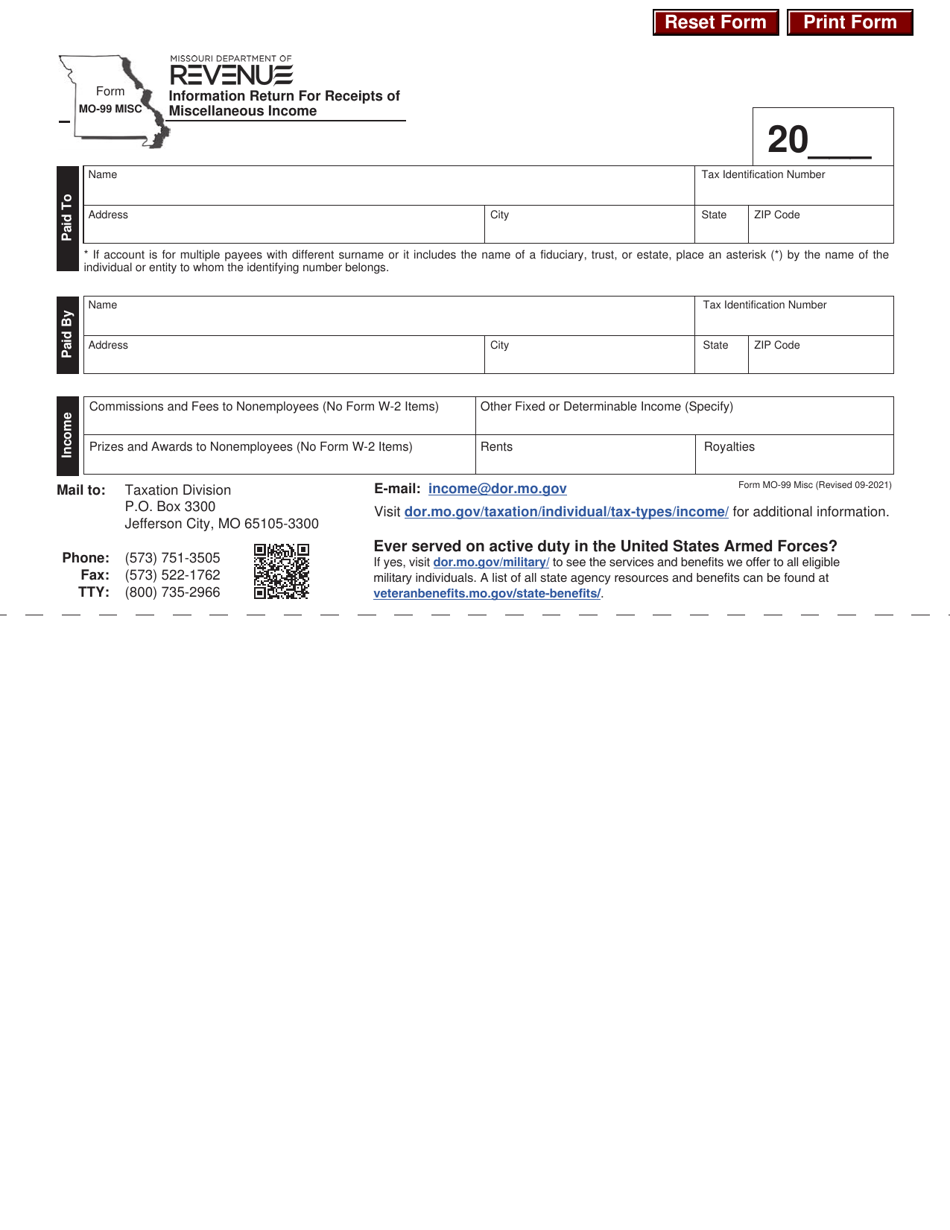

Form MO-99 MISC

for the current year.

Form MO-99 MISC Information Return for Receipts of Miscellaneous Income - Missouri

What Is Form MO-99 MISC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MO-99 MISC?

A: MO-99 MISC is a form used in Missouri to report miscellaneous income.

Q: Who needs to file MO-99 MISC?

A: Anyone who received miscellaneous income in Missouri needs to file MO-99 MISC.

Q: What is considered miscellaneous income?

A: Miscellaneous income includes income from self-employment, rent, royalties, and other sources not reported on other tax forms.

Q: When is the deadline to file MO-99 MISC?

A: The deadline to file MO-99 MISC is typically January 31st of the following year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or failure to file.

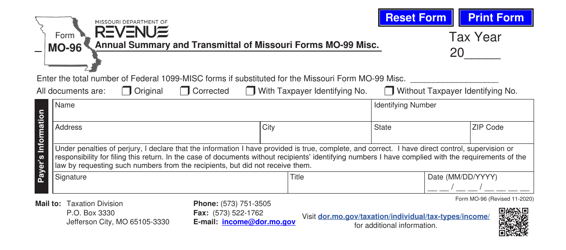

Q: Do I need to include copies of 1099 forms with MO-99 MISC?

A: No, you do not need to include copies of 1099 forms with MO-99 MISC. However, you should keep them for your records.

Q: Is MO-99 MISC only for residents of Missouri?

A: No, MO-99 MISC is for anyone who received miscellaneous income in Missouri, regardless of residency.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-99 MISC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.