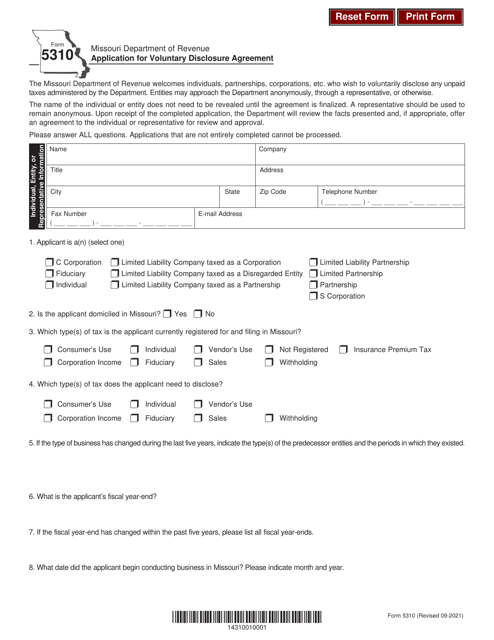

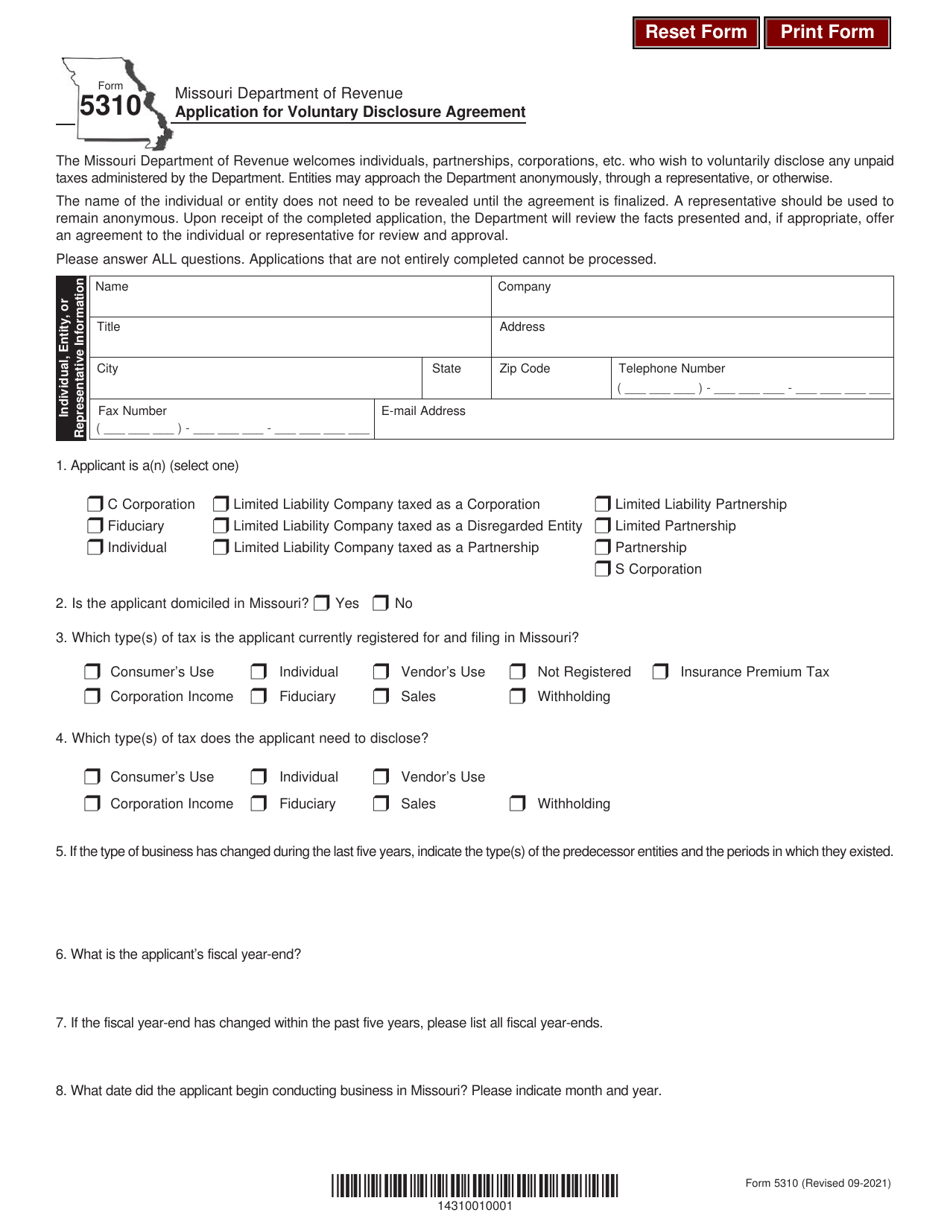

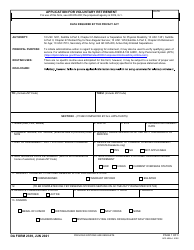

Form 5310 Application for Voluntary Disclosure Agreement - Missouri

What Is Form 5310?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

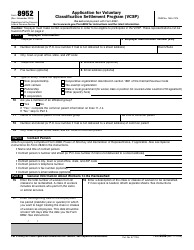

Q: What is Form 5310?

A: Form 5310 is an application for a Voluntary Disclosure Agreement in Missouri.

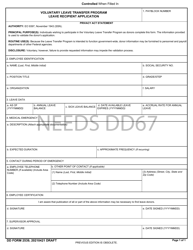

Q: What is a Voluntary Disclosure Agreement?

A: A Voluntary Disclosure Agreement is an arrangement between a taxpayer and a tax authority where the taxpayer voluntarily discloses previously unreported taxes and agrees to pay them, usually in exchange for certain benefits or reduced penalties.

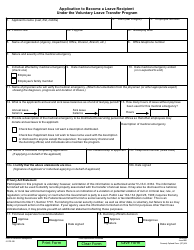

Q: Who can use Form 5310?

A: Form 5310 can be used by taxpayers in Missouri who want to disclose and resolve any unpaid taxes.

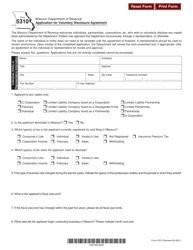

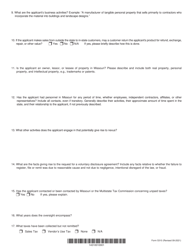

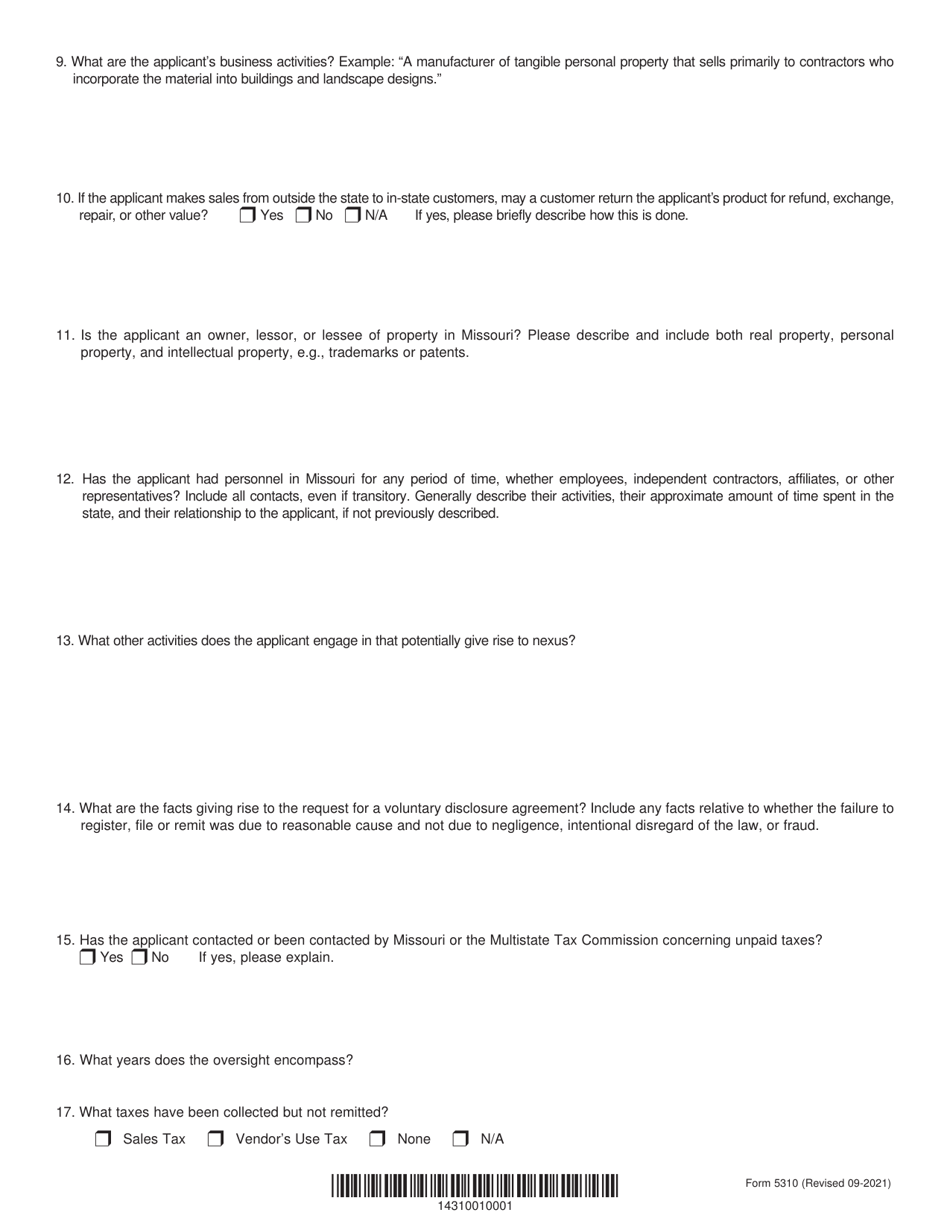

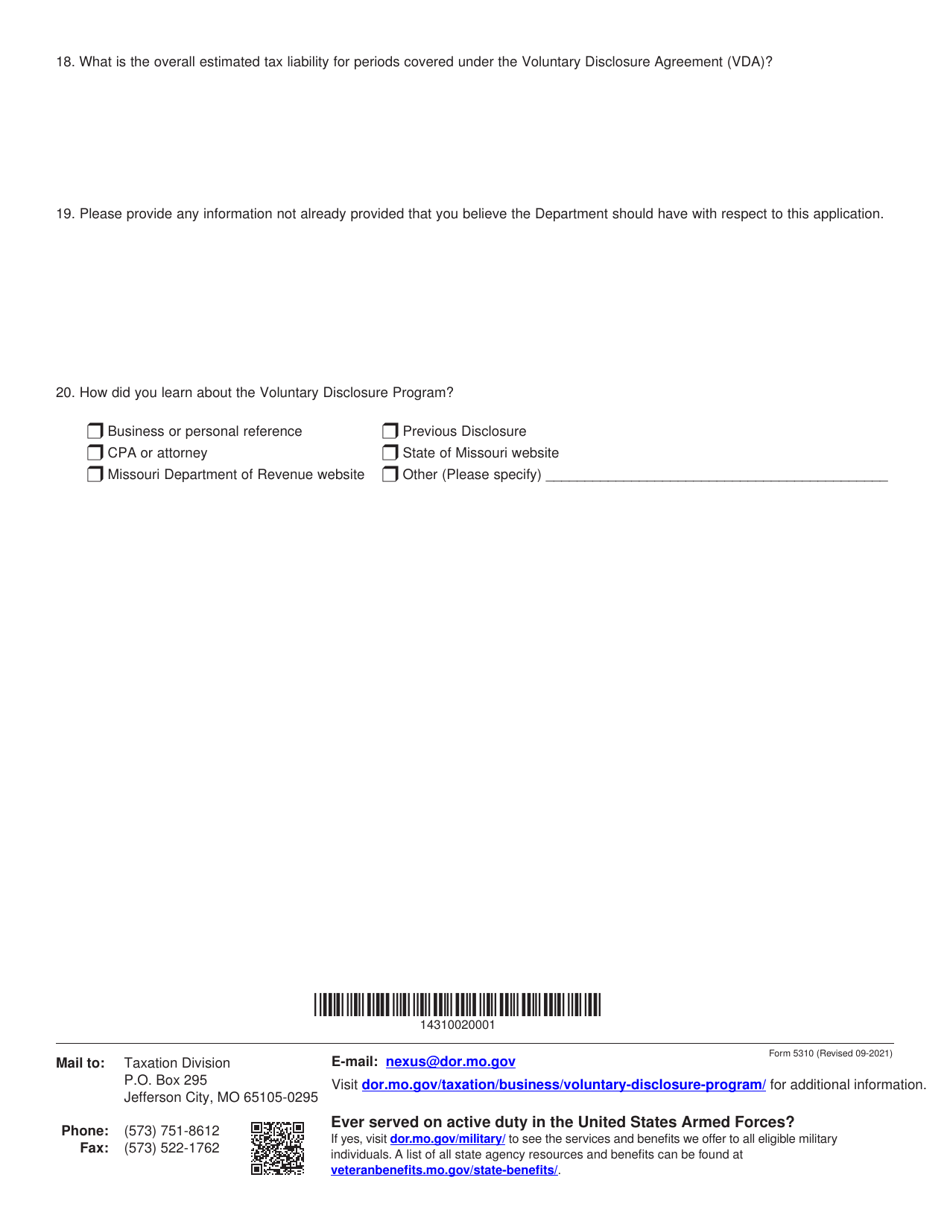

Q: What information is required on Form 5310?

A: Form 5310 requires information about the taxpayer, the specific taxes being disclosed, the amount owed, and any supporting documentation.

Q: What are the benefits of entering into a Voluntary Disclosure Agreement?

A: Benefits of entering into a Voluntary Disclosure Agreement may include reduced penalties, avoidance of criminal prosecution, and a streamlined process for resolving unpaid taxes.

Q: Is completing Form 5310 a guarantee that I will receive a Voluntary Disclosure Agreement?

A: No, completing Form 5310 is only the initial step in the application process. The tax authority will review the application and determine whether to accept or reject the taxpayer's request for a Voluntary Disclosure Agreement.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5310 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.