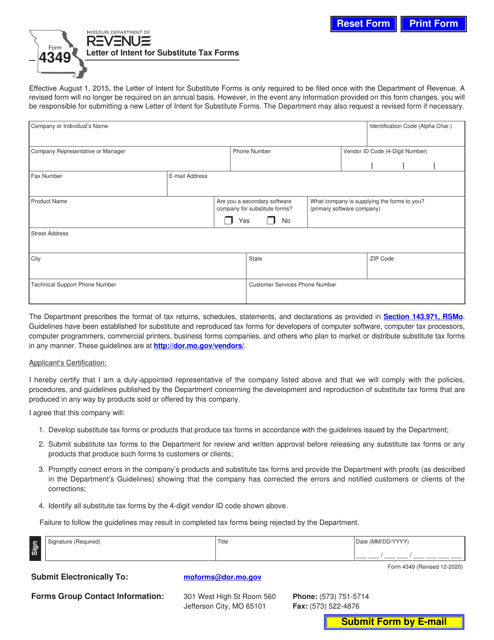

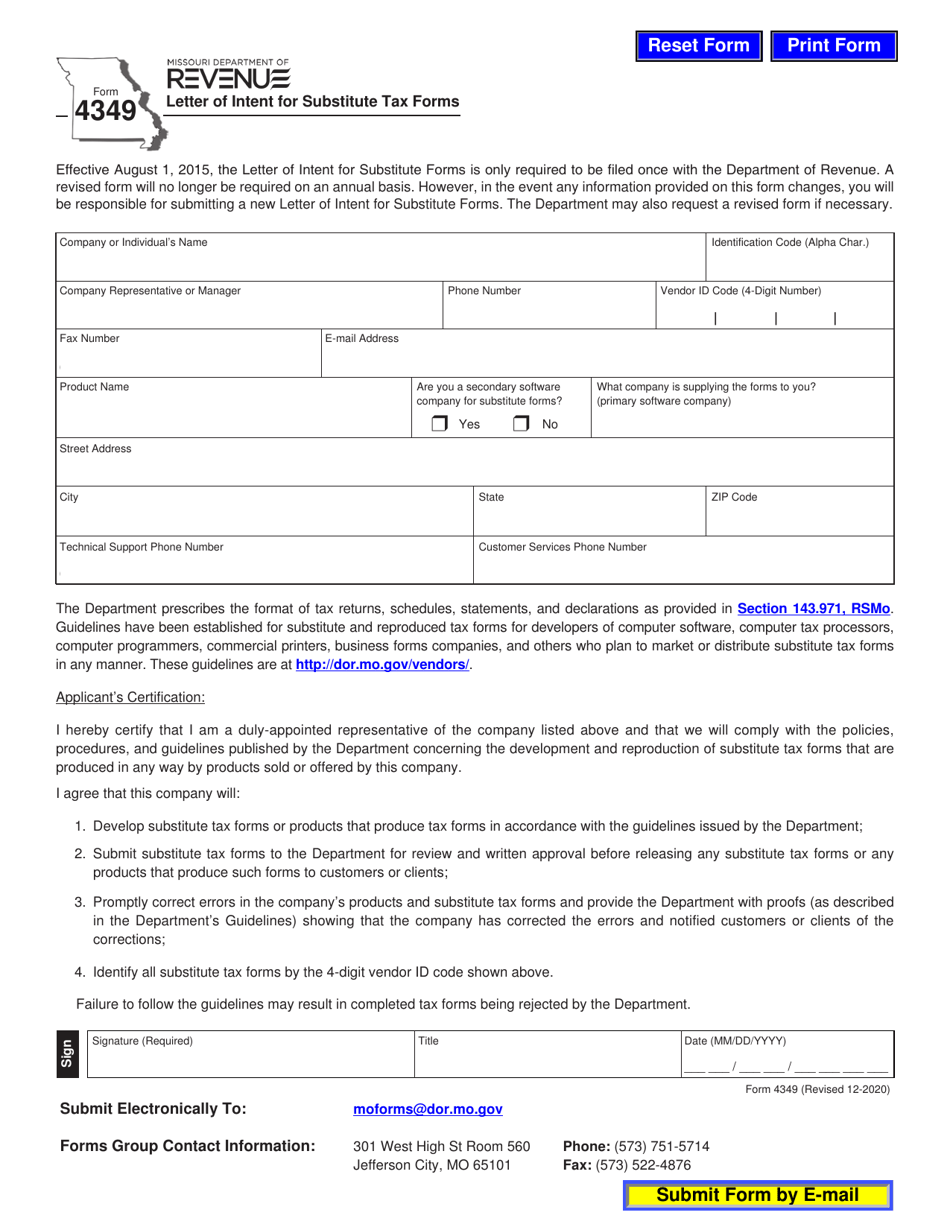

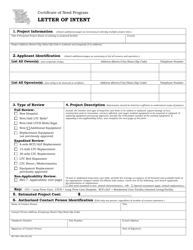

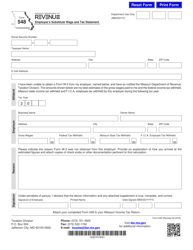

Form 4349 Letter of Intent for Substitute Tax Forms - Missouri

What Is Form 4349?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 4349 Letter of Intent?

A: Form 4349 Letter of Intent is a document used in Missouri to request substitute tax forms.

Q: When is Form 4349 Letter of Intent used?

A: Form 4349 Letter of Intent is used when you need to request substitute tax forms for Missouri.

Q: Why would I need to request substitute tax forms?

A: You may need to request substitute tax forms if you have lost or did not receive your original tax forms.

Q: Is there a deadline to submit Form 4349 Letter of Intent?

A: Yes, Form 4349 Letter of Intent must be submitted by the tax filing deadline for the year in question.

Q: What information is required in Form 4349 Letter of Intent?

A: Form 4349 Letter of Intent requires information such as your name, contact information, tax year, and a detailed explanation for the request.

Q: How long does it take to receive substitute tax forms after submitting Form 4349 Letter of Intent?

A: It may take up to 30 days to receive substitute tax forms after submitting Form 4349 Letter of Intent.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4349 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.