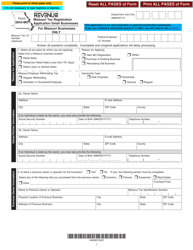

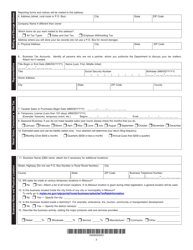

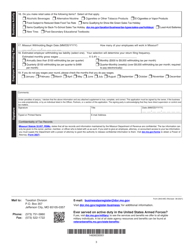

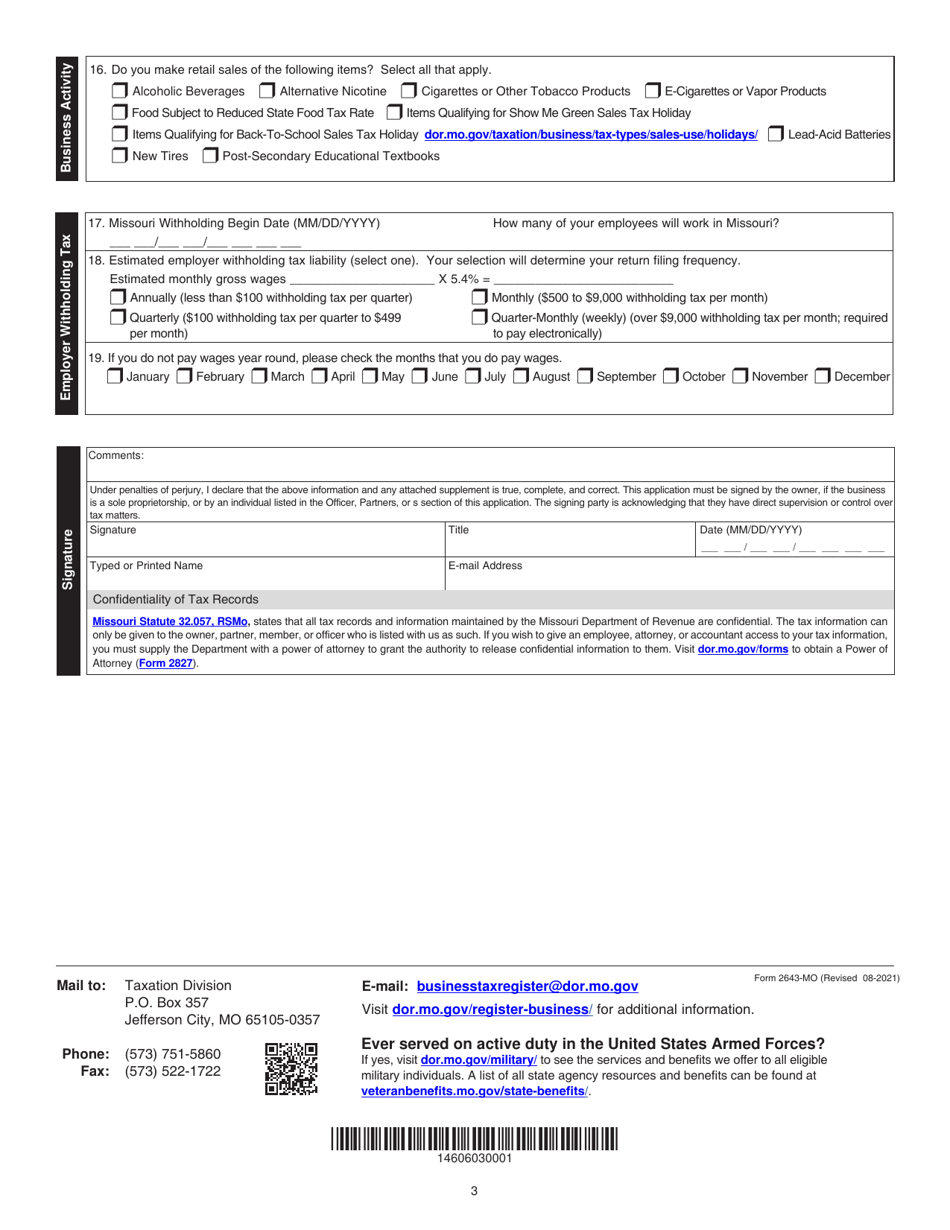

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2643-MO

for the current year.

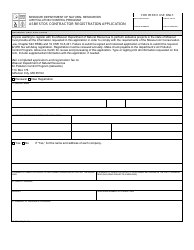

Form 2643-MO Missouri Tax Registration Application Small Businesses - Missouri

What Is Form 2643-MO?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2643-MO?

A: Form 2643-MO is the Missouri Tax Registration Application for Small Businesses.

Q: Who needs to file Form 2643-MO?

A: Small businesses in Missouri who are required to collect and remit sales tax must file Form 2643-MO.

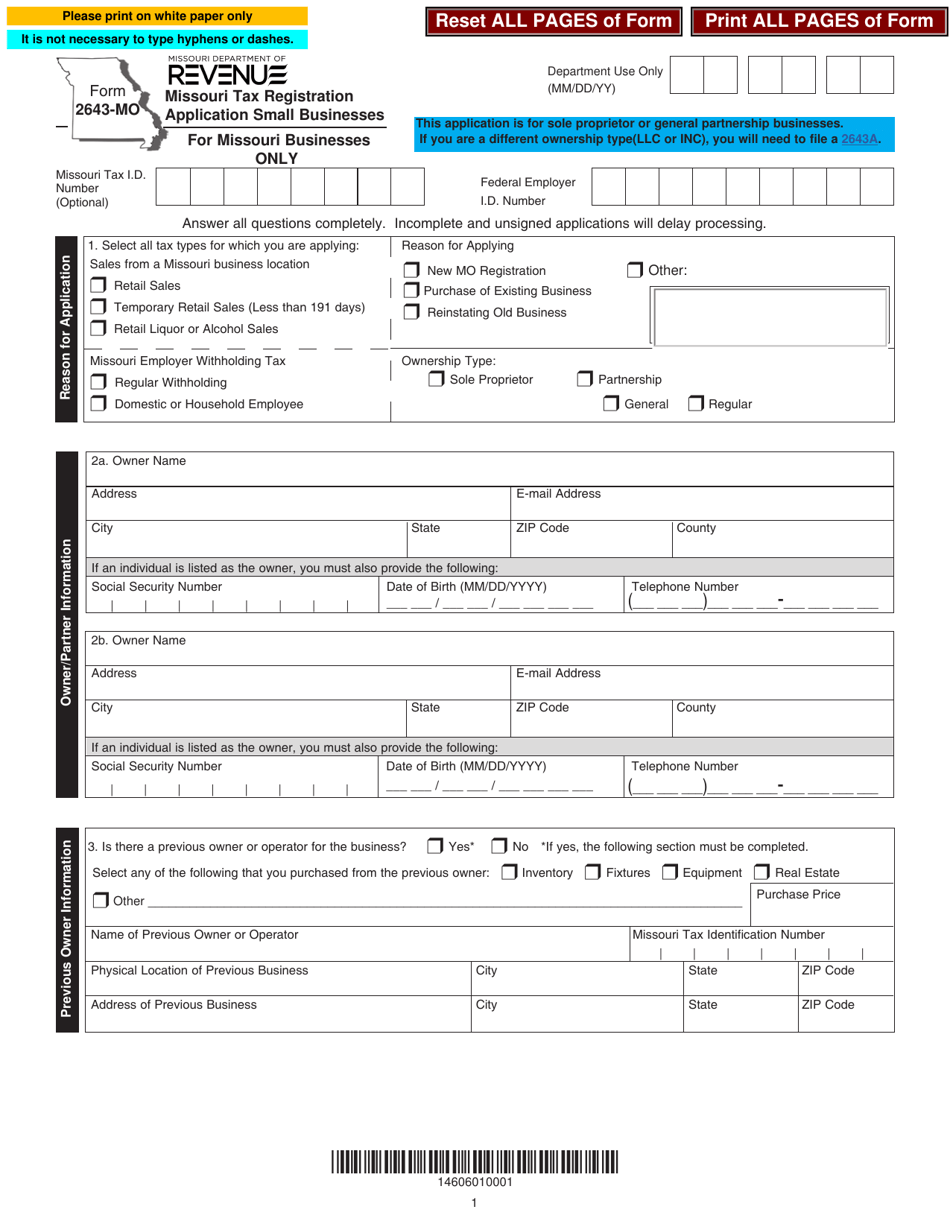

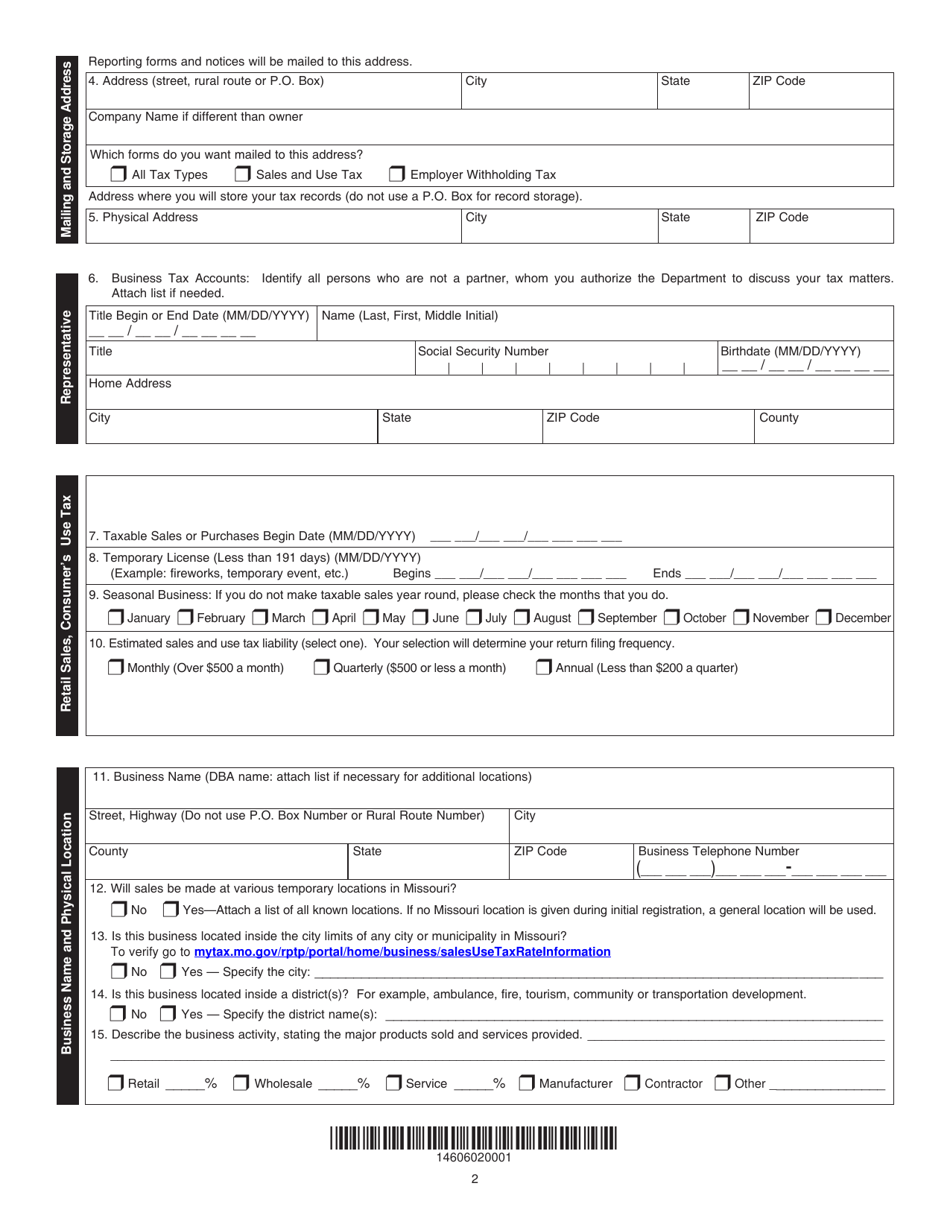

Q: What information is required on Form 2643-MO?

A: Form 2643-MO requires information such as business details, owner information, location information, and types of taxes to be collected.

Q: When is the deadline for filing Form 2643-MO?

A: The deadline for filing Form 2643-MO varies depending on your business's tax year. It is best to check with the Missouri Department of Revenue for specific deadlines.

Q: Are there any fees associated with filing Form 2643-MO?

A: There are no fees associated with filing Form 2643-MO.

Q: What should I do after filing Form 2643-MO?

A: After filing Form 2643-MO, you will receive a Missouri Tax Identification Number. You will be required to collect and remit sales tax using this number.

Q: What happens if I don't file Form 2643-MO?

A: Failure to file Form 2643-MO may result in penalties and interest.

Form Details:

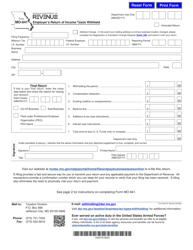

- Released on August 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2643-MO by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.