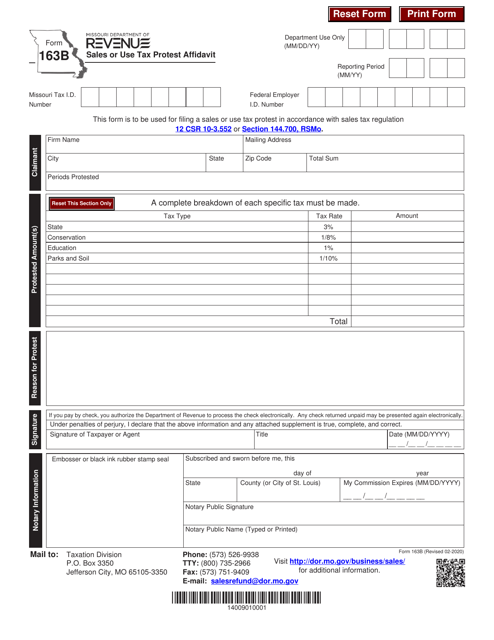

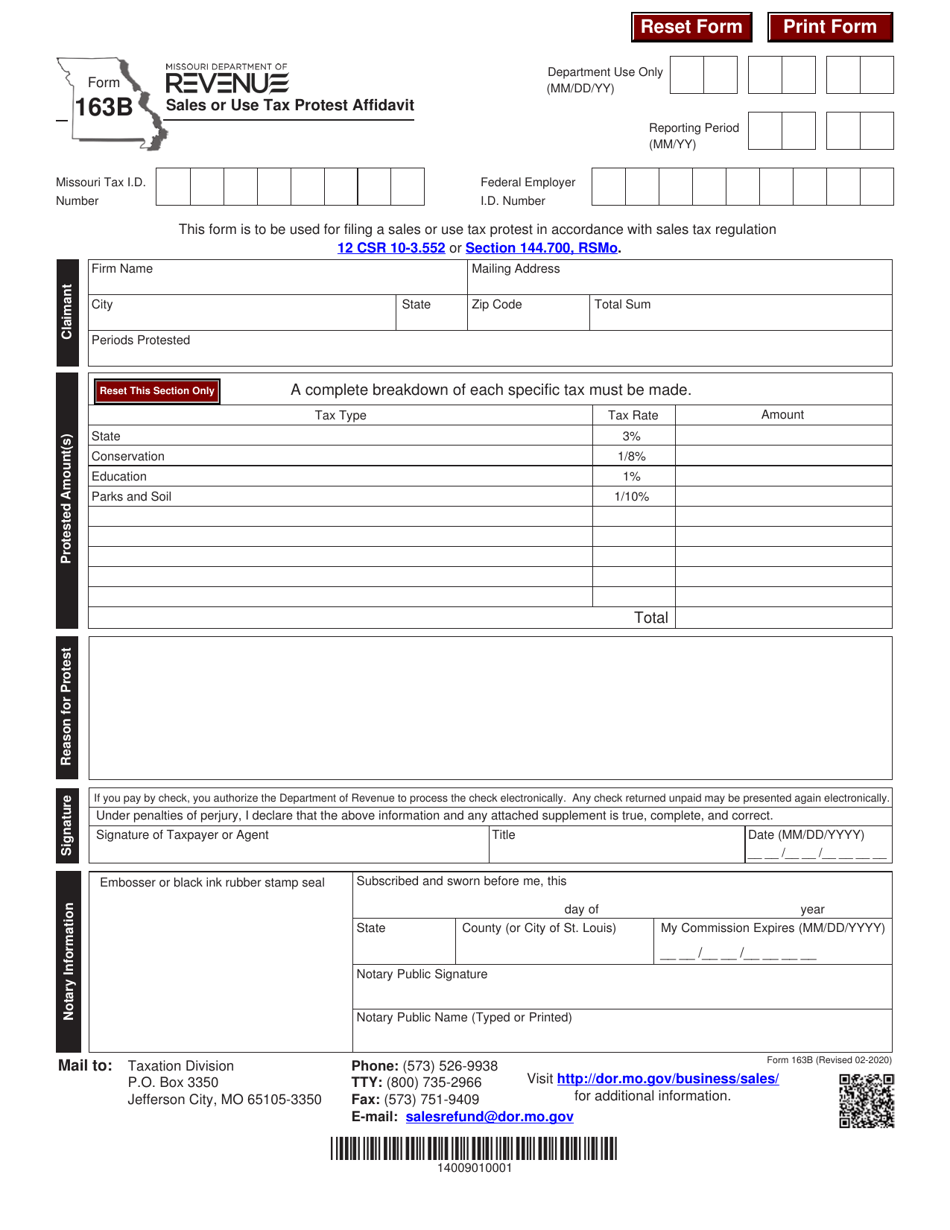

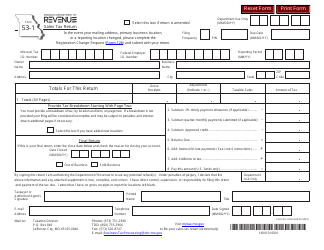

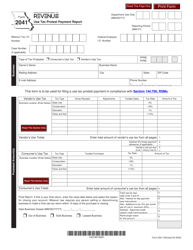

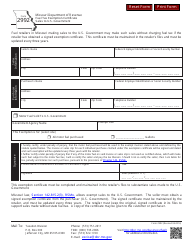

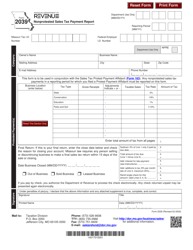

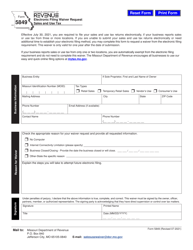

Form 163B Sales or Use Tax Protest Affidavit - Missouri

What Is Form 163B?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

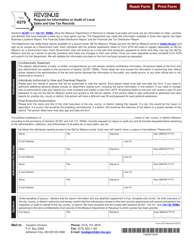

Q: What is Form 163B?

A: Form 163B is the Sales or Use Tax Protest Affidavit used in the state of Missouri.

Q: Who uses Form 163B?

A: Form 163B is used by individuals or businesses who want to protest a sales or use tax assessment in Missouri.

Q: What is the purpose of Form 163B?

A: The purpose of Form 163B is to provide a sworn statement to protest a sales or use tax assessment and request a hearing before the Missouri Administrative Hearing Commission.

Q: Do I need to include any supporting documents with Form 163B?

A: Yes, you may need to include supporting documents such as invoices, receipts, or any other relevant documents to support your protest.

Q: How do I submit Form 163B?

A: You can submit Form 163B by mail or in person to the Missouri Department of Revenue.

Q: Is there a deadline for submitting Form 163B?

A: Yes, Form 163B must be submitted within 60 days of receiving the notice of assessment from the Missouri Department of Revenue.

Q: What happens after I submit Form 163B?

A: After submitting Form 163B, the Missouri Administrative Hearing Commission will schedule a hearing to review your protest and make a decision.

Q: Can I appeal the decision made by the Missouri Administrative Hearing Commission?

A: Yes, if you disagree with the decision made by the Missouri Administrative Hearing Commission, you can appeal to the Missouri State Circuit Court within 30 days of the decision.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 163B by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.