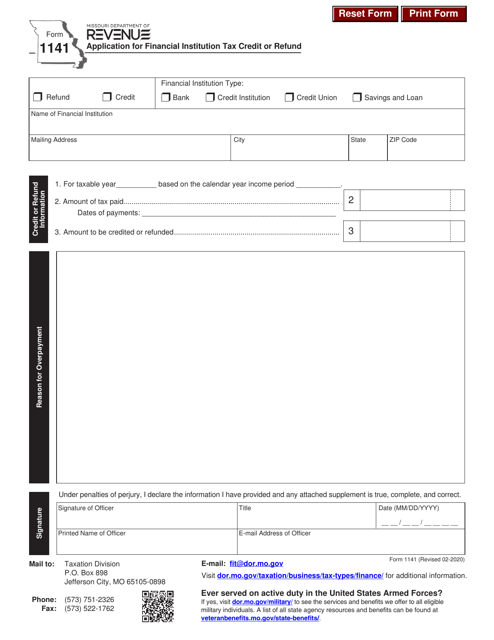

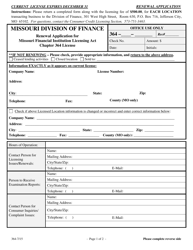

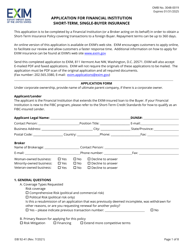

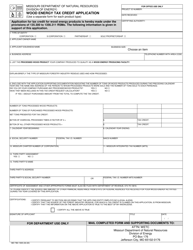

Form 1141 Application for Financial Institution Tax Credit or Refund - Missouri

What Is Form 1141?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

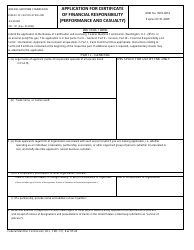

Q: What is Form 1141?

A: Form 1141 is an application for a financial institution tax credit or refund in Missouri.

Q: Who can use Form 1141?

A: Financial institutions in Missouri can use Form 1141 to apply for tax credit or refund.

Q: What is the purpose of Form 1141?

A: The purpose of Form 1141 is to allow financial institutions to claim tax credit or refund in Missouri.

Q: What information is required on Form 1141?

A: Form 1141 generally requires information about the financial institution's tax liability and any claimed tax credits.

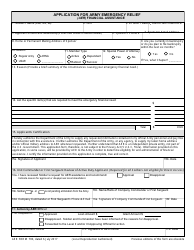

Q: Is there a deadline for filing Form 1141?

A: Yes, financial institutions must file Form 1141 by the due date specified by the Missouri Department of Revenue.

Q: Are there any fees associated with filing Form 1141?

A: There are no fees associated with filing Form 1141.

Q: Can Form 1141 be filed electronically?

A: Yes, financial institutions have the option to file Form 1141 electronically.

Q: What should I do if I need assistance with Form 1141?

A: If you need assistance with Form 1141, you can contact the Missouri Department of Revenue for guidance.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1141 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.