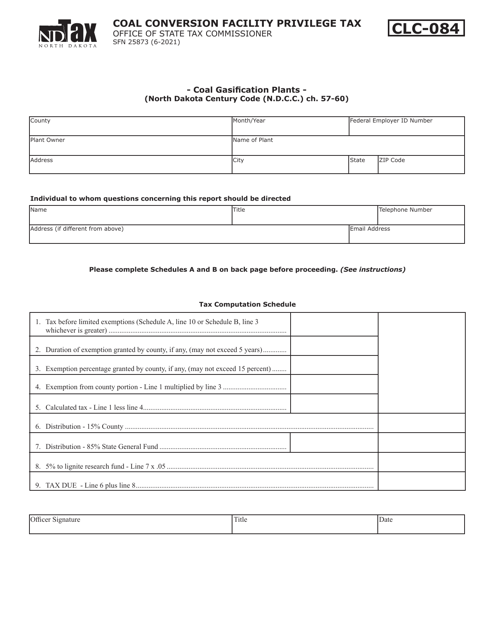

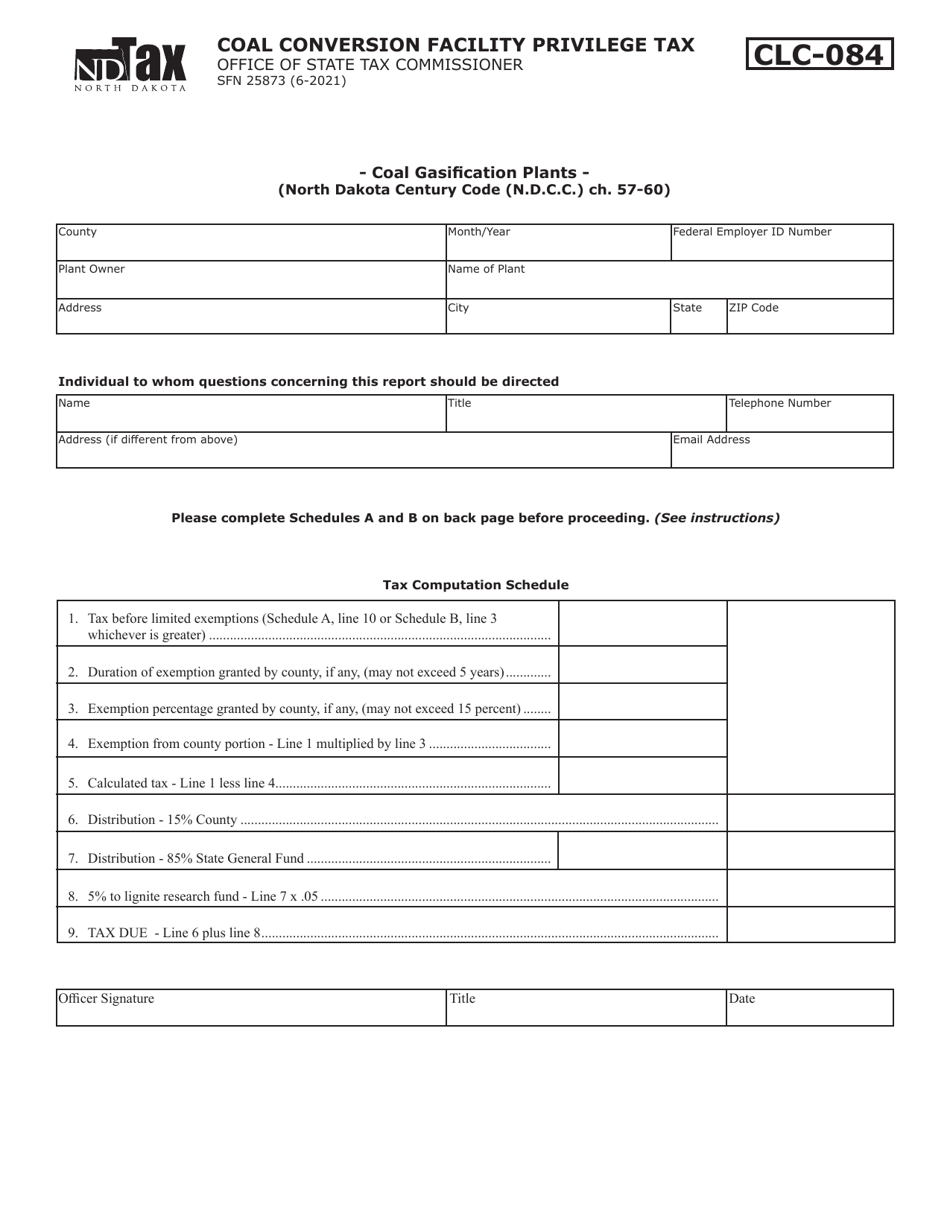

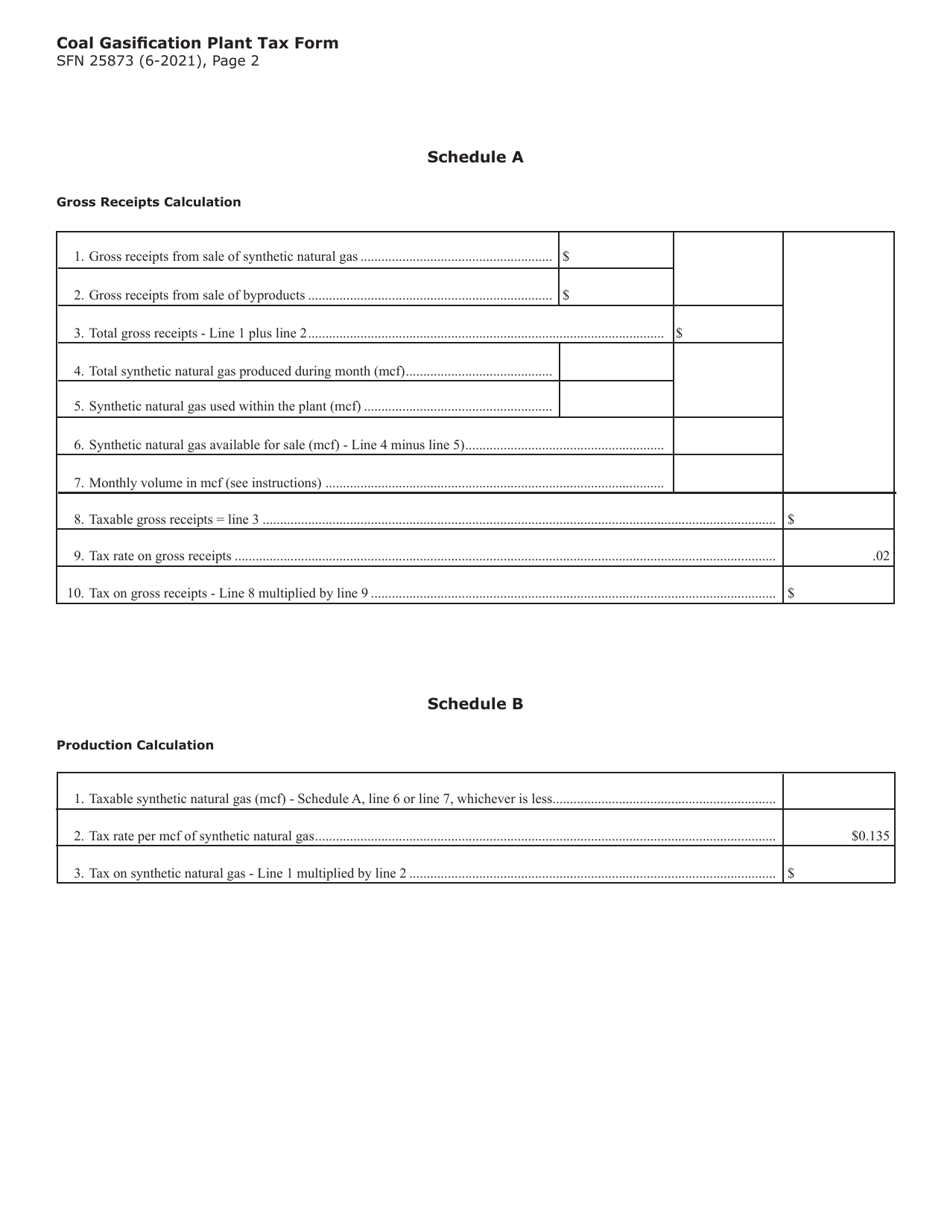

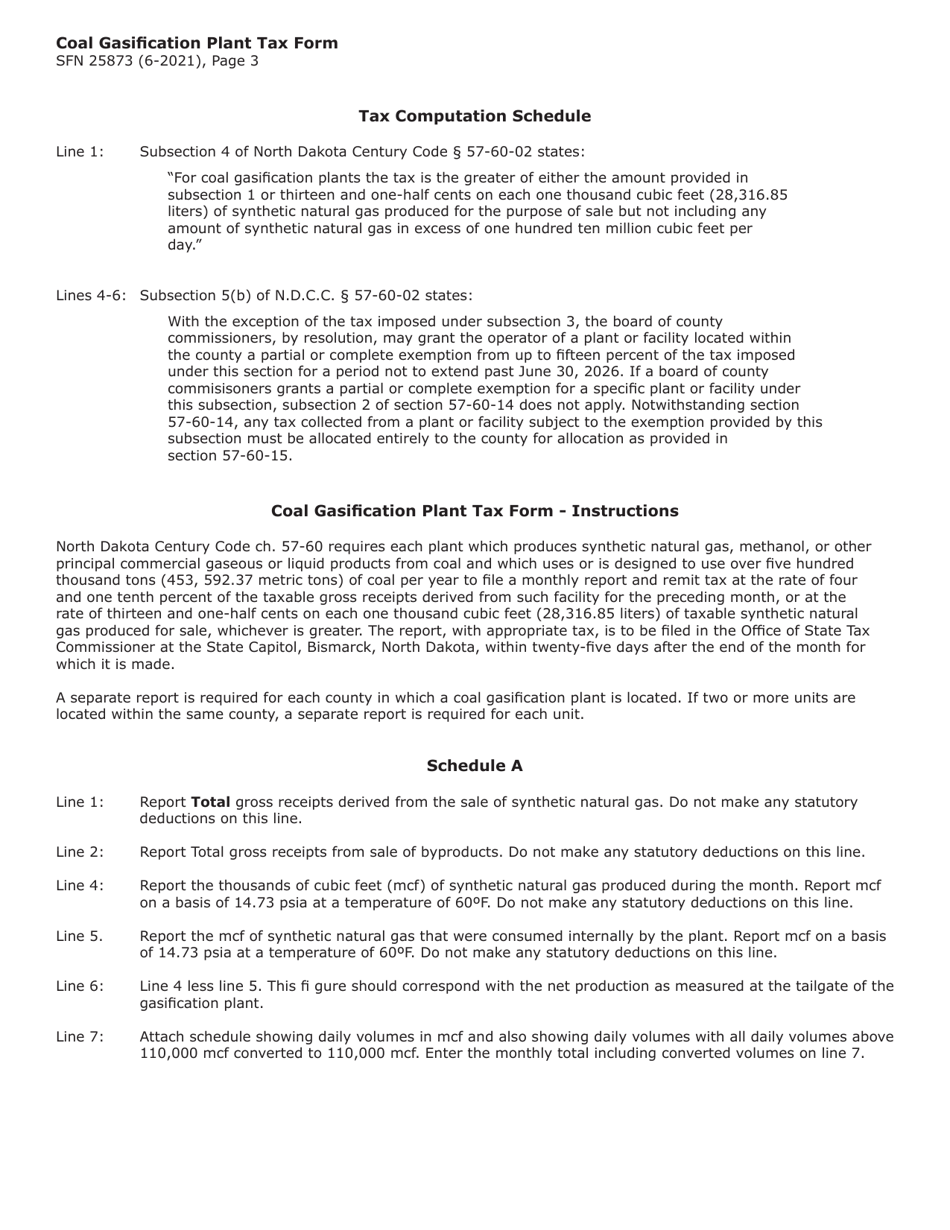

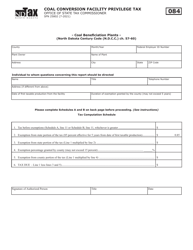

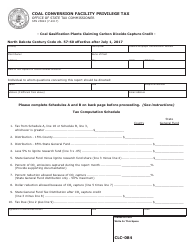

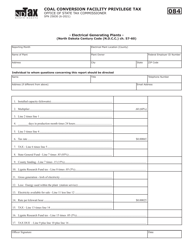

Form SFN25873 (CLC-084) Coal Conversion Facility Privilege Tax - Coal Gasification Plants - North Dakota

What Is Form SFN25873 (CLC-084)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN25873 (CLC-084)?

A: Form SFN25873 (CLC-084) is a tax form related to Coal Conversion Facility Privilege Tax for Coal Gasification Plants in North Dakota.

Q: What is the purpose of Form SFN25873 (CLC-084)?

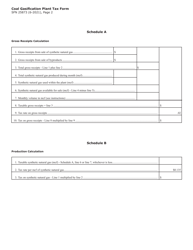

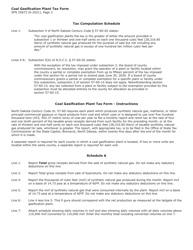

A: The purpose of Form SFN25873 (CLC-084) is to report and pay the Coal Conversion Facility Privilege Tax for Coal Gasification Plants.

Q: Who needs to fill out Form SFN25873 (CLC-084)?

A: Owners or operators of Coal Gasification Plants in North Dakota are required to fill out Form SFN25873 (CLC-084).

Q: What is the Coal Conversion Facility Privilege Tax?

A: The Coal Conversion Facility Privilege Tax is a tax levied on the production of synthetic natural gas or coal-derived liquid fuels from coal at coal gasification plants in North Dakota.

Q: How often is Form SFN25873 (CLC-084) filed?

A: Form SFN25873 (CLC-084) is filed monthly by the owners or operators of Coal Gasification Plants in North Dakota.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN25873 (CLC-084) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.