This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN24757

for the current year.

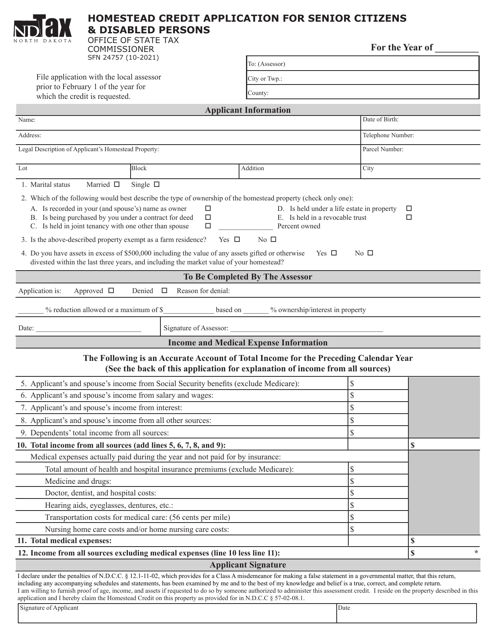

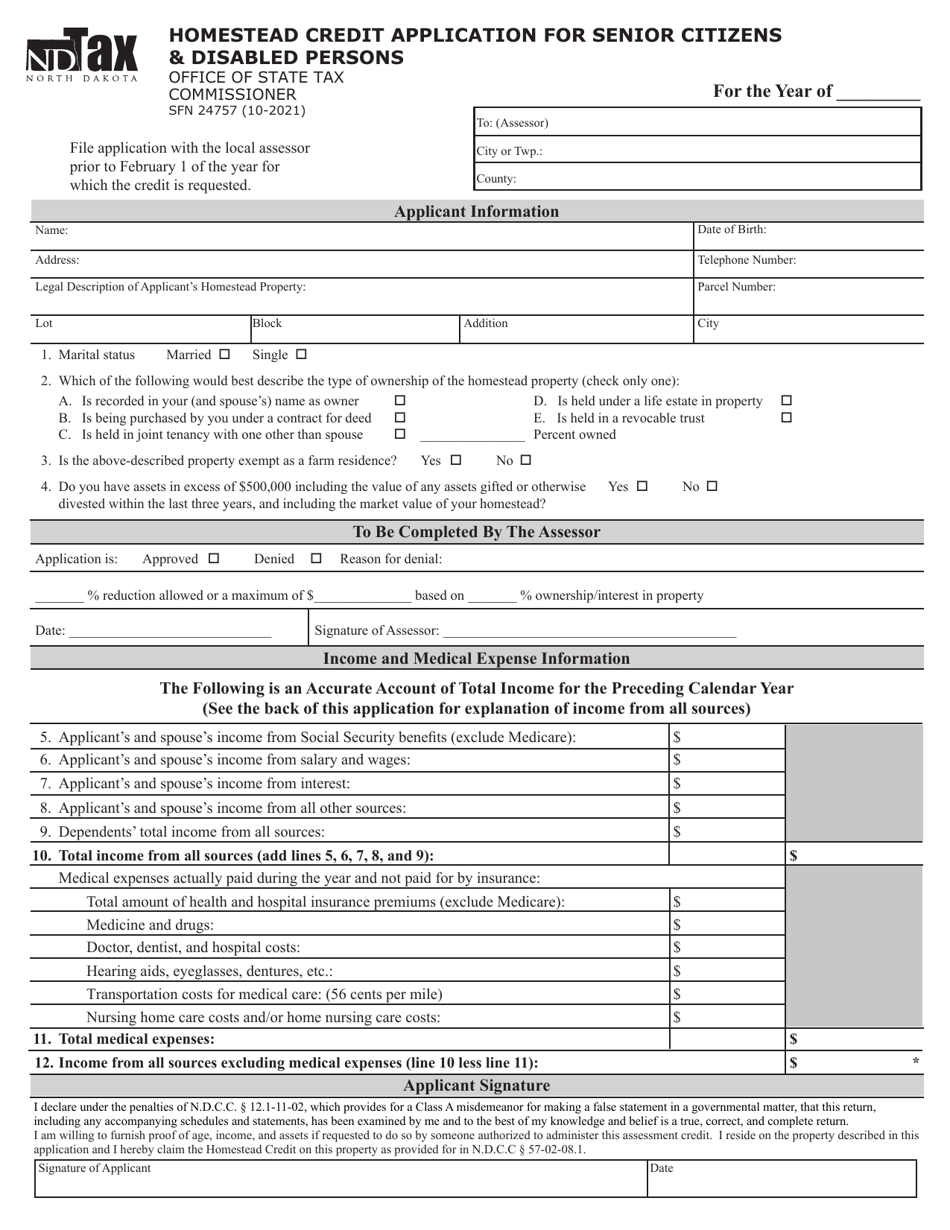

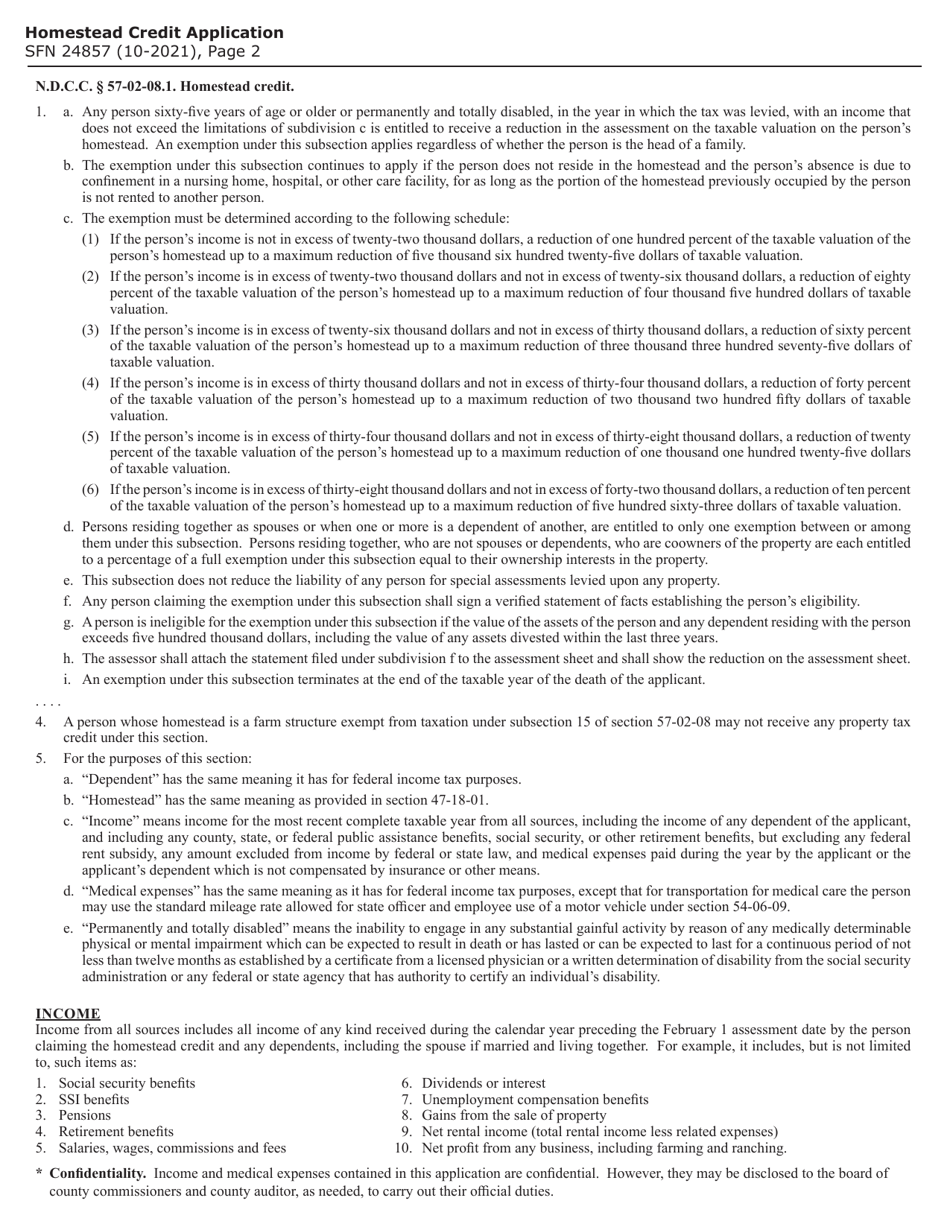

Form SFN24757 Homestead Credit Application for Senior Citizens & Disabled Persons - North Dakota

What Is Form SFN24757?

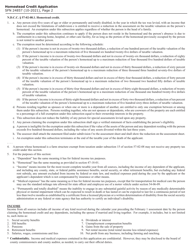

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SFN24757 Homestead Credit Application?

A: The SFN24757 Homestead Credit Application is a form used in North Dakota to apply for the Homestead Credit for senior citizens and disabled persons.

Q: Who is eligible to apply for the Homestead Credit?

A: Senior citizens and disabled persons in North Dakota are eligible to apply for the Homestead Credit.

Q: What is the purpose of the Homestead Credit?

A: The purpose of the Homestead Credit is to provide property tax relief for eligible senior citizens and disabled persons in North Dakota.

Q: What information do I need to provide on the Homestead Credit Application?

A: You will need to provide personal information, property information, and income information on the Homestead Credit Application.

Q: Is there a deadline to submit the Homestead Credit Application?

A: Yes, the Homestead Credit Application must be submitted by February 1st of each year in order to be eligible for the credit.

Q: How long does it take to process the Homestead Credit Application?

A: The processing time for the Homestead Credit Application may vary, but it typically takes several weeks to several months.

Q: How much property tax relief can I receive through the Homestead Credit?

A: The amount of property tax relief you can receive through the Homestead Credit depends on your income and property value. The maximum credit amount is $5,000.

Q: Can I apply for the Homestead Credit if I rent my property?

A: No, the Homestead Credit is only available to homeowners.

Q: What supporting documents do I need to include with the Homestead Credit Application?

A: You may need to include documents such as proof of age, proof of disability, and proof of income with your Homestead Credit Application.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN24757 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.