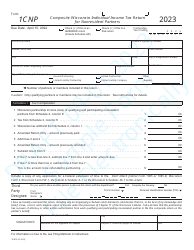

This version of the form is not currently in use and is provided for reference only. Download this version of

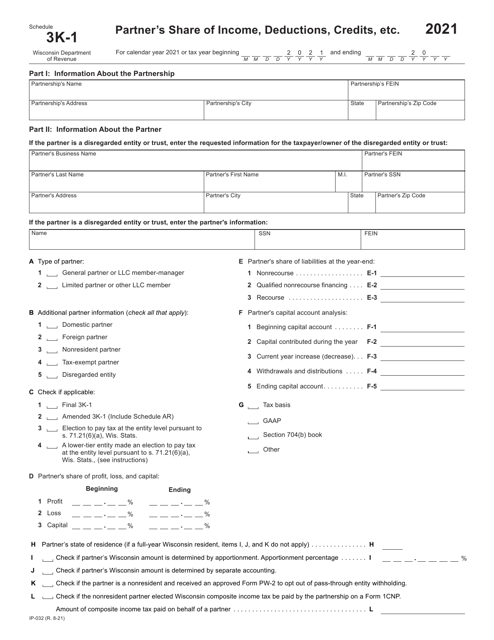

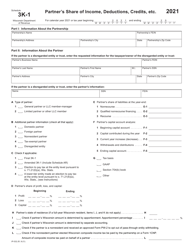

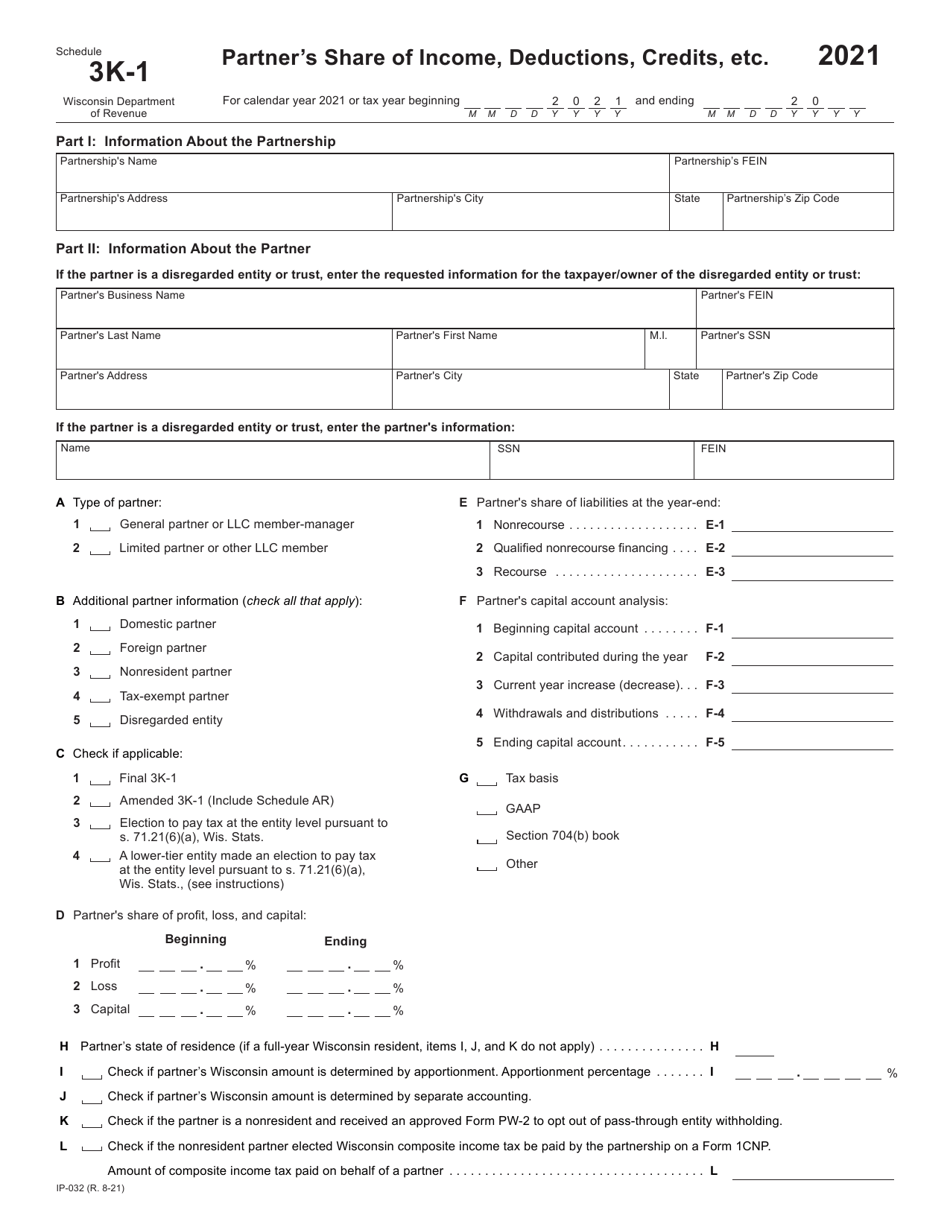

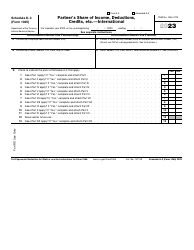

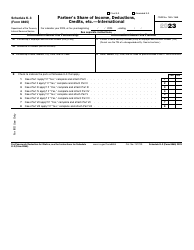

Form IP-032 Schedule 3K-1

for the current year.

Form IP-032 Schedule 3K-1 Partner's Share of Income, Deductions, Credits, Etc. - Wisconsin

What Is Form IP-032 Schedule 3K-1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IP-032 Schedule 3K-1?

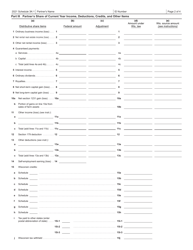

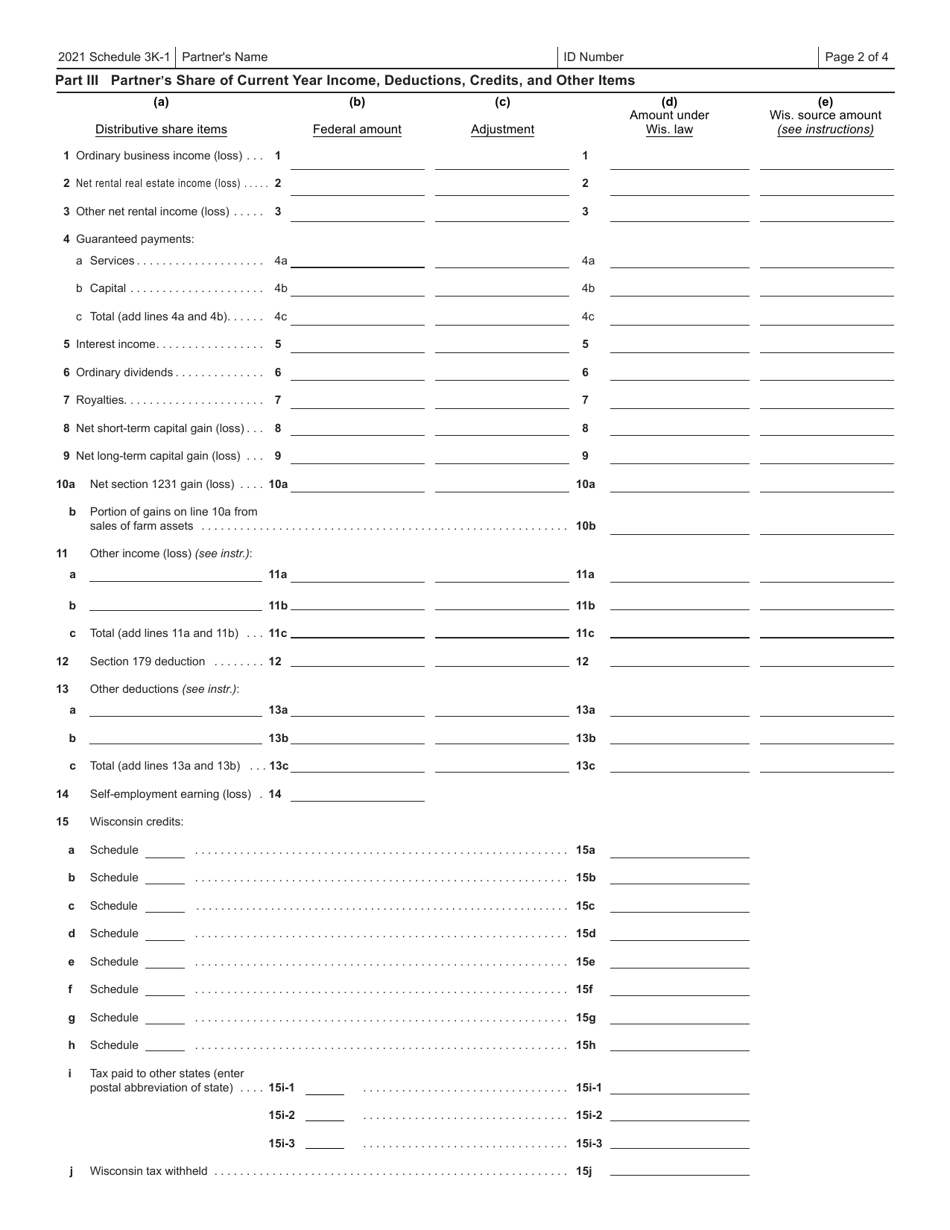

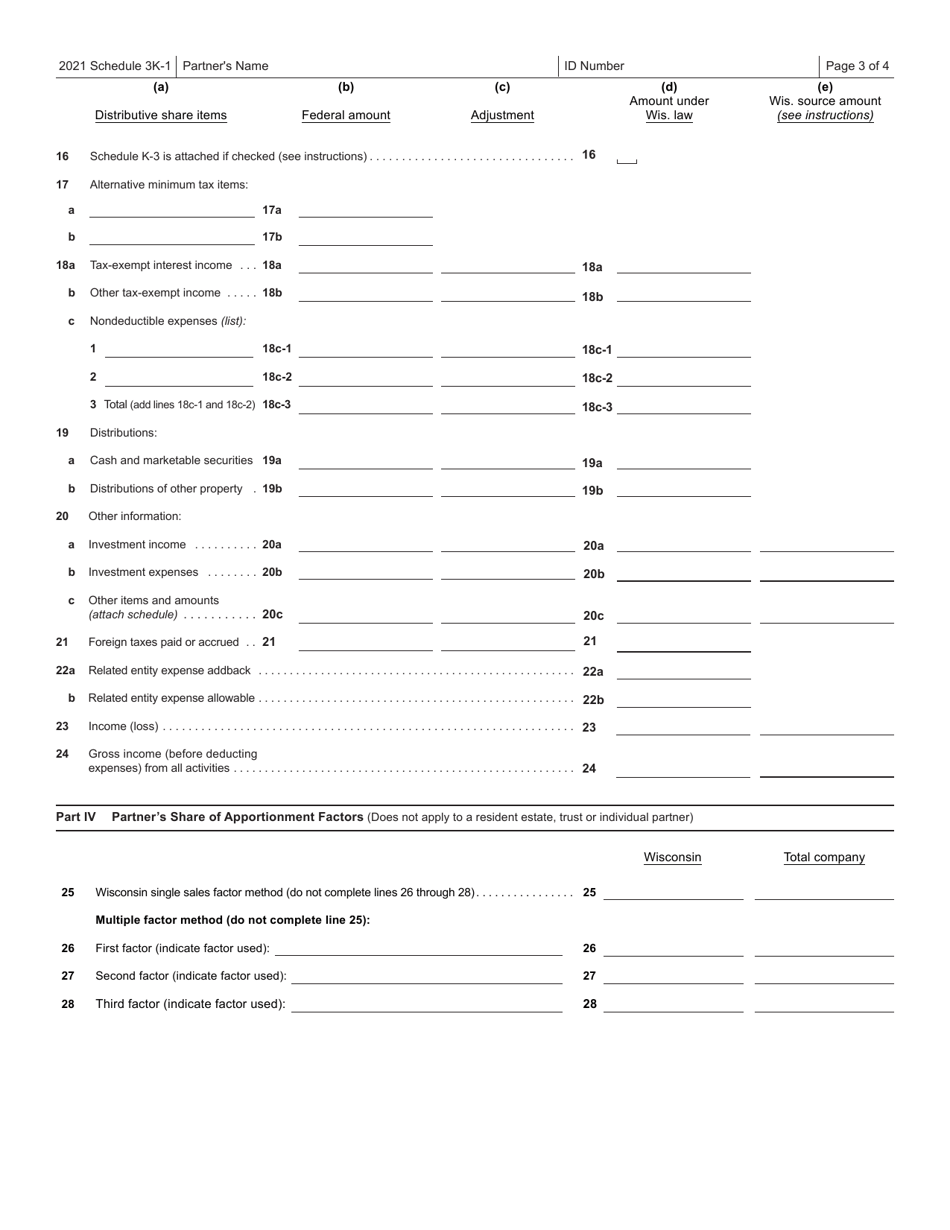

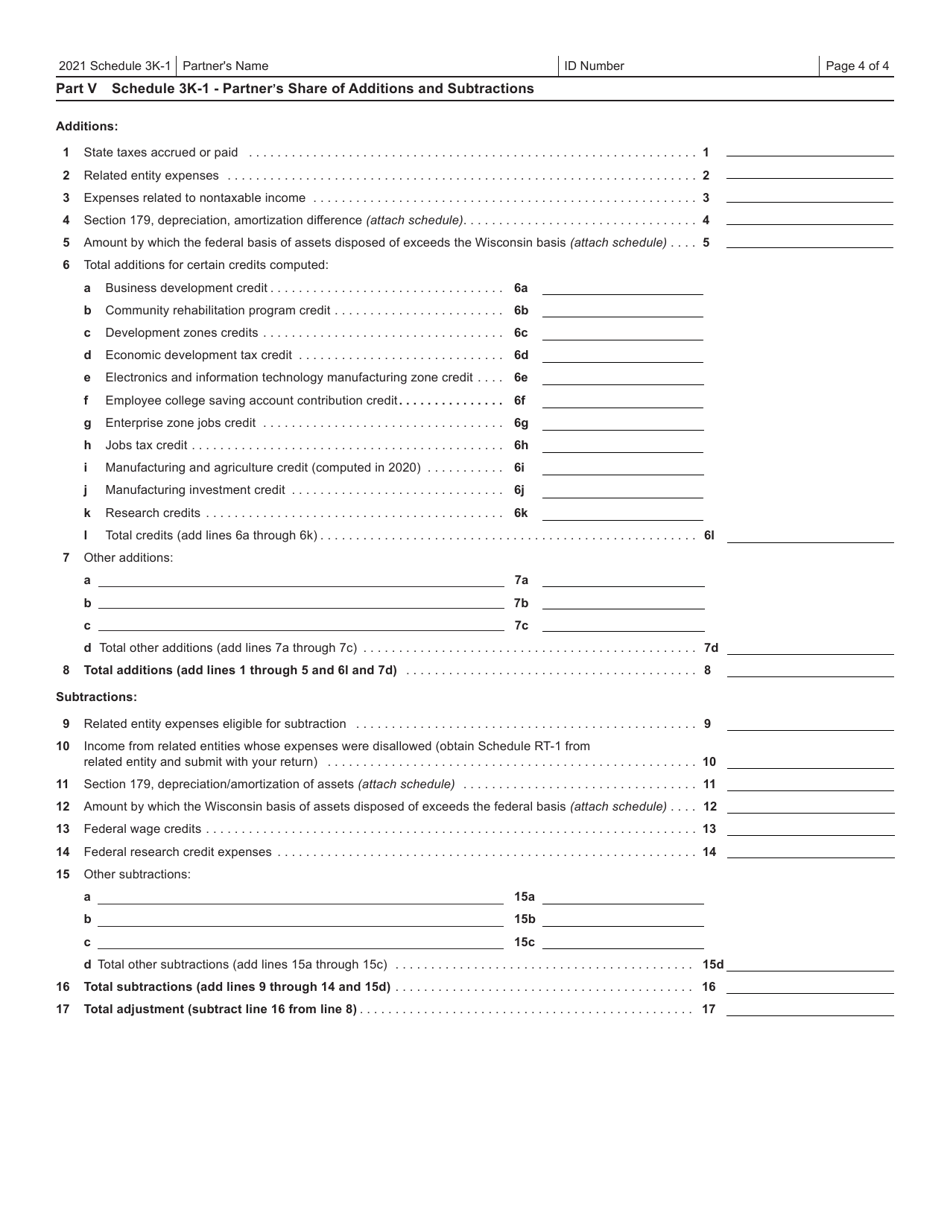

A: Form IP-032 Schedule 3K-1 is used by partners in an LLC or partnership to report their share of income, deductions, credits, and other items for tax purposes.

Q: Who needs to file Form IP-032 Schedule 3K-1?

A: Partners in an LLC or partnership who receive income or deductions from the business need to file Form IP-032 Schedule 3K-1.

Q: What is the purpose of Form IP-032 Schedule 3K-1?

A: The purpose of Form IP-032 Schedule 3K-1 is to report a partner's share of the income, deductions, credits, and other items from an LLC or partnership.

Q: When is Form IP-032 Schedule 3K-1 due?

A: Form IP-032 Schedule 3K-1 is generally due on the same date as the partnership or LLC's tax return, which is typically March 15th for calendar year partnerships or LLCs.

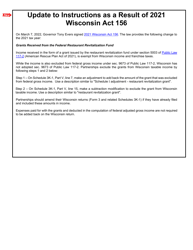

Q: Are there any special instructions for filling out Form IP-032 Schedule 3K-1?

A: Yes, there are instructions provided with the form that explain how to fill it out correctly. It is important to carefully read and follow these instructions.

Q: Do I need to include Form IP-032 Schedule 3K-1 with my personal tax return?

A: No, Form IP-032 Schedule 3K-1 is not filed with your personal tax return. Instead, it is filed with the partnership or LLC's tax return.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IP-032 Schedule 3K-1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.