This version of the form is not currently in use and is provided for reference only. Download this version of

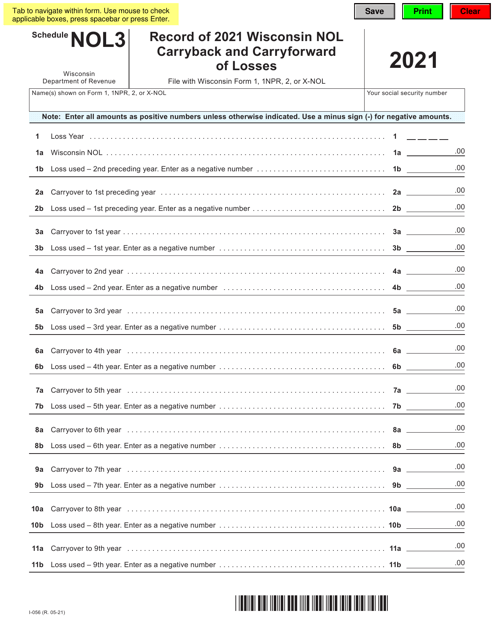

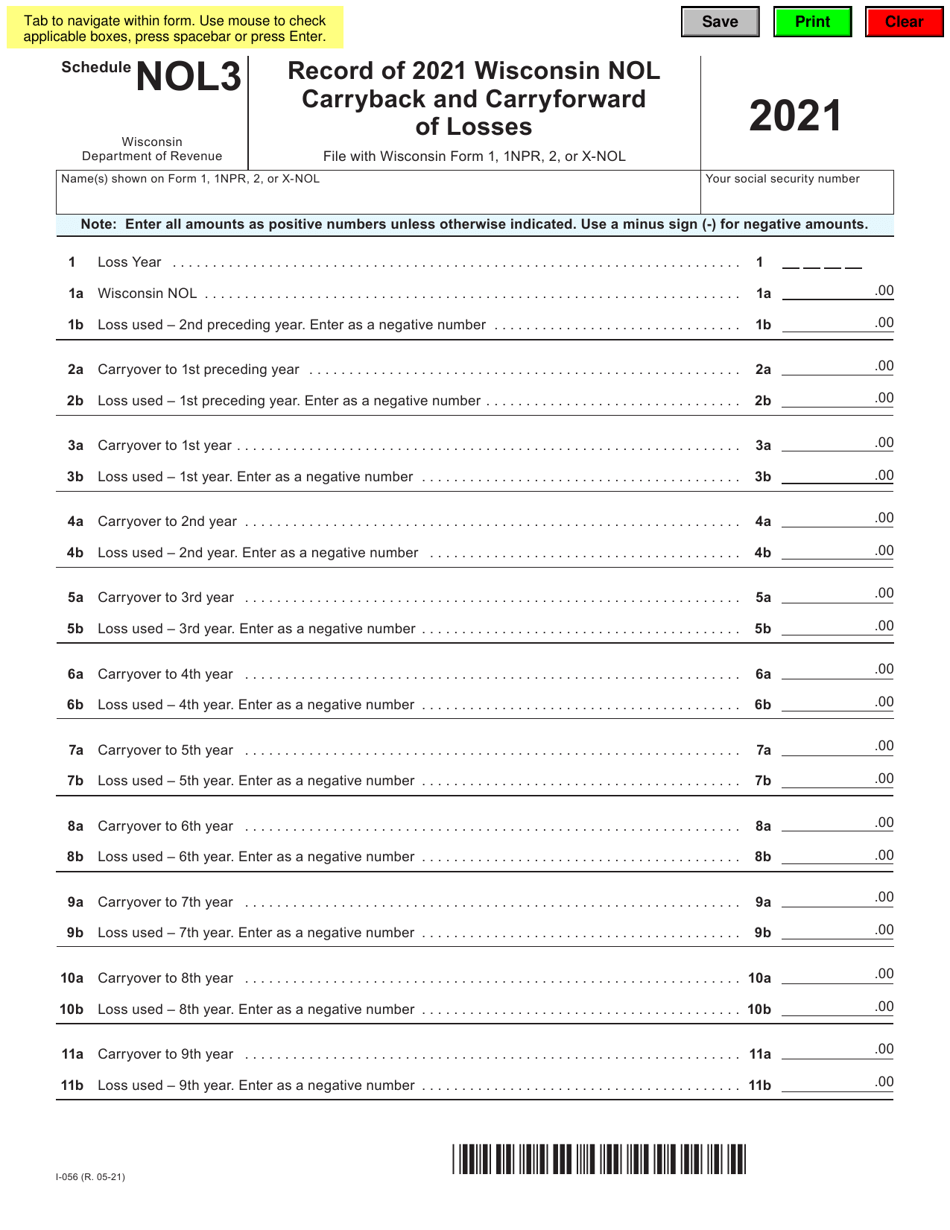

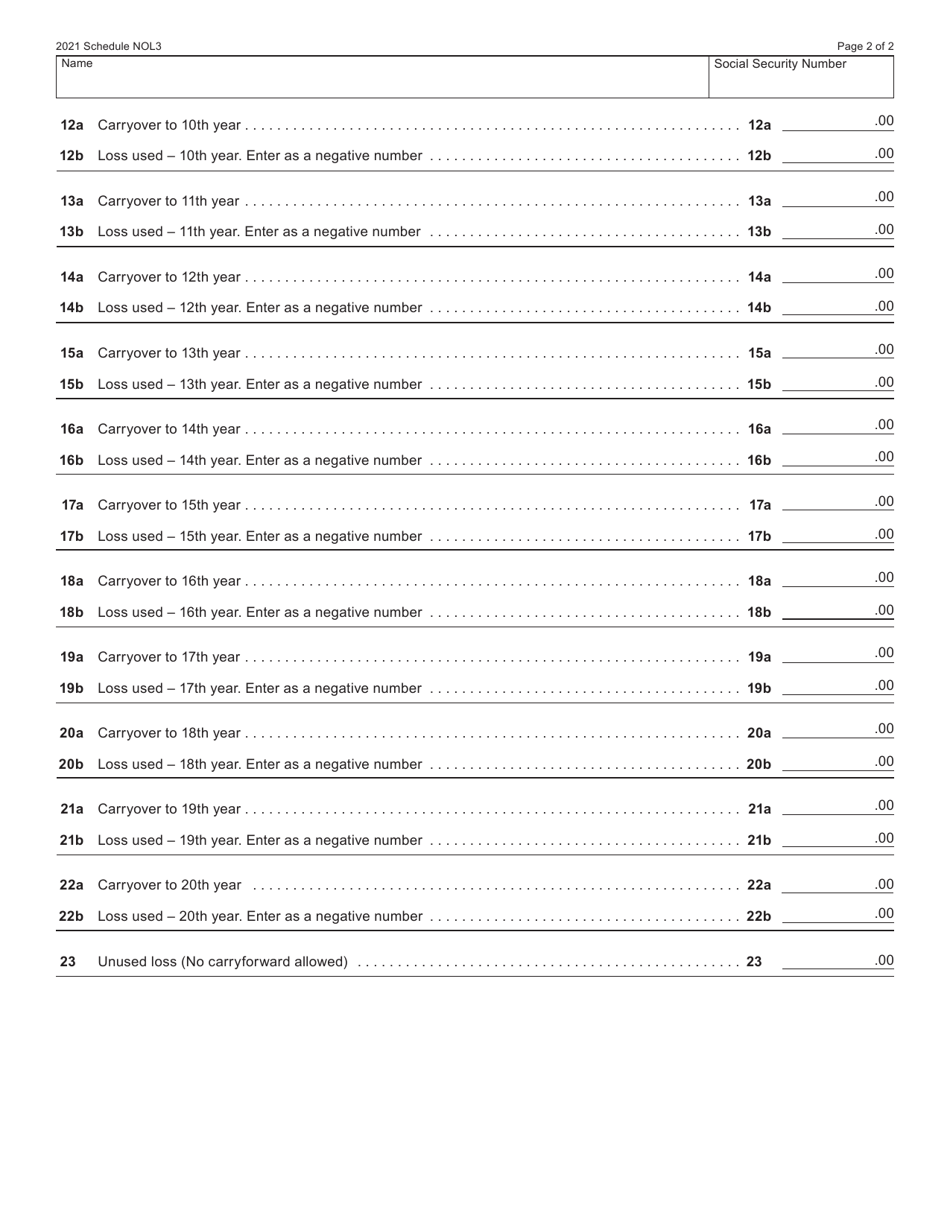

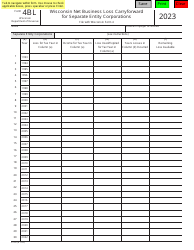

Form I-056 Schedule NOL3

for the current year.

Form I-056 Schedule NOL3 Record of Wisconsin Nol Carryback and Carryforward of Losses - Wisconsin

What Is Form I-056 Schedule NOL3?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form I-056 Schedule NOL3?

A: Form I-056 Schedule NOL3 is a document used in Wisconsin for recording NOL (Net Operating Loss) carrybacks and carryforwards.

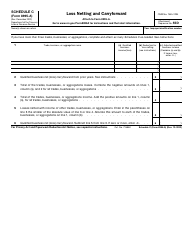

Q: What is NOL?

A: NOL stands for Net Operating Loss, which is the amount by which a company's allowable tax deductions exceed its taxable income.

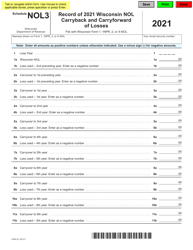

Q: How is Form I-056 Schedule NOL3 used?

A: Form I-056 Schedule NOL3 is used to report and track the carryback and carryforward of NOLs in Wisconsin.

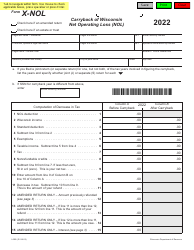

Q: What is a NOL carryback?

A: A NOL carryback is when a business applies its NOL to previous years' tax returns to receive a refund.

Q: What is a NOL carryforward?

A: A NOL carryforward is when a business applies its NOL to future years' tax returns to reduce taxable income.

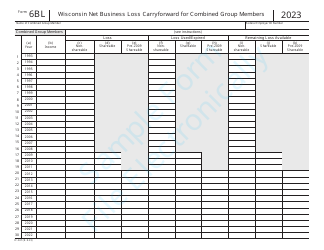

Q: Who needs to use Form I-056 Schedule NOL3?

A: Businesses in Wisconsin that have NOLs and want to carry them back or forward must use Form I-056 Schedule NOL3.

Q: Are there any filing deadlines for Form I-056 Schedule NOL3?

A: Yes, the filing deadline for Form I-056 Schedule NOL3 is generally the same as the income tax return due date, which is usually April 15th.

Q: What are the consequences of not filing Form I-056 Schedule NOL3?

A: Failing to file Form I-056 Schedule NOL3 may result in the loss of NOL carryback or carryforward benefits.

Q: Is Form I-056 Schedule NOL3 only applicable to businesses?

A: Yes, Form I-056 Schedule NOL3 is specifically for businesses and not for individual taxpayers.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-056 Schedule NOL3 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.