This version of the form is not currently in use and is provided for reference only. Download this version of

Form A-115

for the current year.

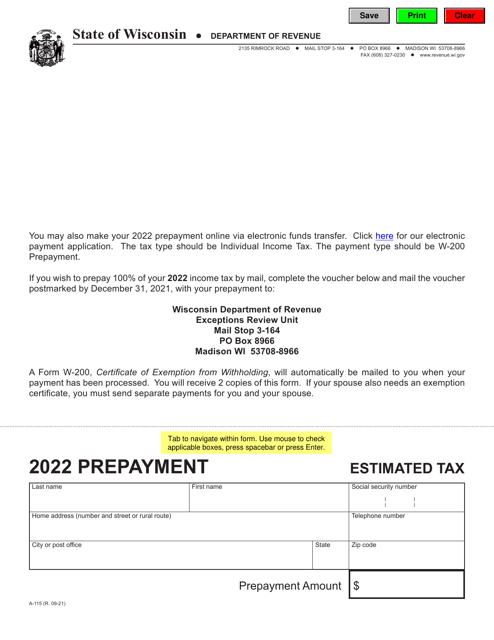

Form A-115 Prepayment Voucher - Wisconsin

What Is Form A-115?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-115?

A: Form A-115 is a prepayment voucher for the state of Wisconsin.

Q: What is the purpose of Form A-115?

A: The purpose of Form A-115 is to make prepayments towards future tax liabilities in Wisconsin.

Q: Who needs to use Form A-115?

A: Taxpayers in Wisconsin who want to make prepayments towards their future tax liabilities need to use Form A-115.

Q: How do I fill out Form A-115?

A: You need to provide your personal information and the amount you want to prepay on Form A-115.

Q: Is there a deadline for filing Form A-115?

A: There is no specific deadline for filing Form A-115 as it is a prepayment voucher.

Q: Can I use Form A-115 for federal taxes?

A: No, Form A-115 is specifically for prepaying Wisconsin state taxes and cannot be used for federal taxes.

Q: Can I make multiple prepayments using Form A-115?

A: Yes, you can make multiple prepayments using Form A-115.

Q: Is there a minimum amount for prepayments using Form A-115?

A: There is no minimum amount for prepayments using Form A-115.

Q: Can I pay my entire tax liability using Form A-115?

A: No, Form A-115 is for making prepayments only and cannot be used to pay your entire tax liability.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-115 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.