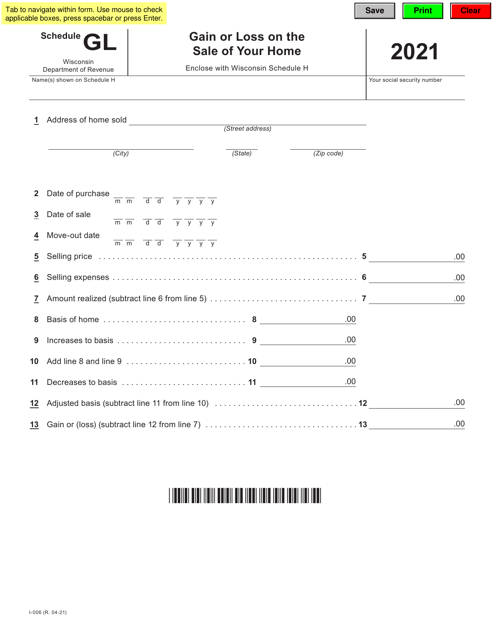

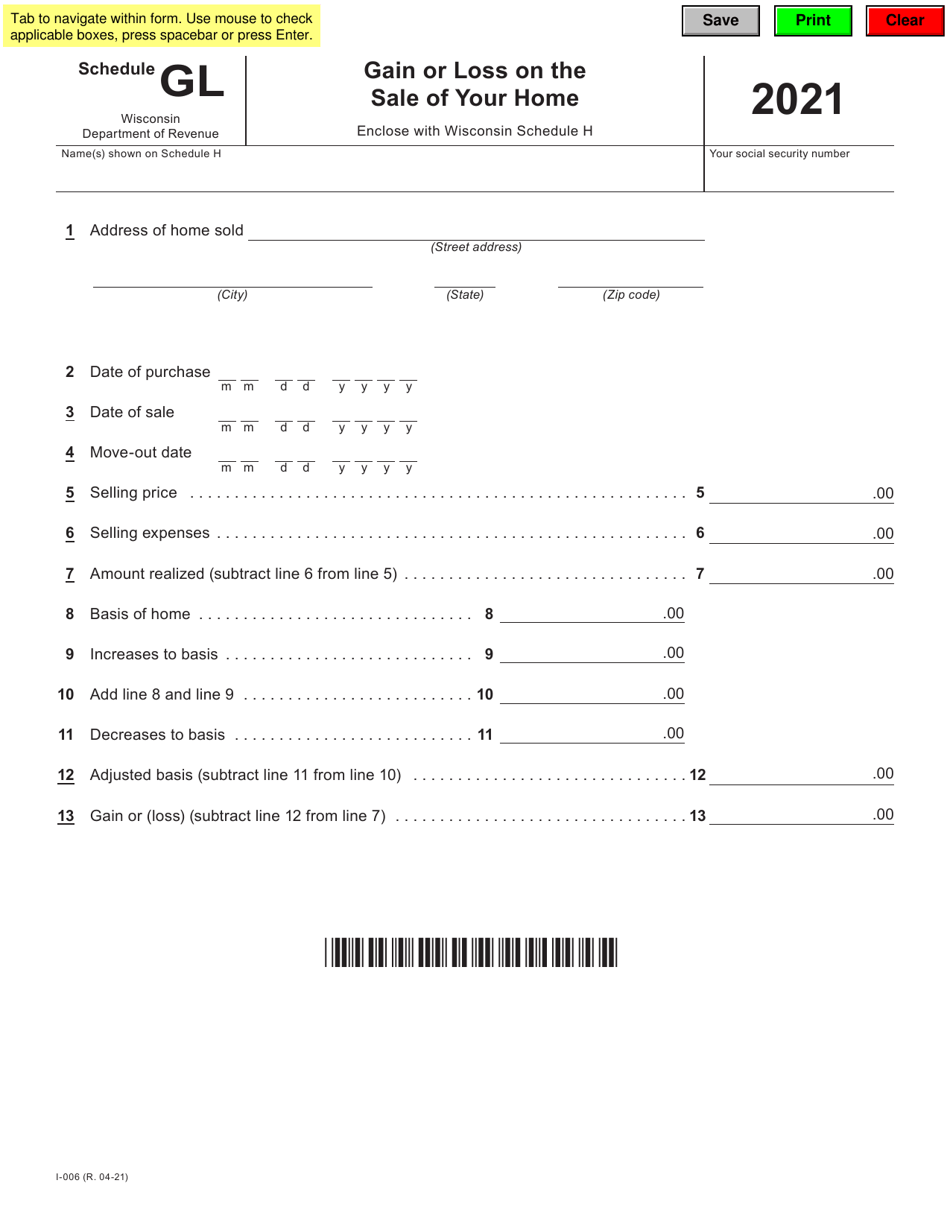

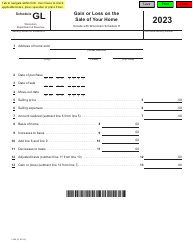

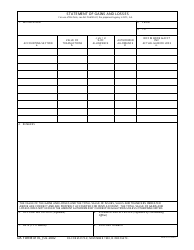

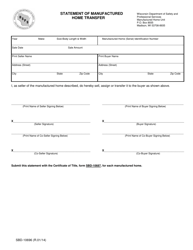

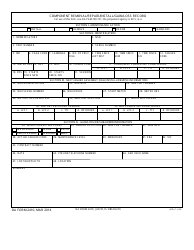

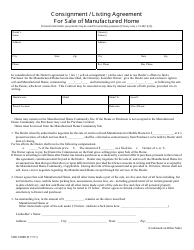

Form I-066 Schedule GL Gain or Loss on the Sale of Your Home - Wisconsin

What Is Form I-066 Schedule GL?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-066 Schedule GL?

A: Form I-066 Schedule GL is used to report the gain or loss on the sale of your home in Wisconsin.

Q: Who needs to file Form I-066 Schedule GL?

A: Anyone who sold their home in Wisconsin may need to file Form I-066 Schedule GL.

Q: What is reported on Form I-066 Schedule GL?

A: Form I-066 Schedule GL reports the gain or loss on the sale of your home in Wisconsin.

Q: What information do I need to complete Form I-066 Schedule GL?

A: You will need information about the sale of your home, including the sale price and any expenses incurred.

Q: When is the deadline to file Form I-066 Schedule GL?

A: The deadline to file Form I-066 Schedule GL varies and depends on the specific tax year.

Q: Do I need to include Form I-066 Schedule GL with my federal tax return?

A: No, Form I-066 Schedule GL is specific to Wisconsin and should not be included with your federal tax return.

Q: Is there a fee to file Form I-066 Schedule GL?

A: No, there is no fee to file Form I-066 Schedule GL.

Q: Are there any special instructions for completing Form I-066 Schedule GL?

A: Yes, you should carefully read the instructions provided with the form to ensure accurate completion.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-066 Schedule GL by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.