This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form I-055 Schedule NOL2

for the current year.

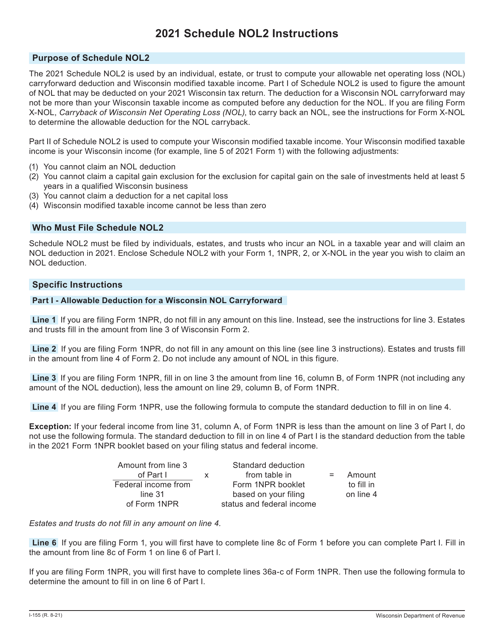

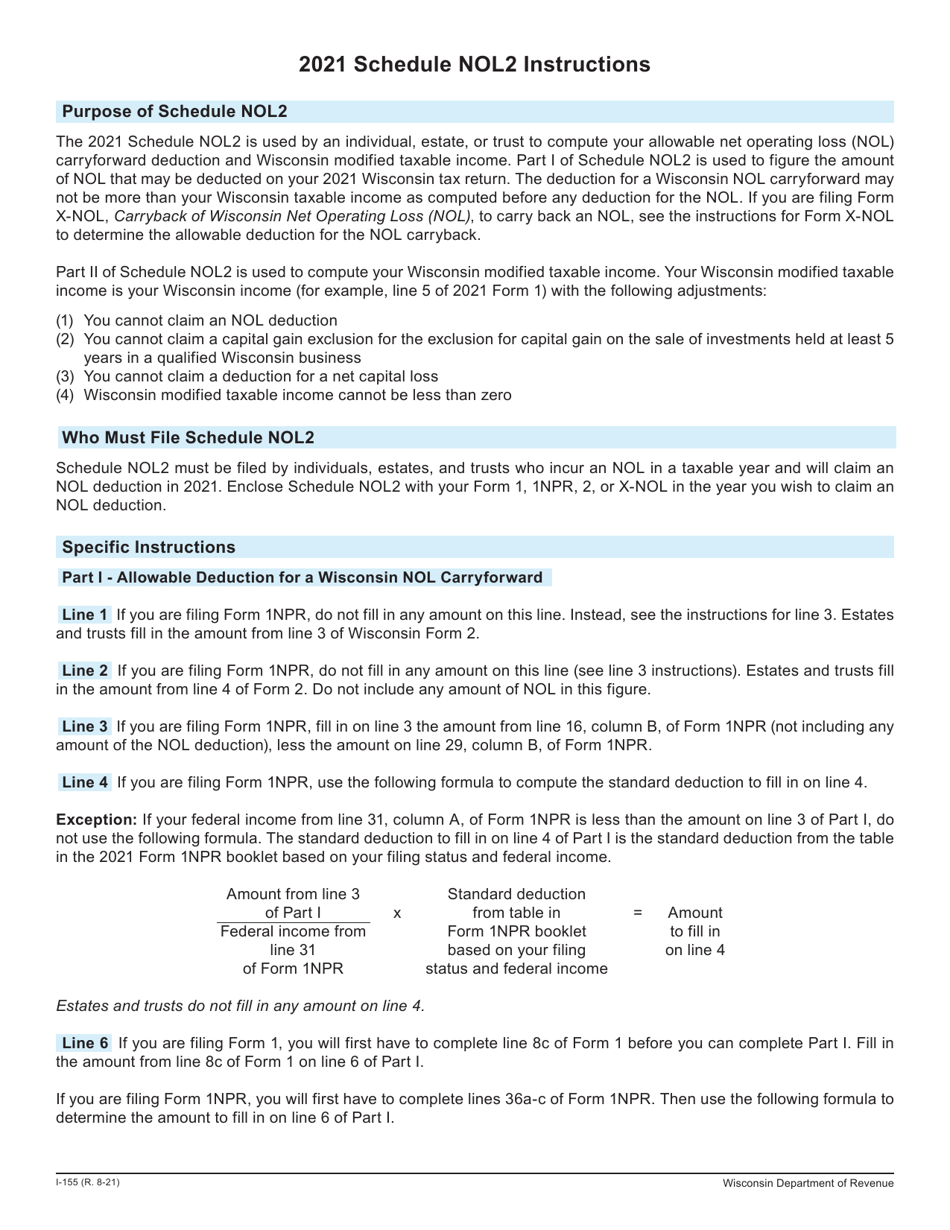

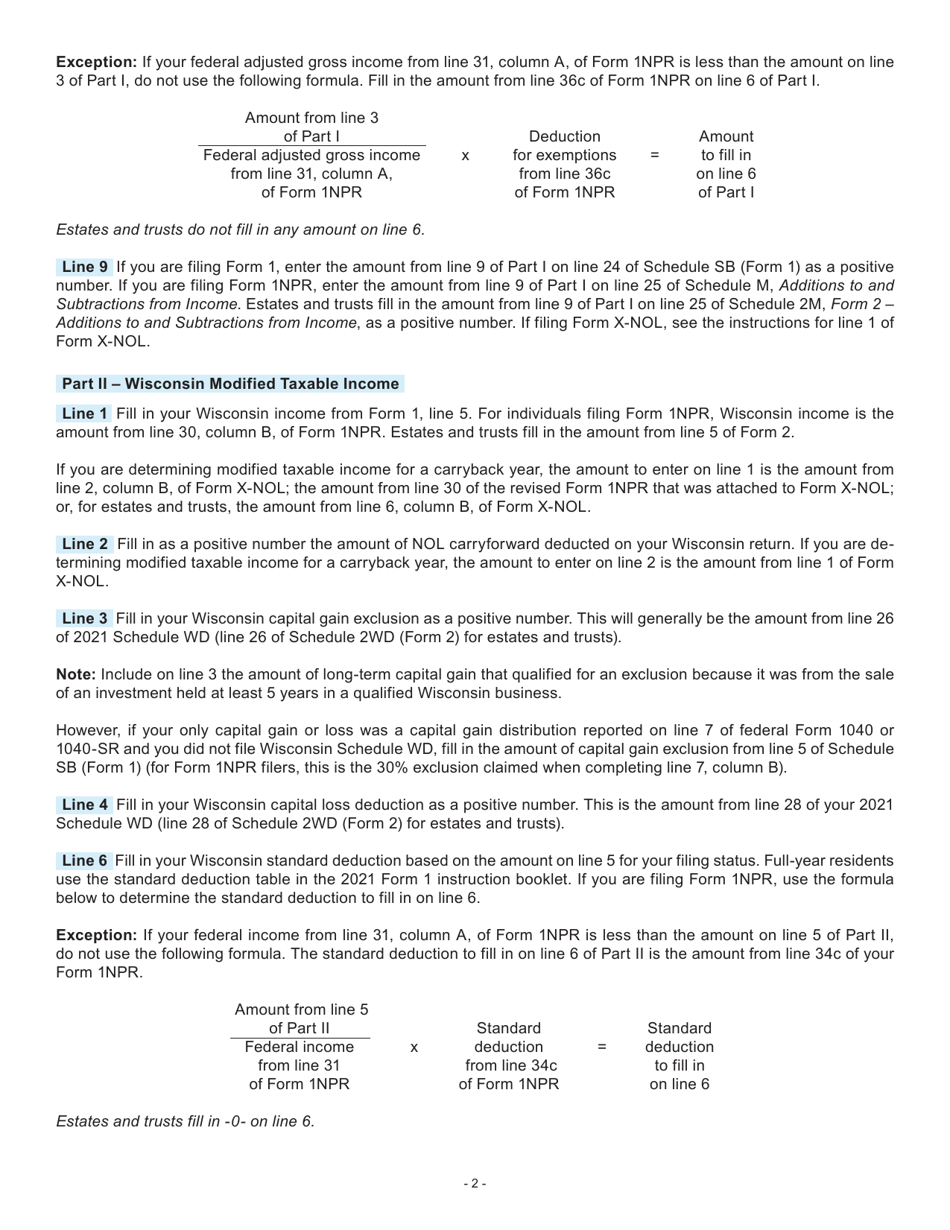

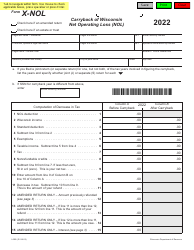

Instructions for Form I-055 Schedule NOL2 Net Operating Loss Deduction and Wisconsin Modified Taxable Income - Wisconsin

This document contains official instructions for Form I-055 Schedule NOL2, Net Operating Loss Deduction and Wisconsin Modified Taxable Income - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form I-055 Schedule NOL2 is available for download through this link.

FAQ

Q: What is Form I-055?

A: Form I-055 is a tax form used to claim the Net Operating Loss (NOL) deduction and calculate Wisconsin Modified Taxable Income.

Q: What is the Net Operating Loss (NOL) deduction?

A: The NOL deduction allows businesses and individuals to offset their losses from one year against their taxable income in another year.

Q: Why would someone need to use Schedule NOL2?

A: Schedule NOL2 is used when claiming the NOL deduction and calculating Wisconsin Modified Taxable Income for Wisconsin state taxes.

Q: What is Wisconsin Modified Taxable Income?

A: Wisconsin Modified Taxable Income is the adjusted gross income (AGI) of a taxpayer with modifications related to Wisconsin tax law.

Q: Who needs to file Form I-055 Schedule NOL2?

A: Taxpayers who have a net operating loss to carry forward or who want to claim the NOL deduction on their Wisconsin state taxes need to file Schedule NOL2.

Q: Are there any deadlines for filing Form I-055 Schedule NOL2?

A: The deadline for filing Form I-055 Schedule NOL2 is usually the same as the deadline for filing your Wisconsin state tax return.

Q: Can I claim the NOL deduction on my federal taxes as well?

A: Yes, you can also claim the NOL deduction on your federal tax return using IRS Form 1045 or Form 1040X.

Q: Is the NOL deduction the same for individuals and businesses?

A: No, the rules for claiming the NOL deduction and calculating NOL carryovers differ for individuals and businesses.

Q: Is professional assistance required to fill out Form I-055 Schedule NOL2?

A: While professional assistance is not required, it is recommended to seek help from a tax professional or use tax preparation software for complex tax matters.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.