This version of the form is not currently in use and is provided for reference only. Download this version of

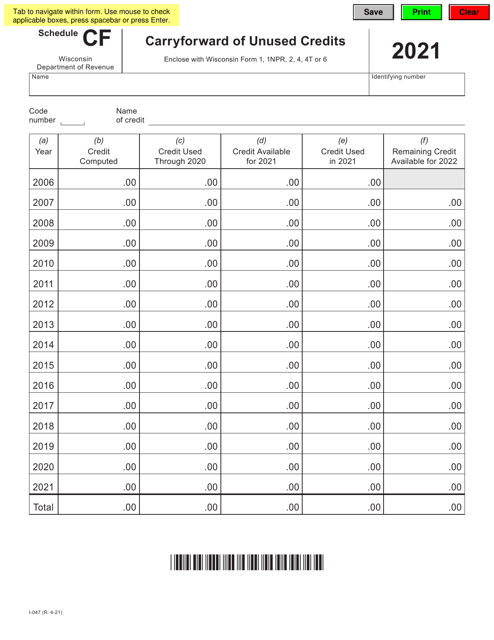

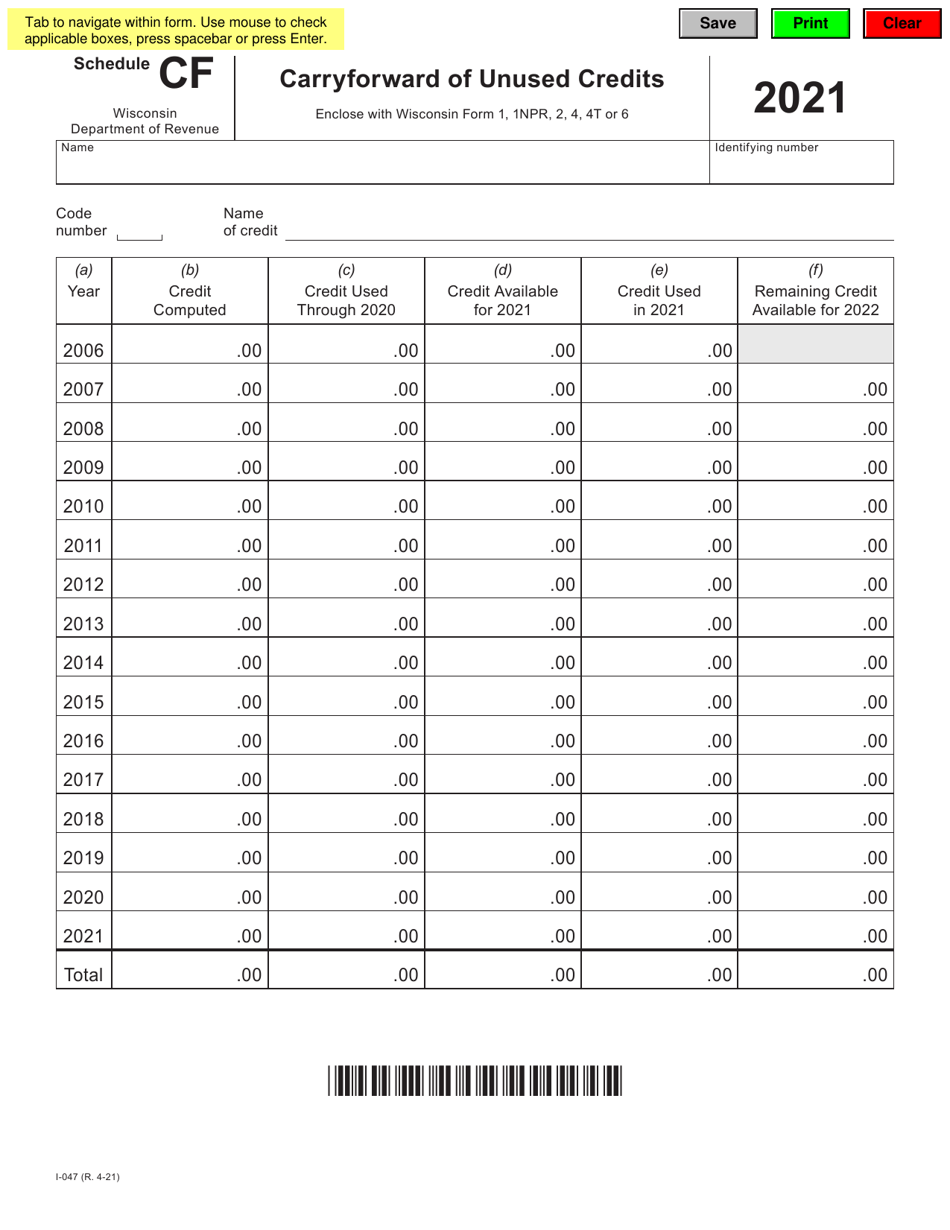

Form I-047 Schedule CF

for the current year.

Form I-047 Schedule CF Carryforward of Unused Credits - Wisconsin

What Is Form I-047 Schedule CF?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-047 Schedule CF?

A: Form I-047 Schedule CF is a form used in Wisconsin to carry forward any unused tax credits from previous years.

Q: What credits can be carried forward on Form I-047 Schedule CF?

A: Form I-047 Schedule CF allows the carry forward of various tax credits, such as the Research Credit, Manufacturing and Agriculture Credit, and Film Production Credit, among others.

Q: How do I complete Form I-047 Schedule CF?

A: To complete Form I-047 Schedule CF, you'll need to provide information about the tax credit being carried forward, the amount of credit from the prior year, and any adjustments or recapture amounts.

Q: Can I carry forward tax credits from multiple years on this form?

A: No, Form I-047 Schedule CF can only be used to carry forward unused credits from the previous tax year.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-047 Schedule CF by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.