This version of the form is not currently in use and is provided for reference only. Download this version of

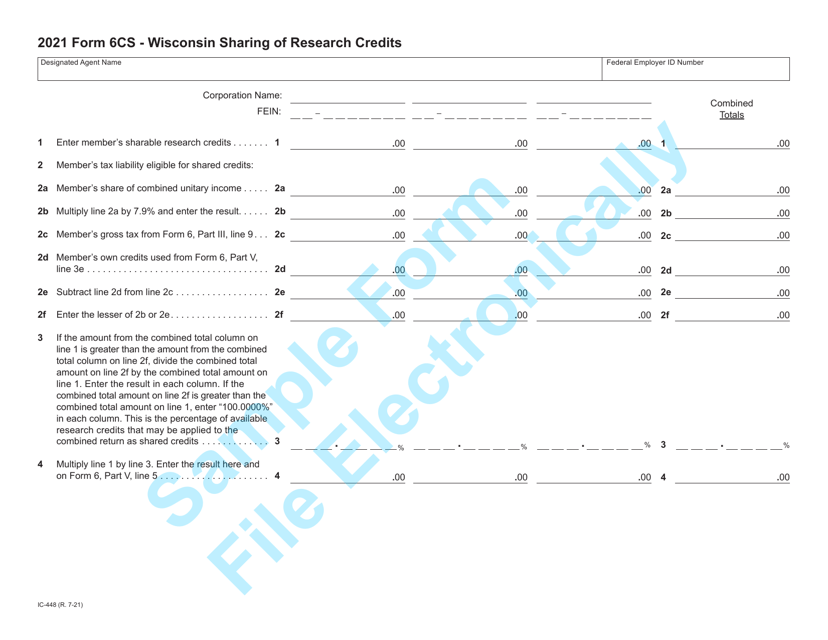

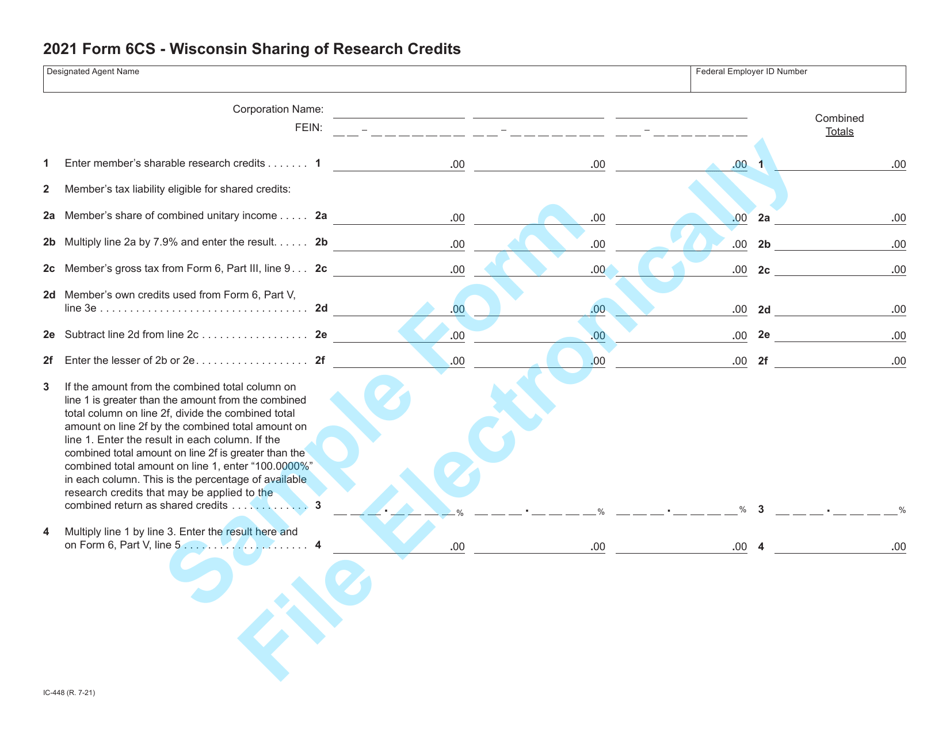

Form 6CS (IC-448)

for the current year.

Form 6CS (IC-448) Wisconsin Sharing of Research Credits - Sample - Wisconsin

What Is Form 6CS (IC-448)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 6CS?

A: Form 6CS is a Wisconsin tax form used to report the sharing of research credits.

Q: Who should use Form 6CS?

A: Form 6CS should be used by taxpayers in Wisconsin who need to report the sharing of research credits.

Q: What are research credits?

A: Research credits are tax incentives that are given to businesses for conducting qualified research and development activities.

Q: Why would someone need to share research credits?

A: Companies often collaborate on research projects, and they may choose to share the research credits earned from those projects.

Q: What information is required on Form 6CS?

A: Form 6CS requires information about the taxpayer, the research credit being shared, and the percentage of the credit being allocated to each party.

Q: Is Form 6CS specific to Wisconsin?

A: Yes, Form 6CS is specific to Wisconsin and is used to report research credit sharing in the state.

Q: Are there any deadlines for filing Form 6CS?

A: Yes, Form 6CS generally needs to be filed by the original due date of the Wisconsin income tax return, including extensions.

Q: Can I e-file Form 6CS?

A: As of now, Form 6CS cannot be e-filed and must be filed by mail.

Q: Is there a separate form for claiming research credits?

A: Yes, to claim research credits in Wisconsin, you need to file Form 6CR.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6CS (IC-448) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.