This version of the form is not currently in use and is provided for reference only. Download this version of

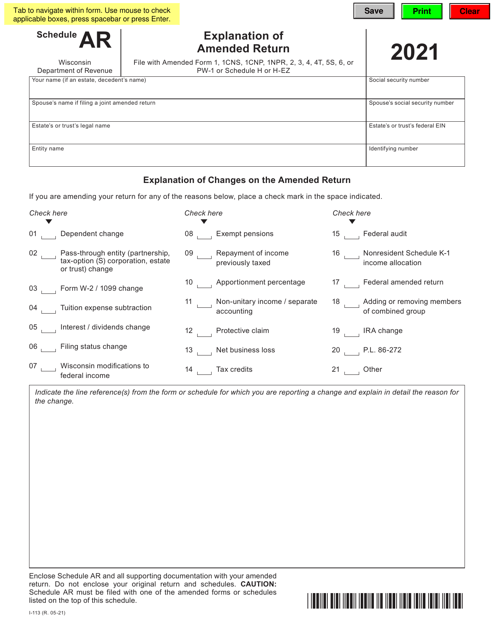

Form I-113 Schedule AR

for the current year.

Form I-113 Schedule AR Explanation of Amended Return - Wisconsin

What Is Form I-113 Schedule AR?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-113 Schedule AR?

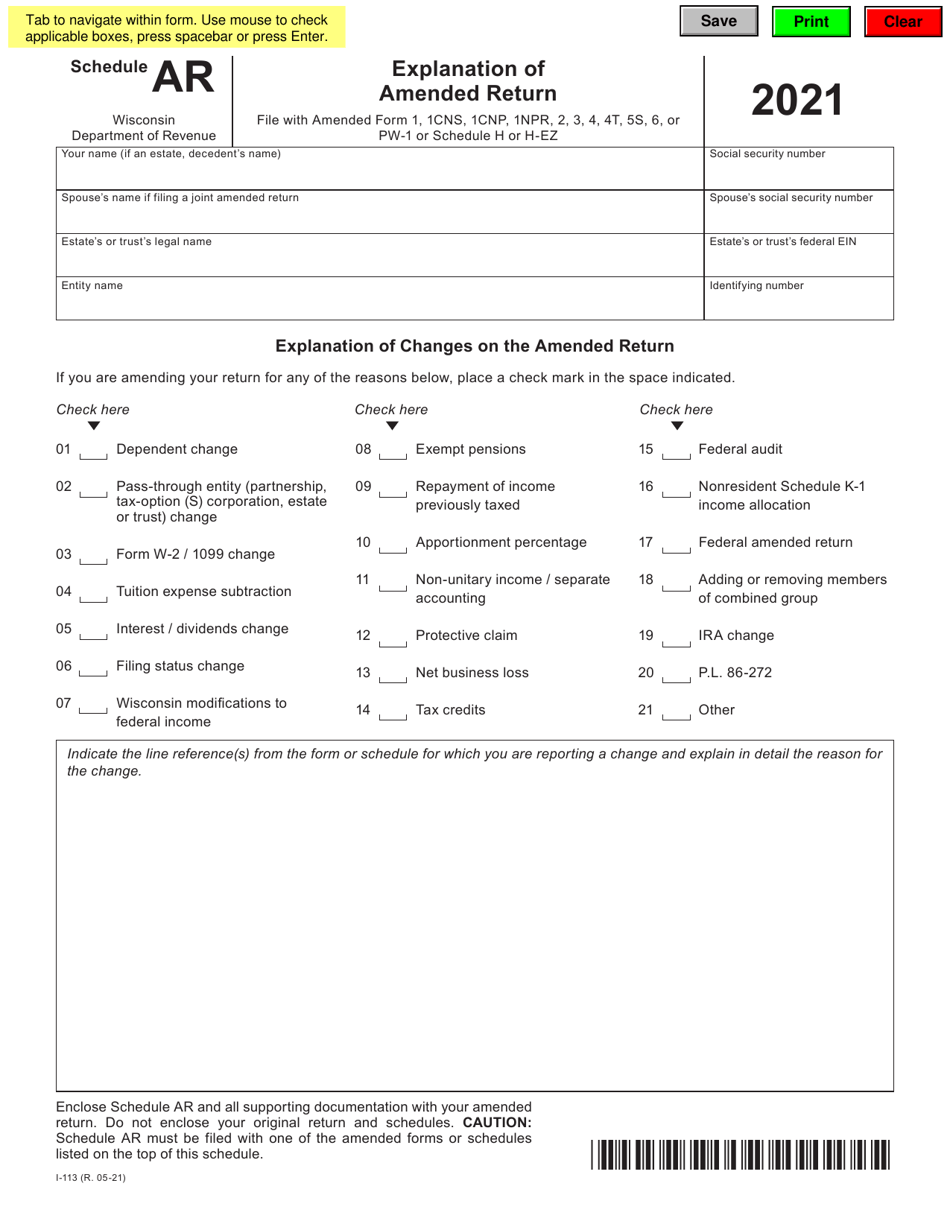

A: Form I-113 Schedule AR is a form used for explaining an amended tax return in the state of Wisconsin.

Q: Why would I need to file an amended return in Wisconsin?

A: You would need to file an amended return in Wisconsin if you made a mistake on your original tax return or need to report additional information.

Q: What information do I need to provide on Form I-113 Schedule AR?

A: On Form I-113 Schedule AR, you need to provide an explanation of the changes you made to your original tax return.

Q: Do I need to pay any fees to file an amended return in Wisconsin?

A: No, there are no fees associated with filing an amended return in Wisconsin.

Q: What are the consequences of not filing an amended return when required?

A: If you fail to file an amended return when required, you may face penalties and interest on any additional tax owed.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-113 Schedule AR by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.