This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5R (IC-042)

for the current year.

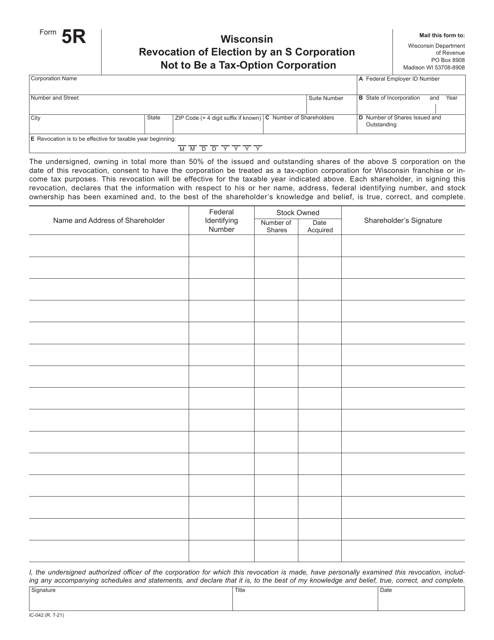

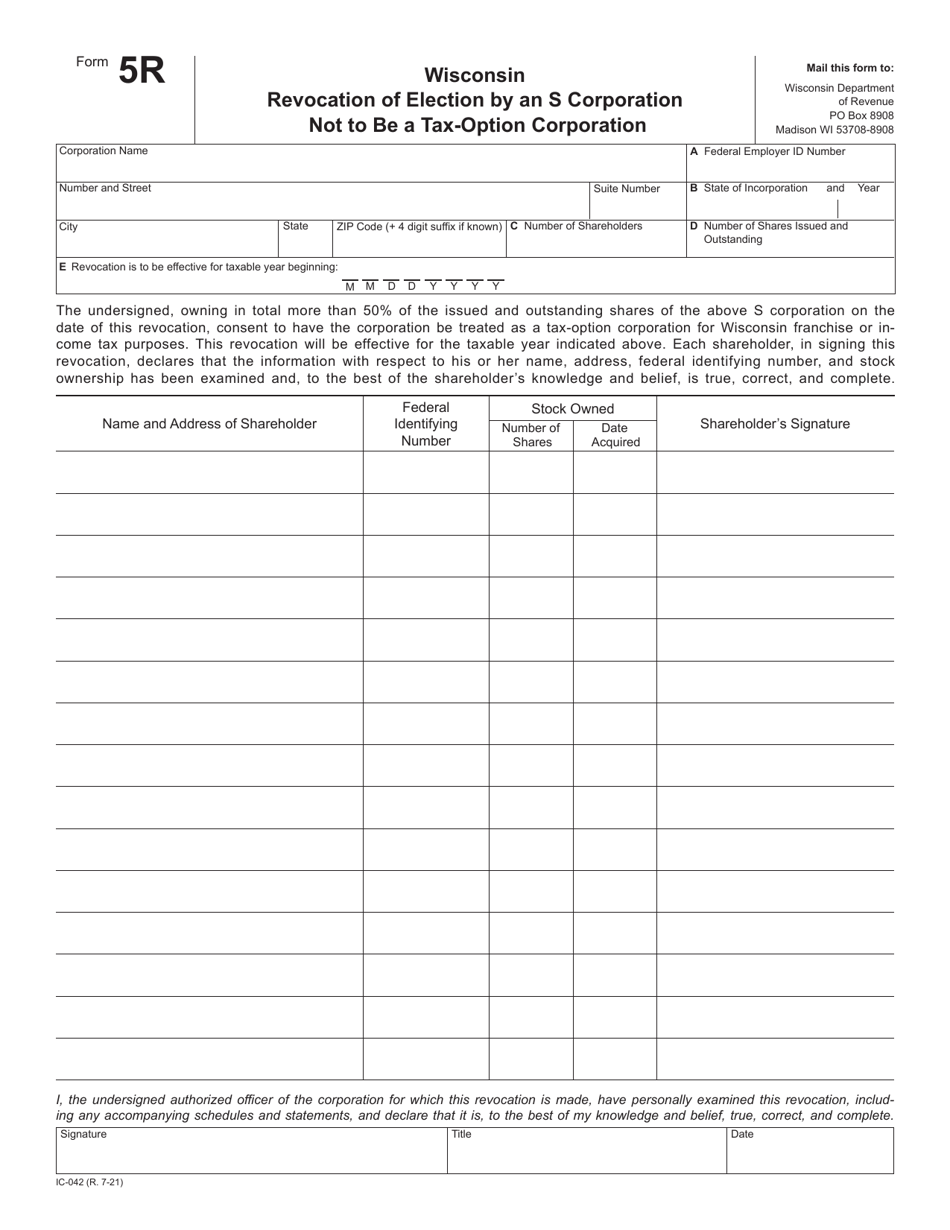

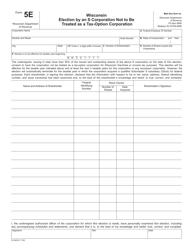

Form 5R (IC-042) Wisconsin Revocation of Election by an S Corporation Not to Be a Tax-Option Corporation - Wisconsin

What Is Form 5R (IC-042)?

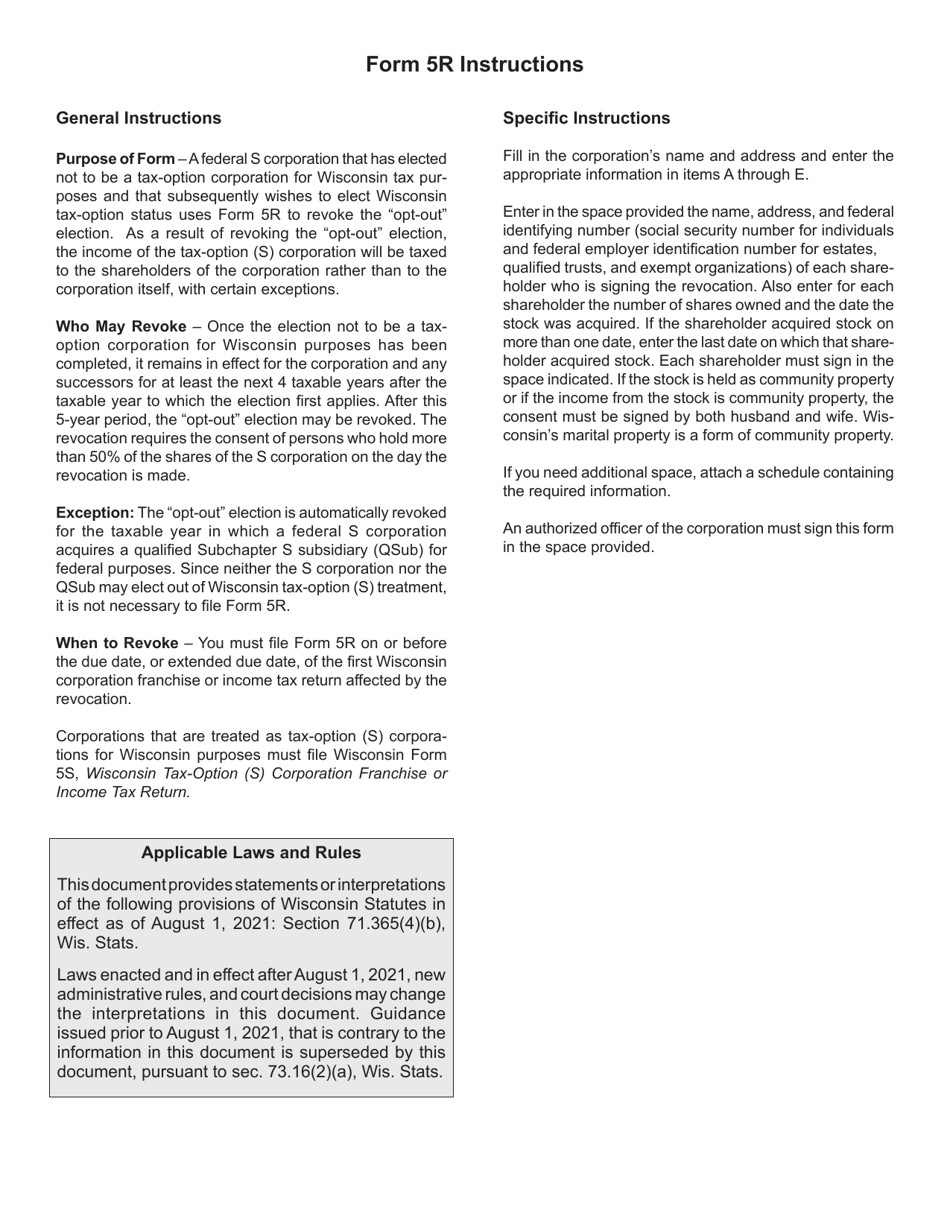

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5R?

A: Form 5R is a Wisconsin Revocation of Election by an S Corporation Not to Be a Tax-Option Corporation.

Q: Who needs to file Form 5R?

A: S Corporations in Wisconsin that want to revoke their election to be treated as a tax-option corporation.

Q: What does it mean for an S Corporation to be a tax-option corporation?

A: A tax-option corporation is a corporation that elects to pass its income, deductions, and credits through to its shareholders, who report them on their individual tax returns.

Q: Why would an S Corporation want to revoke its election to be a tax-option corporation?

A: There may be various reasons, such as changes in the business structure or tax planning strategies.

Q: Is there a deadline for filing Form 5R?

A: Yes, the form must be filed within 90 days from the date the S Corporation no longer wants to be a tax-option corporation.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5R (IC-042) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.