This version of the form is not currently in use and is provided for reference only. Download this version of

Form PW-U (IC-006)

for the current year.

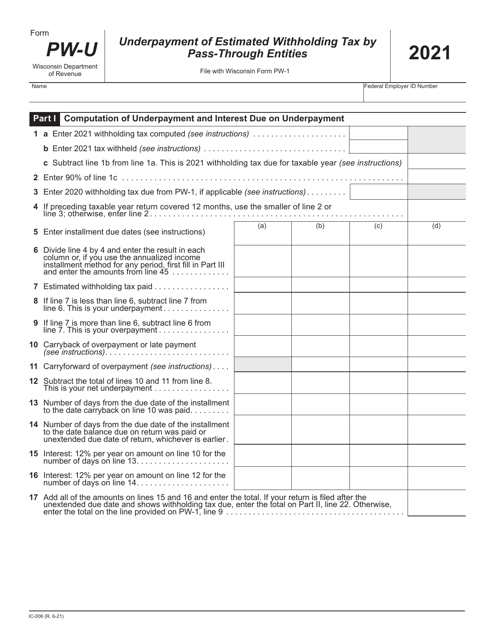

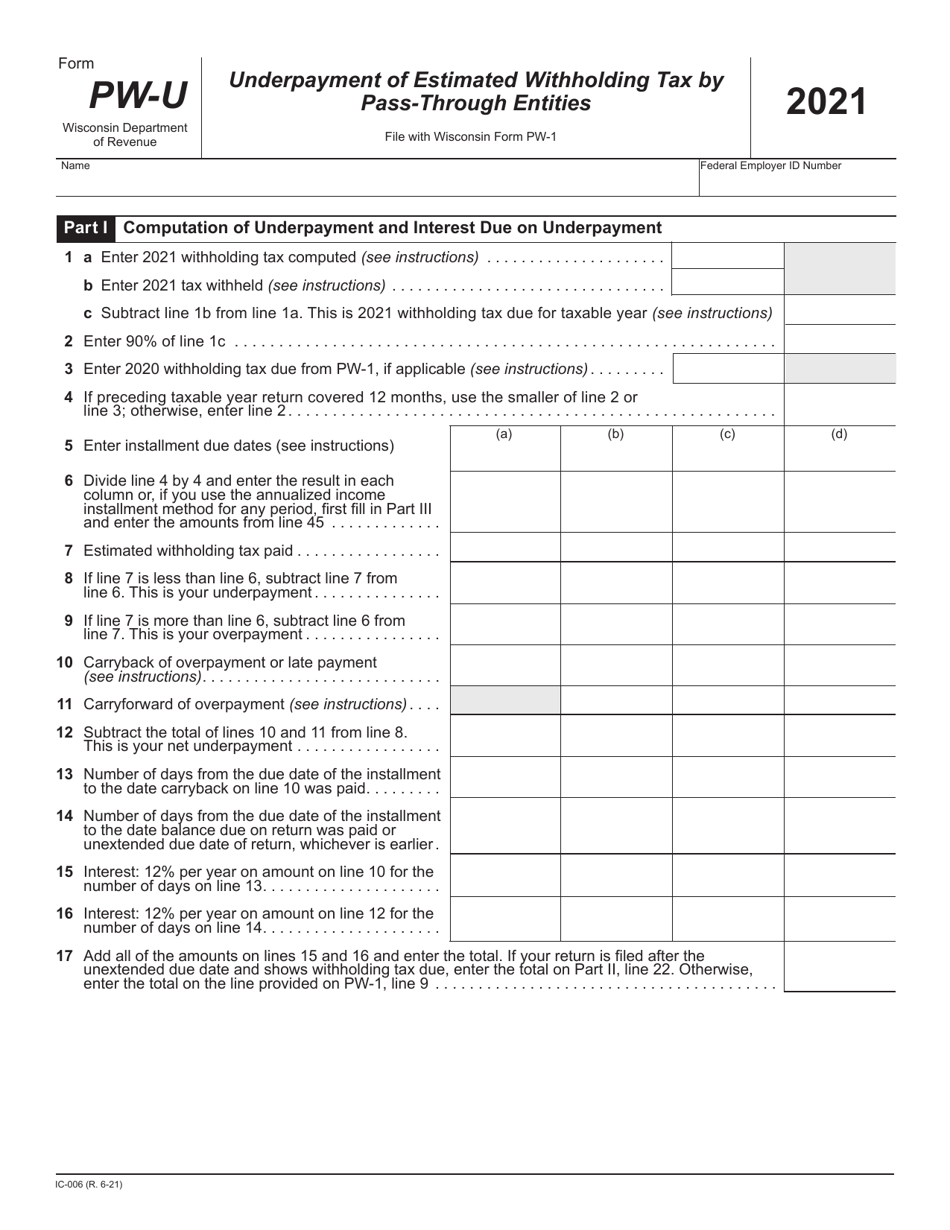

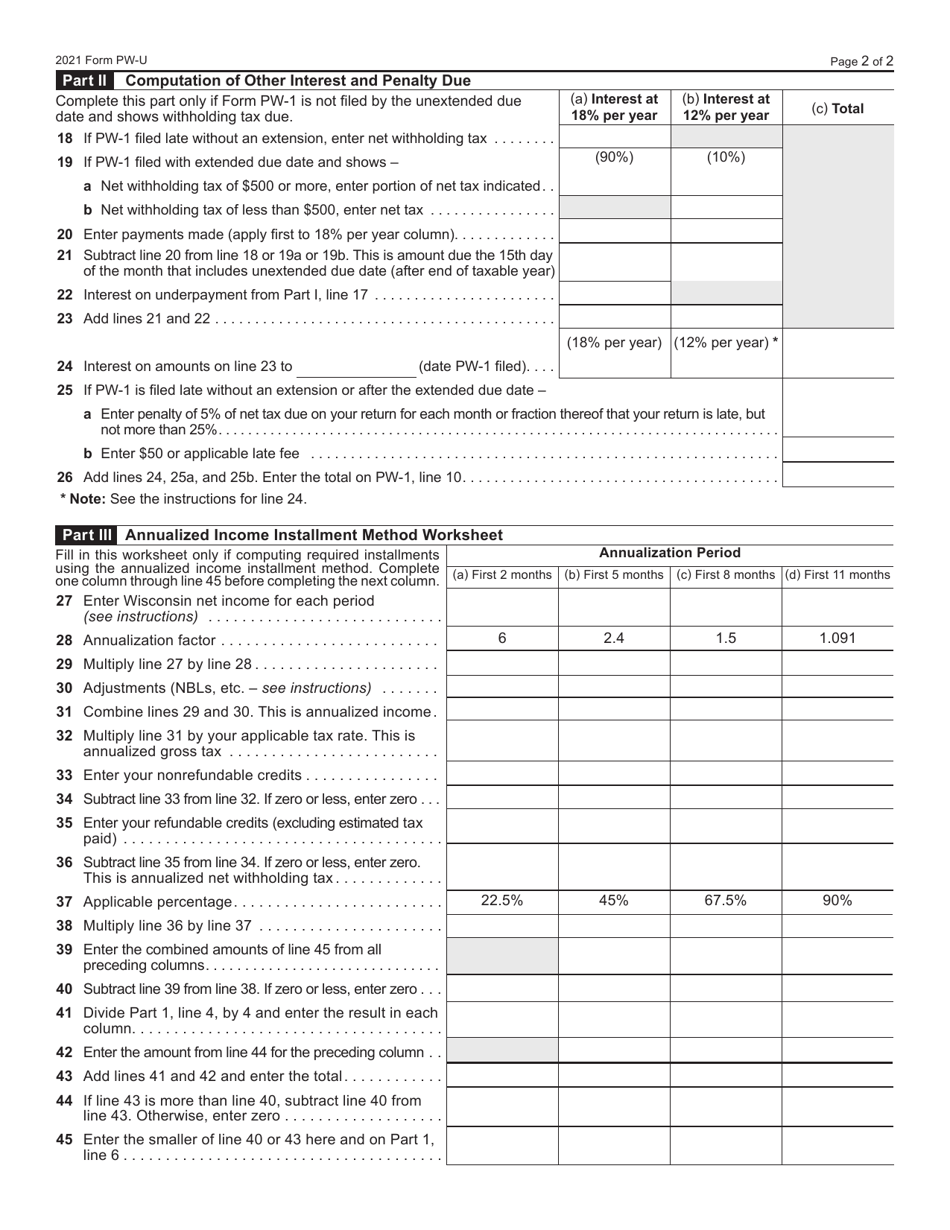

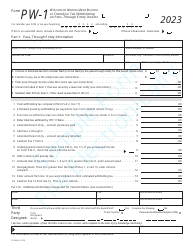

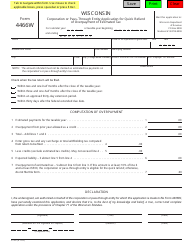

Form PW-U (IC-006) Underpayment of Estimated Withholding Tax by Pass-Through Entities - Wisconsin

What Is Form PW-U (IC-006)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PW-U (IC-006)?

A: Form PW-U (IC-006) is a form used by pass-through entities in Wisconsin to report underpayment of estimated withholding tax.

Q: Who needs to file Form PW-U (IC-006)?

A: Pass-through entities in Wisconsin who have underpaid their estimated withholding tax need to file Form PW-U (IC-006).

Q: What is the purpose of Form PW-U (IC-006)?

A: The purpose of Form PW-U (IC-006) is to report and calculate the underpayment of estimated withholding tax by pass-through entities in Wisconsin.

Q: What information do I need to fill out Form PW-U (IC-006)?

A: You will need information such as your pass-through entity's name and tax identification number, the amount of underpayment, and the applicable tax year.

Q: When is the deadline to file Form PW-U (IC-006)?

A: Form PW-U (IC-006) must be filed by the due date of the pass-through entity's income tax return for the applicable tax year.

Q: Are there any penalties for late filing of Form PW-U (IC-006)?

A: Yes, there may be penalties for late filing of Form PW-U (IC-006), so it is important to file it by the deadline.

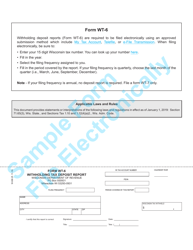

Q: Can I file Form PW-U (IC-006) electronically?

A: Yes, you can file Form PW-U (IC-006) electronically through the Wisconsin Department of Revenue's e-file system.

Q: Is there a fee to file Form PW-U (IC-006)?

A: No, there is no fee to file Form PW-U (IC-006).

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PW-U (IC-006) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.