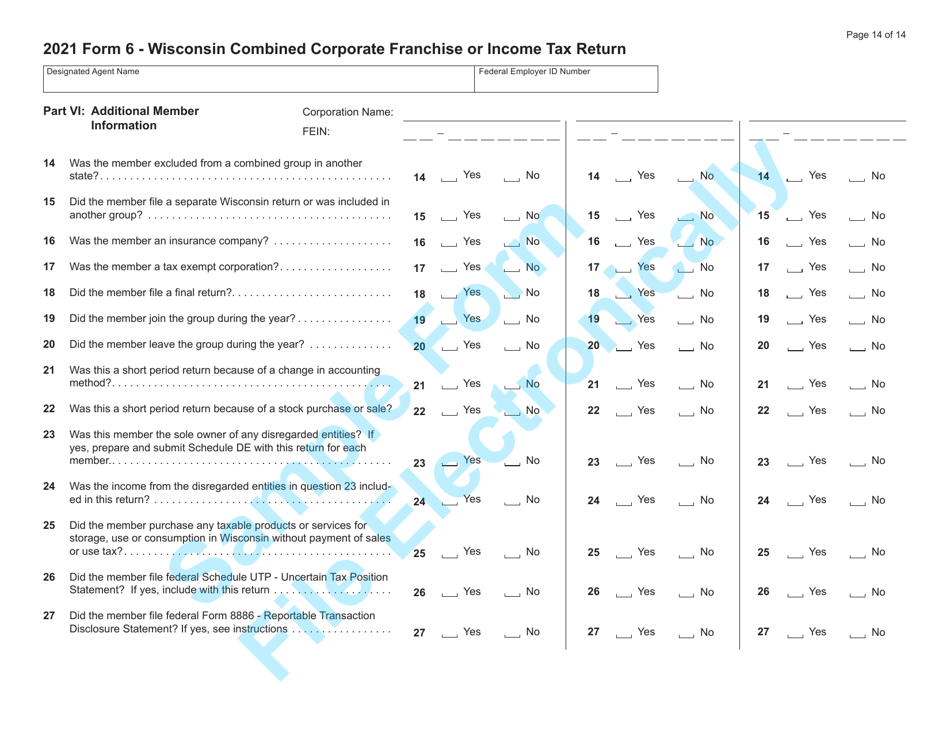

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 6 (IC-406)

for the current year.

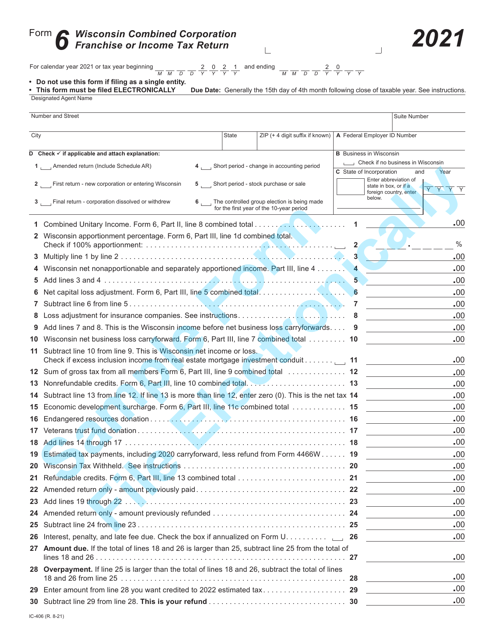

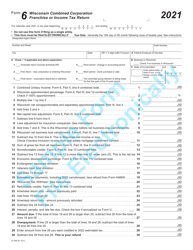

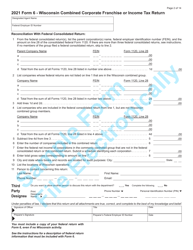

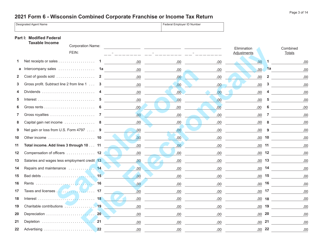

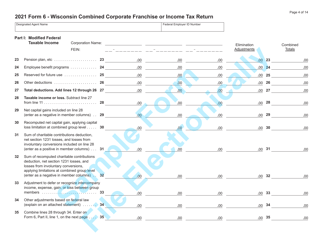

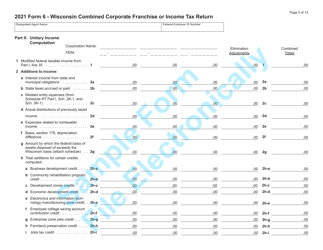

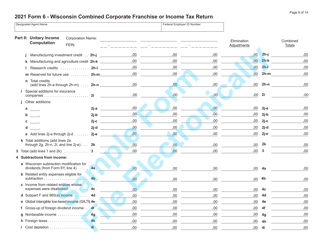

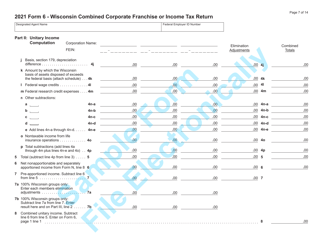

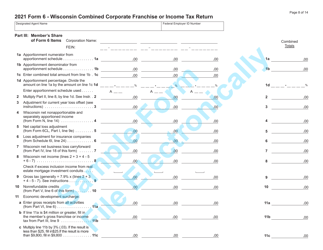

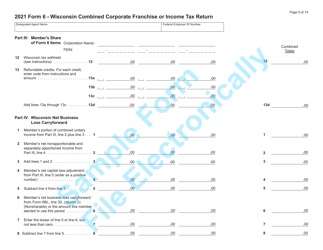

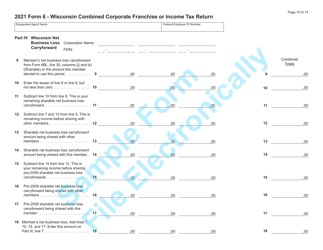

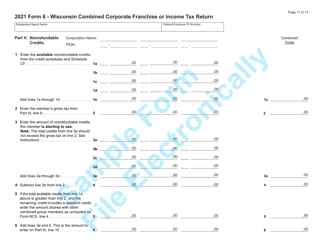

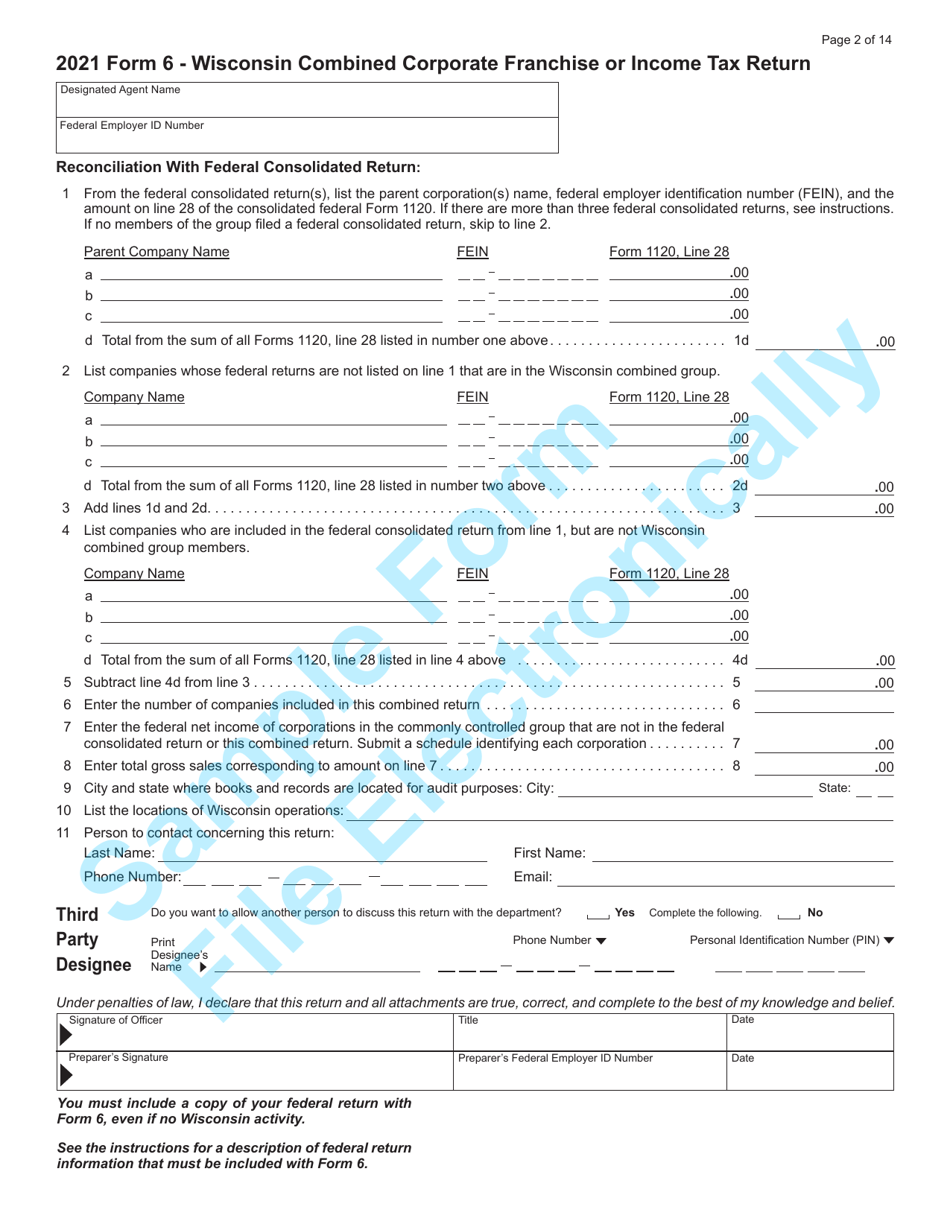

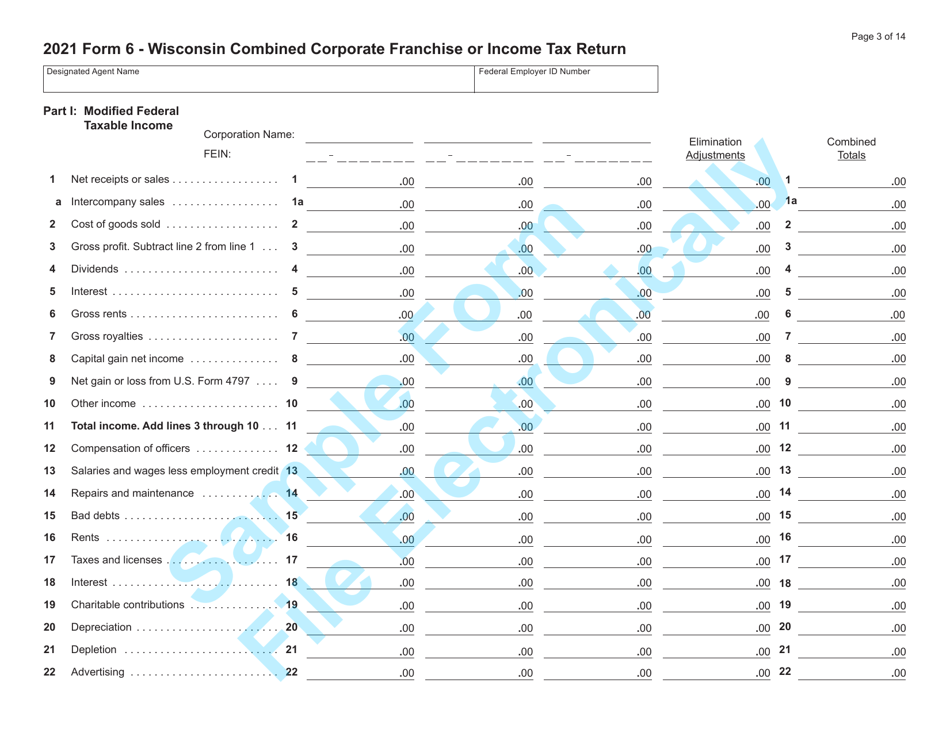

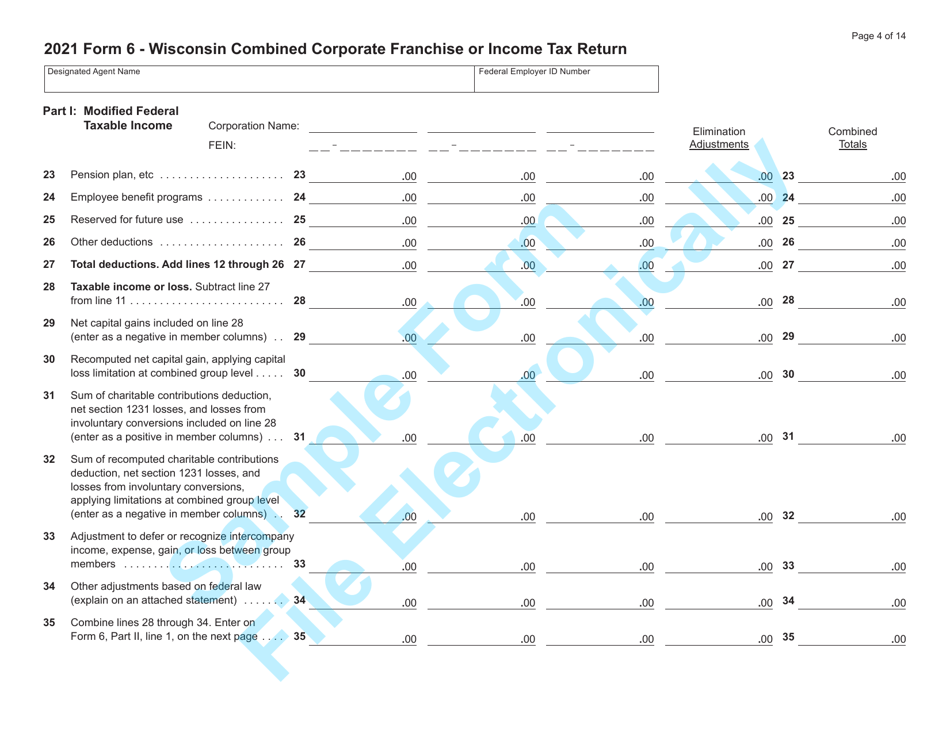

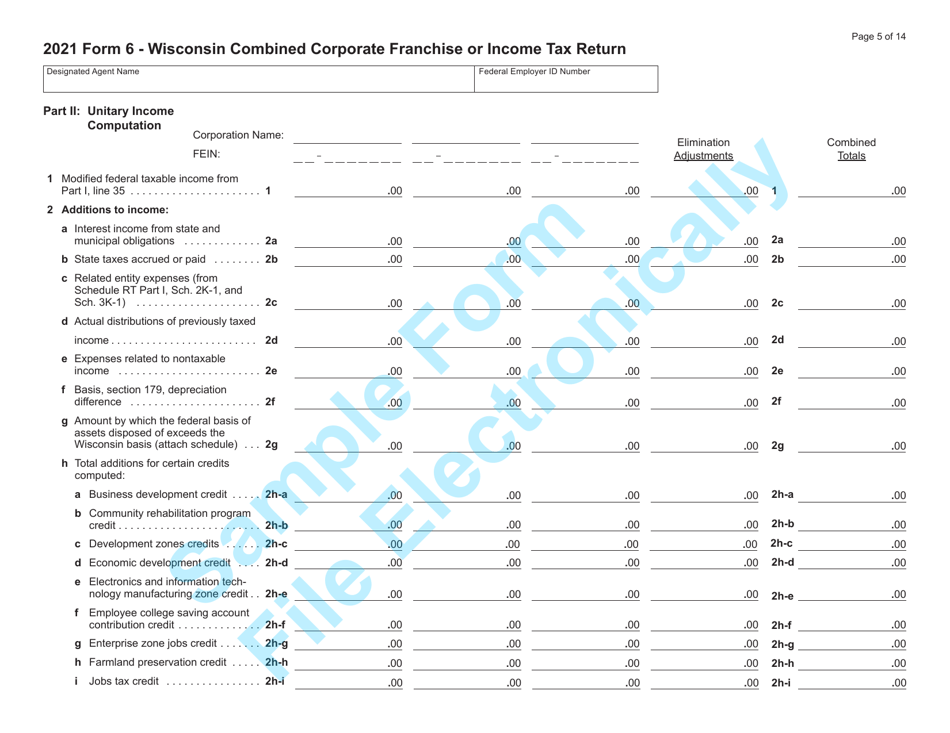

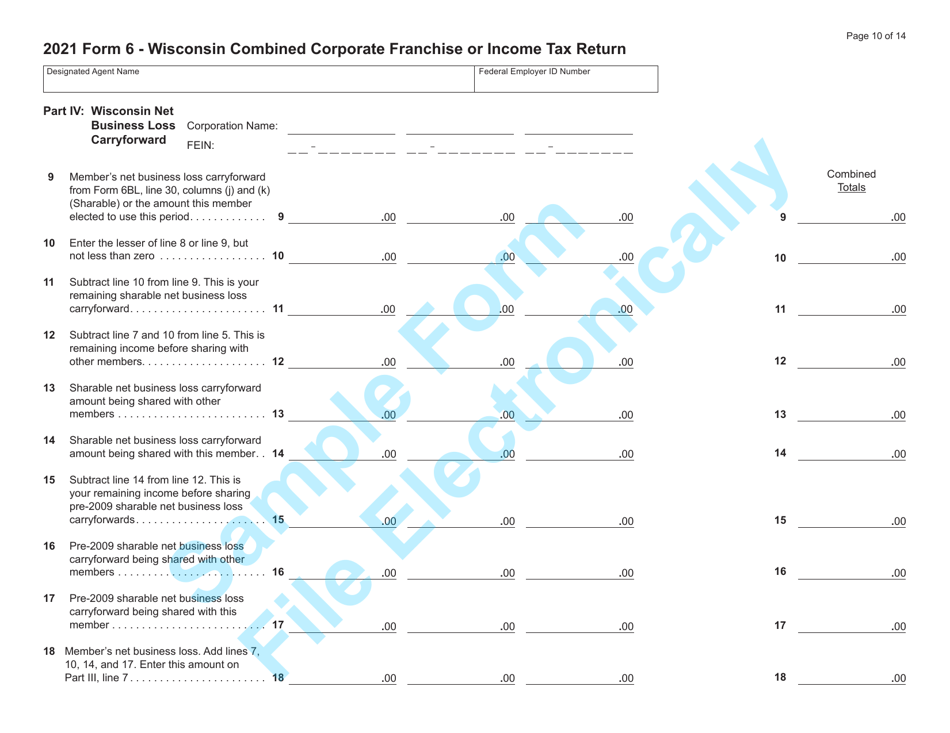

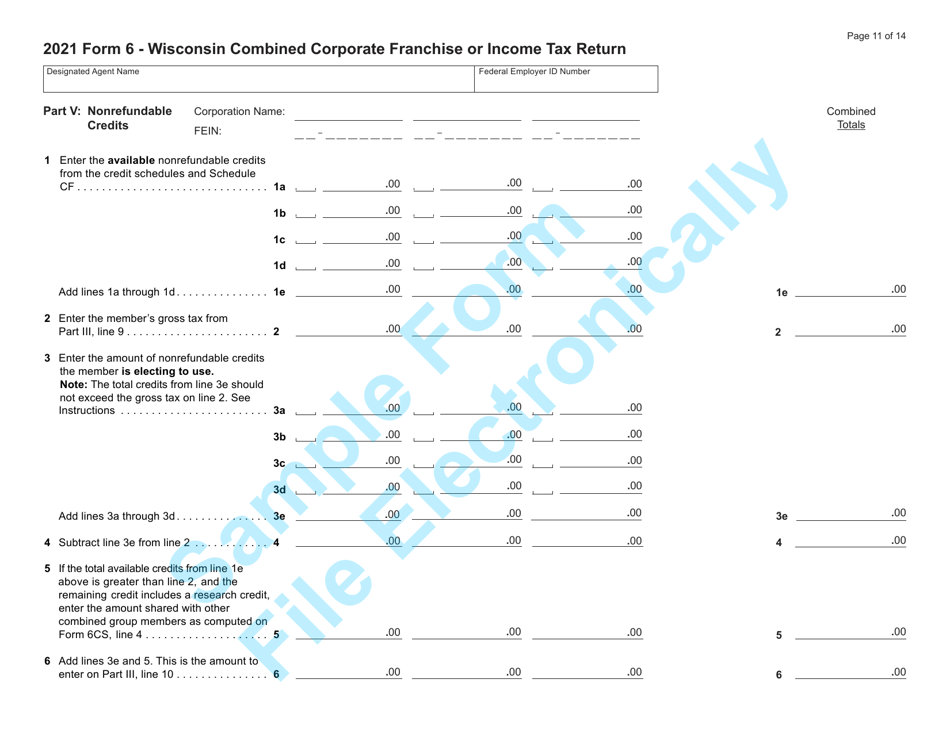

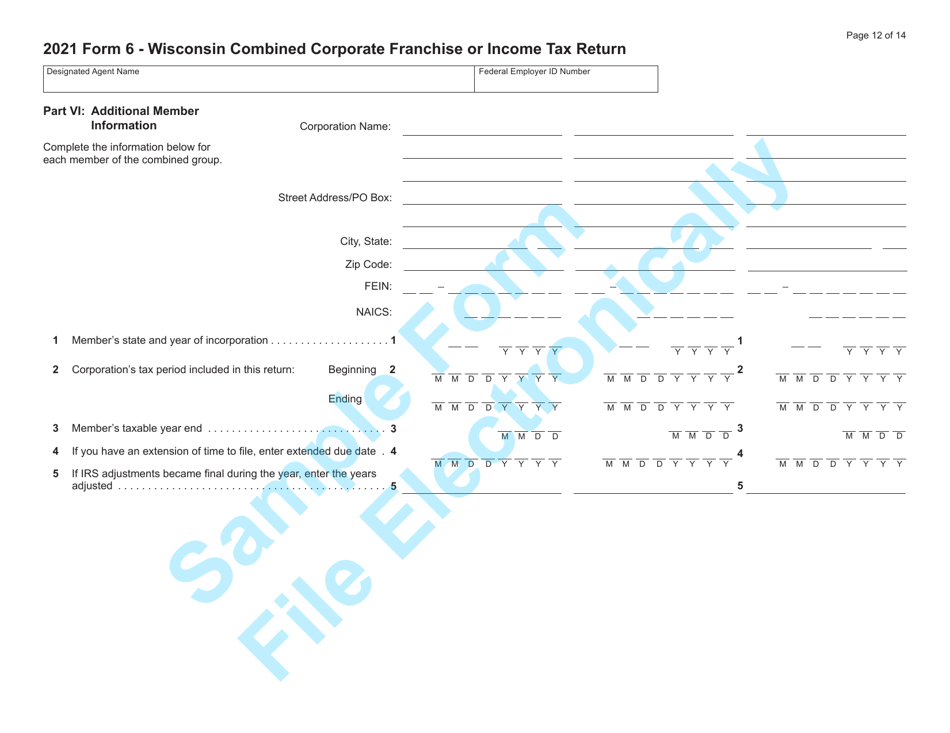

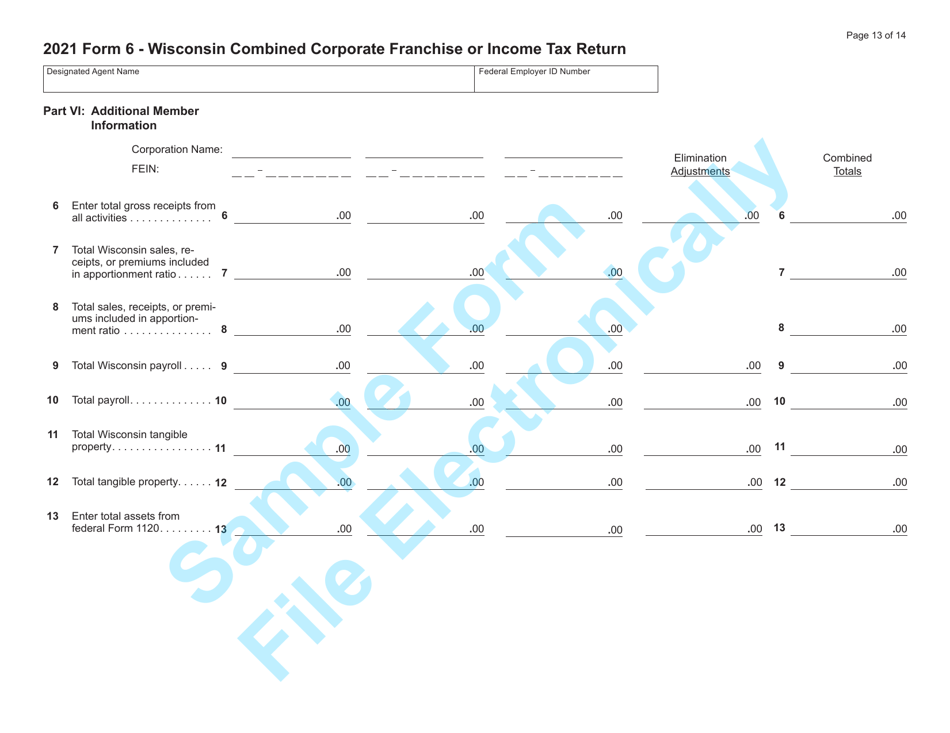

Form 6 (IC-406) Wisconsin Combined Corporation Franchise or Income Tax Return - Sample - Wisconsin

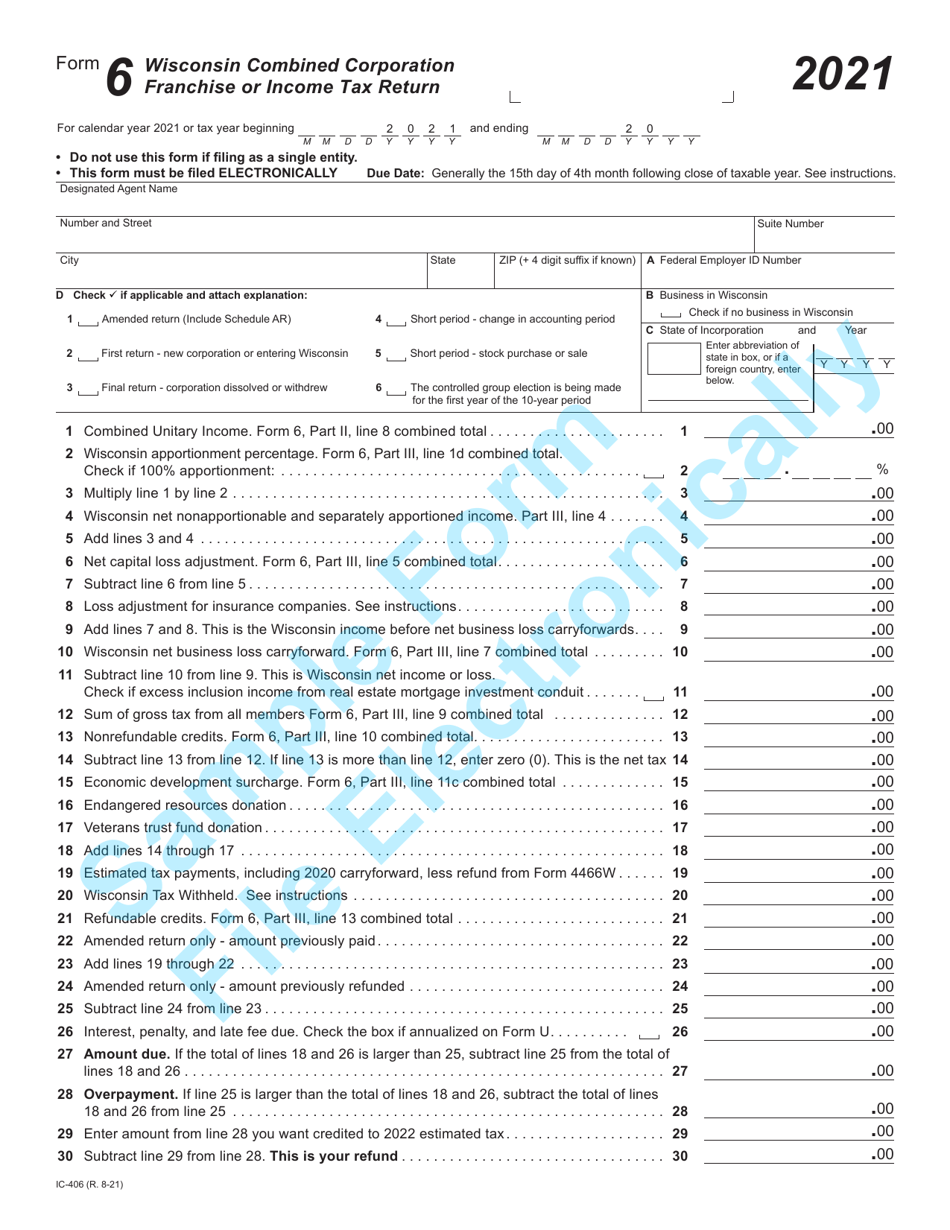

What Is Form 6 (IC-406)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

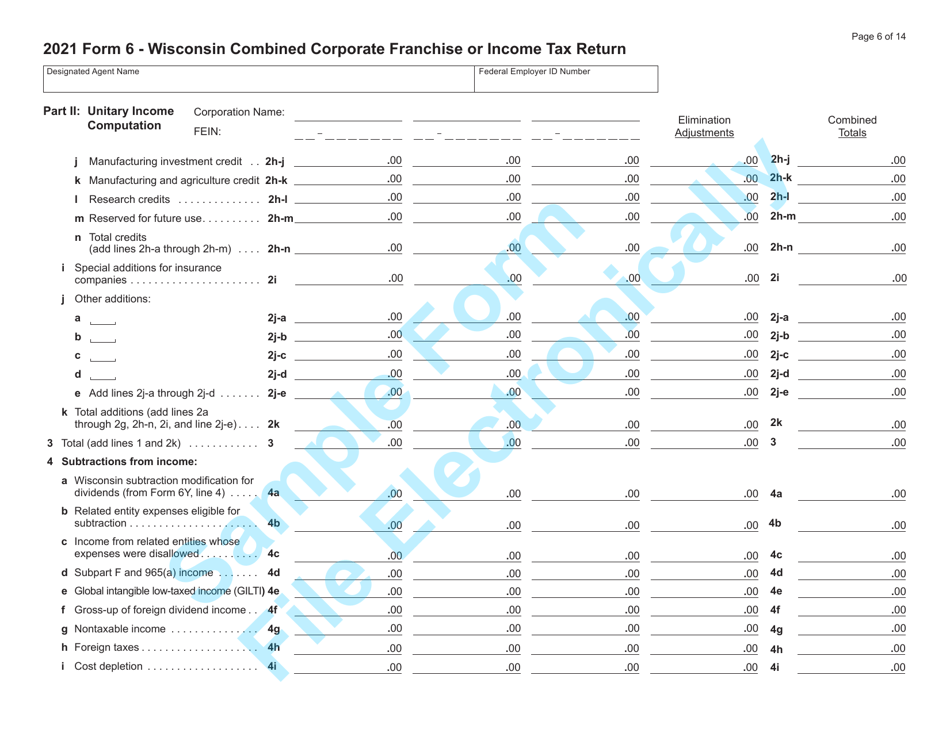

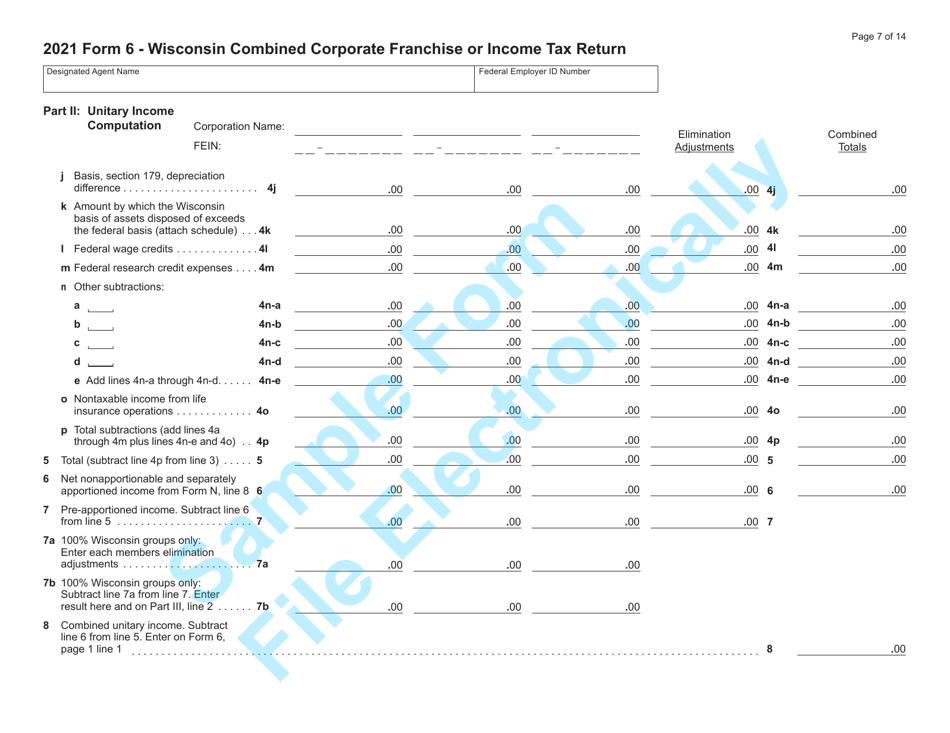

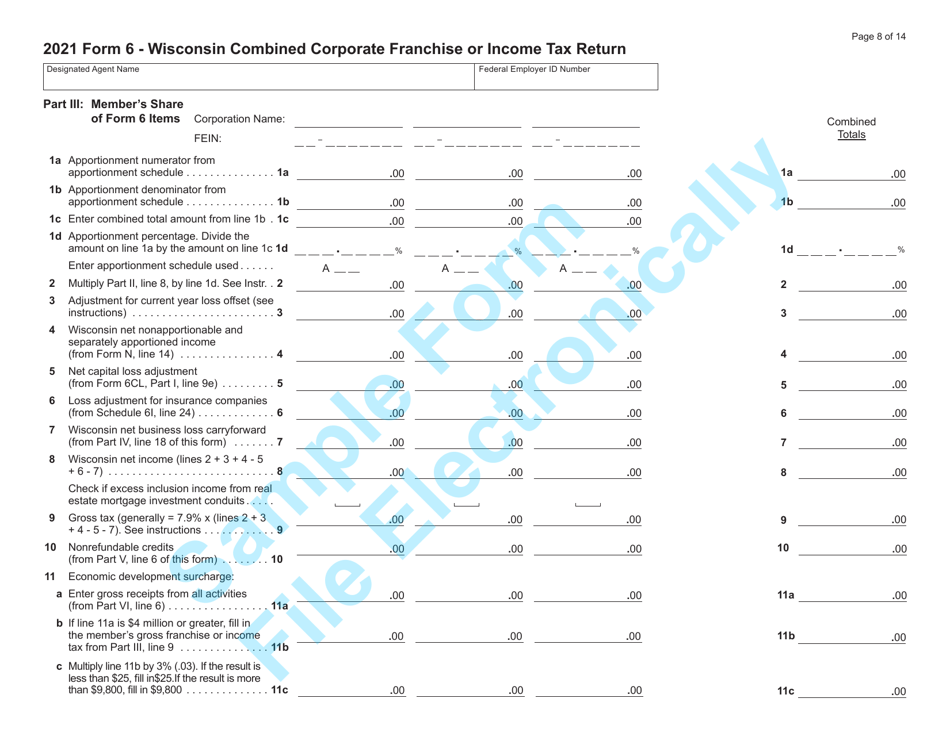

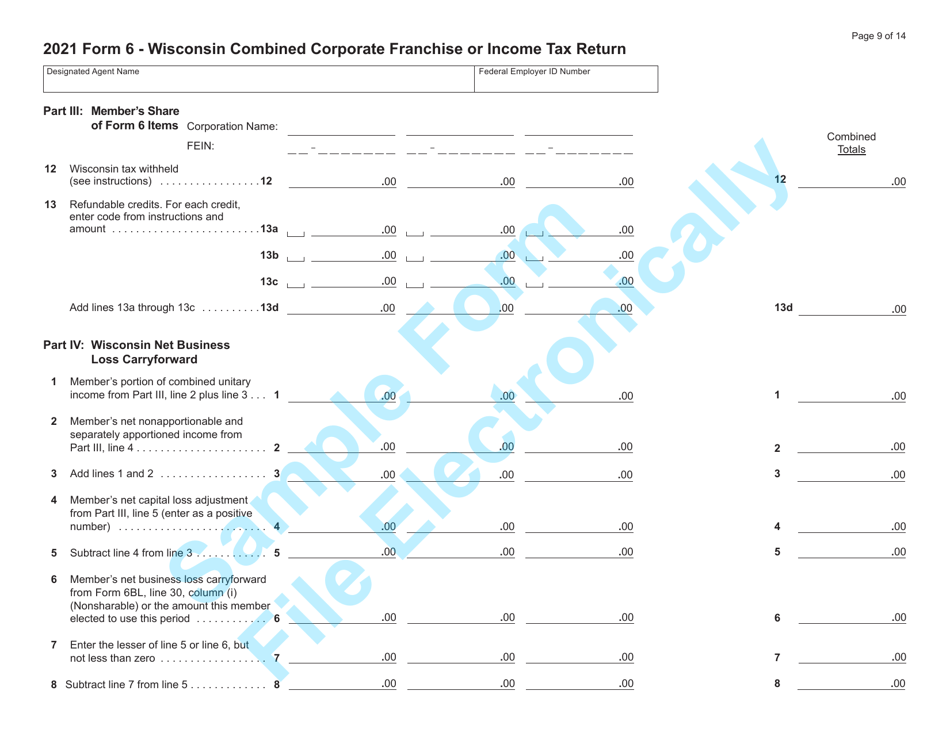

Q: What is Form 6 (IC-406)?

A: Form 6 (IC-406) is the Wisconsin Combined Corporation Franchise or Income Tax Return.

Q: Who needs to file Form 6 (IC-406)?

A: Any corporation registered in Wisconsin that has income and/or franchise tax liabilities must file Form 6 (IC-406).

Q: What is the purpose of Form 6 (IC-406)?

A: The purpose of Form 6 (IC-406) is to report and calculate the corporation's franchise or income tax liability in the state of Wisconsin.

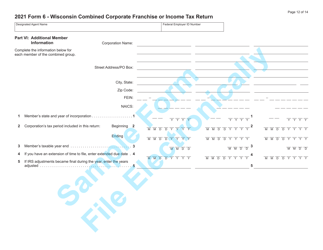

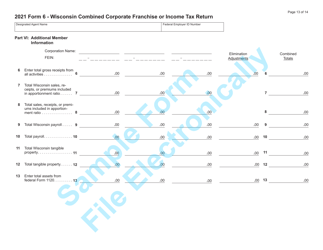

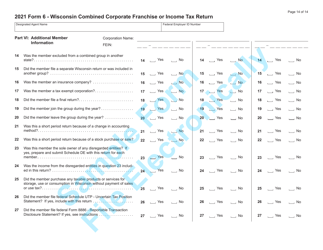

Q: What information is required on Form 6 (IC-406)?

A: Form 6 (IC-406) requires various information, including the corporation's name, address, federal identification number, income and deduction details, and tax computation.

Q: When is Form 6 (IC-406) due?

A: Form 6 (IC-406) is due on the 15th day of the 3rd month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form 6 (IC-406)?

A: Yes, there are penalties for late filing of Form 6 (IC-406). The penalties vary depending on the amount of tax due and the number of months the return is late.

Q: Is payment required with Form 6 (IC-406)?

A: Yes, payment of any tax due must be included with Form 6 (IC-406) at the time of filing.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 6 (IC-406) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.