This version of the form is not currently in use and is provided for reference only. Download this version of

Form S-240

for the current year.

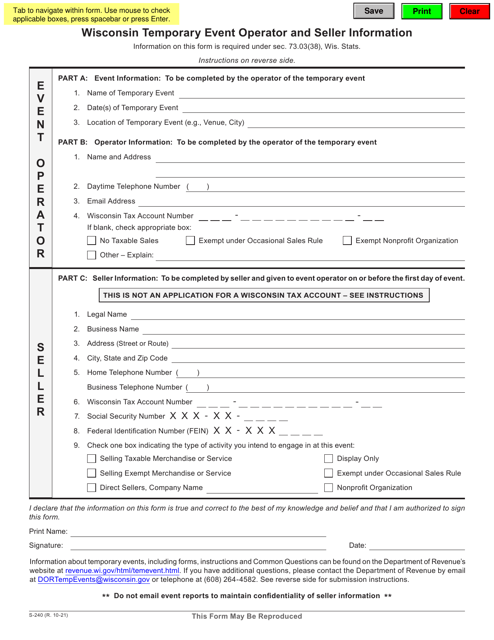

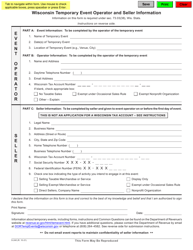

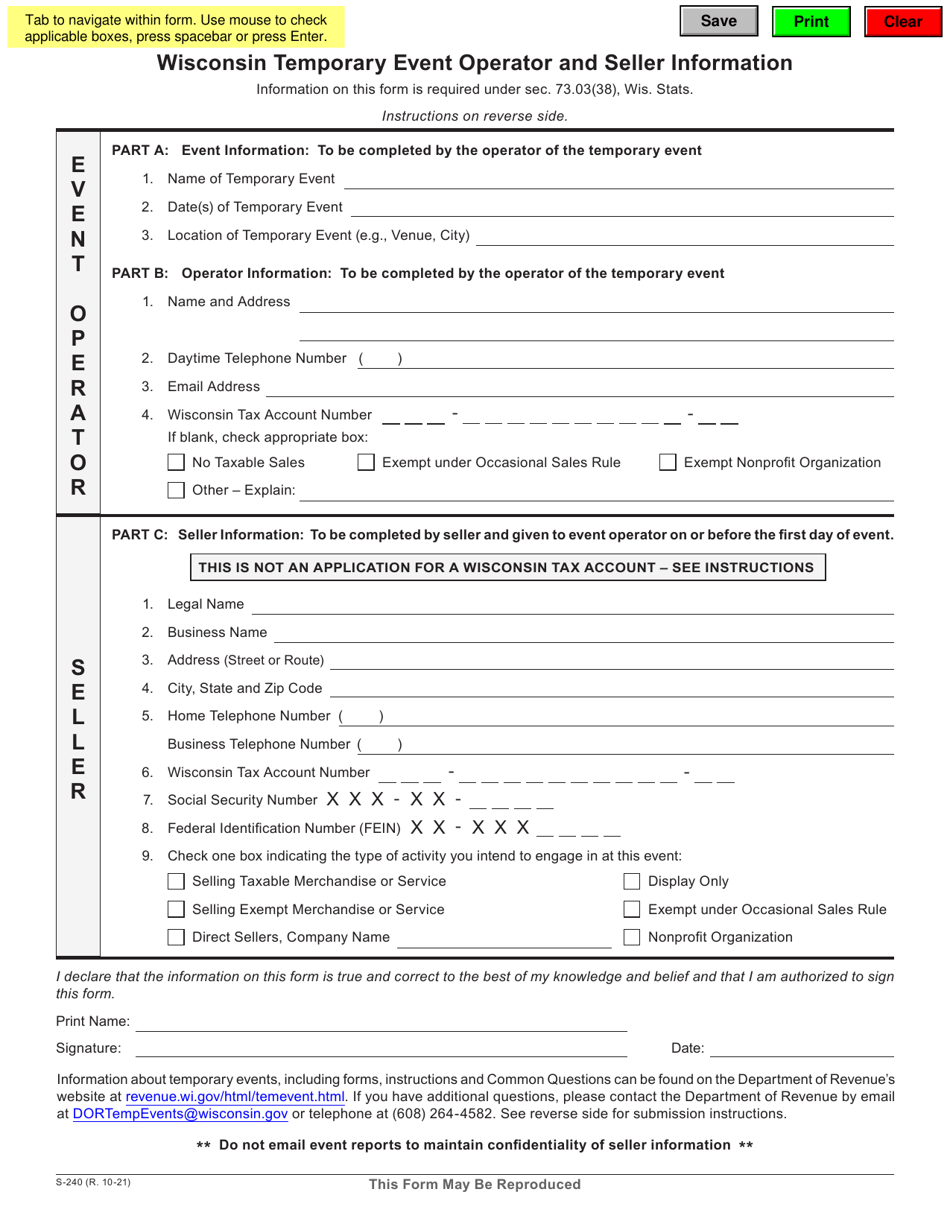

Form S-240 Wisconsin Temporary Event Operator and Seller Information - Wisconsin

What Is Form S-240?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form S-240?

A: Form S-240 is the Wisconsin Temporary Event Operator and Seller Information form.

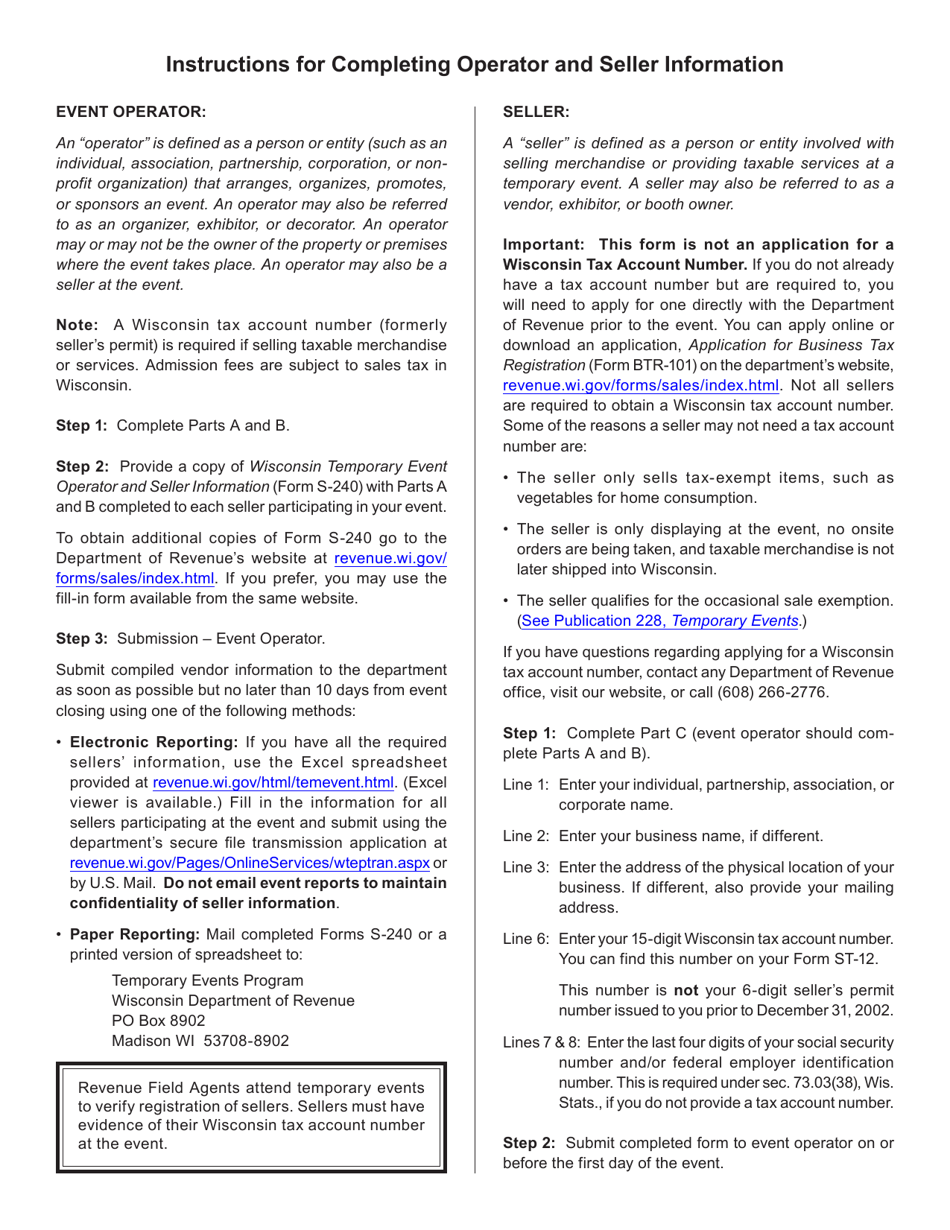

Q: Who needs to fill out Form S-240?

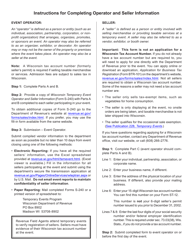

A: Temporary event operators and sellers in Wisconsin need to fill out Form S-240.

Q: What information does Form S-240 require?

A: Form S-240 requires information about the temporary event operator and seller, including contact information and event details.

Q: Is there a fee for filing Form S-240?

A: No, there is no fee for filing Form S-240.

Q: When should Form S-240 be filed?

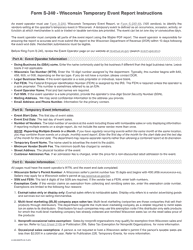

A: Form S-240 should be filed at least 15 days before the start of the temporary event.

Q: Are there any exemptions to filing Form S-240?

A: Yes, certain events and sellers may be exempt from filing Form S-240. Please refer to the instructions for more information.

Q: What happens if I don't file Form S-240?

A: Failing to file Form S-240 may result in penalties and could affect your ability to participate in future temporary events in Wisconsin.

Q: Who can I contact for help with Form S-240?

A: For help with Form S-240, you can contact the Wisconsin Department of Revenue's Customer Service line at 608-266-2776.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-240 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.