This version of the form is not currently in use and is provided for reference only. Download this version of

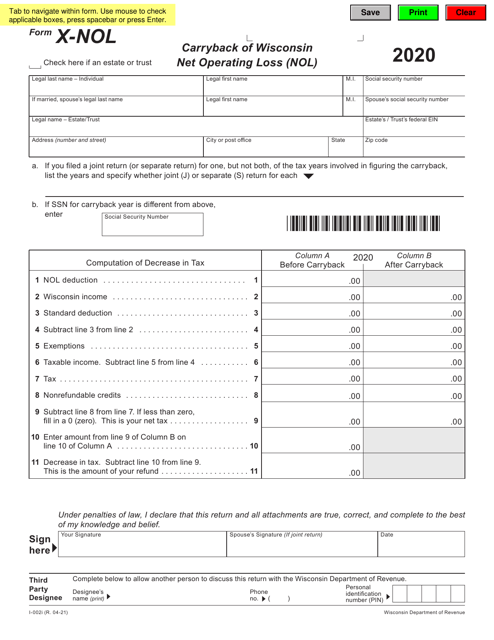

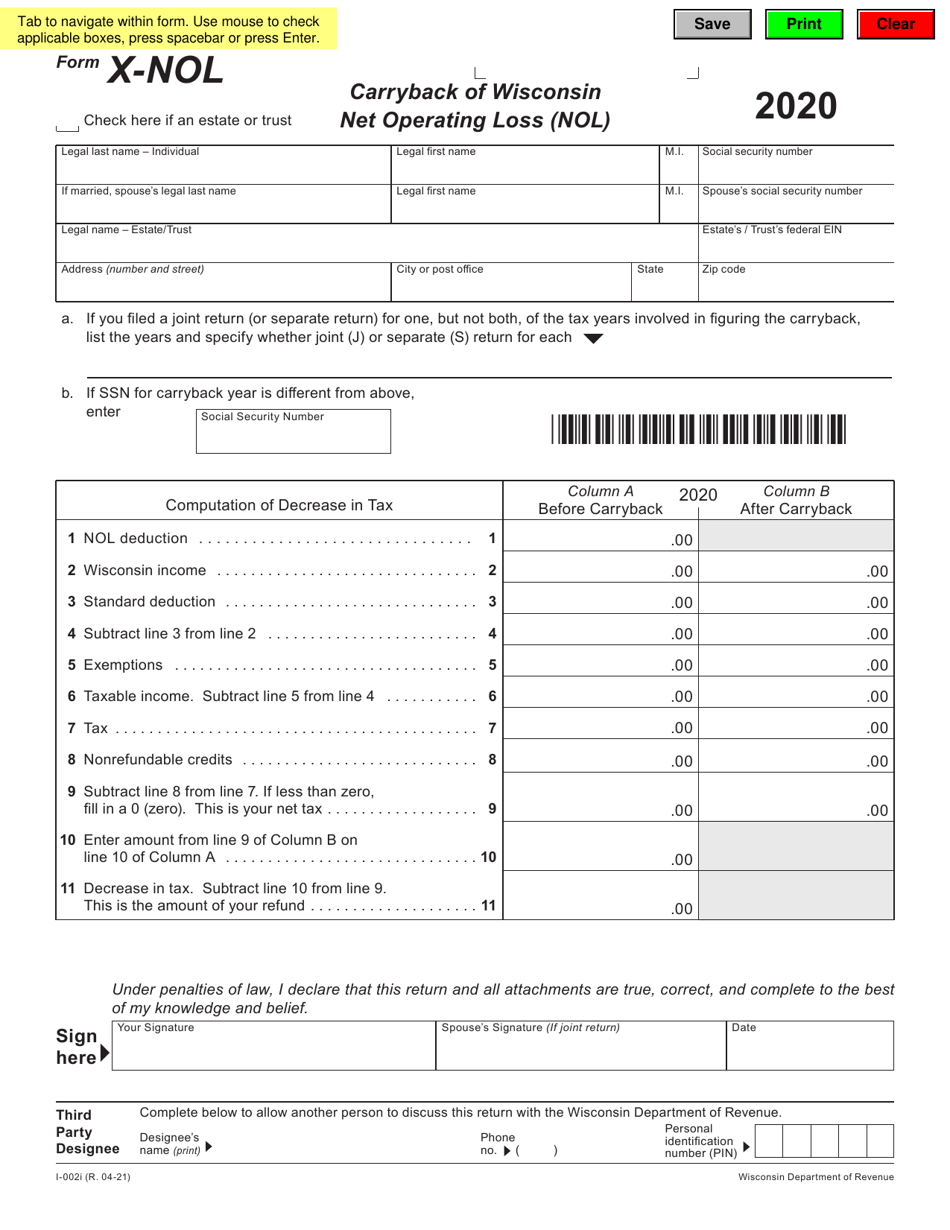

Form X-NOL (I-002I)

for the current year.

Form X-NOL (I-002I) Carryback of Wisconsin Net Operating Loss (Nol) - Wisconsin

What Is Form X-NOL (I-002I)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form X-NOL (I-002I)?

A: Form X-NOL (I-002I) is used to carryback Wisconsin Net Operating Loss (NOL).

Q: What is a Net Operating Loss (NOL)?

A: A Net Operating Loss (NOL) occurs when a taxpayer's allowable deductions exceed their taxable income.

Q: Why would someone need to carryback a Net Operating Loss (NOL)?

A: Carrying back a Net Operating Loss (NOL) allows taxpayers to apply the loss to a prior year's taxable income, potentially resulting in a refund or reducing tax liability.

Q: Who can use Form X-NOL (I-002I)?

A: Wisconsin taxpayers who have a Net Operating Loss (NOL) and want to carry it back to a previous tax year.

Q: What information is required to complete Form X-NOL (I-002I)?

A: To complete Form X-NOL (I-002I), you will need information related to your Net Operating Loss (NOL) and the tax years you wish to carry it back to.

Q: Are there any limitations or restrictions on carrying back a Net Operating Loss (NOL)?

A: Yes, there are limitations and restrictions on carrying back a Net Operating Loss (NOL). It is important to review the instructions and consult with a tax professional for specific guidance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form X-NOL (I-002I) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.