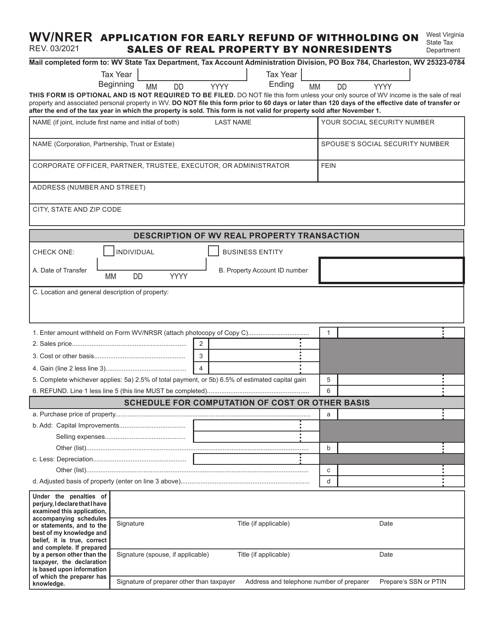

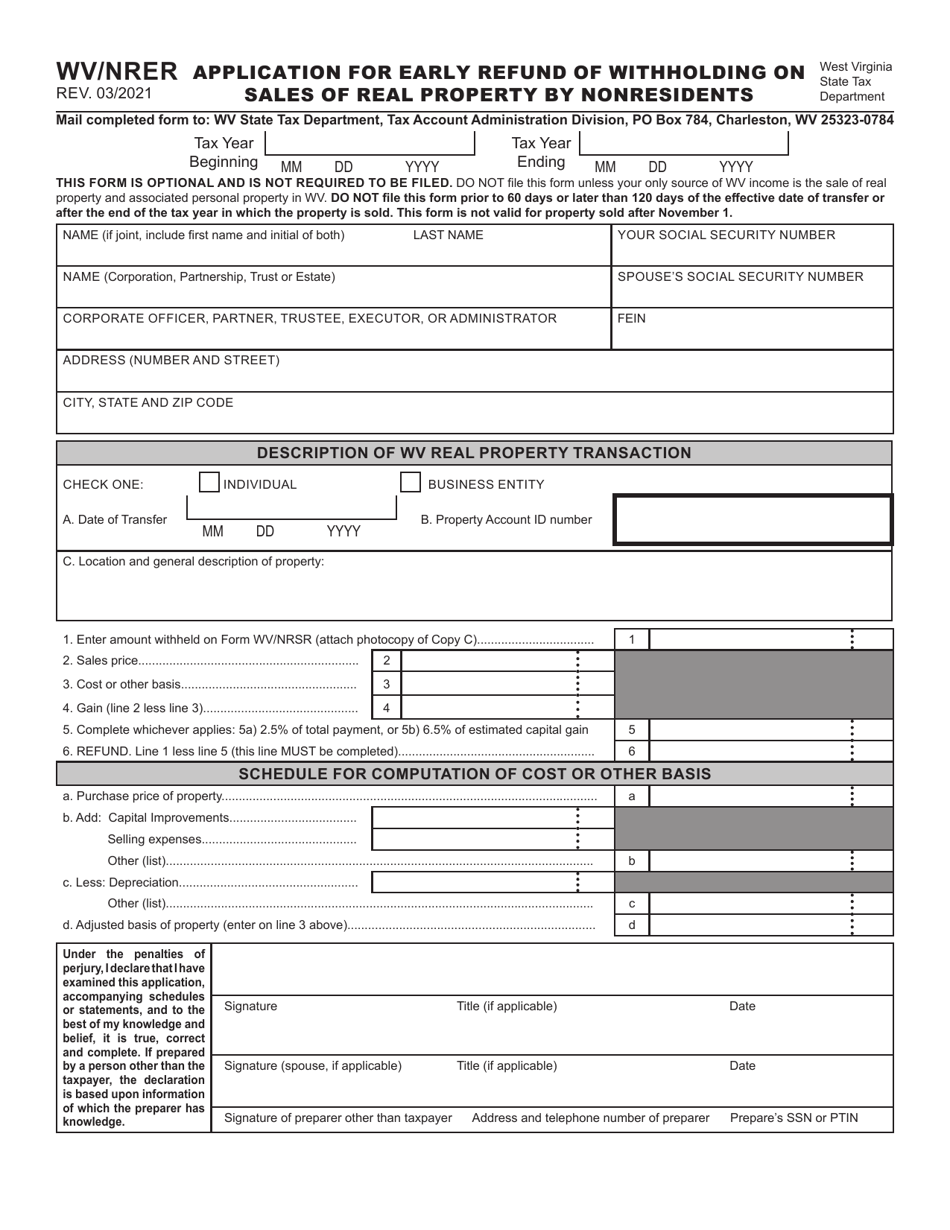

Form WV / NRER Application for Early Refund of Withholding on Sales of Real Property by Nonresidents - West Virginia

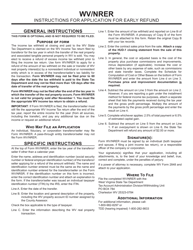

What Is Form WV/NRER?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/NRER Application?

A: The WV/NRER Application is a form used for the early refund of withholding on sales of real property by nonresidents in West Virginia.

Q: Who can use the WV/NRER Application?

A: Nonresidents who have sold real property in West Virginia and had withholding taxes withheld from the proceeds of the sale can use the WV/NRER Application.

Q: What is the purpose of the WV/NRER Application?

A: The purpose of the WV/NRER Application is to request an early refund of the withholding taxes that were withheld from the proceeds of the sale of real property by nonresidents in West Virginia.

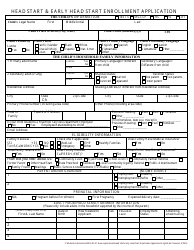

Q: What information is required on the WV/NRER Application?

A: The WV/NRER Application requires information such as the seller's name, address, and taxpayer identification number, details of the real property sold, and information about the withholding taxes withheld.

Q: When should I submit the WV/NRER Application?

A: The WV/NRER Application should be submitted as soon as possible after the sale of the real property in order to request an early refund of the withholding taxes.

Q: Is there a deadline for submitting the WV/NRER Application?

A: Yes, the WV/NRER Application must be submitted within 18 months from the date of the sale of the real property.

Q: What happens after I submit the WV/NRER Application?

A: After you submit the WV/NRER Application, the West Virginia State Tax Department will review your application and process your request for an early refund of the withholding taxes.

Q: How long does it take to receive the refund after submitting the WV/NRER Application?

A: The processing time for the WV/NRER Application can vary, but you can expect to receive the refund within a few months after the application is approved.

Q: Are there any fees associated with submitting the WV/NRER Application?

A: Yes, there is a $10 fee for submitting the WV/NRER Application.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/NRER by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.