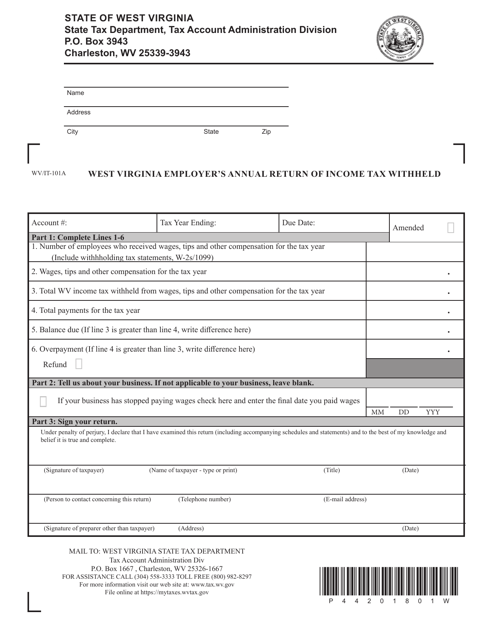

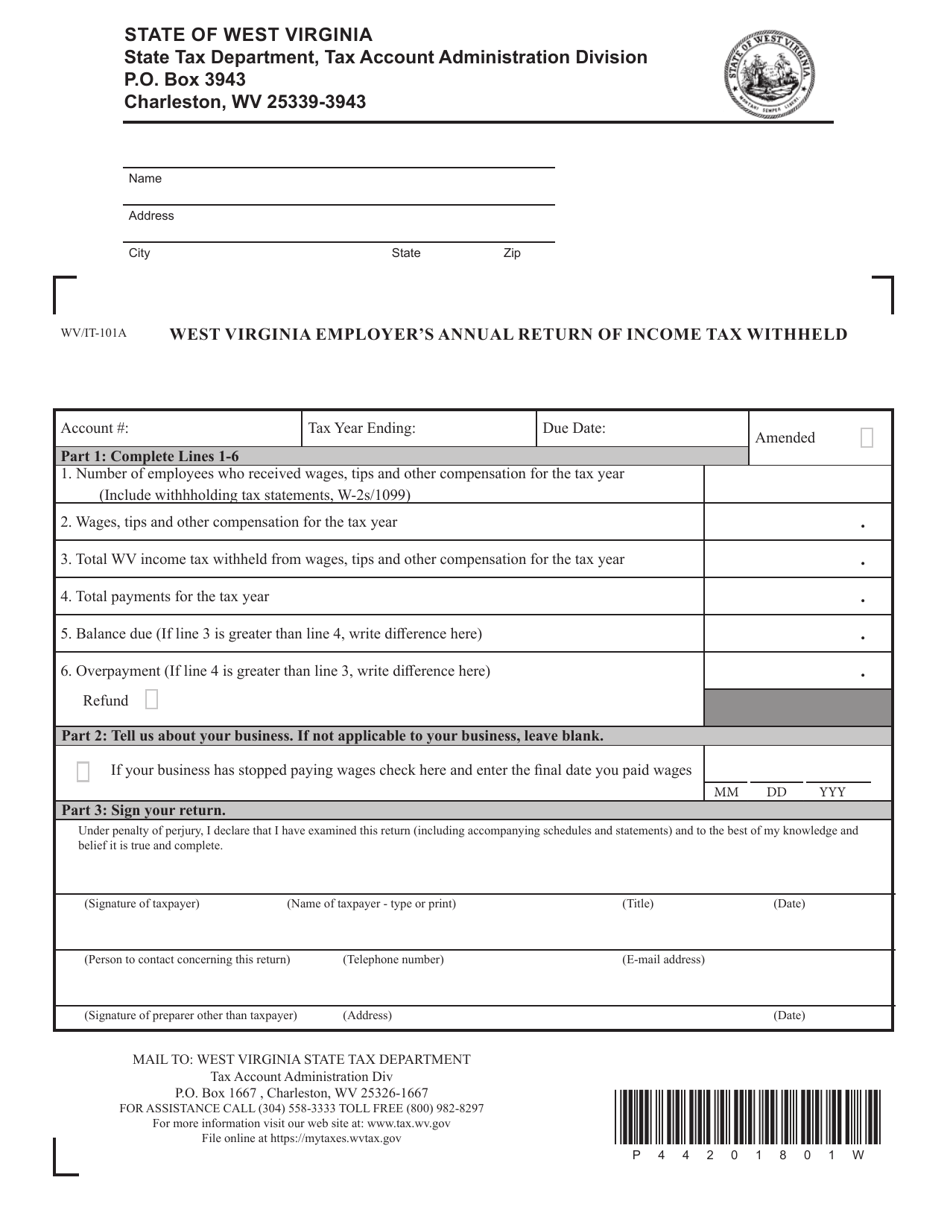

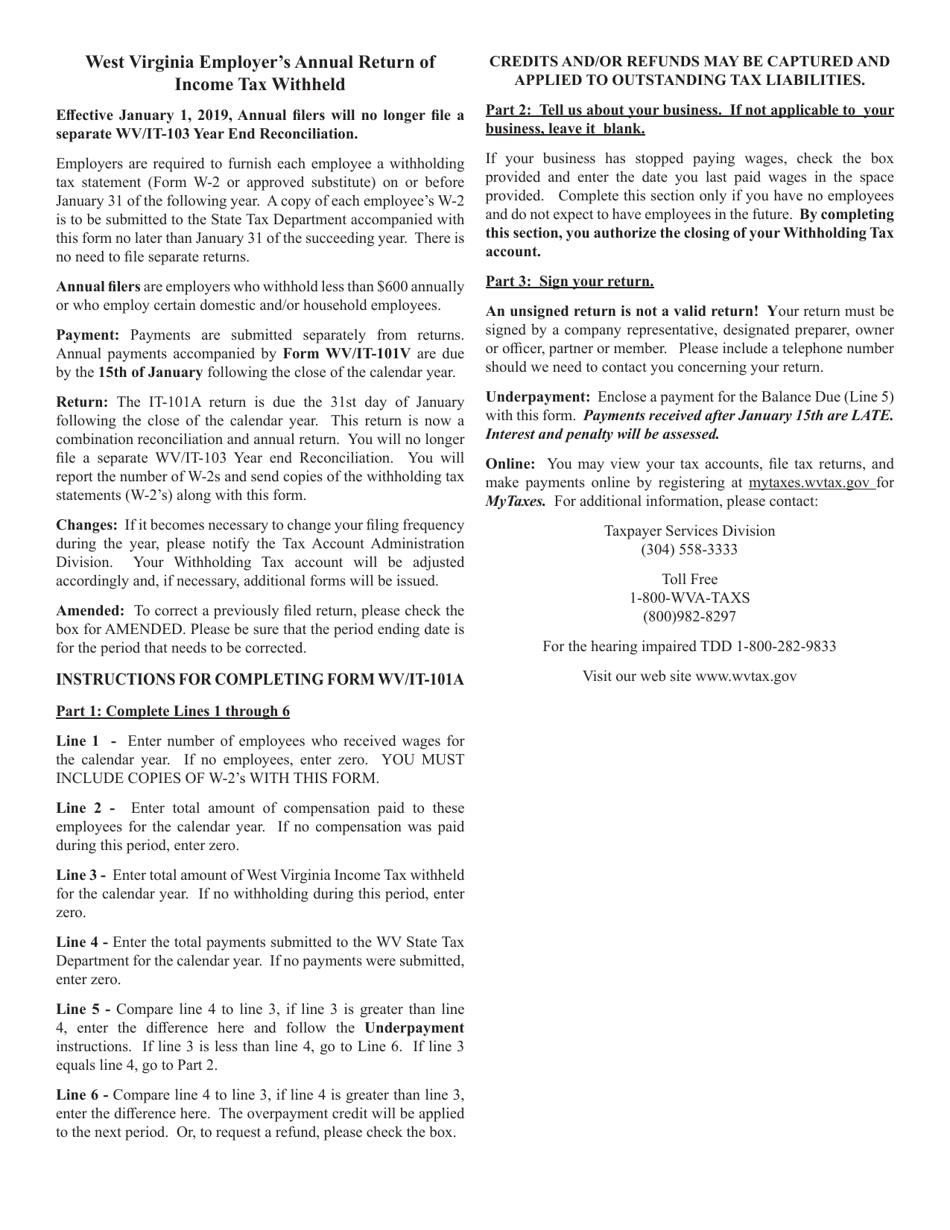

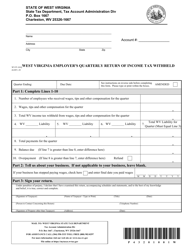

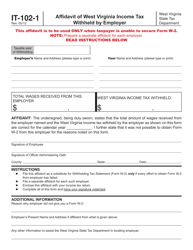

Form WV / IT-101A West Virginia Employer's Annual Return of Income Tax Withheld - West Virginia

What Is Form WV/IT-101A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/IT-101A?

A: Form WV/IT-101A is the West Virginia Employer's Annual Return of Income Tax Withheld.

Q: Who needs to file Form WV/IT-101A?

A: Employers in West Virginia need to file Form WV/IT-101A if they have withheld income tax from their employees.

Q: What information is required on Form WV/IT-101A?

A: Form WV/IT-101A requires information such as employer's name, address, federal employer identification number (FEIN), and details of income tax withheld from employees.

Q: When is the due date for filing Form WV/IT-101A?

A: The due date for filing Form WV/IT-101A is February 28th of the following year.

Q: Is there a penalty for late filing of Form WV/IT-101A?

A: Yes, there may be penalties for late filing of Form WV/IT-101A. It is important to file the form on time to avoid any penalties.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/IT-101A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.