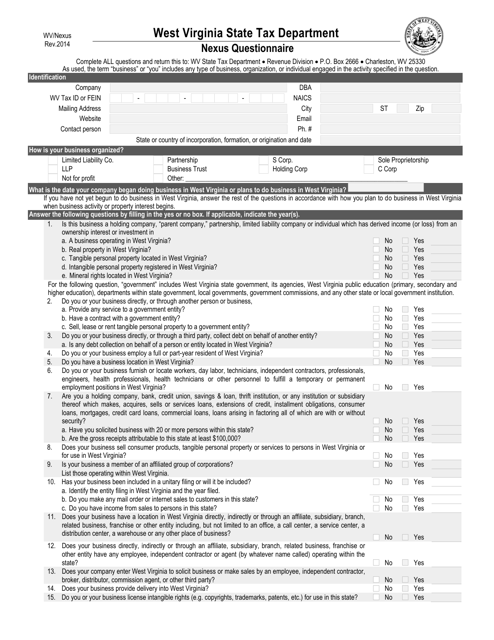

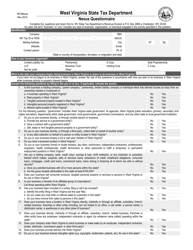

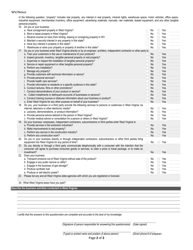

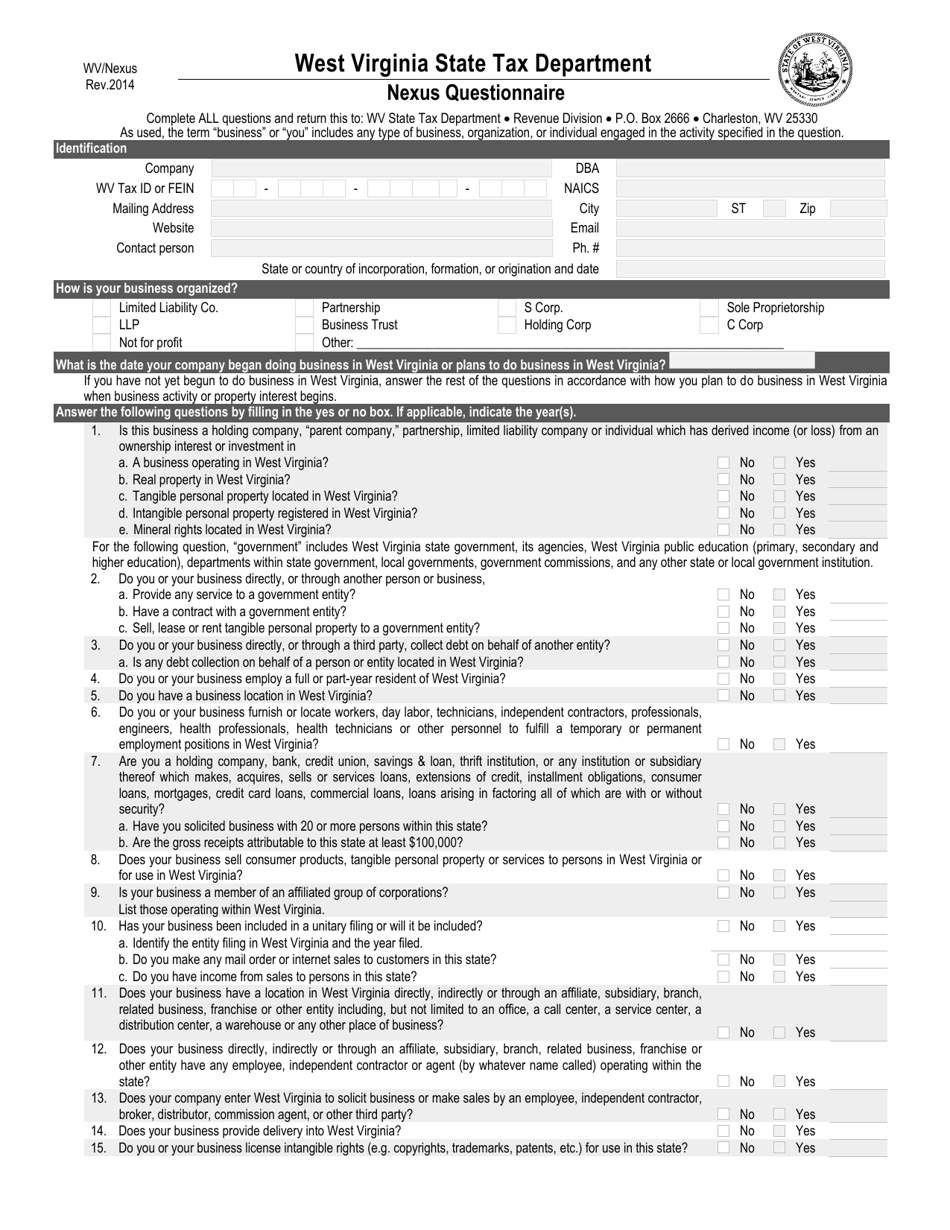

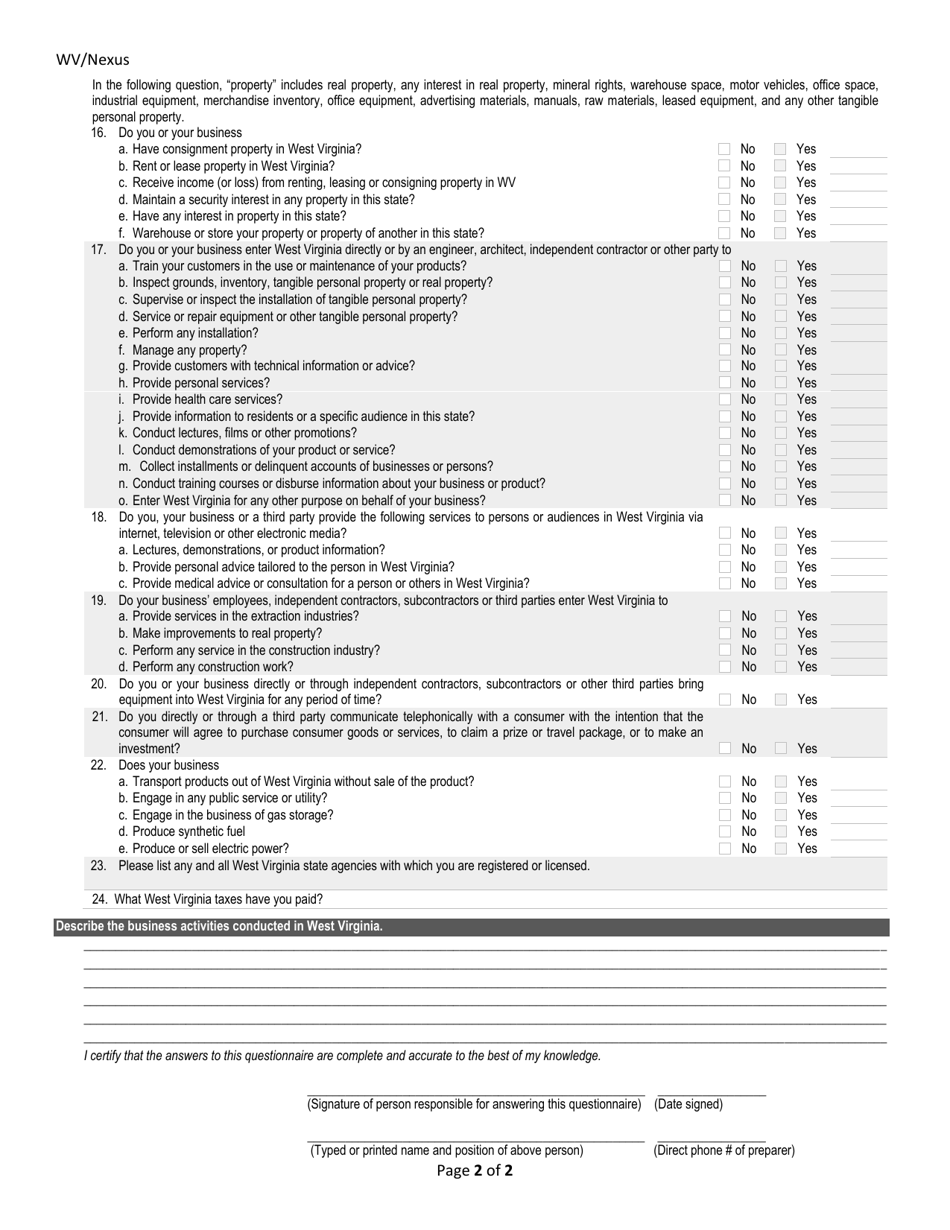

West Virginia State Tax Department - West Virginia

West Virginia State Tax Department is a legal document that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.

FAQ

Q: What is the West Virginia State Tax Department?

A: The West Virginia State Tax Department is the government agency responsible for administering and enforcing the tax laws of the state of West Virginia.

Q: What taxes does the West Virginia State Tax Department handle?

A: The West Virginia State Tax Department handles various taxes including personal income tax, sales and use tax, corporate income tax, and property tax.

Q: When is the deadline to file my state income tax return in West Virginia?

A: The deadline to file your state income tax return in West Virginia is typically April 15th, but it may vary slightly each year.

Q: What is the sales and use tax rate in West Virginia?

A: The sales and use tax rate in West Virginia is currently 6%. However, additional local sales taxes may apply.

Q: What should I do if I can't pay my state taxes in West Virginia?

A: If you are unable to pay your state taxes in West Virginia, contact the State Tax Department to discuss possible payment options or a payment plan.

Form Details:

- Released on January 1, 2014;

- The latest edition currently provided by the West Virginia State Tax Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.