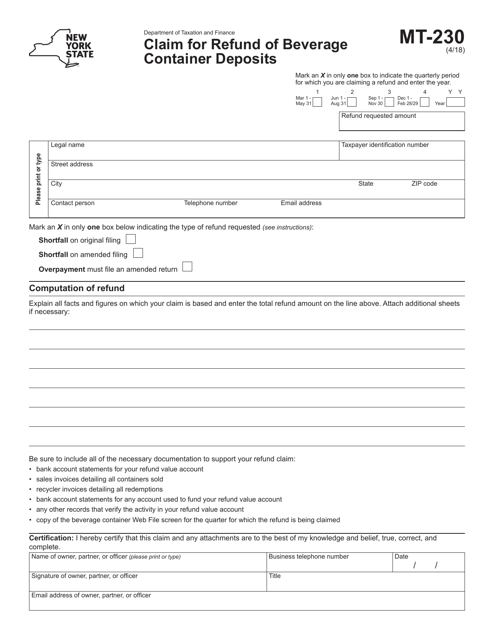

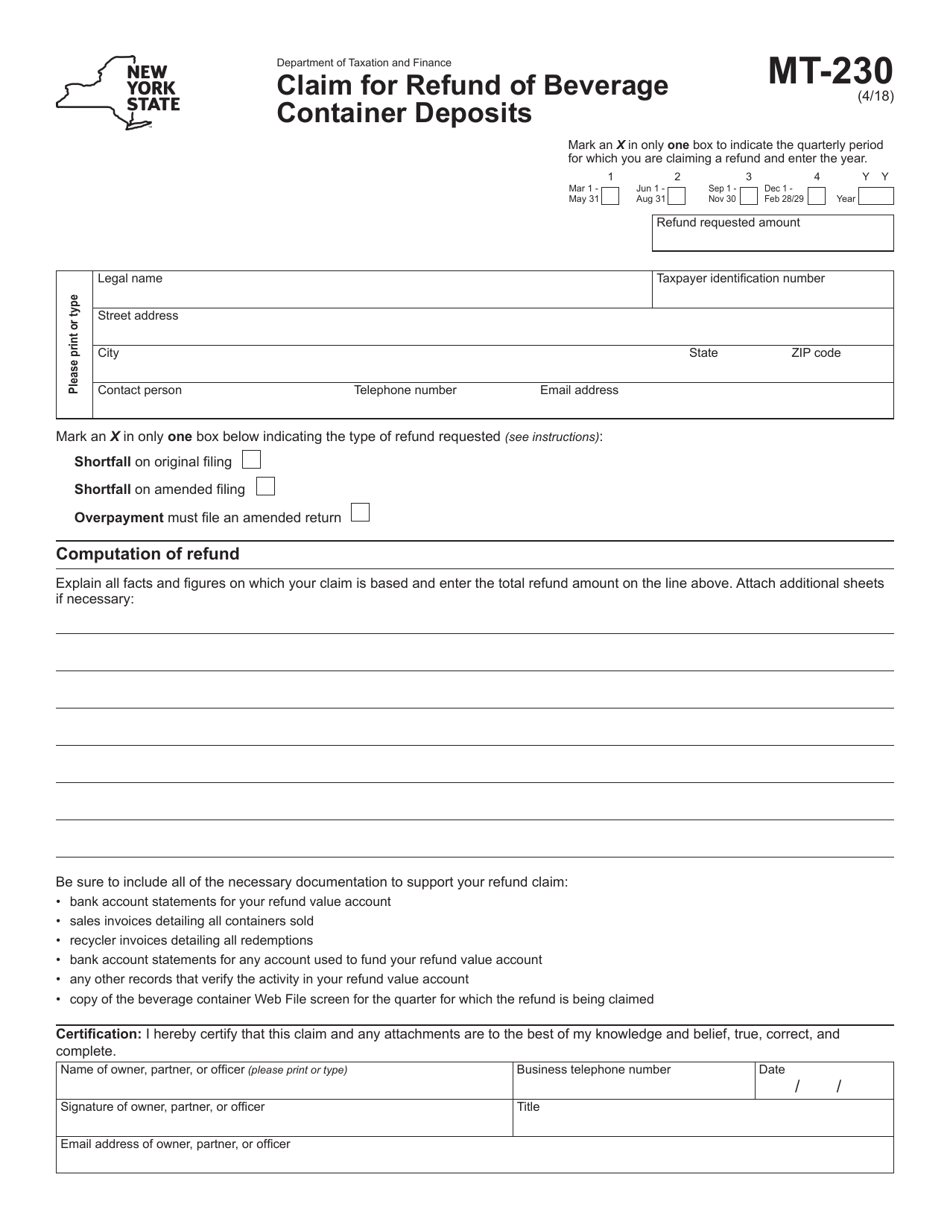

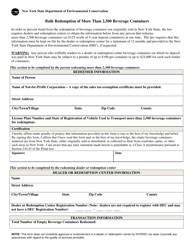

Form MT-230 Claim for Refund of Beverage Container Deposits - New York

What Is Form MT-230?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-230?

A: Form MT-230 is a claim form used to request a refund of beverage container deposits in New York.

Q: Who can use Form MT-230?

A: Anyone who has paid beverage container deposits in New York and is eligible for a refund can use Form MT-230.

Q: What is the purpose of Form MT-230?

A: The purpose of Form MT-230 is to request a refund of beverage container deposits that have been paid in New York.

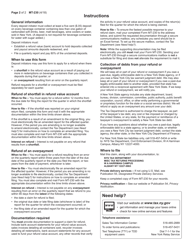

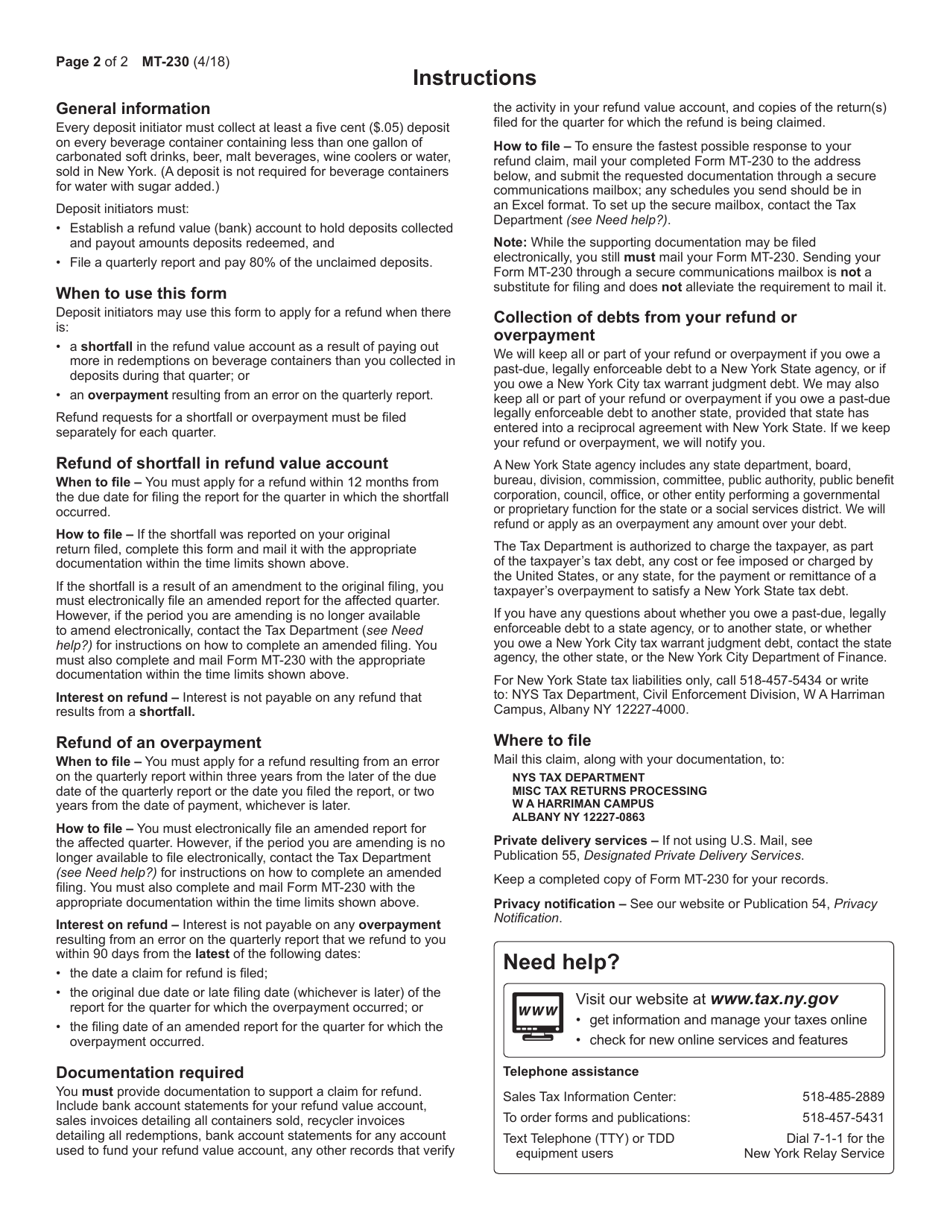

Q: How do I submit Form MT-230?

A: Form MT-230 can be submitted by mail to the New York State Department of Taxation and Finance.

Q: What information is required on Form MT-230?

A: Form MT-230 requires information such as the name and address of the claimant, the amount of deposits paid, and the reason for the claim.

Q: What documentation do I need to submit with Form MT-230?

A: Documentation such as receipts or invoices showing the payment of container deposits may need to be submitted with Form MT-230.

Q: How long does it take to process Form MT-230?

A: The processing time for Form MT-230 may vary, but it generally takes a few weeks to receive a refund.

Q: Are there any fees associated with submitting Form MT-230?

A: There are no fees associated with submitting Form MT-230.

Q: Can I submit Form MT-230 electronically?

A: No, Form MT-230 cannot be submitted electronically and must be mailed to the New York State Department of Taxation and Finance.

Q: What should I do if I have more questions about Form MT-230?

A: If you have more questions about Form MT-230, you should contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-230 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.