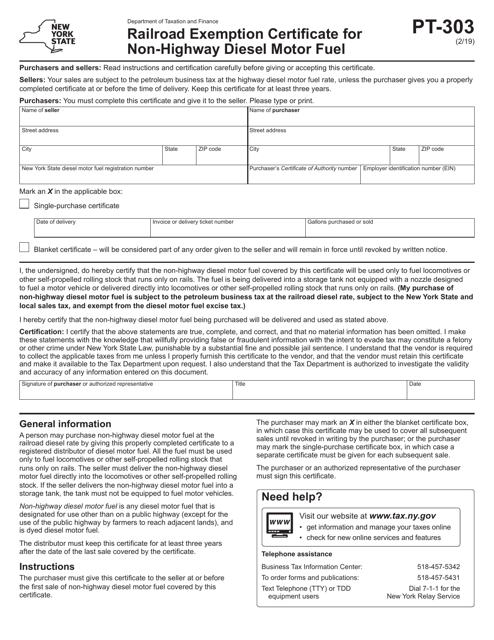

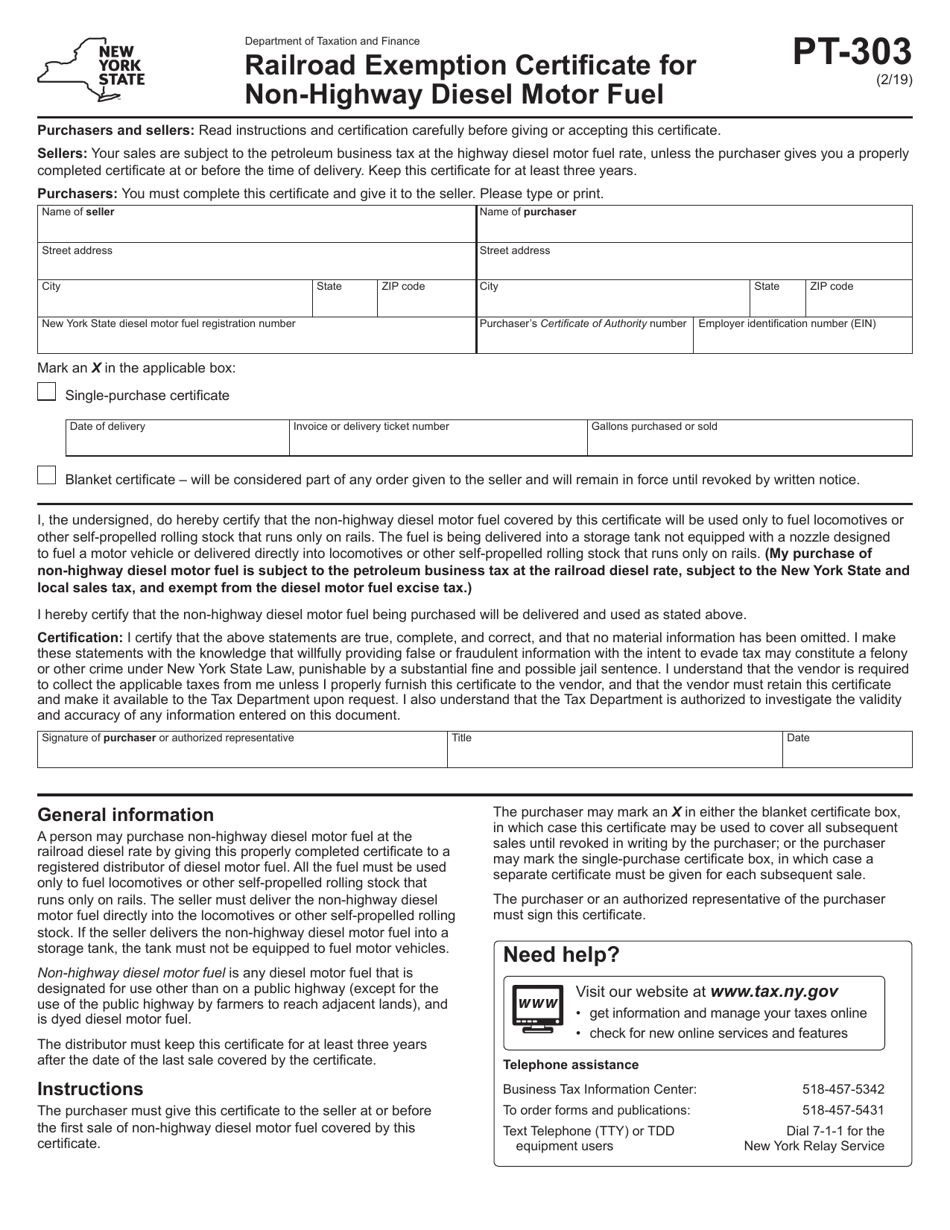

Form PT-303 Railroad Exemption Certificate for Non-highway Diesel Motor Fuel - New York

What Is Form PT-303?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-303?

A: Form PT-303 is the Railroad Exemption Certificate for Non-highway Diesel Motor Fuel in New York.

Q: Who is required to fill out Form PT-303?

A: Railroad companies operating in New York that want to claim an exemption for non-highway diesel motor fuel.

Q: What is the purpose of Form PT-303?

A: The purpose of Form PT-303 is to certify that the non-highway diesel motor fuel will be used exclusively for railroad operations.

Q: What information do I need to provide on Form PT-303?

A: You will need to provide details about the railroad company, the fuel supplier, and the intended use of the non-highway diesel motor fuel.

Q: Do I need to submit Form PT-303 every year?

A: Yes, Form PT-303 must be submitted annually to claim the exemption for non-highway diesel motor fuel.

Q: Are there any specific instructions for completing Form PT-303?

A: Yes, the form includes instructions that must be followed carefully to ensure accurate completion.

Q: Is there a deadline for submitting Form PT-303?

A: Yes, Form PT-303 must be filed by the last day of the month following the end of the calendar quarter in which the non-highway diesel motor fuel was purchased.

Q: What happens after I submit Form PT-303?

A: The New York State Department of Taxation and Finance will review the form and determine if the exemption is valid.

Q: Can I claim a refund for previously paid taxes on non-highway diesel motor fuel?

A: Yes, if you were previously taxed on non-highway diesel motor fuel that qualifies for the exemption, you can file a claim for a refund using Form AU-11.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-303 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.