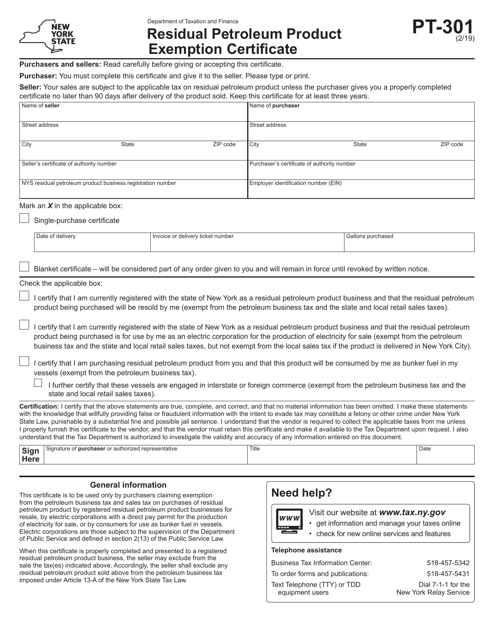

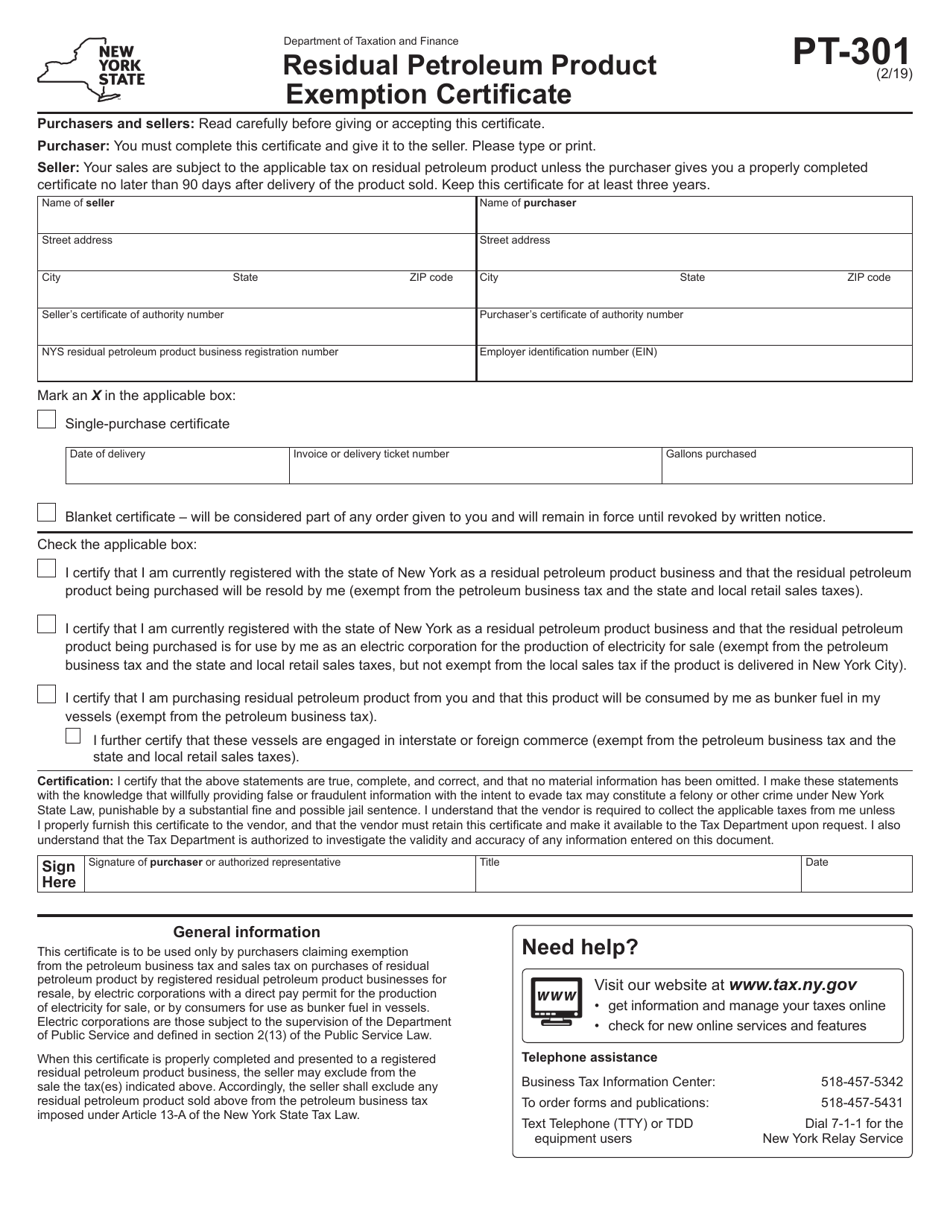

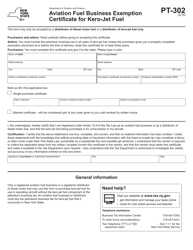

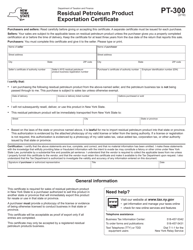

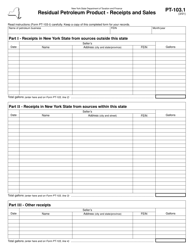

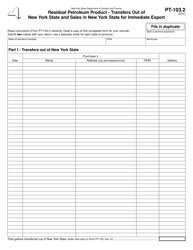

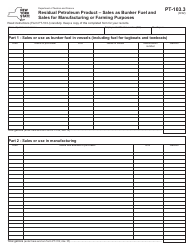

Form PT-301 Residual Petroleum Product Exemption Certificate - New York

What Is Form PT-301?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-301?

A: Form PT-301 is the Residual Petroleum Product Exemption Certificate used in New York.

Q: What is the purpose of Form PT-301?

A: The purpose of Form PT-301 is to claim an exemption for residual petroleum products from certain taxes.

Q: Who should use Form PT-301?

A: Form PT-301 should be used by businesses or individuals who qualify for the exemption on residual petroleum products in New York.

Q: What information is required on Form PT-301?

A: Form PT-301 requires information such as the taxpayer's name, address, product description, quantity, and proof of eligibility for the exemption.

Q: Are there any deadlines for submitting Form PT-301?

A: The deadlines for submitting Form PT-301 vary depending on the specific exemption being claimed. It is important to review the instructions and guidelines provided with the form.

Q: What should I do if I need assistance with Form PT-301?

A: If you need assistance with Form PT-301, you can contact the New York State Department of Taxation and Finance's customer service for guidance.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-301 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.