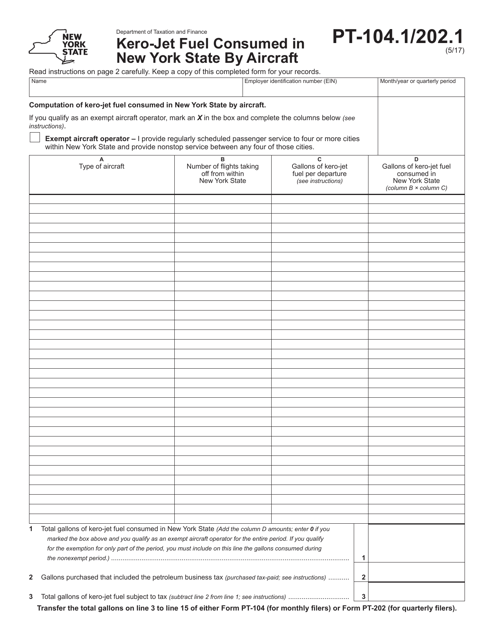

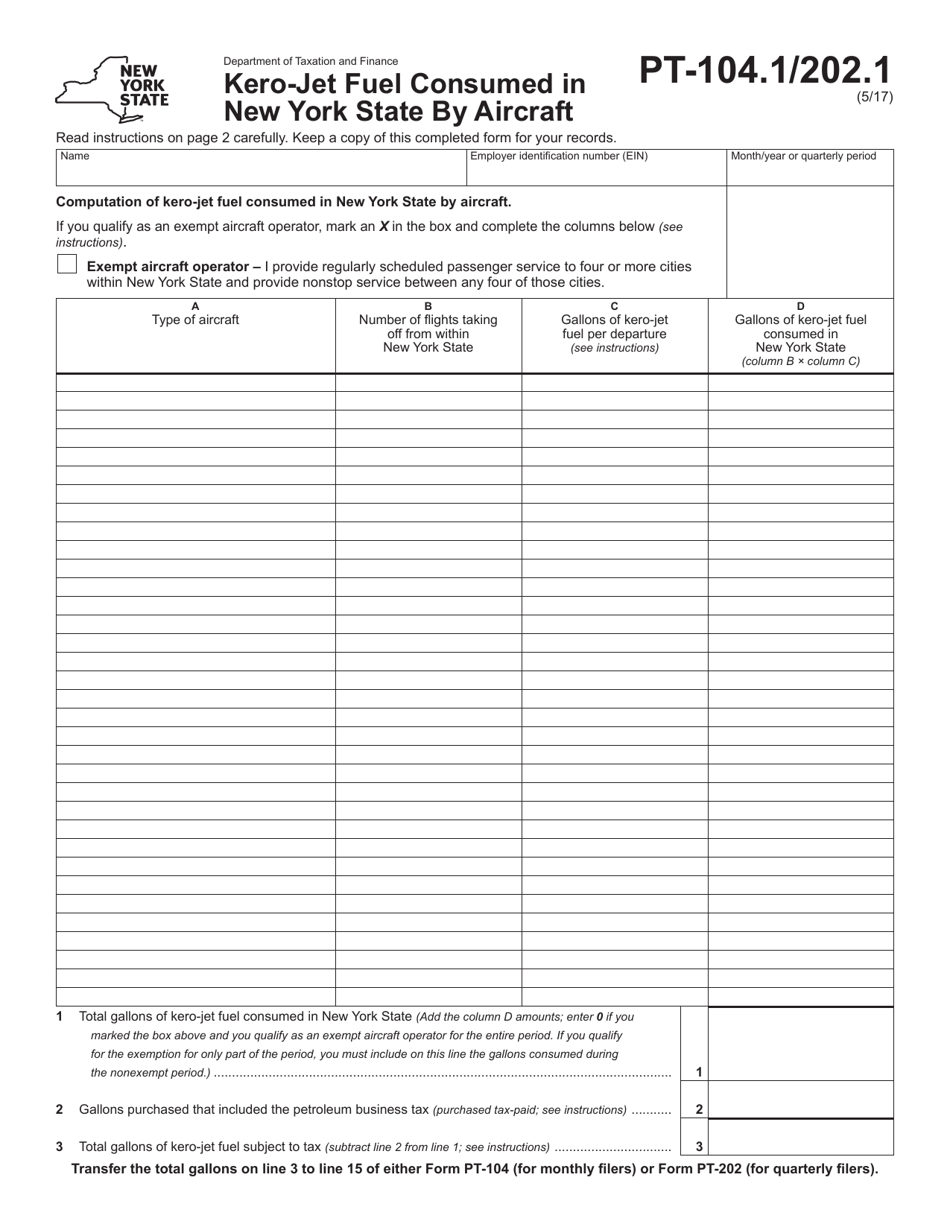

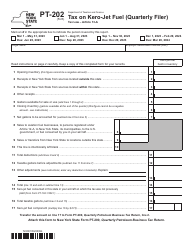

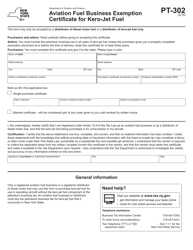

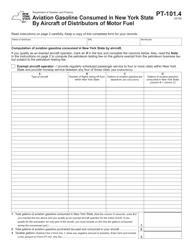

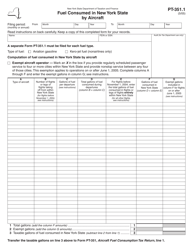

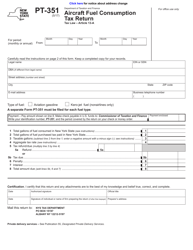

Form PT-104.1 / 202.1 Kero-Jet Fuel Consumed in New York State by Aircraft - New York

What Is Form PT-104.1/202.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-104.1/202.1?

A: Form PT-104.1/202.1 is a reporting form for kero-jet fuel consumed in New York State by aircraft.

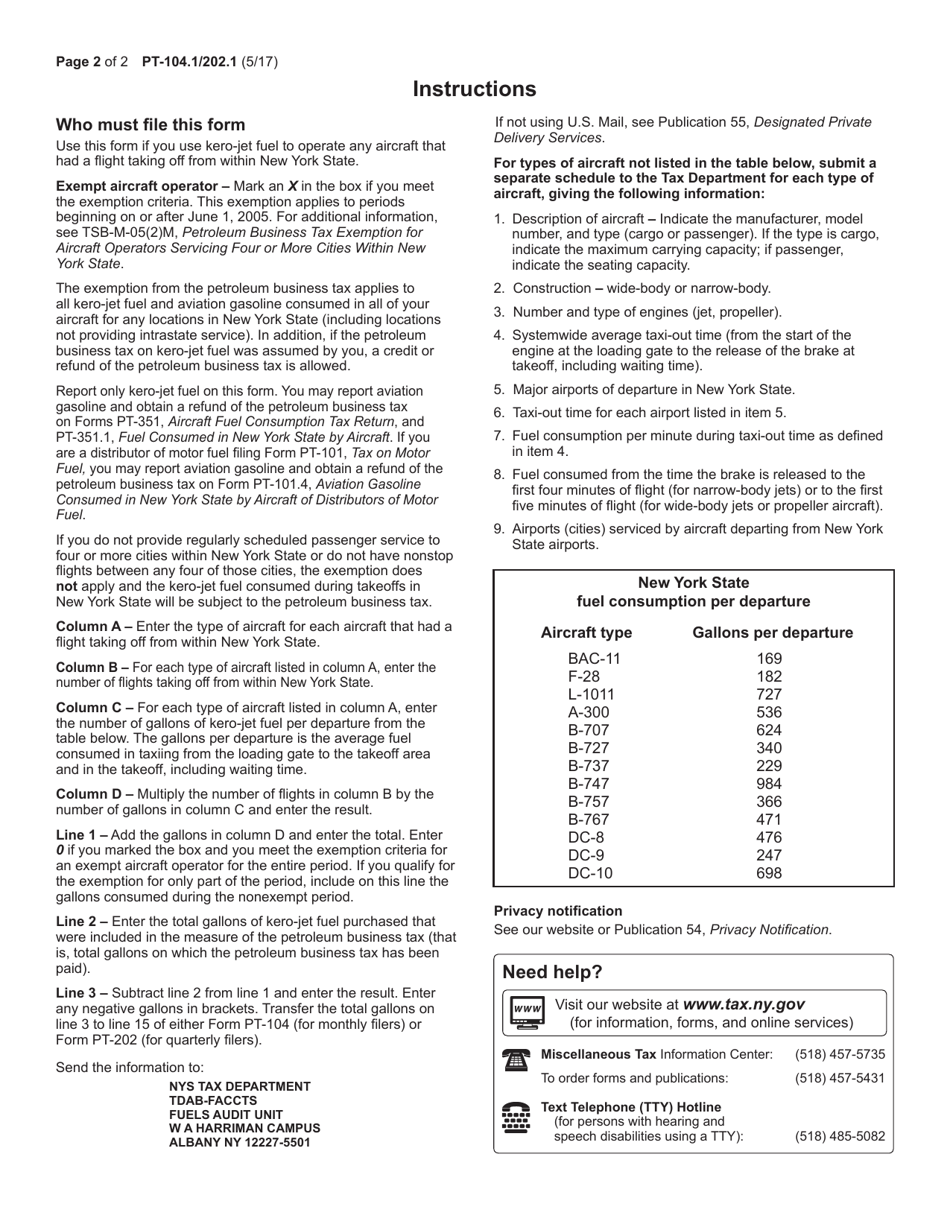

Q: Who needs to fill out Form PT-104.1/202.1?

A: Aircraft operators who consume kero-jet fuel in New York State need to fill out Form PT-104.1/202.1.

Q: What is the purpose of Form PT-104.1/202.1?

A: The purpose of Form PT-104.1/202.1 is to report the amount of kero-jet fuel consumed by aircraft in New York State.

Q: What information do I need to provide on Form PT-104.1/202.1?

A: You will need to provide information such as the name of the aircraft operator, the total gallons of kero-jet fuel consumed, and the number of aircraft operated.

Q: When is Form PT-104.1/202.1 due?

A: Form PT-104.1/202.1 is due on a quarterly basis, with the due date falling on the last day of the month following the close of the quarter.

Q: Are there any penalties for late filing of Form PT-104.1/202.1?

A: Yes, there are penalties for late filing. It is important to submit the form by the due date to avoid these penalties.

Q: Is there a fee for filing Form PT-104.1/202.1?

A: There is no fee for filing Form PT-104.1/202.1. However, you may be required to pay taxes on the kero-jet fuel consumed.

Q: Do I need to file Form PT-104.1/202.1 if I did not consume any kero-jet fuel in New York State?

A: If you did not consume any kero-jet fuel in New York State during the reporting period, you may not need to file the form. Check with the New York State Department of Taxation and Finance for specific requirements.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-104.1/202.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.