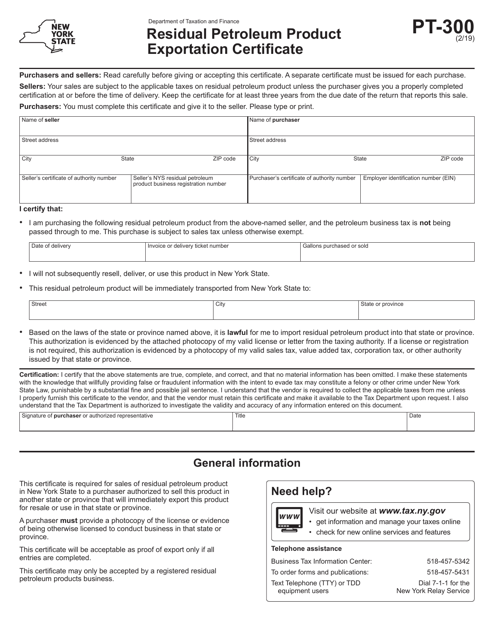

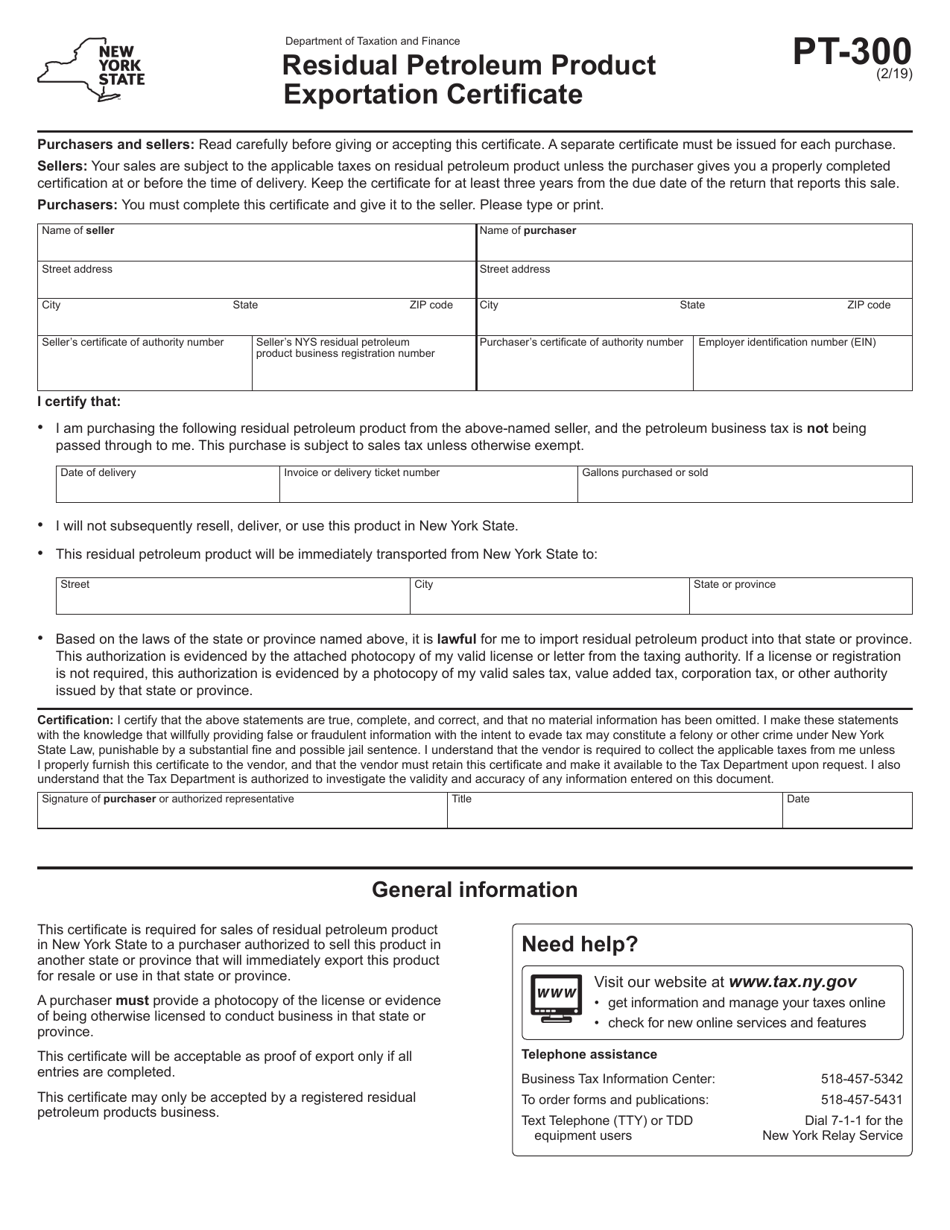

Form PT-300 Residual Petroleum Product Exportation Certificate - New York

What Is Form PT-300?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300?

A: Form PT-300 is the Residual Petroleum Product Exportation Certificate.

Q: What is the purpose of Form PT-300?

A: The purpose of Form PT-300 is to report and certify the exportation of residual petroleum products from New York.

Q: Who needs to file Form PT-300?

A: Anyone exporting residual petroleum products from New York needs to file Form PT-300.

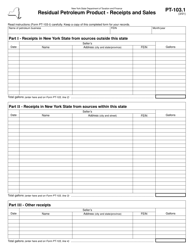

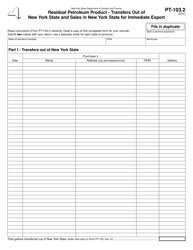

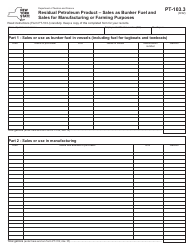

Q: What information is required on Form PT-300?

A: Form PT-300 requires information such as the exporter's name, address, product description, quantity exported, and destination.

Q: When is the deadline for filing Form PT-300?

A: Form PT-300 must be filed within 20 days after the end of the month in which the exportation occurred.

Q: Are there any fees associated with filing Form PT-300?

A: No, there are no fees associated with filing Form PT-300.

Q: What are the consequences for not filing Form PT-300?

A: Failure to file Form PT-300 may result in penalties and interest.

Q: Is Form PT-300 specific to New York?

A: Yes, Form PT-300 is specific to the state of New York.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-300 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.