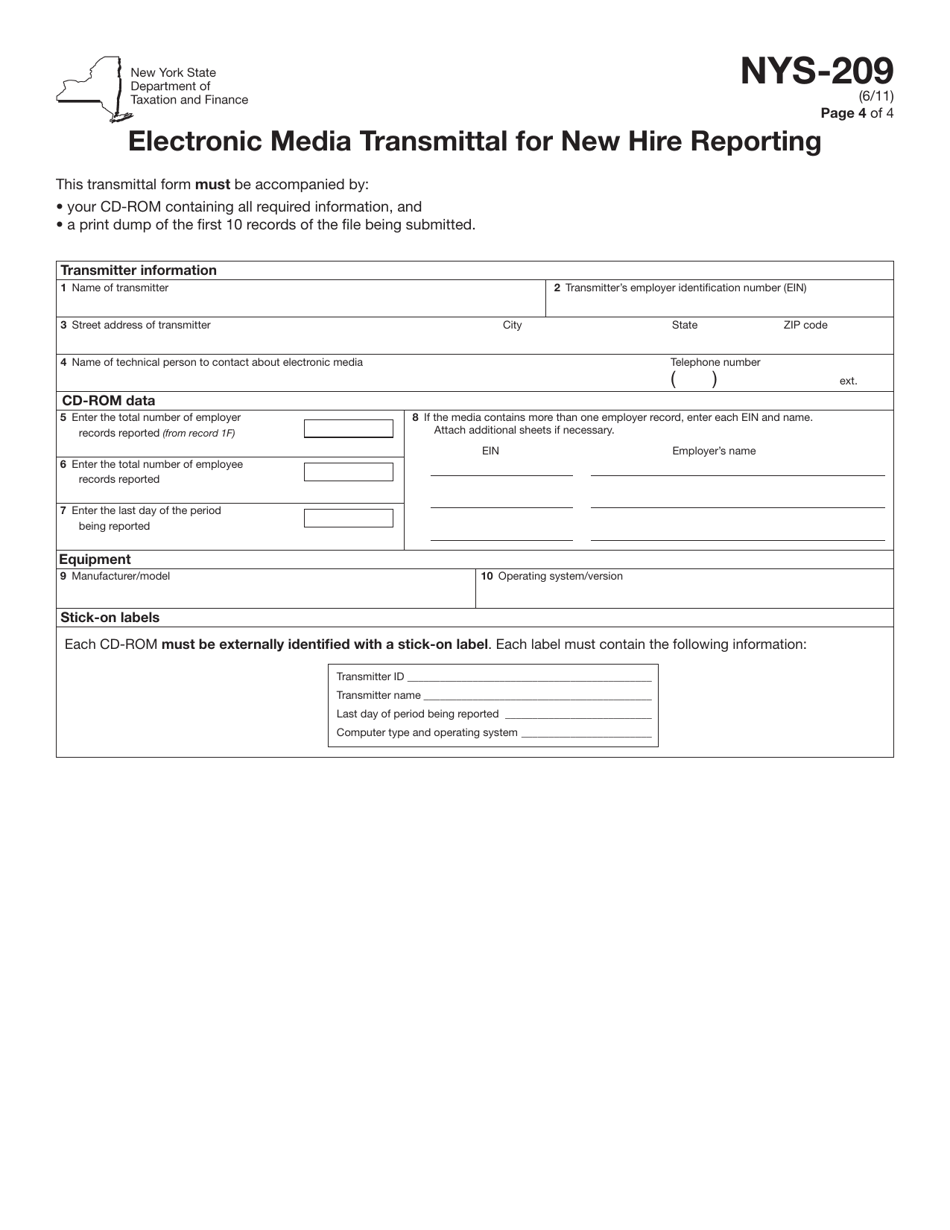

Form NYS-209 Electronic Media Transmittal for New Hire Reporting - New York

What Is Form NYS-209?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

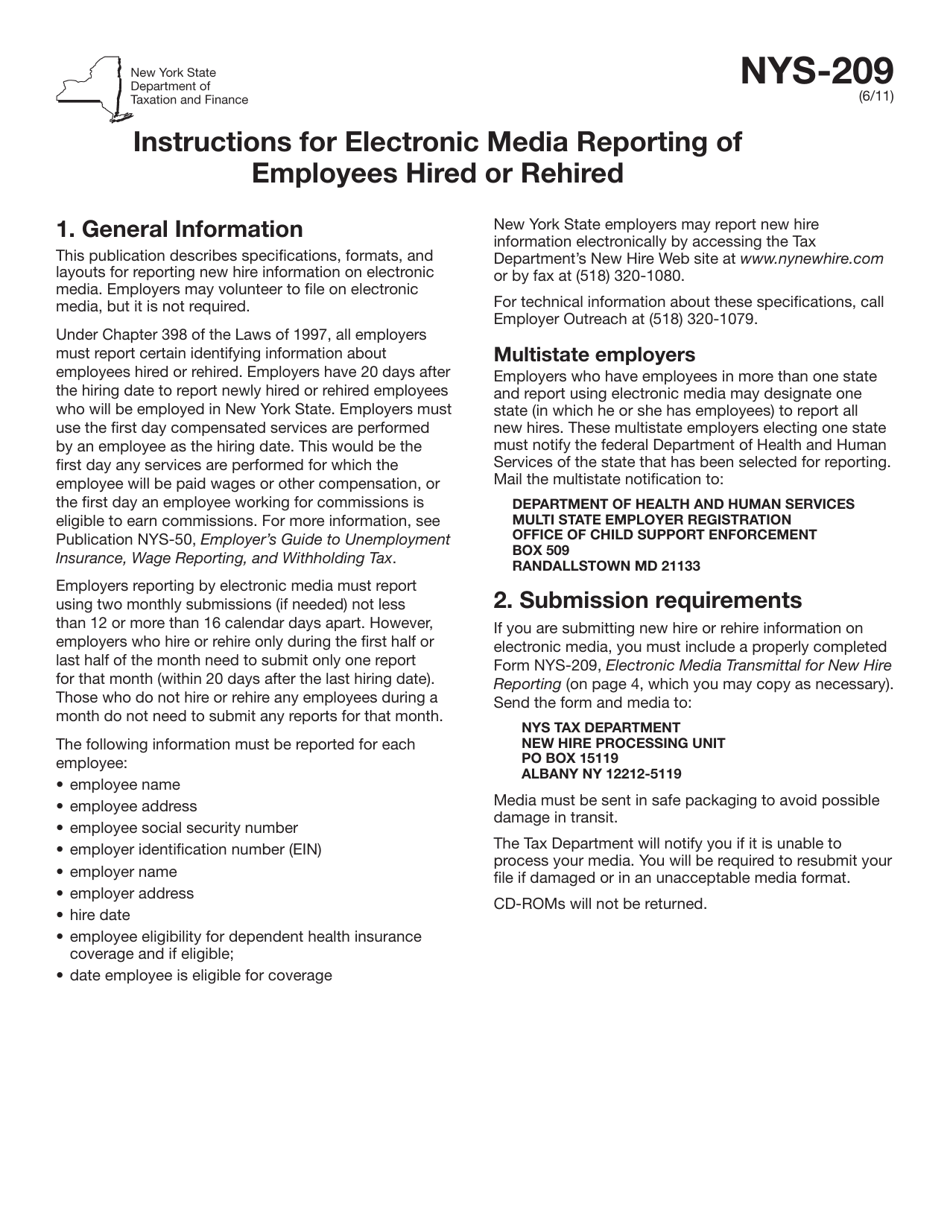

Q: What is Form NYS-209?

A: Form NYS-209 is the Electronic Media Transmittal for New Hire Reporting in New York.

Q: What is the purpose of Form NYS-209?

A: The purpose of Form NYS-209 is to report new hires to the New York State Department of Taxation and Finance.

Q: Who needs to file Form NYS-209?

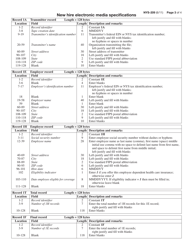

A: Employers in New York State are required to file Form NYS-209 for each new hire.

Q: When should Form NYS-209 be filed?

A: Form NYS-209 should be filed within 20 calendar days of the date of hire or the first day services were performed.

Q: Are there any penalties for failing to file Form NYS-209?

A: Yes, there are penalties for failing to file Form NYS-209, including fines and other enforcement actions.

Q: Is there a fee to file Form NYS-209?

A: No, there is no fee to file Form NYS-209.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYS-209 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.