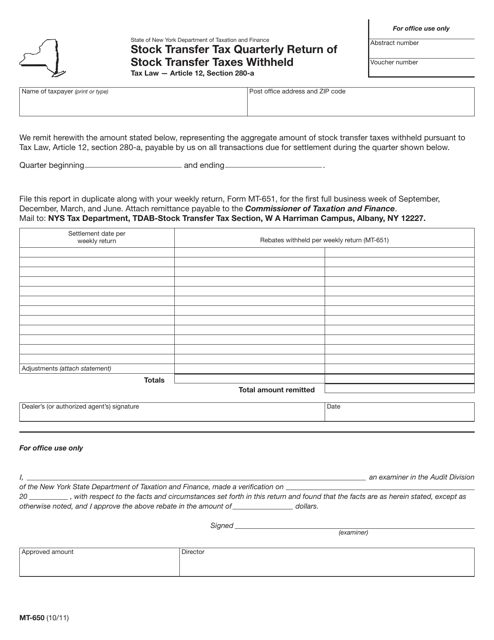

Form MT-650 Stock Transfer Tax Quarterly Return of Stock Transfer Taxes Withheld - New York

What Is Form MT-650?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-650?

A: Form MT-650 is the Stock Transfer Tax Quarterly Return of Stock Transfer Taxes Withheld in New York.

Q: Who needs to file Form MT-650?

A: Persons or entities who withhold stock transfer taxes in New York need to file Form MT-650.

Q: When is Form MT-650 due?

A: Form MT-650 is due quarterly, on the last day of the month following the end of each calendar quarter.

Q: What information is required on Form MT-650?

A: Form MT-650 requires information such as the taxpayer's name, address, tax period, stock transfer tax withheld, and related details.

Q: Is there a penalty for failing to file Form MT-650?

A: Yes, there may be penalties for failing to file Form MT-650, including interest on unpaid taxes and potential legal consequences.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-650 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.