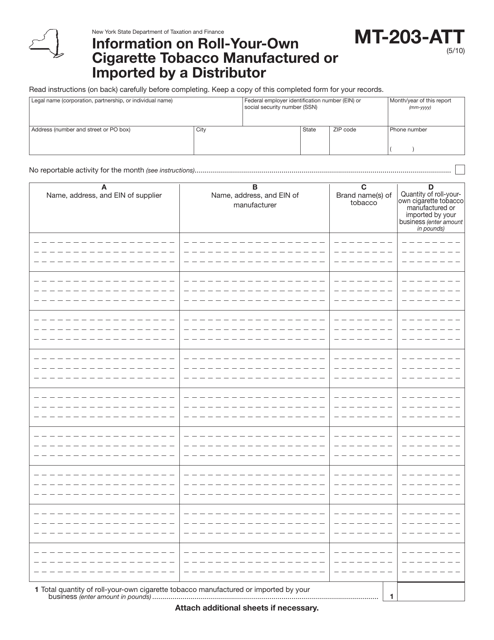

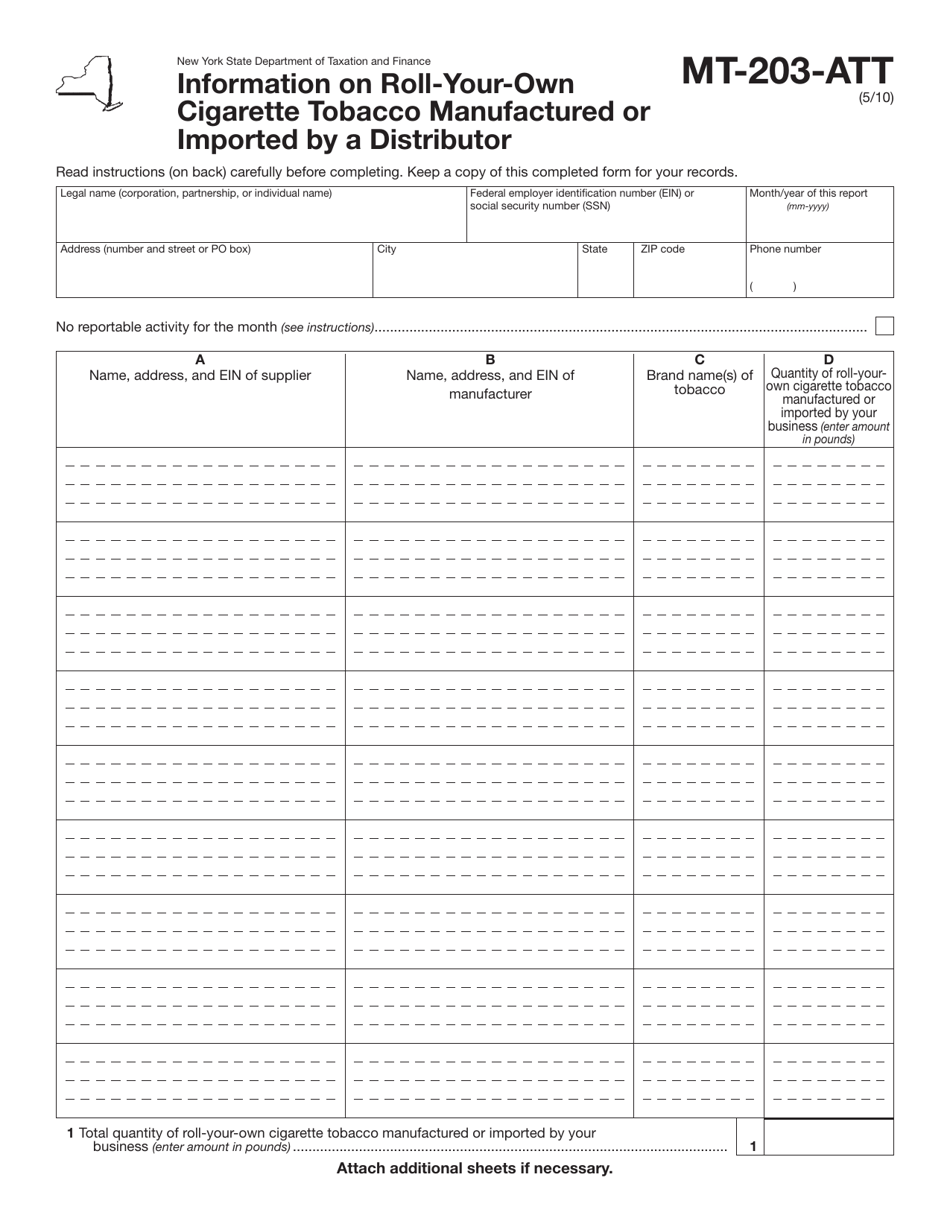

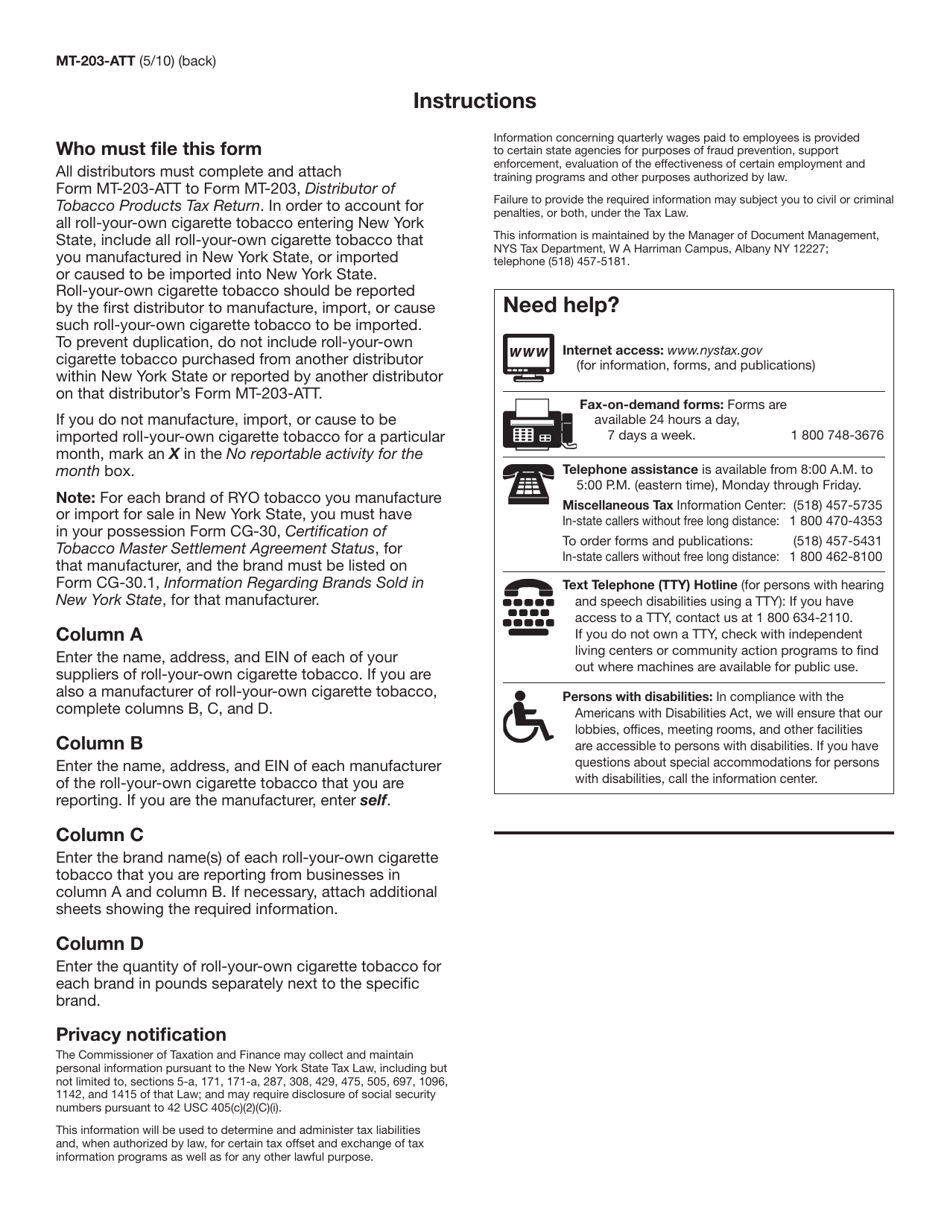

Form MT-203-ATT Information on Roll-Your-Own Cigarette Tobacco Manufactured or Imported by a Distributor - New York

What Is Form MT-203-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-203-ATT?

A: Form MT-203-ATT is a form used to provide information on roll-your-own cigarette tobacco manufactured or imported by a distributor in New York.

Q: Who uses Form MT-203-ATT?

A: Distributors who manufacture or import roll-your-own cigarette tobacco in New York use Form MT-203-ATT.

Q: What information does Form MT-203-ATT require?

A: Form MT-203-ATT requires information about the manufacturer or importer, the quantity of roll-your-own cigarette tobacco, and the state or country where it was manufactured or imported.

Q: Is Form MT-203-ATT mandatory?

A: Yes, Form MT-203-ATT is mandatory for distributors who manufacture or import roll-your-own cigarette tobacco in New York.

Q: When is Form MT-203-ATT due?

A: Form MT-203-ATT is due on a quarterly basis, with deadlines falling on the last day of January, April, July, and October.

Q: Are there any penalties for not filing Form MT-203-ATT?

A: Yes, there are penalties for not filing Form MT-203-ATT, including fines and potential legal consequences.

Q: Can I fill out Form MT-203-ATT by hand?

A: Yes, you can fill out Form MT-203-ATT by hand, but it is recommended to file it electronically for faster processing.

Q: What should I do with Form MT-203-ATT after filing?

A: After filing Form MT-203-ATT, you should keep a copy for your records and retain it for at least three years.

Form Details:

- Released on May 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-203-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.